Apple (AAPL) Returns to Growth

Make no doubt, equities are still running on a bullish trajectory.

Tentative selling over the past week or so is dissipating. ‘Buy the dip’ has returned. Look no further than Apple (APPLE).

Its share price started the week with a strong upside breakout to new all-time highs. Prices traded above $260 for the first time, a level that elevates the firm’s market cap one step closer to the $4 trillion mark. Another small rally from here will propel Apple, after Nvidia, into the “$4-T Club”. But what has happened to the fashionable 3-T Club? Not elitist enough anymore. As market capitalisations swell incessantly, we will soon talk about the new “$5T-Club”.

The key catalyst for Apple’s share strength was the unexpected demand for its latest iPhone 17. Sales for the smart handset have surged 14 percent in the first ten days and are expected to exceed $200 billion. Black Friday and the Christmas season may see consumers splash out further. If these better-than-expected sales materialised, iPhone’s growth will significantly improve Apple’s financial health. Hence the sudden rally here.

Chartwise, the obvious upside target is noted at the round number psychological level at $300. But judging from Apple’s price pattern, the current bull run is unlikely to reach there in one sprint. Profit taking at some areas (eg $275) may slow the upward march. That said, Apple’s trend over the next few months is unmistakably bullish.

Another Mag-7 that edged to new record highs this week is Alphabet (GOOG). Prices are, slowly but surely, eroding short-term resistance at $255. If broken, the next upside target is at $265. To dent this bullish view requires a corrective wave below $235 (see below).

Meanwhile, Broadcom (AVGO), Netflix (NFLX) and AMD (AMD) are all climbing near their 52-week highs. No detectable increase in selling pressure in this sector.

So what do we make of these still-rising mega tech stocks? Are they still a buy?

For one, they steadfastly hold major US equity indices (S&P 500 and Nasdaq) in a bull swing. Market concentration in the US stock market is at historic highs (new term: ‘ultraconcentration’). As long as these Mag-7 (or Mag 12 now, see list below) do well technically and fundamentally, investors are in no rush to dump the sector.

What about the rest of the market? Again, as long as they trade sideways and do not collapse like First Brands, the general market will probably see new highs soon.

US Small Caps ready to pump?

At the other far side of the size spectrum – small caps – the trend there appears bullish.

Take a look at the long-term chart of the iShares Russell 2000 ETF (IWM). For readers who are unfamiliar with Russell 2000, it is an index that tracks the smallest 2,000 stocks in the Russell universe. Rising risk appetite during a market upswing makes these small, speculative securities outperform the market.

For example, IWM performed strongly in the weeks before and after the spectacular GameStop episode in 2021, when the retail risk appetite soared.

This year, the $68-billion ETF saw some wild swings too. The fund was on the cusp of an upside breakout before President Trump’s tariff smashed prices down to 170. Surprisingly, the ETF rebounded as quickly as it dropped. This tells us that there is plenty of liquidity on the sidelines ready to jump in.

Recently, IWM flirted again with the resistance at 240. A tentative advance to 250 – a new high – was noted.

Will this gentle push lead to a decisive breakout? Maybe. IWM’s trend is strikingly bullish and this could propel the index higher until the turn of the year.

Crypto “Stonks” Stocks Making a Comeback!

Among the small caps, I note that many crypto ‘stonks’ are surging like 2021.

Look at these speculative crypto miners and digital asset facilitators. Until the middle of this year, many were asleep. Then, they suddenly came alive and surged 5-10x over a short period of time.

This surprising bullishness tells us two things: One, investors’ risk profile has pivoted sharply into smaller, riskier securities. Two, the crypto industry is still booming, just that speculative capital has rotated from BTC treasury companies (eg MSTR) into other crypto subsectors.

In other words, investors are no longer content with 20-50 percent return, but are eyeing 5-10x price moves. Greed, it appears, is the order of the day. We are definitely in the latter phase of a bull market.

What about the UK small caps?

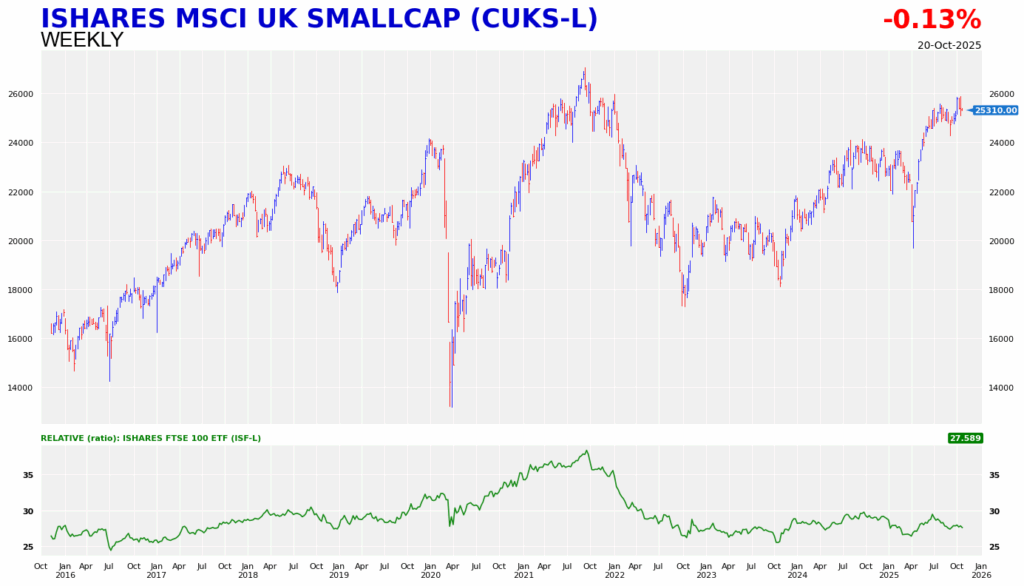

UK small caps did join the FTSE 100’s rally this year, albeit reluctantly.

If I use the iShares MSCI UK Small Cap ETF (CUKS, factsheet) as a proxy for the sector, clearly it is lagging large-cap stocks. The FTSE AIM All Share Index (AXX) tells the same story.

CUKS broke to new multi-year highs in June, but its upward momentum has stalled somewhat beneath 26,000p. No new highs here, unlike the FTSE 100 ETF (ticker: ISF).

Will we see a strong rally in UK small caps? Hard to say. A more bullish outlook suggests that UK small caps may eventually rally hard, so long as the large-caps hold their ground. Risk appetite will flow to the British small-cap sector like it did in the US.

The other, less sanguine, view is that UK small caps may continue to lag. This is due to the sluggish UK economic growth and lower revenue growth.

For now, some exposure to the UK small-cap may be appropriate if you think the sector will bounce in the months ahead. Risk management, however, remains critical.

Appendix: Largest Tech Stocks in the US:

- Nvidia (NVDA)

- Apple (AAPL)

- Google (GOOG)

- Amazon (AMZN)

- Meta (META)

- Broadcom (AVGO)

- Tesla (TSLA)

- Oracle (ORCL)

- Netflix (NFLX)

- Palantir (PLTR)

- AMD (AMD)

- Cisco (CSCO)

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.