eCommerce retailers are thriving during the pandemic. Listed online companies are reporting amazing sales growth, leading to some spectacular rallies. Should investors look to buy into some of the world’s leading eCommerce companies when opportunities arise or is it too late?

Why invest in online retailers?

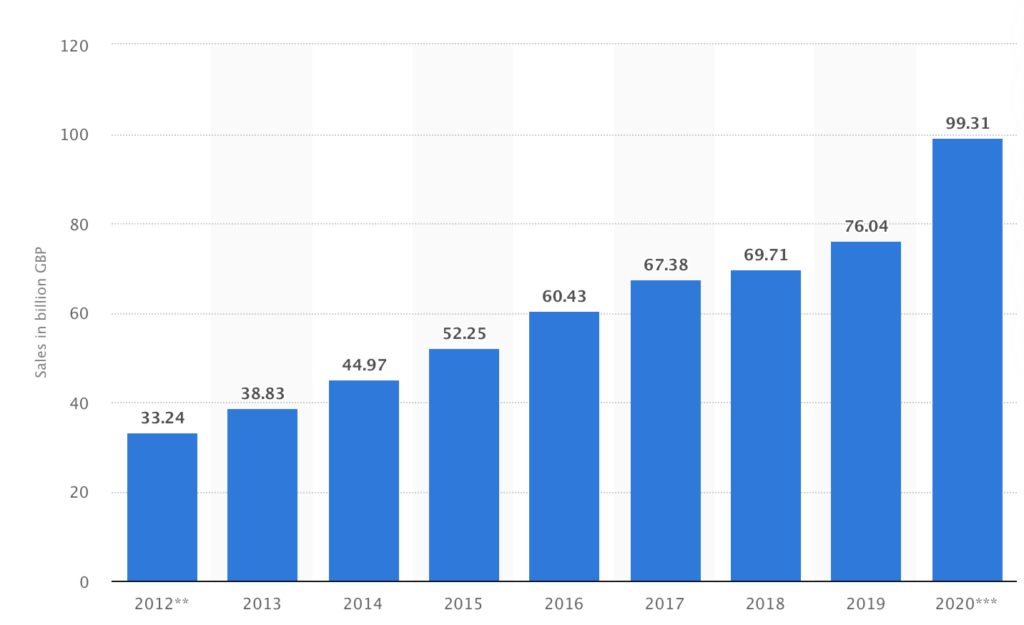

The pandemic has completely changed consumer behaviour. Physical shopping is all but impossible during lockdowns. As a result, consumers are tapped into online shopping. Some estimated that eCommerce in the UK rose by more than 30% during 2020 (see below).

Chart 1 Value of online retail sales in the UK

Source: Statistica.com

This new eCommerce paradigm has been building for some time. All it took was the pandemic to accelerate the trend.

When it arrived last March, however, many retailers were caught out and ill-prepared for the change. Scores of bricks-and-mortar UK retailers collapsed in 2020 as footfall dwindled. A further lockdown this year will push more retailers over the financial edge.

On the flip side, the surge in online trading presented an unexpected opportunity for many others. No longer do these companies need to pay expensive rent and burdensome rates. Thus they can sell cheaper. That’s how online retailers like Amazon gained an advantage over the years.

Upheaval is rippling through the entire online ecosystem, and not only for retailers. In this new ecosystem, many peripheral – but highly essential – sectors are booming.

For example, the ‘last mile‘ delivery companies are reporting a large increase in orders. Warehouses are snapped up to store products. Work from home (WFH) results in a higher demand for computers, et cetera. Below is a list of sectors thriving during the pandemic.

Main sectors of the eCommerce Ecosystem thriving during Covid-19

- Online retailers (e.g., grocery, household, luxury, auto)

- Delivery Supply Chain (e.g. last mile)

- Online auction platforms (e.g., trading goods)

- Warehousing (e.g., logistic real estate)

- Packaging Companies

- Takeaways (e.g. platforms)

- Health (e.g. streamed classes and on-demand lessons)

- Online Finance (e.g. payment system, brokerage)

- Workplace (e.g., WFH, communication, recruitment)

- Leisure (e.g., online gaming)

- Digital Marketing (e.g., online advertising)

This is just a minor snapshot of the changes impacting the retail world.

Retail sector stocks that have benefitted from Covid-19

In a world where growth is scare, sectors that can grow during the pandemic are especially favoured by investors. Small wonder that capital is flowing to prospering online stocks.

Amazon (AMZN), the king of online retail, rose to become one of the most valuable companies in the world. Alibaba (BABA) became the largest Chinese stock at one point. Ocado (OCDO) is worth almost 8-10 times Marks & Spencer (LON:MKS).

In the UK, The Hut Group (THG) was listed last year. Its IPO was one of UK’s largest in years. Prices rose by 20% since.

Flushed with financial resources, some online retailers are pouncing on dying retail brands with physical stores. Boohoo (BOO) bought the Debenhams brand recently. Another large online retailer, Asos (ASC), is in talks to buy Arcadia.

Even in the luxury sector, Watches of Switzerland (WOSG) is enjoying better-than-expected sales growth – despite the lack of tourists and the absence of footfall. Little wonder its share price hit new all-time highs over the past few months.

Online growth led to a revival of some struggling companies too. Look at the online electrical retailer AO World plc (AO.) Buyers snapped up white goods to improve their homes during the pandemic. This drove the company back to profits. The sudden turnaround resulted in a 700% boom in its share price (see below).

Royal Mail’s (LON:IDS) share price was falling to the floor in 2019. By the end of 2020, prices broke out to new long-term highs.

Is it too late to invest in online retailers?

It is clear that eCommerce is here to stay. It may not grow as fast as before, but it will become a formidable channel for retailers. For investors, however, the more important question is whether to buy now. Are we too late to join the party? Have we reached ‘Peak Amazon’?

Yes and no. Note this: the covid-19 pandemic is almost 12-months old. A rally that had lasted for more than nine months is naturally vulnerable to a correction.

Look at Zoom (ZM), the online communication company, in the US. Prices rose 8x from their March lows and then entered into a 30-40% correction. Peleton (PTON), the stationary bike manufacturer with a subscriber base, also struggled to advance following an 8x rally. AO (AO.) is in retreat after an 8x rally.

Even Amazon (AMZN) has been stagnating since August.

In the US, the $1.2 billion ProShares Online Retail ETF (ONLN) is accelerating upwards. This could be a sign of a late-stage sprint (see below). The ten-dollar rally from $40 to $50 entails a different risk proposition to that from $80 to $90.

For Amplify Online Retail ETF‘s (IBUY), its bull trend is even stronger. Prices are up nearly 3.5x from their March lows.

The strongest of all is the Emerging Markets Online and Ecommerce ETF (EMQQ). Prices are rising parabolically. Therefore, I would be wary of chasing these online retail sector ETFs at current prices.

Buying considerations when investing in online retailers

Still, we’re in a cyclical bull market, driven by monetary largesse and fiscal stimulus. Over the medium term, there is still some upside for e-commerce stocks. It is a question of whether we want to chase high-momentum shares or buy into some value shares.

In the UK, where value stocks dominate the market, there is a case for investing in some retailers with a growing online presence. For example, one of the top ten e-commerce UK websites is Marks and Spencer (MKS). Its share prices just made a tentative recovery above 120p. Prices remained steady throughout the current lockdown and so another step higher from here is possible.

Another way to ease into the sector is via decisive price breakouts. Look at Ebay’s (EBAY) chart below. Prices have been consolidating for some months. A breakout about $60 would be a bullish event and perhaps worth buying into.

New all-time highs is another signal to buy into a stock.

Apart from online retailers, perhaps one should also consider the eCommerce supply chain. The L&G Ecommerce Logistics ETF (EGOG) is one such fund. It follows the Solactive eCommerce Logistics Index.

When to invest in online retailers

Ecommerce is a growing sector. Profound changes are happening in the sector due to the pandemic. This creates significant opportunities for investors.

To earn good returns, one would have to pay attention to entry prices. We’re amidst a cyclical bull market and hence wait patiently for modest pullbacks to gain exposure to fast-growing online retailers.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.