Is the S&P a Buy, Sell or Hold?

S&P 500 (INDEXSP: .INX) Outlook (Jan 2025)

Provider: S&P 500

Verdict: S&P 500 is one of the most traded equity indices globally. When the opening bell rings in the NY Stock Exchange at 9.30 am sharp, traders, brokers, and algorithms all scrutinise the index's detailed movements tick by tick. From here, the impact of S&P will ripple to nearly all equity markets elsewhere in the world.

View:

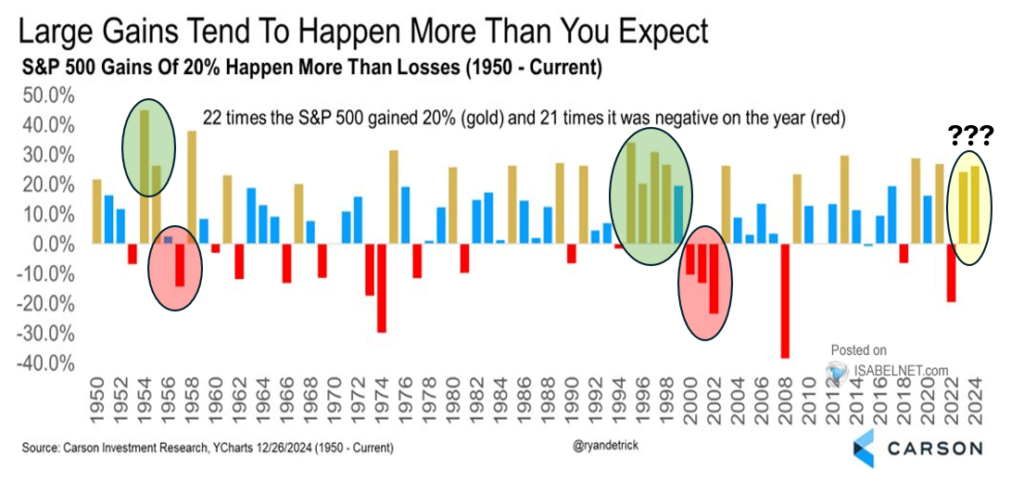

In 2024, sustained optimism lifted the blue-chip index’s by more than twenty percent. That was a really good year. In particular, the ‘Trump Trade’ injected a large dose of animal spirits into crypto and large-cap equities. But after a heady and exultant period, investor sentiment has tempered somewhat. Will 2025, many wonder, see a repeat of twenty-plus returns?

Investors are naturally anxious because it has been some time since the market witnessed a back-to-back gain of twenty percent or more. In fact, it has only done this thrice (see below). Moreover, these annual gains were unusual given the wider context of high inflation, rising interest rates and volatile economic growth. Will we see a reversion to the mean, or further gains? Nobody knows for sure.

Source: Realinvestmentadvice.com

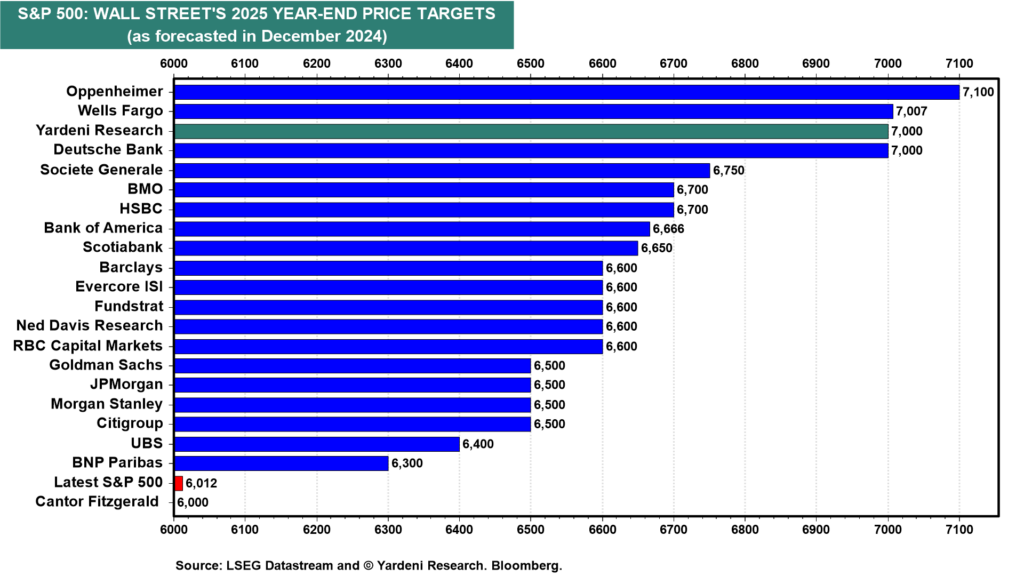

Still, at the end of last year, most brokers anticipated positive returns for the US large-cap index in 2025.

At the end of the bullish spectrum, some analysts are expecting another thousand-point gain for the S&P, to 7,000 and beyond. Only a tiny minority predicted the index to stay flat. The bulk of predictions sits in the middle of the forecast range: a 10-15 percent increase for the S&P (see below). At the time of writing (Jan 28), the index has remained buoyant above 6,000.

Are these reasonable forecasts? Certainly bullish I’d say. But forecasting, as they all say, is a hazardous business.

Source: Yardeni.com (2025)

To understand the S&P further, we have to delve deeper into the index composition. What drove the index to multiple all-time highs (54 new highs in total last year) over the last two years?

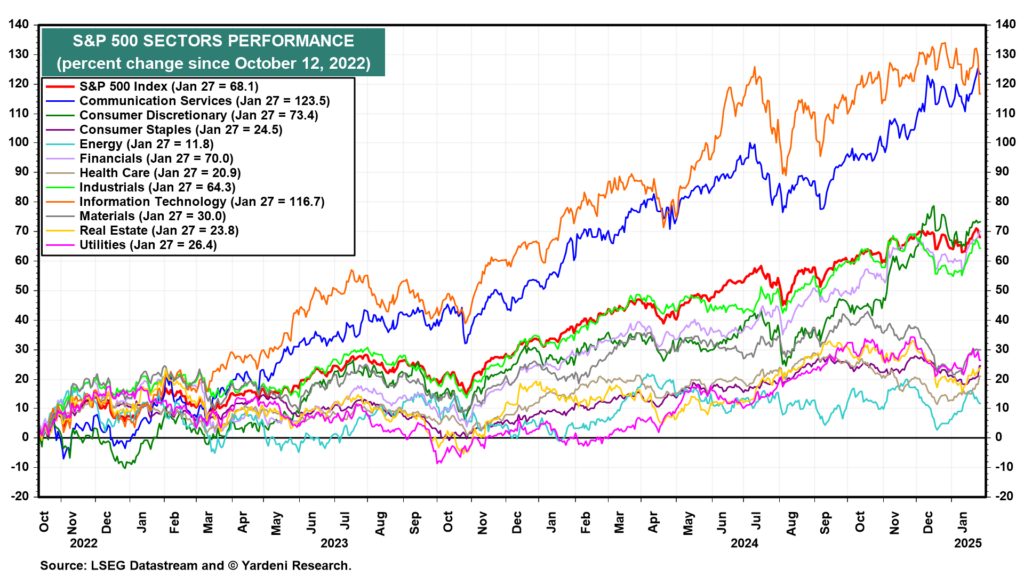

Two sectors have been pulling the index relentless higher since 2023: Communication Services and Information Technology.

Companies like Nvidia (NVDA) and Broadcom (AVGO) have surged to become trillion-dollar tech behemoths after Artificial Intelligence (AI) took flight. The catalyst for this stunning turnaround was the emergence of ChatGPT. But will these AI darlings will continue to propel the S&P 500 higher? If you ask the same question a year ago, the answer is most definitively yes. Then, the sector valuation was less stretched, sentiment less bullish, and speculative froth less obvious.

But after a two-year explosive rally, the answer is more nebulous these days. Many AI-related stocks have gained 500-1,000 percent in the past 24 months. Some even more. For these rallies to maintain their bullish trajectories, earnings delivery have to beat expectations quarter after quarter. This is really tough task to achieve.

Plus, when some unexpected factors emerge from nowhere – like DeepSeek in January – the entire sector plunged amidst uncontrolled selling. NVDA saw $600 billion of its market cap wiped off in a day (27 Jan) – the largest in US market history.

At the end of 2024, big tech dominated the party. Mag7’s* percentage of total S&P market capitalisation is about one third. This is a worryingly narrow leadership. For the S&P to continue its rally, other sectors have to take advance as well.

Right now, we are starting to see this leadership rotation in the financials. This is helping the S&P to maintain its upward movement. (see iShares Financials, ticker: XLF)

* Mag7 – Apple, Amazon, Google, Meta, Tesla, Nvidia, Microsoft

Source: Yardeni.com

Chart-wise, the index is continuing its multi-week rally at around 6,000. The series of rising low is maintained above the upward-sloping trend line (see below). This means that the odds of a further advance is reasonably high. A correction below 570-560 is needed to break the bullish trendline and momentum.

What may cause the index to soften? One potential factor is higher-than-expected inflation readings, which may cause the Fed to tighten. The other is weaker-than-anticipated corporate earnings. A few shares are richly valued. When profits are less than expected, investors will revise the current thesis.

In sum, S&P 500 is starting 2025 in a firm manner. All fine and good. The current rally, which started in earnest at the end of 2023, is still in motion. Until the index wobbles and registers weekly bearish dynamics, the path of least resistance is still pointing north.

Pros

- Includes most large-cap stocks

- Wide base (500 stocks) and includes most industries

- Long-term bull trend

Cons

- Large-cap focussed

- Dominated by a few mega-caps

- Low dividend yield

-

Outlook

(4)

Overall

4S&P 500 Analysis & Guides

Best Index Trading Platforms Compared & Reviewed

Index brokers provide access to indices markets such as the FTSE, DAX, and S&P for the purposes of trading, speculation, and hedging. These indices are made up of individual shares traded on stock exchanges. For example, the FTSE 100 is an index of the 100 biggest publicly listed shares traded on the London Stock Exchange.

Best Indices To Trade

In this guide, we look at the best indices for trading & investing. We explain what they are, the risks involved and also how you can invest in and trade stock market indices. Plus, what are the best indices to trade for beginners and experienced investors. What is a stock market index? A stock market