How can I start trading Bitcoin?

This is a question I am sure that many have been asking themselves over the last year or so.

The lure of new markets and the highly publicised potential gains of Bitcoin trading have been hard to ignore.

But, I’m afraid there is a very simple answer to this question about trading Bitcoin with no experience and it’s this:

You shouldn’t, as you will most likely lose all your money!

Bitcoin and cryptocurrencies are one of the most volatile asset classes at the moment. The more volatile an asset class the harder it is to predict and the harder a price move is to predict, then the more likely it is that you will lose.

But what if I really really want to speculate on Bitcoin?

If trading Bitcoin is something you want to do the first thing you will need is a bitcoin broker.

There are two types of bitcoin trading – buying and holding on a cryptocurrency exchange or speculating on short-term price movements with CFDs or spread betting.

When you buy bitcoin on an exchange such as Revolut, you buy the cryptocurrency and keep it in an e-wallet. If you want to buy £1,000 of bitcoin, you need to deposit £1,000 in your account. If Bitcoin doubles then you make £1,000. Likewise, if the value of Bitcoin halves, you lose £500. Or worse, if it’s exposed as a fraud then your Bitcoin becomes worthless and you lose your £1,000.

Also, when buying Bitcoin on an exchange you can also only profit when the price goes up.

However, with spread betting and CFDs you can trade and potentially profit when the price goes down by shorting Bitcoin.

With CFDs and spread betting on Bitcoin you are also trading on margin so you can leverage your risk capital. Or buy or more Bitcoin than the value of your account.

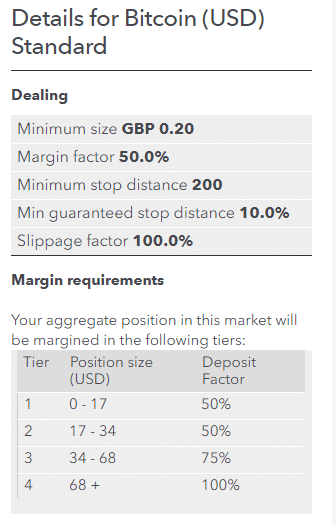

As you have stated that you have no experience you will be treated as a retail customer and the margin rates for trading Bitcoin will be high. For example, with IG it would be 50%. So if you wanted to buy £1,000 of Bitcoin you would only need to put down a £500 deposit for the trade.

That is called Bitcoin initial margin. However, as the price moves and your account makes a profit or a loss you would have to deposit more funds (or have them in your account) to cover the P&L. Plus, if you have a big position, the margin rate will increase. You can see that with IG for example (in the image) if you hold over 68 Bitcoin, then the margin rates increase to 100%.

You would also be charged overnight financing for holding a position overnight. This is currently around 0.05% per day which is nearly 20% a year. So if you hold a long Bitcoin position for a year and it only goes up by 10% you have actually lost 10% instead of making 10%.

For more information about overnight financing charges you can read our article: How important are overnight financing charges for spread betting and CFD accounts?

If you want to reduce the risks of trading Bitcoin further use a stop loss so you can predetermine what losses you are prepared to take. Never expect to make money from trading Bitcoin alone. Cryptocurrency trading should form a small part of your overall diverse investment portfolio. Never trade with money you cannot afford to lose on very risky leveraged speculative products like cryptocurrencies via CFDs or spread betting.

Avoid like the plague any automated Bitcoin trading system, they are all scams. Avoid any broker or service that offer advice on when to buy and sell Bitcoin, it’s completely unproven and there are many unregulated providers out there scamming customers.

Always check a broker is regulated by the FCA, you can do that by either searching for an individual or firm on the FCA register here.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.