In recent weeks, there has been talk of an initial public offering (IPO) for crypto exchange Kraken. Nothing is confirmed yet, but there are reports that an IPO could take place in the near future. Interested in learning more about the Kraken IPO? Here’s what we know right now.

Who is Kraken?

Kraken is a US-based crypto exchange that was founded in 2011. Today, it is one of the largest crypto exchanges in the world, serving millions of customers across around 200 countries.

Via the Kraken platform, users can trade a wide range of crypto-assets including Bitcoin, Ethereum, and Cardano. They can also trade futures, use margin to trade, and access a crypto wallet.

Like many other crypto companies, Kraken has come under pressure from the US Securities and Exchange Commission (SEC) in the past. However, the financial regulator recently dismissed its lawsuit against the exchange following a shift in regulatory oversight under the Trump administration.

When Will the Kraken IPO Take Place?

An IPO for Kraken has not been confirmed yet. However, according to Bloomberg, the exchange is considering an IPO in the first quarter 2026.

Note that Kraken told Bloomberg “we’ll pursue public markets as it makes sense for our clients, our partners and shareholders.” So, there is no guarantee that an IPO will actually take place in 2026.

Will Kraken Be Worth Investing in?

Currently, it’s hard to know if Kraken will be worth investing in. That’s because we don’t have information on the company’s potential valuation.

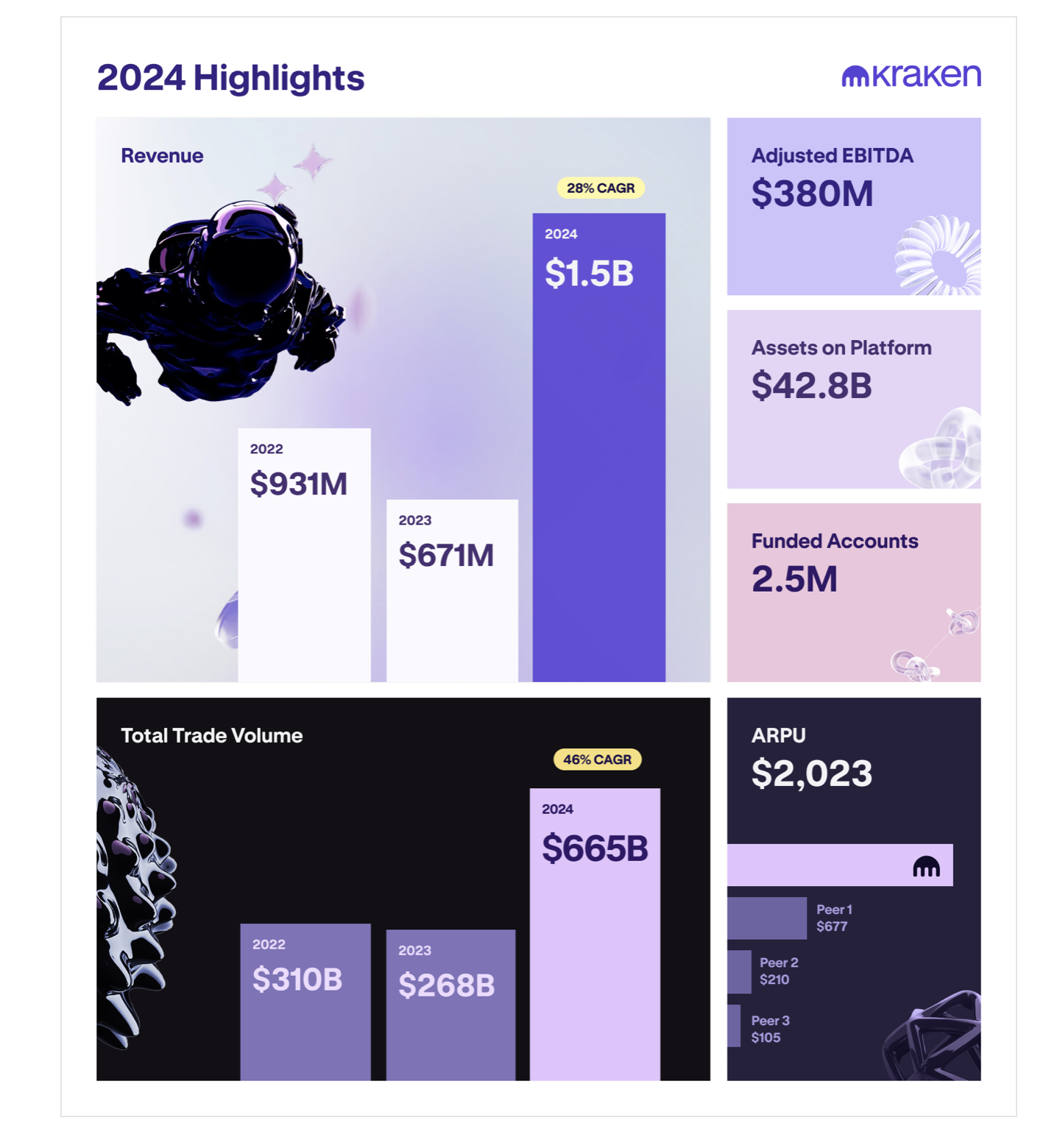

We do have some insight into the company’s financials, however. Because recently, the company posted some financial highlights for 2024.

These financials show that Kraken has experienced rapid growth lately. Investors should note, however, that 2024 was a very strong year for crypto-assets (due to Trump’s win in the US election) and the operating environment for the crypto exchange may not be as favourable in the years ahead.

How Have Other Crypto Exchange IPOs Performed?

There have not been many crypto exchange IPOs. Today, most exchanges are still private. One company that has gone public, however, is Coinbase (COIN: NASDAQ). It did an IPO in the first half of 2021.

In terms of its performance, Coinbase stock initially shot up well above the IPO price of $250, reaching a high of $430 at one stage. However, over the following two years, the stock experienced a massive slump as interest in crypto cooled and by late 2022 it was trading near $30 (it has since recovered to $170).

This highlights the risks of investing in crypto exchanges. While investors can see gains in bull markets, bear markets can lead to nasty losses.

How To Participate in the Kraken IPO

There is a good chance that the Kraken IPO won’t be open to retail investors. It will almost certainly not be open to UK investors.

So, those interested in investing in Kraken will most likely have to buy shares after the IPO. Once the company has gone public, the shares should be available on platforms such as Hargreaves Lansdown and Interactive Investor.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognised as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please see his Invesdaq profile.