The latest Pocket Money Index is here. Produced annually by RoosterMoney, this survey contains nuggets of insights from the spending habits of children (over 125,000 of them) in the last year

Insights from children’s spending habits during a cost-of-living crisis

In late 2020, the index told us that children then were spending an enormous amount of their pocket money on virtual games. The pandemic lockdown limited outdoor activities and engagements. Bored hands hammered furiously away at peer-to-peer games. Unsurprisingly, gaming stocks were red-hot on Wall Street in 2021. Two years on, has anything changed?

Yes, in a number of ways:

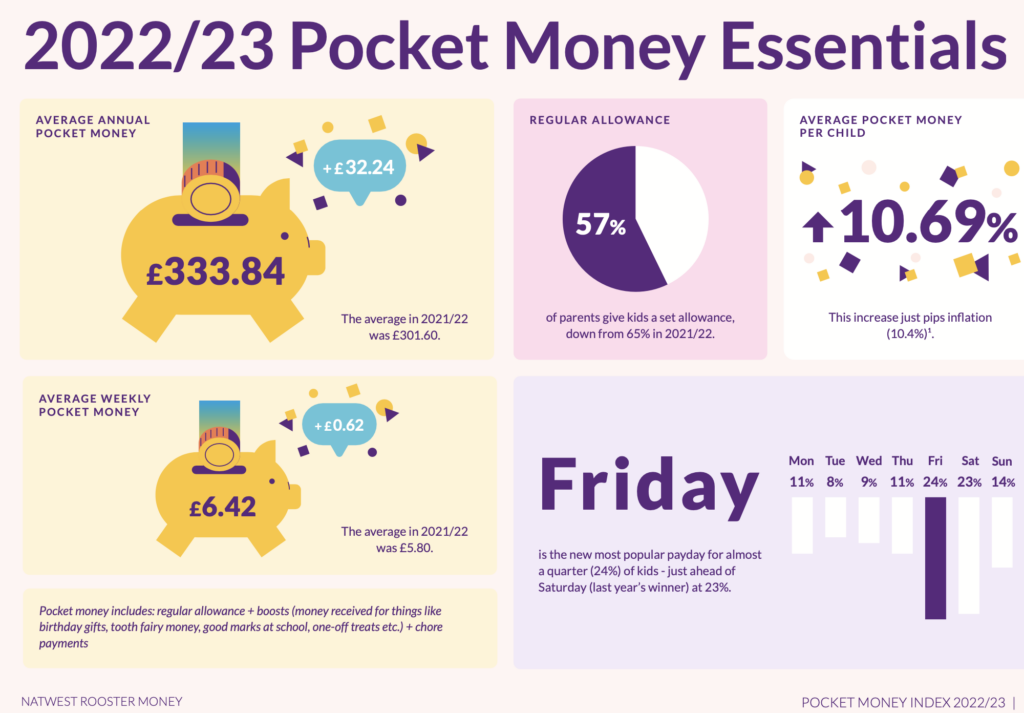

- Over the past year, kids’ pocket money has increased by an inflation-busting 10.4%. They now earn on average £338 a year.

- Spending on physical stores/restaurants has increased as pandemic restrictions eased further

- Children are becoming more entrepreneurial – such as reselling unused items – to top up their pocket money

As the CEO of RoosterMoney Will Carmichael remarked:

This year, kids have been more entrepreneurial than ever, regularly ticking off chores and tasks for pocket money, plus bringing in cash through re-selling their things, babysitting and tutoring.

- Related – Read our interview with Will Carmichael about why he founded Roostermoney.

Source: RoosterMoney

However, due to economic uncertainties, parents are now topping up pocket money when they have the means to do so. Regular allowance has declined from 65% to 57%. I expect this figure to fall further on a recession (defined as two-quarters of economic contraction).

How to use the Pocket Money Index?

The interesting question, however, lies with what the kids are spending on and whether this survey can be used as some form of an investment ‘indicator’. Arm with this info, perhaps we can guess where new relevant investment trends are emerging and research new potential ideas.

But before we move on, some limitations of the Pocket Money survey must be spelt out.

- First, it is a lagging indicator. The survey is only published once a year. By the time it is published, stock prices may have already moved significantly.

- Two, it is a broad indicator. It does not pick out specific stocks.

- Three, it only sheds some narrow ideas related to the kids’ spending trends – and not the general economy.

Still, the survey points to some subsectors that are benefitting from the splurge of pocket money.

Pocket Money trends to watch- Apple, McDonald’s and Roblox

According to the Pocket Money Index, kids have been out and about over the past year. No longer are they confined to their living rooms. Kids hung out with friends in cinemas, shopped in supermarkets and ate in McDonald’s.

Among the 10 favourite places children are spending their money, Amazon is the biggest faller, down 3 places. Another loser is Microsoft Xbox, down 4 four places (see below).

Another interesting point worth noting is this – public transport spending is on the rise. This is because kids, perhaps along with their parents, are travelling more. This trend is easily understood as covid restrictions are lifted everywhere. Humans are not meant to be lock up in dwellings in solitude. The urge to travel is stronger than ever.

Source: RoosterMoney

So what can the above rankings tell us?

For one, Apple (US:AAPL) has become one of the most sought-after tech gadgets for youngsters. Their products are well received even at that young age group, indicating the huge popularity of its iphones, computers and tablets. From this, I can infer three general points:

- Brand loyalty – Familiarity of certain brands from a young age may carry over into adulthood

- Service offerings – the ‘network effect’ among children may spillover into games, music and general communication thus helping Apple sell more services in the future

- “Prestige status” – among teenagers may increase premium payments on Apple products

All these points are not unfamiliar to people who invest in Apple stock.

Legend had it that Warren Buffett decided to take a closer look at Apple when one of his fellow Berkshire Hathaway (BRK.A) directors was devastated by the loss of his iPhone. Perplexed by his emotion at an advanced age, Buffett realised the amazing pulling power of Apple products for people of all ages – and then decided to pile into the stock. His $35 billion bet is netting Berkshire 300% in profits.

In February, Apple released its first-quarter results. On the service department, Apple “set an all-time revenue record of $20.8 billion in our Services business.” Total revenue for the quarter was $117 billion. I am not surprised if sales from services surpass that of hardware in the next few years.

Given Apple’s attractiveness around the world and its phenomenal cash flow, no wonder Apple’s stock price held up well. The share sailed right through the boom-bust cycle in tech stocks, the soaring inflation and a war in Ukraine. At $175, the stock is near new all-time highs. An upside breakout beckons.

Another stock worth taking a look is McDonalds (US:MCD). Parents with young kids know the appeal of the golden arch.

The food is uniformly good in most of its restaurants across the globe. A Big Mac in London will taste the same in Singapore. Familiarity is one of the things people sought when eating out.

And despite the rise in food costs and energy bills, McDonalds managed to report a 12% increase in global sales and a 3% rise in consolidated income. This is a remarkable set of results. Bullish investors continue to chase after the stock.

Unlike many securities, McDonald’s stock prices rose to new cyclical highs this year. Prices are consolidating after hitting $300.

Another interesting point from the Pocket Money Index is that kids are now travelling more. So much so that the CEO of easyJet (UK:EZJ) Johan Lundgren recently remarked during easyJet’s 1H trading update: “What we can confirm today is that the strong demand that’s reflected in the booking trend is continuing really across the whole network.”

This is a sign that international travelling is fast returning to pre-pandemic levels. Even struggling train stocks are slowly returning to life. Trainline Plc (UK:TRN), for example, has arrested its 18-month decline and started to recover. This is occurring despite the cost-of-living crisis.

Perhaps over time, other transport stocks like British Airways (UK:IAG) and National Express (UK:NEX) may do better than expected as travels increase and energy costs drop.

The last point worth noting is that kids are spending less time playing games. Ergo, gaming stocks were hit hard in the past few quarters.

One of the most popular games – Roblox (US:RBLX) – saw its stock price decimate in 2022. Its top-to-bottom drawdown reached a shocking 82 percent (see below). But kids are not giving up on the Roblox. They are still saving their pocket money to purchase RBUX, the currency widely used in the game.

The gaming company’s first-quarter results published this month saw a 22% increase in revenue to $655 million while both users and hours engaged rose by double digits. These are positive fundamental trends despite the wobbly share price.

Therefore, I suspect Roblox’s wide base formation may be a good time to ease into the stock. Remember, though, this is a stock for the bottom drawer since I have no idea when Roblox will complete its base.

Conclusion

Do not underestimate the power of children. They instinctively chase trends and fads. Nothing excites them more than playing the latest games. Sometimes, they are onto the ‘next big thing’.

As a parent, of course we have to pay attention to where our kids go and what gadgets they buy. The investment angle from this information could be lucrative if we invest at the idea at the right time. Do some research on the gadgets, which company makes them, and how much kids are spending time on it. It will give you some inklings of how popular the products are – and whether the company is making lots of money from it.

To paraphrase the investment guru Peter Lynch’s Principles (#14): If you like the product, chances are you’ll love the stock.*

[*] Peter Lynch (1989) Beating the Street, amazon.co.uk bookstore

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com