No change, for the Federal Reserve told the market yesterday. On balance, the monetary committee noted that “…economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low.”

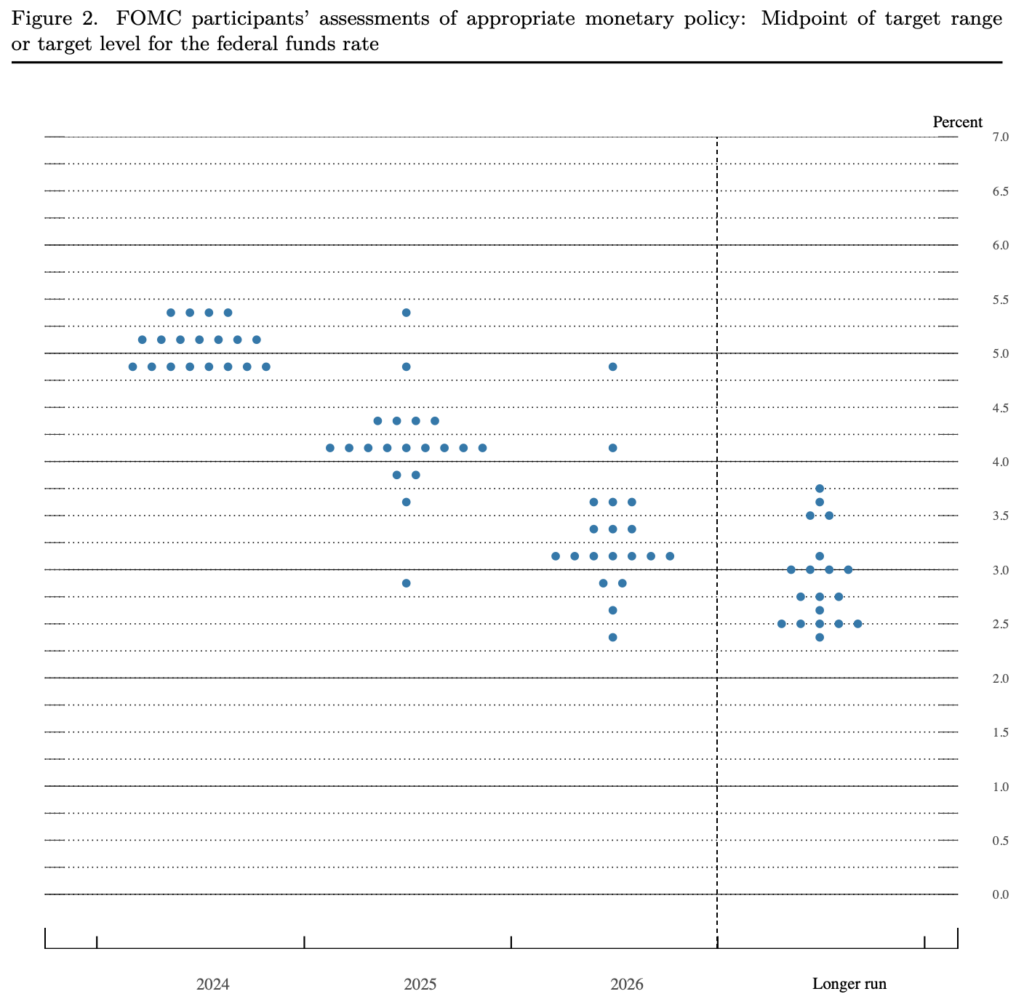

More importantly, the Fed statement noted that “inflation has eased over the past year but remains elevated.” The policy rate thus stays at 5.25-5.50 percent. The central bank’s accompanying forecast figure – ‘dot diagram’ – signals that for the rest of the year only one rate cut is on the table (see below).

The US economy is humming along nicely, unemployment near cyclical lows, and stock markets at record highs. What’s the rush anyway? In fact, a growing number of policy-setters are saying no to any rate cuts. This means that any rebound in inflation rates may tip the central bank into a tightening mode again.

This means that those dovish forecasts at the start of the year have been completely thrown out of the window. The American economy is performing far better than expected, with inflation rates near the target range.

Source: Federal Reserve (June 2024)

So how did the stock market take it? Not an iota of concern.

Look at the Nasdaq 100 Index (proxied by the ETF QQQ). Prices broke out to all-time highs earlier this year and then gapped up again on Wednesday. The fact that no rate cut is forthcoming did not matter much to the ongoing massive bull run in the tech sector.

Apple (AAPL), for instance, surged for the second session in a row this week. The California-based phone-maker is integrating ChatGPT into its ecosystem and this move excited investors greatly. Prices emphatically broke through the multi-month $200 resistance and are now surging in a vacuum of resistance.

Nvidia (NVDA) is also establishing new all-time highs; as are Microsoft (MSFT) and Google (GOOG). Meta (META), too, is on the verge of breaking out at $520.

With these tech behemoths on a roll, the rest of the stock market could only look on with envy. The next upside target for QQQ is at 500.

For the FTSE 100 Index, it too is on a long-term uptrend, although the magnitude of its advance is much slower. Currently, the large-cap index is on a correction following the upside breaking at 8,000.

That psychological level, formerly resistance, is now being re-affirmed as support (see below). Whether this level will hold is hard to say now, as another support is noted nearby at 7,800. One significant factor causing investors to stay on the sidelines now is the looming UK general election. Until this event is over, the British stock market may continue to lag behind the US.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.