Options trading is now available to UK customers as US broker Charles Schwab rolls out the integration of the TD Ameritrade trading platform thinkorswim (acquired in 2020), which is now powering the new Schwab Trading account.

Thinkorswim

Before the launch, I had a demo of the thinkorswim platform from Andrew Kahling, the head of international education at Charles Schwab, he’s has been with the platform for more than 16 years, even back in the days when Tom Sonsoff was at the helm. Incidentally, do you know what the name “thinkorswim” means? “Do your research, then dive in?” No, it doesn’t mean anything. Apparently, they just made it up…

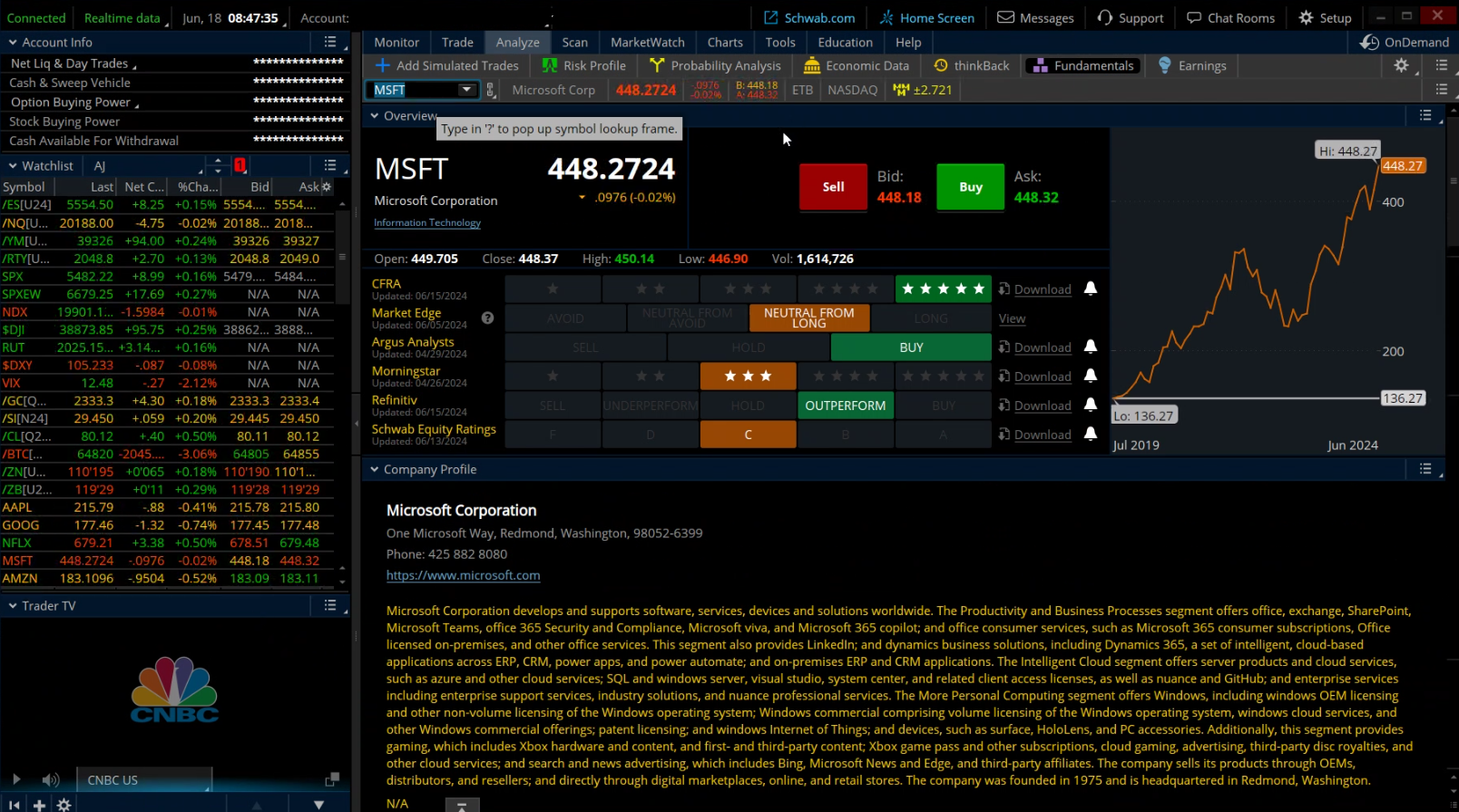

It’s funny looking at American trading platforms because they are, well, very American, and by that I mean excellent. Just like Interactive Brokers, the technology clearly surpasses the majority of UK or European-based options traders available to retail investors. They have a very institutional feel to them. The new “thinkorswim” dealing platform, which is part of the Schwab Trading account, is customisable and offers what are described as elite-level trading tools to clients.

It will be interesting to see if UK retail investors embrace the technology or stick to speculating with CFDs and spread bets.

It’s clearly a good bit of kit though. Andrew was telling me that the first thing he does when he fires up the platform in the morning is turn on the streaming CNBC services in the sidebar. I think all active traders need a sqwark of some sorts, silence is lonely.

The sidebar offers some fairly good features for stimulus, like currency maps, that show how various FX rates are moving against the USD. Another tool called Trade Flash highlights analysts’ upgrades and downgrades, block trades and trade imbalances at the opening and closing of the market.

The stock screener allows clients to sift through the market looking for stocks that meet their criteria and goals.

A Stock Hacker tool, allows clients to find the stocks and signals that matter most to them whilst filtering out those that don’t. Users can create their own custom filters and alerts using alternative data sets such as technical analysis and options market data.

When there isn’t a trade in the market, you can add Tetris and Minesweeper to your trading platform sidebar. I’ve spent many a day on dealing desks playing both, but I still think Bloomberg has one of the best trading games around.

Trading

The thinkorswim platform is available as a download, as a browser-based platform, or as a mobile app. But there are initial limitations, at the moment you can mainly trade options. For futures, CFDs and forex you’ll have to look for another trading platform.

But it does show the functions as view only, thinkorswim has Nasdaq level II data, conditional order types and live financial news on both the desktop and mobile variants. The mobile platform doesn’t have the screening functionality of the desktop or web-based versions, however.

The platform offers charting and trader education, but also brings futures and options trading to Schwab clients (only US at the moment) on one platform, for the first time.

Options trading, including multi-legged trading strategies, is available now, with futures trading scheduled for the near future. However, the thinkorswim platform does not offer mutual funds or fixed-income instruments. Plus they only offer US stocks, you can trade UK stocks, but it’s not cheap.

But for options trading in the UK it is superb, if and when retail traders get the hang of it over here. There are tools that show probability calculations and theoretical pricing. There is also a huge amount of fundamental analysis tools integrated into the platform.

Plus, you can adjust forecast targets by amending what you think a company’s profitability will be if you disagree with analyst ratings. The Schwab spread hacker will also help you build options strategies.

You can’t collect premium by selling options naked unless you are approved to do so and have demonstrated the relevant experience. Schwab will conduct a suitability test for active traders, who want to take on more risk. But for investors buying covered calls to hedge potential dips in their equity portfolio, it’s an ideal tool.

Additional facilities and help

Additional facilities, accessible via Schwab Trading, include 24/5 support from a desk of product experts, who the broker says can act as a second set of eyes for your trading and offer help and suggestions to clients about structuring complex trades and risk management.

The support team that Schwab calls trading specialists, will help clients to configure the thinkorswim platform to meet their specific needs, via a phone, online chat or even directly in the platform itself.

Thinkorswim looks like a very powerful multi-asset trading platform, and the addition of options and futures trading will greatly expand the trading universe for Schwab clients.

Today’s clients want more from their broker and their trading tools, and many retail clients have now become quite sophisticated in their approach to the markets, which of course is what Schwab is banking on.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.