Unlike buying a physical property, buying a developer’s shares as an investment depends on more than just property prices. To make money, a buoyant stock market and a competent management are required too. And you will need to know which developer to buy as different firms will have different strategies. Lastly, you are buying a stock rather than a property. As we all know, the stock market is much more volatile. These are added factors to consider when analysing developers’ stock.

When looking at Taylor Wimpey’s share price, it is one of the largest developers on the London Stock Exchange worth around £3.3 billion. Its operating profit totalled around £900 million a year, and the order book stands at around 10,000 homes. Its long-term financial position appears good, but the firm has not been tested since 2008.

Is (LON:TW) Taylor Wimpey’s share price overvalued or undervalued at the moment?

‘Cheap’ is the first reaction when we glance at Taylor Wimpey’s financial ratios. The housebuilder’s price-earning ratio is at a lowly 6; while its dividend yield is in excess of 9 percent. Under normal circumstances, investors would snap up stocks like this.

But we are in unchartered economic territory. Inflation is at generational high; war has come to Europe for the first time in decades. Economic uncertainty is high and rising.

As such, housebuilders could stay cheap for some time. Perhaps investors are expecting a potential cut in dividends, or its profits to decelerate.

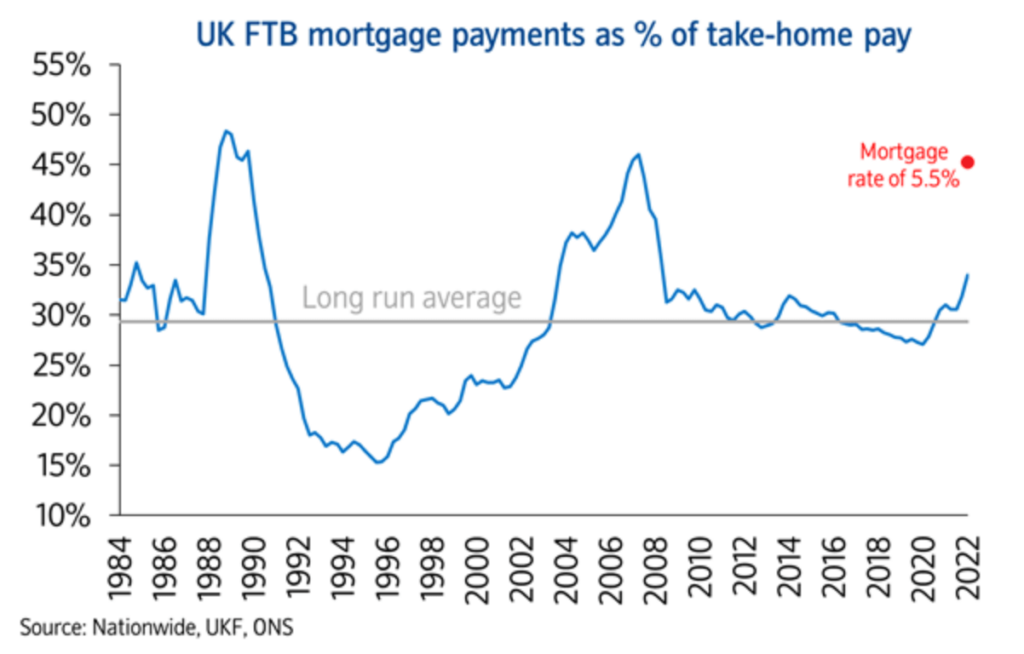

Look at this chart from the building society Nationwide. The recent surge in mortgage cost pushed First-Time Buyers’ (a large segment of Taylor’s customer base) mortgage payments to 45% of their take-home pay. This is the highest level in 15 years – and often precedes a market crash.

Source: Nationwide

In the stock market, what is cheap often becomes cheaper. We would not be in a rush to buy the sector just yet.

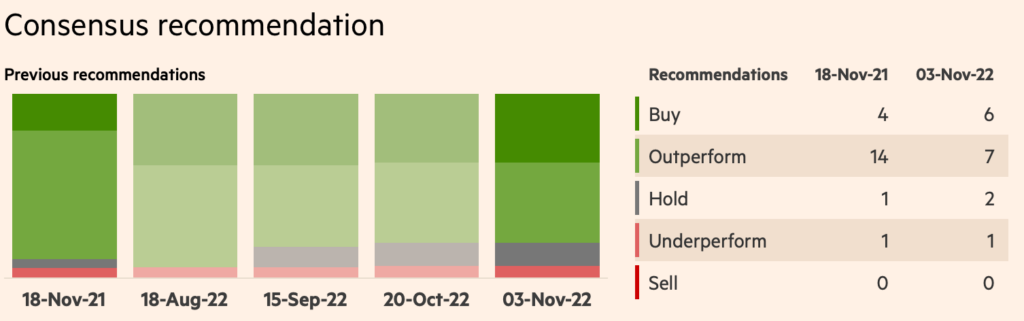

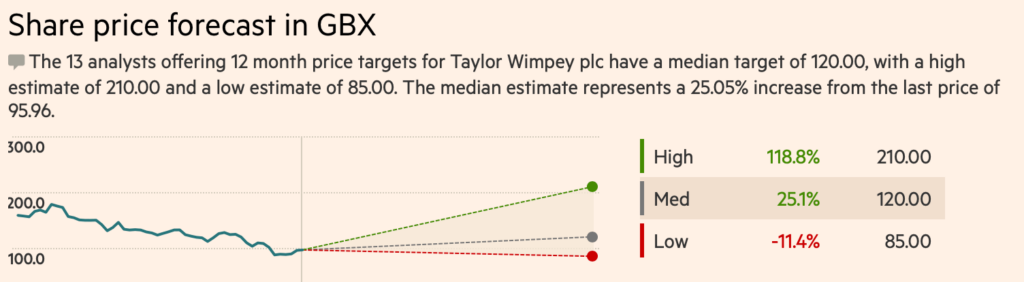

What is Taylor Wimpey’s share price prediction? (LON:TW forecasts)

Source: Financial Times

Latest Taylor Wimpey (LON:TW) analyst price targets

| Date | Broker name | New | Price at time | TW price target |

| 20-Oct-22 | Deutsche | Buy | 89.78 | 115.00 |

| 21-Sep-22 | JP Morgan Cazenove | Overweight | 106.95 | 170.00 |

| 12-Sep-22 | Berenberg Bank | Hold | 110.65 | 122.00 |

| 04-Aug-22 | JP Morgan Cazenove | Overweight | 127.85 | 180.00 |

| 04-Aug-22 | Deutsche | Buy | 127.85 | 189.00 |

| 21-Jul-22 | JP Morgan Cazenove | Overweight | 125.9 | 180 |

| 26-May-22 | JP Morgan Cazenove | Overweight | 131.15 | 180 |

| 25-May-22 | Liberum Capital | Buy | 127.15 | 165 |

| Averages | 118.41 | 162.63 |

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.