Caterpillar’s share price (CAT) has been an absolute machine for investors over the past three decades. But will the stock dump or keep on trucking over the next five years? Caterpillar (NYSE:CAT) is synonymous with construction and transport. Whenever Caterpillar’s trucks are mentioned, it immediately conjures up the image of yellow-coloured mining trucks supported by man-size tires. This is the power of a good (and dominant) business.

Is Caterpillar a good long-term stock?

Is Caterpillar, then, a good long-term stock? To answer this, let’s have a quick look at CAT’s multi-decade monthly chart. What do you see? A definite long-term bull trend, punctuated by cyclical downturns. In other words, this is a fairly good long-term stock to hold in one’s portfolio. From the $25 low in 2008, the stock recently approached $300. That’s a 10-12x rise in just over one-and-a-half decade.

You may, however, wonder about those fairly steep corrections. During 2008, for example, Caterpillar’s stock collapsed from $75 to $25. That’s a drop of 66 percent.

Should these setbacks concern long-term investors? These drawdowns are, in fact, part and parcel of Caterpillar’s operations. Deep cyclicality in the mining and construction businesses is the norm. By extension, the company manufactures and delivers heavy-duty machinery and, engages in the financing of this expensive equipment (via Cat Financials). When the mining industry contracts, which happens now and then due to a slowdown in the global commodity demand, this will inevitably slow Caterpillar’s business and the CAT share price will correct accordingly.

Taking a secular view of Caterpillar’s business, these steep downswings should be viewed positively, since it allows you to buy Caterpillar’s shares cheaper. Over time, the world will still construct new buildings, factories and infrastructure. In 1992, Caterpillar’s revenue totalled $11.4 billion. Three decades later, this figure rose to $59 billion. Free cash flow per year is expected to hit $4-8 billion. Given its strong financials, the Texas-based company completed a $4.2 billion share repurchase program in 2022. Caterpillar’s products’ strength, niche and diversity succinctly capture global growth.

Does CAT pay dividends?

For patient investors, there’s a further advantage in buying Caterpillar’s shares – dividends.

Did you know that Caterpillar is one of the ‘dividend aristocrats‘ in the S&P 500? The $147-billion machinery business has been upping its annual dividends for at least 25 years. This is a great achievement, a track record that few companies have. You can purchase the S&P Dividend Aristocrat ETF via First Trust Dividend Aristocrat Target Income (KNG, factsheet) where CAT has a weighting of 1.6%. While Caterpillar’s yield is currently on the lower side – 1.7 percent – wait for a drawdown before increasing the position.

Where will CAT stock be in 5 years?

Where the Caterpillar share will be in 5 years is a hard call to make given the randomness of financial markets. The stock has been on a bull trend since 2020 and if the past is prologue, a correction may happen in the next few years. Be ready to dip back in if this happens.

Who owns the most Caterpillar stock?

Caterpillar does not have majority shareholders. According to some statistics, the largest shareholder of Caterpillar is the Vanguard Group, owning about 9 percent of the entire stock (see below). Next on the list is SSGA Funds at 7.4% and Capital Research at 5.7%. As a matter of fact, the top 10 owners of Caterpillar are mostly institutional funds. This may help to stabilise its shareholder base.

| Top 10 Owners of Caterpillar Inc | Percentage | Shares | Total value ($) |

| The Vanguard Group, Inc. | 9.05% | 46,068,853 | 13,621,177,767 |

| SSgA Funds Management, Inc. | 7.39% | 37,624,509 | 11,124,438,576 |

| Capital Research & Management Co…. | 5.68% | 28,933,474 | 8,554,760,258 |

| BlackRock Fund Advisors | 4.40% | 22,388,616 | 6,619,642,093 |

| State Farm Investment Management … | 3.49% | 17,761,276 | 5,251,476,475 |

| Geode Capital Management LLC | 1.90% | 9,654,207 | 2,854,459,384 |

| Fisher Asset Management LLC | 1.57% | 7,965,932 | 2,355,287,114 |

| Bill & Melinda Gates Foundation T… | 1.44% | 7,353,614 | 2,174,243,051 |

| Northern Trust Investments, Inc.(… | 1.24% | 6,284,941 | 1,858,268,505 |

| Norges Bank Investment Management | 0.96% | 4,905,890 | 1,450,524,496 |

Source: CNN.com

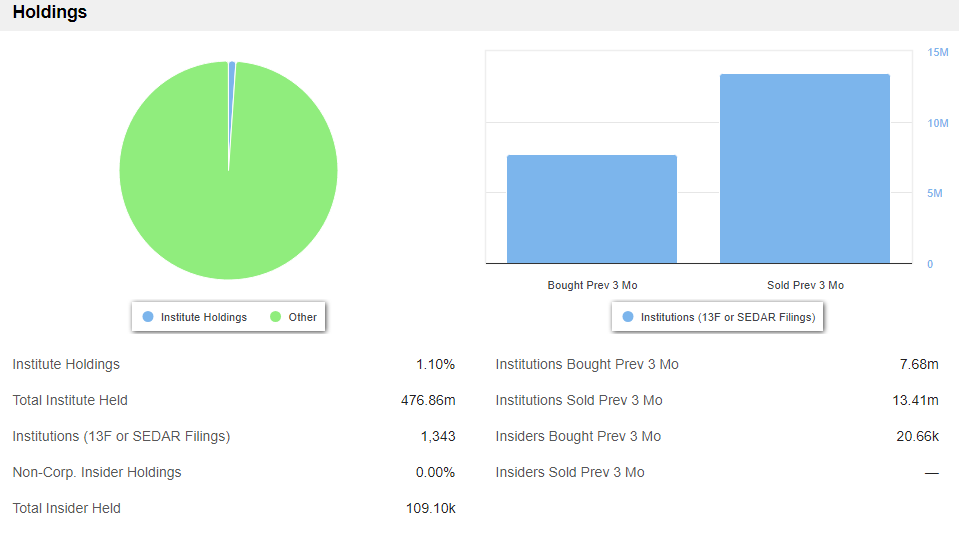

You can also see the breakdown of insiders (people who work at CAT) versus institutions and how much has been bought or sold over the last 3 months.

For the most up-to-date info see our CAT Share price performance section.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please ask a question in our financial discussion forum.