Fundamentals of a stock matter. But occasionally, macro factors will overwhelm these fundamentals. In 2022, investors were more concerned about the impact of inflation, war in Ukraine, cost-of-living crisis, et cetera. As a result, they are marking down most stocks.

Tesco could not escape from this wholesale de-rating of UK stocks. By some measures, Tesco could be slightly ‘undervalued’ as investors fled from the UK market. And if we measure Tesco’s share in USD, they are down a lot more particular during the autumn of 2022.

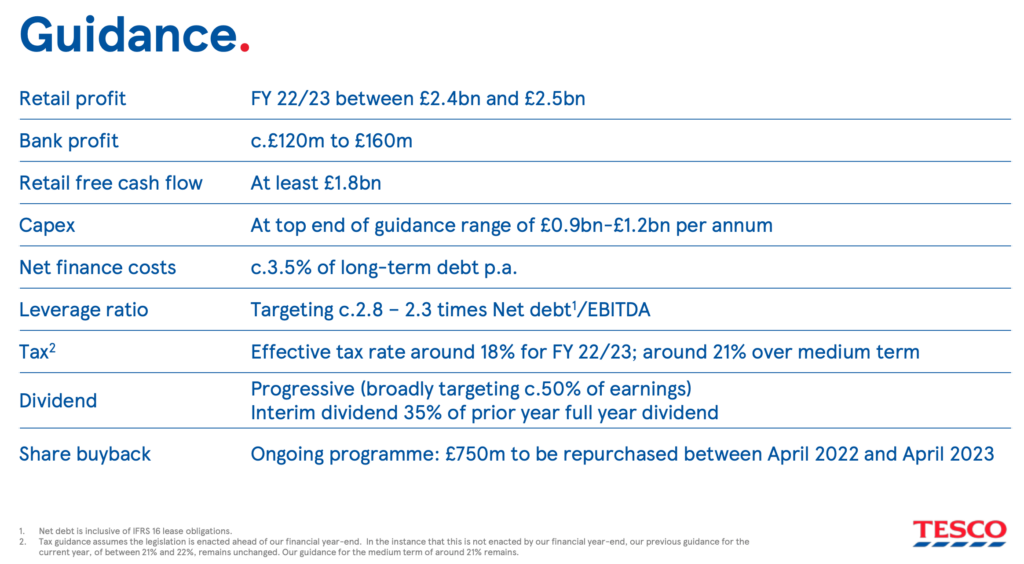

However, the market may be too pessimistic about UK stocks, especially those with a good set business operations churning out plenty of profits week in, week out. In the latest RNS, Tesco plc reaffirmed guidance for FY 22/23, with ‘retail adjusted operating profit of between £2.4bn and £2.5bn; retail free cash flow of at least £1.8bn; Bank adjusted operating profit of c.£120m to £160m‘.

Another point worth highlighting – Tesco is actually buying back its shares to the tune of £750 million between Apr ’22 and Apr ’23. A weak company will not be spending cash to buy back its shares if the management is not confident about its future profits.

Source: Tesco Plc

When I examined Tesco’s daily share price for 2022, a marked fall from 300p is noted. The 33 percent decline earlier was caused by three factors:

- Weak market sentiment – most sectors were impacted when interest rate soared as Bank of England hike rates

- A re-rating of corporation margins – due to cost, energy and labour inflation

- A fall in consumer spending – as the cost-of-living crisis escalates

The spike in energy costs shrunk consumer wallets and this means less money to spend on Tesco’s products.

However, this fear may prove to be overly negative – as reflected in the sharp bounce in Tesco share price from November. The rebound happened because the worst economic fears did not materialise. Oversold, investors returned to equities.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.