Crypto exchange Gemini is preparing to exit the United Kingdom, European Economic Area and Australia, giving customers a tight deadline to sell or withdraw their assets before accounts are closed in April.

The company confirmed that all accounts in the affected regions will be placed into withdrawal-only mode from 5 March 2026, with full account closures scheduled for 6 April 2026. After the March deadline, customers will no longer be able to trade or sell crypto assets on the platform.

This maybe because Gemini has received regulatory approval in the United States to enter the prediction markets space, so it may be focusing on US prediction markets as interest in cryptocurrency in the UK is dwindling as Bitcoin prices fall.

Gemini has advised users to cancel recurring purchases, avoid new deposits, and begin unstaking any staked crypto immediately to avoid delays. Customers with open perpetual futures positions must close them before the withdrawal-only phase begins, or risk positions being force-closed at market prices.

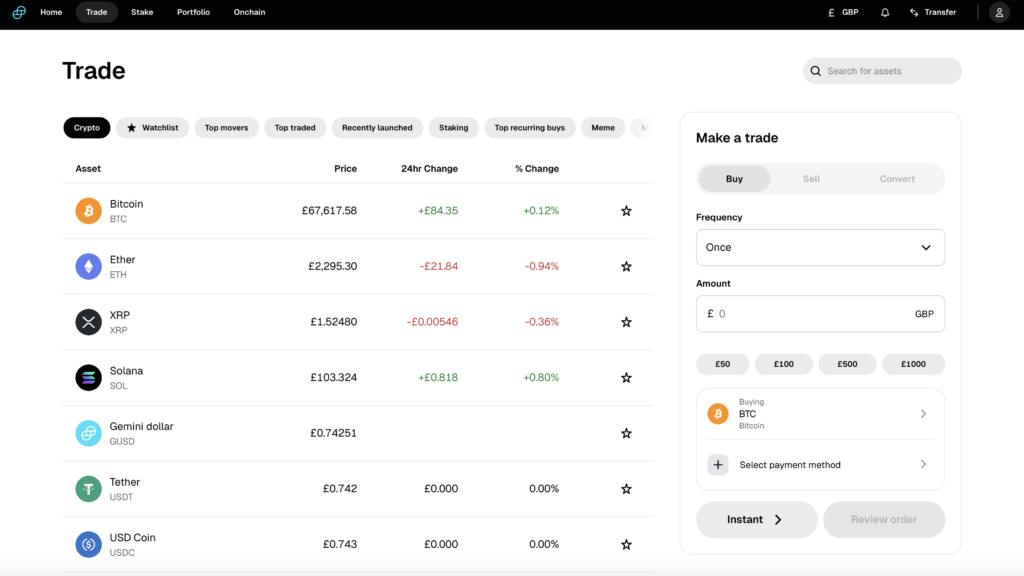

eToro suggested as an alternative cryptocurrency platform

To help customers move funds, Gemini has partnered with social trading platform eToro, offering a transition route and sign-up incentives for some users who transfer assets. However, customers remain free to move funds to any exchange or withdraw crypto to a self-custody wallet and fiat to a bank account.

The exchange has urged customers to act quickly, warning that account verification, bank linking and withdrawal address approvals can take time. In some cases, adding a new crypto withdrawal address may take up to seven days to approve, while unresolved account reviews could limit the ability to withdraw funds before closure.

Gemini also encouraged customers to download transaction histories and statements before their accounts are shut, as access will be removed after closure. Referral and promotional programmes have already been discontinued in the affected regions.

The company stressed that funds provided for payment services are safeguarded under UK and EU e-money rules, but are not covered by deposit protection schemes such as the FSCS.

It’s hardly a surprise, all the cryto platforms I speak to say that the UK market is hard to crack. Gemini’s withdrawal from multiple major markets highlights how saturated the UK markets are for US providers trying to scoop up new customers.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.