There has been a lot of talk recently about if Bitcoin can reach $1,000,000. Our Bitcoin forecasts were recently featured in the Daily Mail, alongside other analysts who thought it may reach $1m in the next ten years. So we take a look at whether Bitcoin at $1m is possible.

Tom Lee, co-founder of Fundstrat Advisors, predicted that Bitcoin is likely to hit this magical number sooner than expected. Bitcoin, he explained, Bitcoin is a “great safe haven asset.” And over the next few years, “it should have the same network value as gold.”

Of course, he is not the first to predict a $1m Bitcoin.

When could Bitcoin reach $1m?

Back in 2022, for example, ARK’s Cathie Wood, the famed manager backing new technologies like Blockchain, already anticipated a seven-figure Bitcoin. She kept supporting Bitcoin even when the sector was shattered by a series of financial crises (scandals, really, eg, FTX’s implosion). She even put in a date on this optimistic prediction – 2030. The cryptocurrency’s trial by fire passed quickly, some say with flying colours. The network emerged stronger; confidence returned and prices have never looked back from the nadir of $16,000.

Source: Bloomberg (2022, video link)

To be fair, $1 million per Bitcoin is not the highest prediction we have seen so far. Earlier this month, Michael Saylor, longtime CEO of Strategy₿ (formerly Microstrategy, ticker: MSTR), affirmed his view that Bitcoin will – eventually – attain a ‘base value’ of $13 million. Yes, you read that right: $13 million. The most optimistic side of his prediction? $49 million!

Saylor, as most would have known by now, is the most ardent and biggest backer of Bitcoin. He anticipates that in 2045 Bitcoin will rise to become one of the largest assets globally, worth a spectacular $270 trillion ($13 million times 21 million coins, plus or minus a few trillions).

Certainly, he is backing his convictions with money. Whenever possible, he is busily converting the firm’s equity into Bitcoin, running, for example, at-the-market equity sales to buy Bitcoins. The chart below tracks MSTR’s corporate purchases since 2020, when the firm first bought Bitcoin.

Note the dot pattern here. Strategy₿ was able to buy more Bitcoin during a general crypto bull market, since a) investors are in an ebullient mood and more eager to hand over cash to Strategy₿ and b) fast-rising Bitcoin prices affirms investor confidence and elevates Strategy₿‘s share price. When Bitcoin was languishing below $20,000 during the winter of 2022, Strategy only made 3 purchases.

In a way, these dots are akin to a classic momentum trade. You leverage up a long bull market.

Source: Strategy (May 2025)

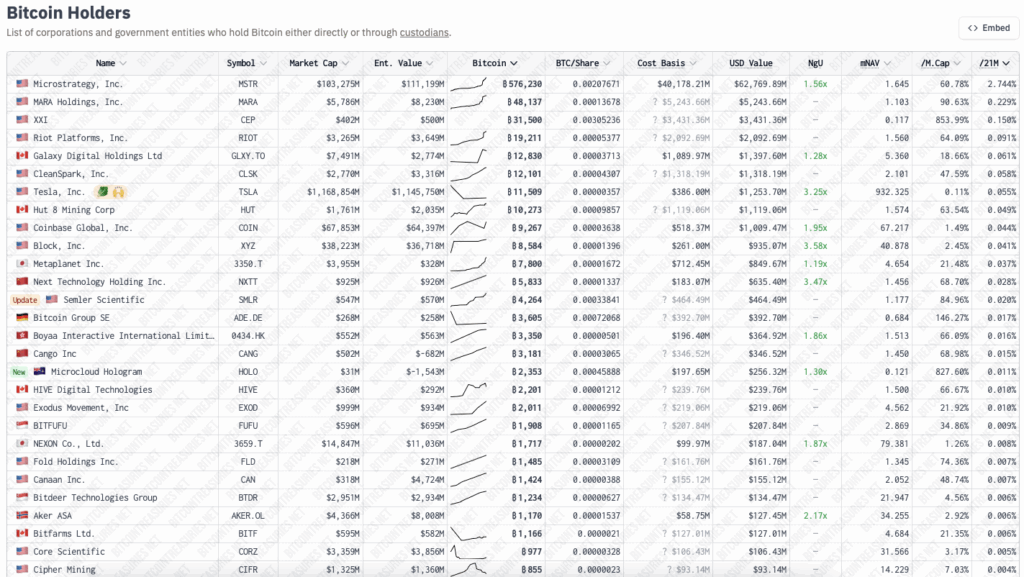

Seeing the success he is making with Bitcoins, other companies are slowly aping his strategy. The website bitcointreasuries.net tracks an increasing number of corporations that are stacking crypto coins:

A self-reinforcing cycle is at work here. As price rises, confidence of a perpetual bull market increases. Capital flocks to the asset, thus attracting more players. Trump Media (US:DJT) is one of the latest companies to raise money to buy Bitcoins.

Source: bitcointreasuries.net (May 2025)

A Repeat of the Dow at 36,000?

Have we not seen Bitcoin’s breathtaking forecasts somewhere before?

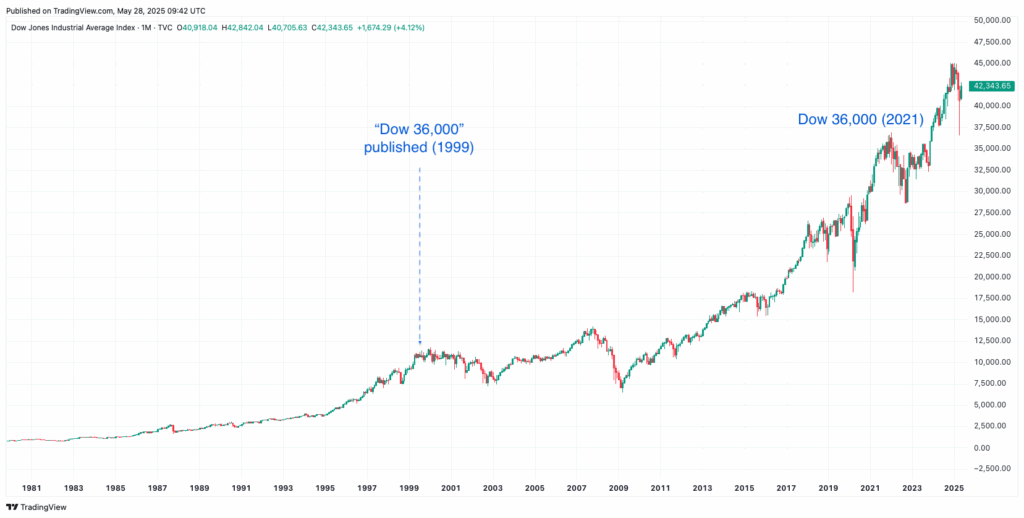

Nothing, they say, is new under the sun. Many old timers will readily tell you that Bitcoin’s sky-high predictions aren’t novel. A quarter of century ago, long before the invention of Bitcoin, two optimistic authors published ‘Dow 36,000‘ (link to article) at the tail-end of the decade-long US equity bubble. They argued vehemently that Dow Industrials (or US stocks generally) is ‘safe’ and that the ‘old “limits” of yields and P/Es do not apply anymore — if they ever did.’ They also asserted that in a separate article “at its current levels Cisco (CSCO) is not an overvalued stock.”

Well, we all know what happened soon after. Cisco crashed 85 percent a few quarters later; the Internet Bubble imploded; many high-flying stocks plummeted. Dow did reach 36,000 – only 21 years later! (see Dow’s long-term chart below.) A generation has passed. Meanwhile, due to inflation Dow 36,000 in 2021 is not the same as Dow 36,000 in 1999.

The reason I’m bringing up the above discussion is to remind readers that during a long bull market – when prices only go up – large predictions are being made. These predictions are justified based on many rosy assumptions.

Certainly, I’m unsure when Bitcoin will attain the magical threshold of $1 million. Can it actually reach the seven-figure mark ever? Perhaps. More importantly, will it reach at the timeframe that many experts are saying? That’s a tougher ask. Like Dow 36,000, perhaps Bitcoin will keep rising, but at a rate that is markedly different to its past.

Financial markets are full of randomness. New factors will emerge to derail the current assumptions.

In the end, Saylor is right on one point: only buy Bitcoin will money you can afford to lose, since the holding period is long and price trends uncertain.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.