Wealthify's Investing App is Excellent for passive investors

Account: Wealthify investing app

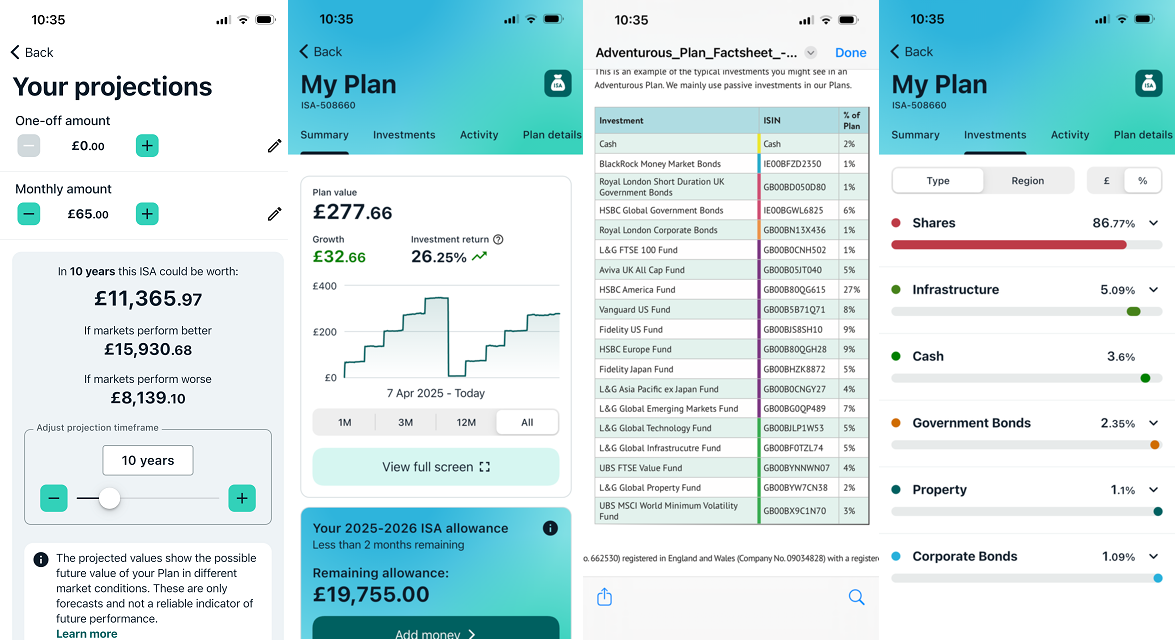

Description: Wealthify lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments. The platform is a robo-advisor and it’s part of the Aviva Group. Capital is at risk.

Is Wealthify a Good Investing App?

Yes, Wealthify is an excellent app but it’s not as good as the web version, because it’s easier to explore the risk and performance tables and choose a portfolio on a bigger screen.

The Wealthify app used to be brilliant for beginner investors but since the upped the minimum deposit required to start investing, it’s not not as acceisble as it once was.

Fees: Wealthify’s app is free to download and once you start investing is fiarly cheap for a managed robbo-advisor. It costs 0.6% to start investing with Wealthify, which is one of the cheapest robo-advisor account fees. There are also investment costs of, on average, 0.15% for original plans and 0.58% for ethical plans.

Market Access: You can only invest in two portfolios, but you can choose how much risk you want to take.

App & Platform: Very easy to use, and gives you lots of information if you want to dig deeper into your portfolios.

Customer Service: Excellent – good team and friendly support.

Research & Analysis: A bit here and there, but if you are a passive investor I doubt you’ll read any of it.

Pros

- Managed portfolios

- Low account fee of 0.6%

- Easy to use

Cons

- Cannot trade individual shares or ETFs

- Minimum investment of £1,000

- Mid range performance

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.7- Expert opinion: Wealthify reviewed & rated