Yes, we rank Interactive Brokers as the best online trading platform as it is exceptionally good for sophisticated trading. It offers by far the most access to the most markets through DMA futures, options, physical shares and CFDs. It also has the most advanced execution tools for retail traders, including complex order types such as VWAP, pairs trading, iceberg, and algorithmic trading.

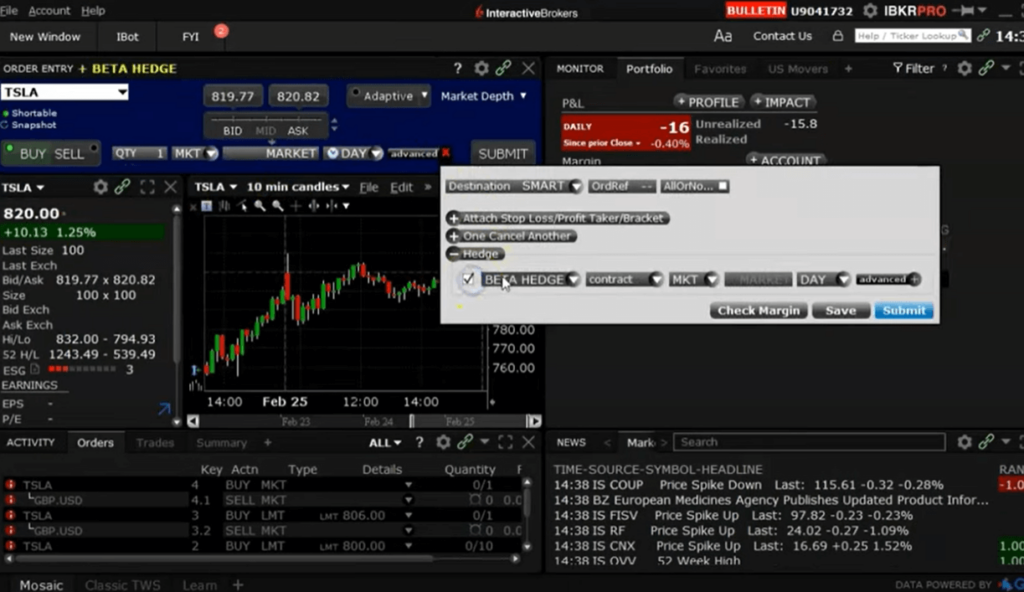

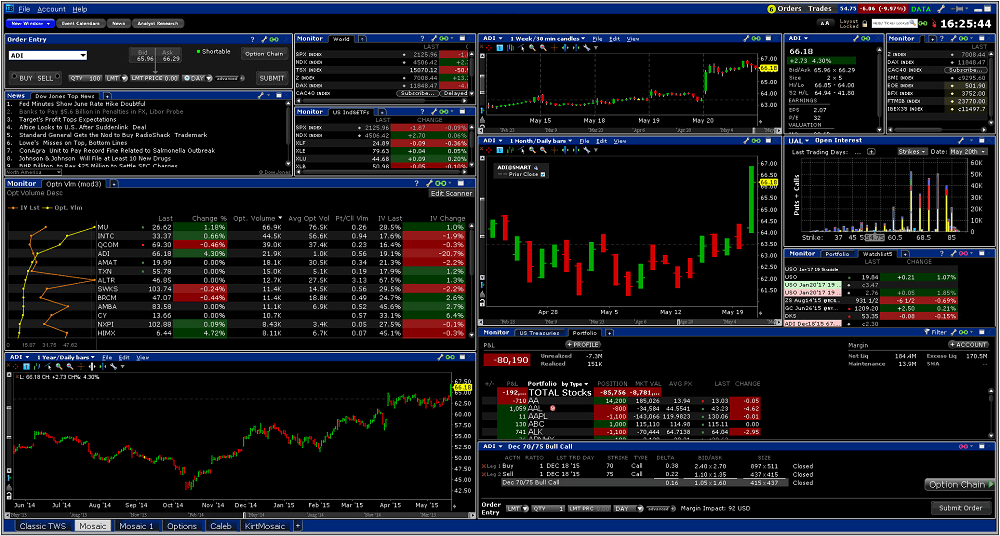

IBKR Workstation

What makes Interactive Brokers the best trading platform? In a word – execution. In two words, execution capabilities. If you are a private professional trader there is no other trading platform that comes close to offering institutional-grade order types to retail traders.

Yes, when I was testing the trading platform, one thing that is immediately obvious though is that the desktop version is almost too good for retail traders and most will only use a small percentage of its capabilities. However, new traders should not be put off by its institutional-grade offering. The heavy-duty Interactive Brokers Trader Workstation is available as a download on PC, but there is also a simplified web-based version that is very simple to use called Portal.

On the web-based Portal trading platform, you can execute trades as physical deals, CFDs, futures and options (on the widest range of stocks). There are lots of webinars (with the founder Thomas Peterffy and his team) that cover trading strategy. You can also evaluate your portfolio based on how ethical your positions are. There are stock scanners, fund scanners, bond scanners, a fundamentals explorer for hunting out undervalued stocks and you can convert currency at some of the best exchange rates around.

IBKR also gives you more control over your currency exposure. Most other trading platforms automatically convert currency when you trade instruments outside your base currency but IBKR lets you do it manually on a per-trade or ad hoc basis.

Overall, Interactive Brokers, as the pioneer of the online trading industry, remains one of the best all-round online trading platforms for sophisticated investors and traders.

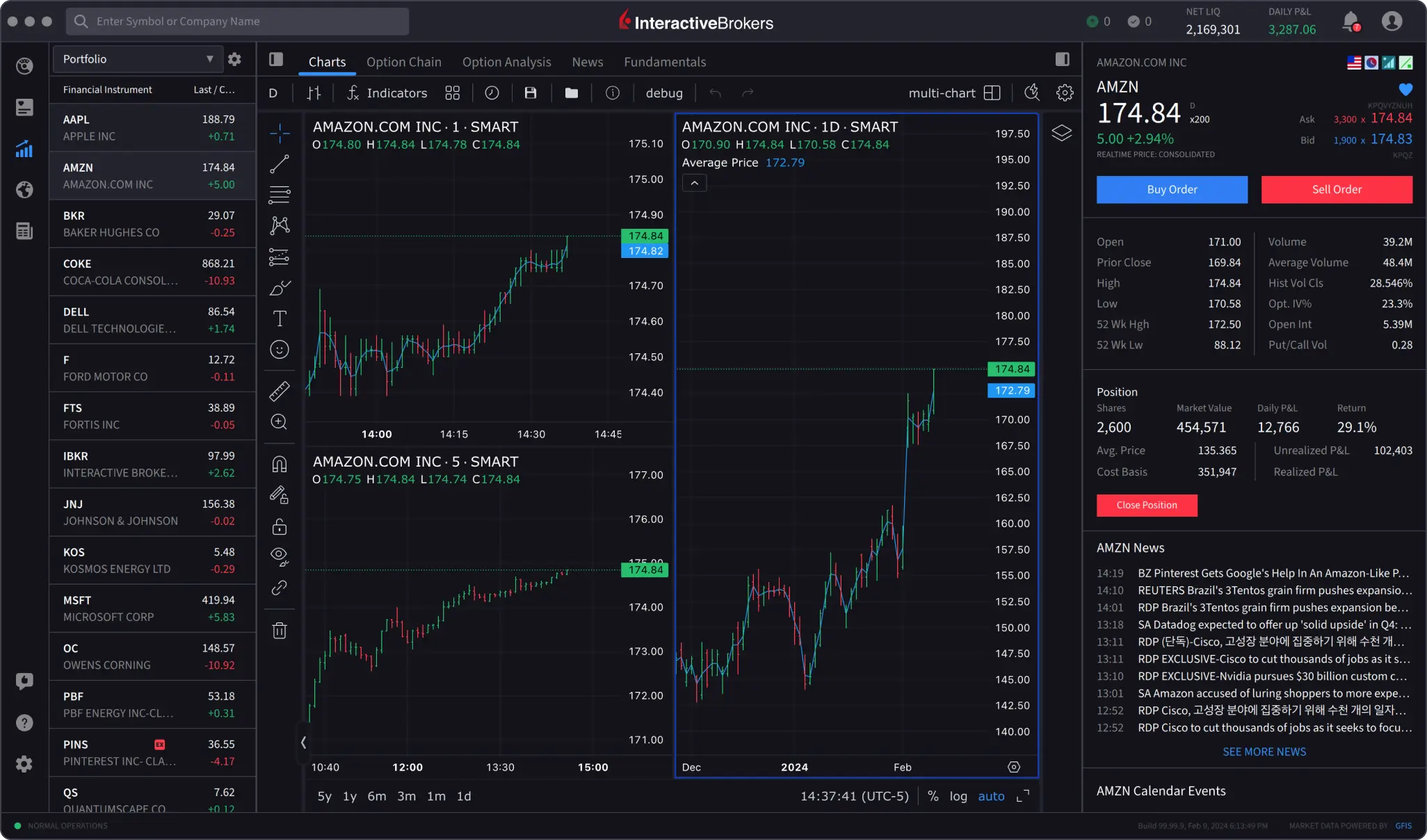

IBKR Desktop

In February 2024 Interactive Brokers unveiled its latest dealing platform. The new software, called IBKR Desktop, is described by the broker as a ‘next-generation desktop trading application’, developed for both Windows and Mac (iOS) machines.

The new platform comes complete with a suite of advanced trading tools including two innovations:

MultiSort: This allows users to sort data simultaneously using multiple factors. For example, fundamentals, technical indicators and historic price performance.

Traders can specify up to 10 different factors to sort by and can rank these factors by their relative importance.

Data revealed by the search updates dynamically expanding or contracting as fields are selected, excluded or enriched.

Option Lattice: This is a graphical display of an options chain, that visualises outliers in key data points such as open interest, the volume traded, and implied volatility.

Option traders can quickly switch between views in Option Lattice and can also look at the historical performance of the underlying security, that the selected options chain is over.

- Related Guide: Read our full Interactive Brokers review.

IBKR Desktop Training Guides

Interactive Brokers provides users with a comprehensive course about using IBKR Desktop and the features that the platform contains.

The course can be found at the IBKR Campus website under the Traders Academy section.

Further information on using MultiSort and or the Options Lattice can be found in the dedicated IBKR Desktop user guide.

Which we surfaced by simply using the search function on the Campus website to find MultiSort.

Innovation

Nasdaq-listed Interactive Brokers is one of the largest online trading businesses in the world.

The company, which was set up by its chairman Thomas Peterffy 46 years ago, has a market cap of just over $45.0 billion and processes some 1.9 million trades per day.

The firm employs more than 2900 staff in offices located in North America, the UK, Europe, Asia and Australia, and operates in more than 150 securities markets across the globe.

Speaking about the launch of the new trading tools Milan Galik, CEO of Interactive Brokers said:

“Interactive Brokers has a rich lineage of delivering market-leading technology. Responding to our client’s requests for powerful trading tools in a user-friendly interface”

He added that

“We’ve leveraged our experience building cutting-edge trading solutions to create our latest-generation platform. With IBKR Desktop, traders of all levels can enjoy the advanced trading capabilities of Interactive Brokers”

If there is one criticism that could be levelled at Interactive Brokers it’s that some of its platform interfaces look dated and ‘clunky’.

However, that’s something the firm is now addressing with the launch of next-generation trading tools, such as the IBKR Desktop platform.

Compare IBKR to other trading platforms below:

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.