Is now a good time to buy UK shares?

These days, investors chase growth. If the UK stock market is viewed as a value play, then it is dangerously out of fashion. What could prompt a re-rating of the UK market?

UK shares underperforming peers

Financial tidings come and go. Some are transient; some persist. Look at interest rates. Down and down for forty years. Not even the ‘lower bound’ – zero, that is – can stop rates from sinking into negativity. Generational turning points are actually quite rare.

A few weeks ago, Mark Atherton of the Sunday Times asked: “Is this the best time in 40 years to be buying British shares?”

‘UK shares,’ he pointed out, ‘are at a 42 per cent discount to other global markets, compared with a historic average of about 17.5 per cent.‘ This raises an intriguing issue, of ‘whether this will make the UK a once-in-a-generation buying opportunity, or whether it will have substantially further to fall before it can climb back.’

Merryn Somerset Webb of the Financial Times (Oct 2, 2020) further added that the ‘UK market as a share of both the European and global equity markets is the lowest since the 1970s.‘ International capital is seemingly underweighting UK shares, for good reasons.

Here is how to buy shares in any company from any stock exchange.

Why are investors shunning UK shares?

The global financial market, metaphorically speaking, is one big beauty contest. Sadly, UK is not looking all that pretty. The list of reasons why international investors are shunning British shares is long. Some are strikingly obvious, like Brexit. Others include:

- A looming Brexit (Jan 2021, 58 days to go!)

- A lack of large tech stocks

- A weak currency

- Unproductive labour

- A market stuffed with ‘value stocks’ like banks, miners, and energy, etc etc.

Taken together, investors find the UK market to be unattractive compared to others. Why should capital flow to a market with a higher level of political and economic risk with no higher expected return? You may well remember the political mayhem during Teresa May’s premiership, with her ‘red lines’ and hard brexit rhetoric.

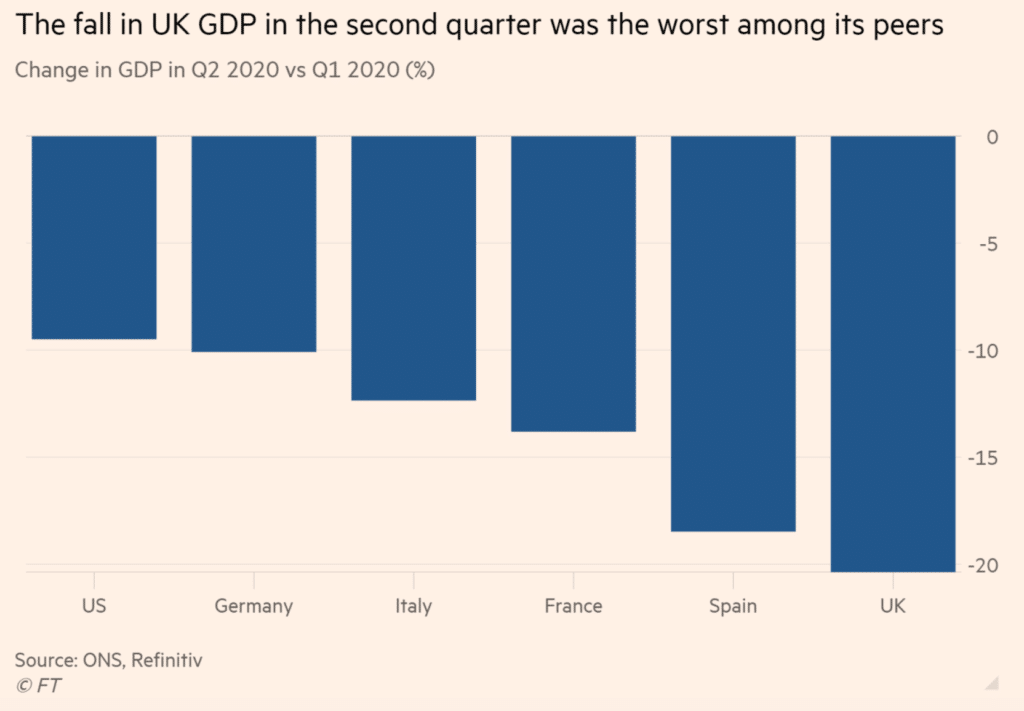

Moreover, the UK economy is underperforming during the 2020 pandemic. The second quarter GDP fall was the worst among its peers (see below).

Source: Financial Times

Are UK shares cheap?

When commentators mentioned that UK shares are cheap with a compelling story, beware. In markets, prices are cheap for a reason.

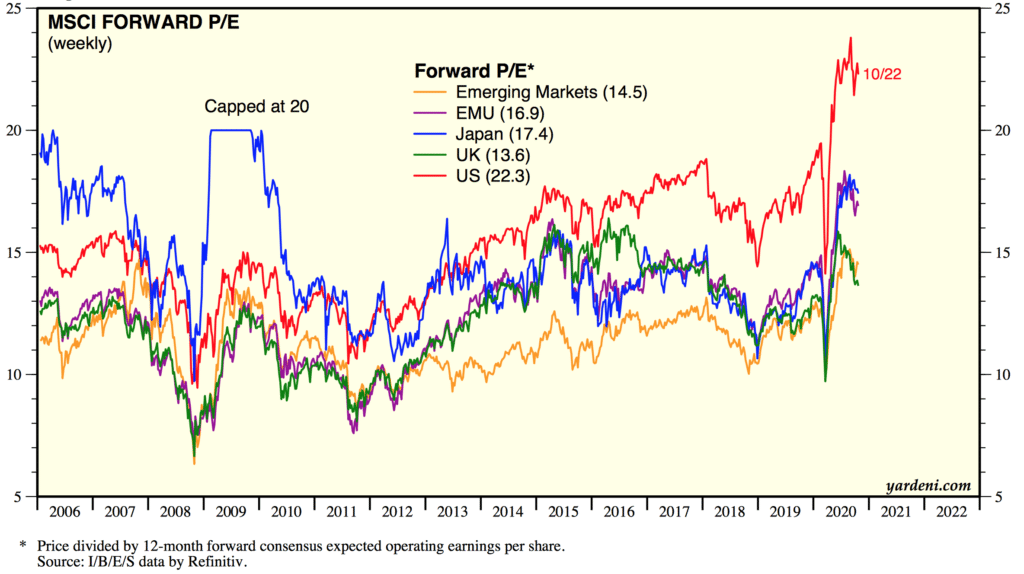

More to the point, I am not even sure UK shares are ‘cheap’. According to some MSCI Forward P/E estimates, UK is now valued at 13.6 while EU is at 16.9. The US? Sitting at its 15-year high at 22.3, far above other countries. A higher ratio means investors are paying a higher price for future earnings (see below, as of October 28). Investors are expecting US companies to grow much faster.

In absolute terms, however, note UK shares are not very cheap by historical standards. Current PE ratios stand at double digits, in contrast to single-digit level seen in 2008 or 2011.

UK shares may be cheaper relative to others, but they are not cheap in absolute terms now especially after a huge rally during March-September.

Of course, these measures are broad. Here is a host of very distressed stocks (from Investor Chronicle) that are potentially cheaper.

Source: Yardeni.com

But what is relatively cheap can become cheaper

Market trends last, sometimes for a long time. These days, value often counts for nothing. Investors all chase growth. If the UK is seen as one big value play, then it is dangerously out of fashion.

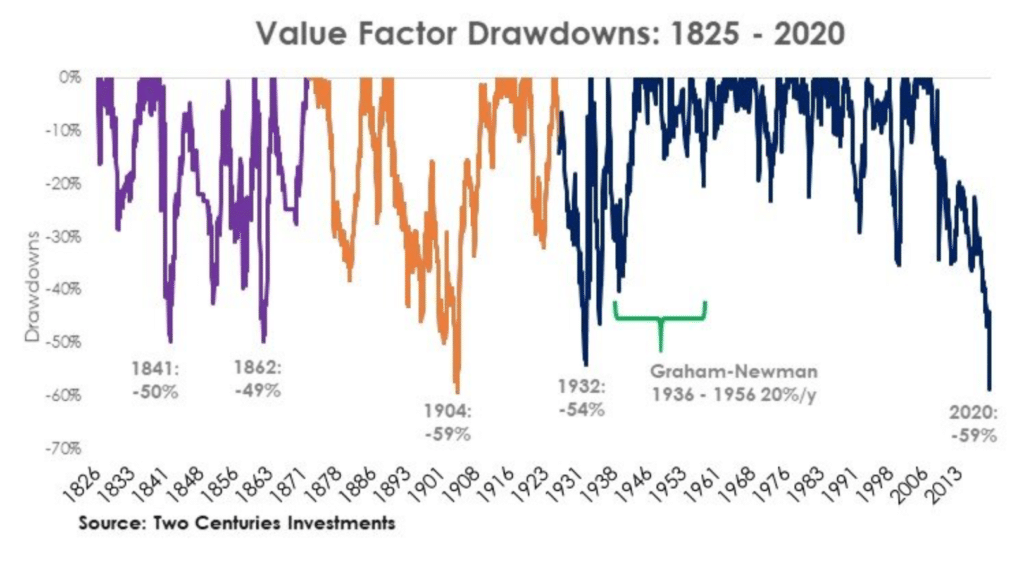

Some recent studies have been done in the US on how far value is underperforming growth stocks like tech. The result is astonishing. According to the investment firm Two Centuries Investments, they studied this disparity (link to blog) and found that value, as an investment style, is possibly suffering its worst performance in a century!

What is perceived as a “bargain” becomes even cheaper. Funds that stuck to value hunting are being punished. AJO Partners, a value fund with $10 billion AUM, threw in the towel altogether. ‘Our return sucks over the past few years,’ AJO’s Aronson admitted, ‘…our secret sauce, it worked sometimes – and it worked for about 30 years of our existence – and in the tailend it didn’t…..we still believe there is a future for value investing; sadly, the future is unlikely to arrive fast enough — for us.‘

That brings us back to the UK stock market. Yes, it is cheap, relatively speaking. But do not forget that prices can become even cheaper relative to other markets as investors chase growth. Investors are partying like it is 1999 again.

What could tempt investors back to British shares again?

All the above discussion brings us to the point: spotting turning point in markets. History tells us that genuine market turning points are not all that common. Are British shares heading for a historic turning point where it will outperform its peers in the years to come?

To reverse market perceptions, watch out for positive catalysts

Turning a big stock market like the UK around requires many conditions, such as a strengthening economy, a good Brexit deal with the EU and the US, and stable government. Above all, the market requires a catalyst. But what exactly is a market ‘catalyst’? Simply it is an event that decisively changes prevailing market perceptions.

In Jack Schwager’s renowned book Market Wizards, the interview with Jim Rogers is worth re-visiting:

SCHWAGER: What made you so bullish on Germany at that time?

ROGERS: The bull market had started here in August 1982. More important, Germany had not had any kind of bull market since the previous all-time high in 1961 twenty-one years earlier. The German market had crumbled in 1962 and had essentially gone sideways since then….

SCHWAGER: But you could have bought that market ten years earlier on the same theory.

ROGERS: That’s absolutely right. You could have bought it in 1971 for exactly those reasons and watched German stocks sit for ten years, while we had a major bull market in the US. But this time there was a catalyst. You always need a catalyst to make big things happen. At the time, the catalyst was the upcoming German elections. (emphasis mine)

The lesson of this story is that markets can remain moribund far longer than we expect them to be. To reverse the prevailing trend requires big political or economic triggers – triggers that are still missing in the UK.

More than a year ago, some commentators were already writing about how cheap and unloved UK stocks are. But the trend has persisted.

Buying UK stocks at a good price now is one matter. Staying with these positions is another. If you intend to value hunt in the UK market, be warned, waiting for a reversionary upswing in the UK will require a good dose of patience.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.