Wealthyhood Alternatives

We’ve tested and reviewed the best general investing accounts (GIAs) in the UK. This guide lets you compare top providers, see what real customers think, and read our expert insights. You’ll also learn which platforms suit DIY investors and which are managed by professionals, helping you choose the right GIA and start investing today.

| Name | Logo | GMG Rating | Customer Reviews | GIA Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews |

GIA Annual Fees £59.88 |

Dealing Commission £3.99 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0% |

Dealing Commission £1 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

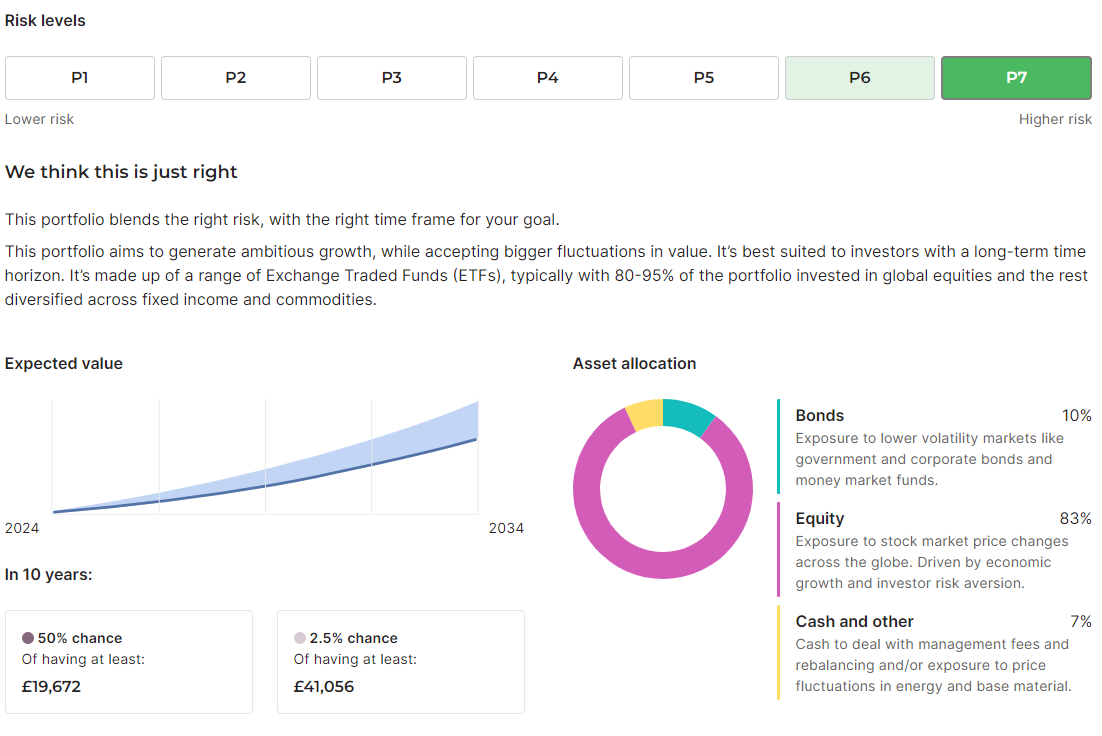

GIA Annual Fees 0.6% |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

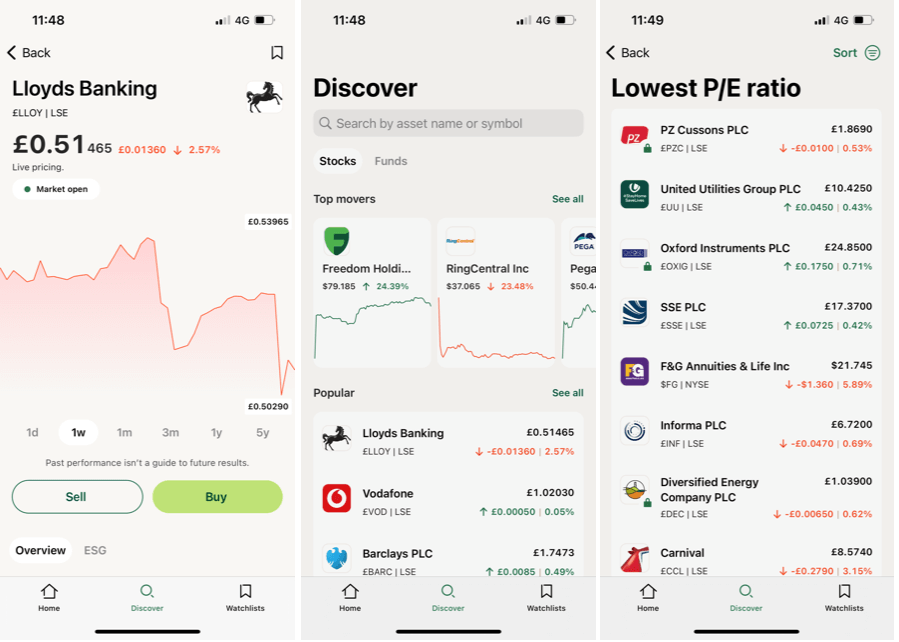

GIA Annual Fees £0 |

Dealing Commission 0.05% |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

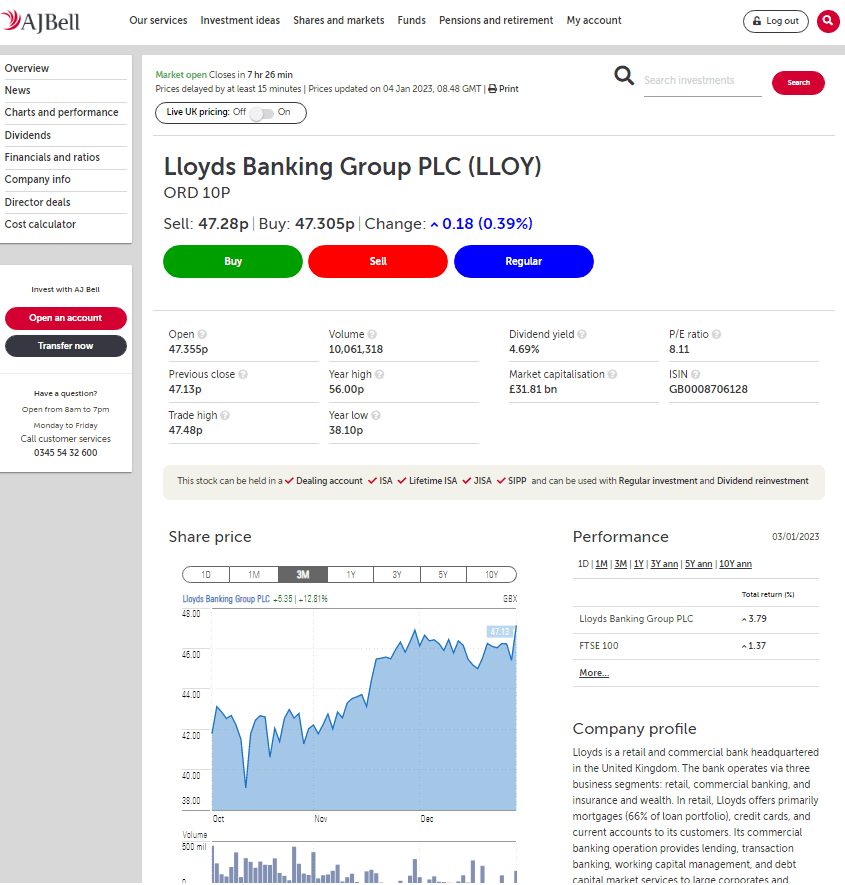

GIA Annual Fees 0% - 0.75% |

Dealing Commission £3.95 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

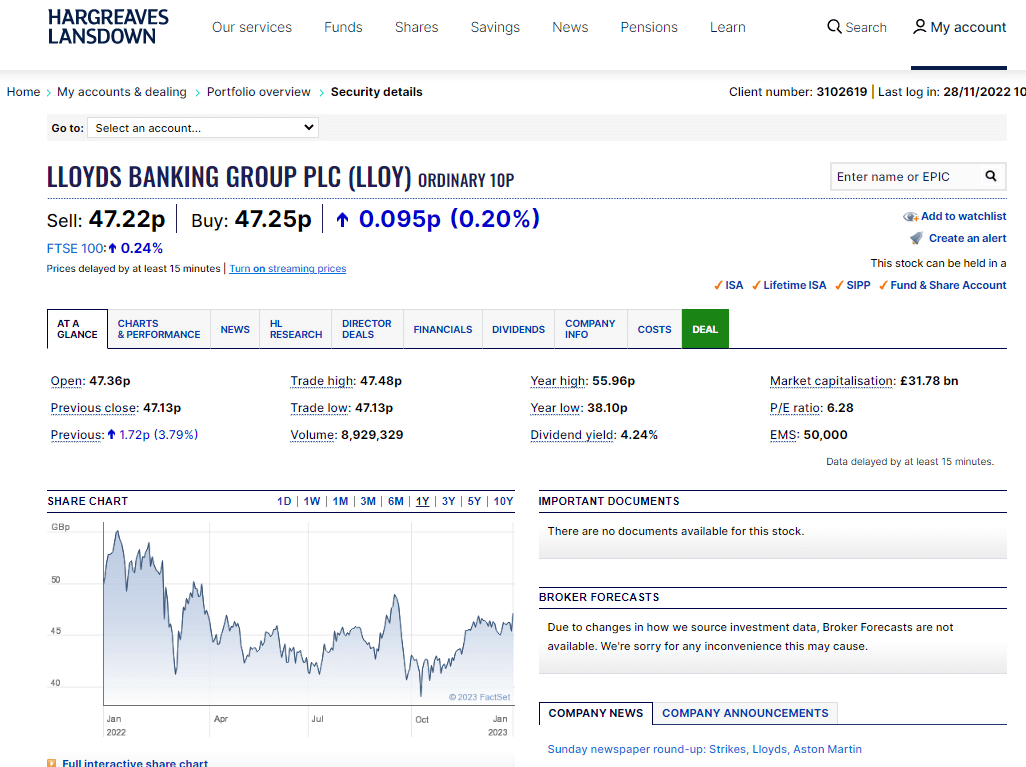

GIA Annual Fees 0% - 0.25% |

Dealing Commission £3.50 - £5 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0% - 0.45% |

Dealing Commission £5.95 - £11.95 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0.12% |

Dealing Commission 0.08% |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees 0.15% |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees £120 |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|

||

|

GMG Rating |

Customer Reviews |

GIA Annual Fees £96 |

Dealing Commission £0 |

See Offer Capital at risk |

Features:

|

|