What Are They Best Performing Private Pension Funds To Buy For Your SIPP?

Hargreaves Lansdown investors were firmly in buying mode in the third quarter of 2025, with the Artemis Global Income Fund emerging as the most bought fund across all three pension wrappers, SIPPs, Junior SIPP and Drawdown.

The latest HL data show investors continuing to favour global and passive funds during the accumulation phase, with top buys including Fidelity Index World, Vanguard FTSE Global All Cap Index, and Legal & General International Index Trust.

In contrast, drawdown investors leaned toward income-producing strategies such as Artemis High Income, Royal London Sterling Extra Yield Bond, and Aegon High Yield Bond. Despite gold hitting new highs during the quarter, no gold ETCs appeared among HL’s top ten lists, suggesting investors maintained confidence in diversified equity and bond markets.

What Is The Artemis Global Income Fund?

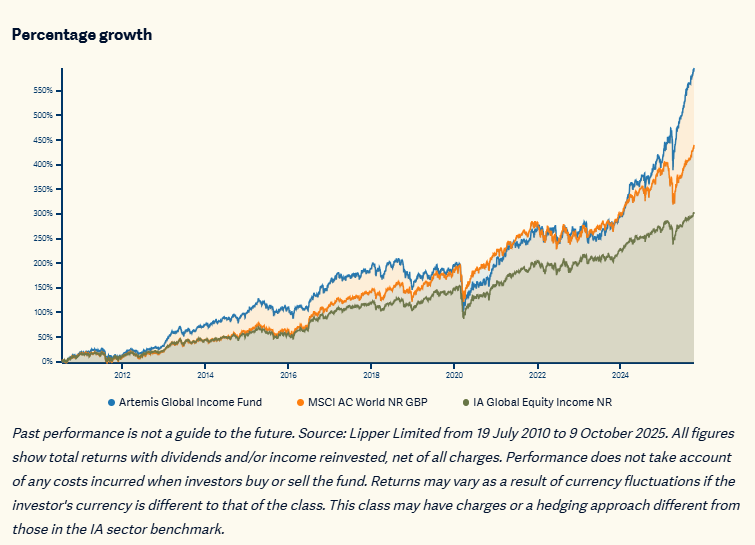

The Artemis Global Income Fund, managed by Jacob de Tusch-Lec and James Davidson, aims to deliver a rising level of income and long-term capital growth by investing in 60–80 dividend-paying companies worldwide. With around £3.3 billion under management, the fund blends high-yield and dividend-growth stocks across sectors and regions, typically yielding about 2.5%.

Its global remit allows it to diversify beyond the technology and U.S. concentration that dominates many portfolios — one reason HL analysts believe it appealed to investors seeking balance after a strong AI-led rally.

Artemis integrates ESG considerations into its investment process and has a flexible approach that can adapt to changing market conditions. The fund’s success over the past year, up more than 30%, has drawn renewed inflows, though HL cautions that such high returns are unlikely to persist indefinitely.

Over the longer term, Artemis Global Income also stands out as one of the best-performing funds among HL’s top buys, delivering a five-year annualised return of around 18 %, comfortably ahead of most global equity income peers. Other consistent performers include Fidelity Index World and the Legal & General US Index, both of which benefited from the strong run in U.S. and technology stocks.

However, Artemis’s ability to generate both income and capital growth, without overreliance on any single market, explains why it dominated HL’s SIPP, Junior SIPP, and Drawdown investor flows in Q3 2025.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.