Interactive Brokers CFD Trading Expert Review

Account: Interactive Brokers CFD Trading

Description: IBKR offers CFD trading on around 8,500 markets including 100 forex pairs, 20 commodities, 13 indices, and thousands of international stocks. I’ve traded through IBKR a fair bit and there is no doubt that Interactive Brokers CFD offering is one of the best around.

59.7% of retail investor accounts lose money when trading CFDs with this provider

Can you trade CFDs with Interactive Brokers (IBKR)?

Yes, you can trade CFDs or contracts for difference with Interactive Brokers, but you have to go through some quite arduous suitability tests to ensure that you understand the risks involved.

But once you are in, I found Interactive Brokers to be one of the best CFD brokers, most appropriate for experienced and sophisticated CFD traders. However, it also has lighter versions of its Workstation downloadable trading platform on the portal for newer traders who may want to stick with one platform as they become more experienced.

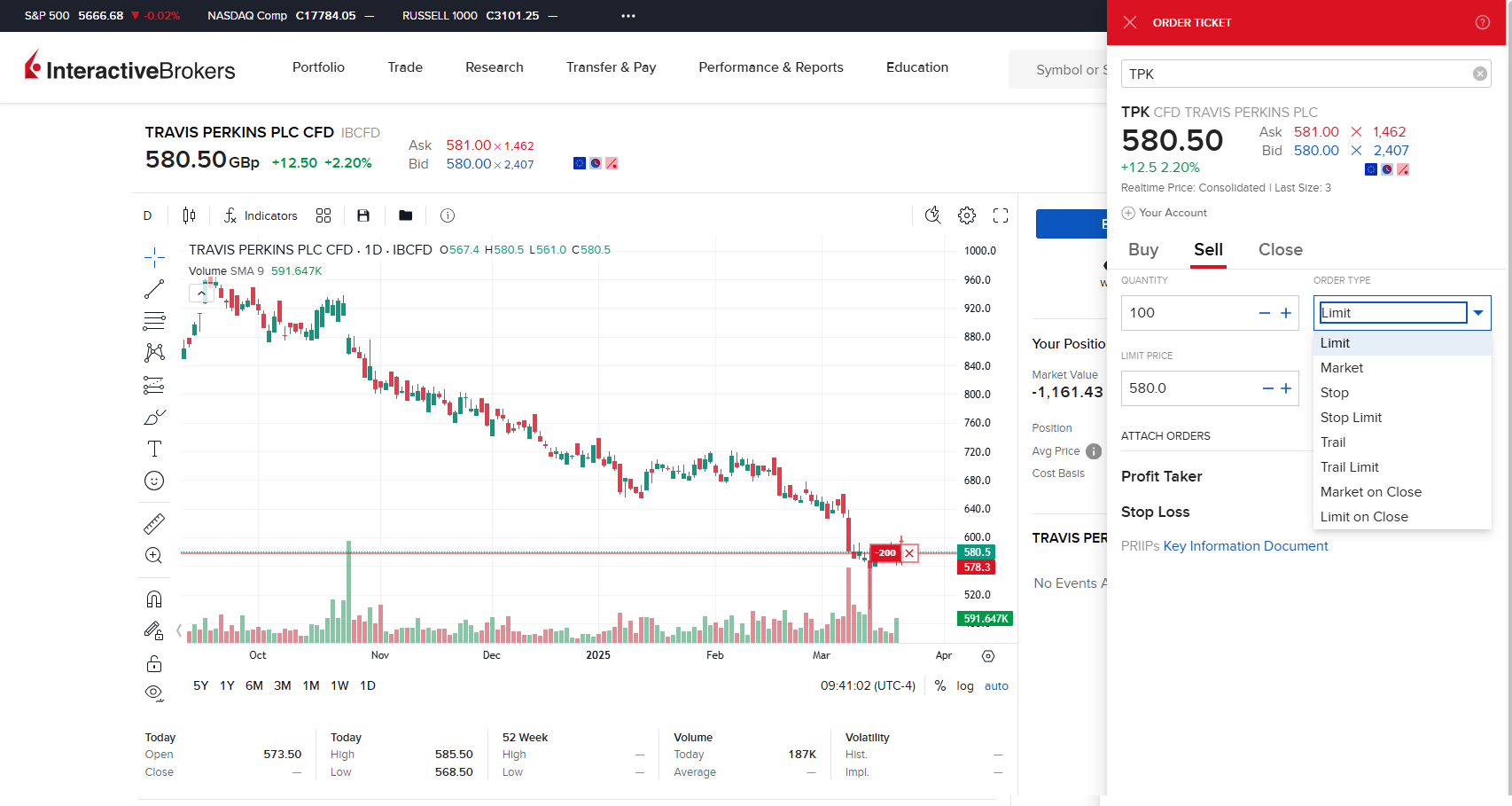

Trading Platforms: There are two different platforms, which I tested by short-selling Travis Perkins as a CFD. We discussed TPK in our podcast, and the general consensus in the comments on TikTok was that everyone hates them and that it’s too expensive. You can see below examples of both trading platforms and how different they look.

The downloadable platform Workstation lets you trade CFDs with the most types of order execution with IBKR, for instance, VWAP, pairs trading, time and price-sensitive order entry. These tools are most suited to professional and very high-volume traders, or hedge funds that are working very large orders and don’t want to scare the market. Most retail CFD traders will have no need for them, but it is representative of IBKRs overall service in that it provides an exceptional institutional-grade CFD platform to retail clients.

There is also an excellent pairs trading feature where you can simultaneously trade one CFD stock against another as a percentage. IBKR is the only CFD broker that lets you do this. With other trading platforms you have to do two separate orders.

As you can see from when I shorted TPK on the Portal web-based version it is much simpler. But you still get some good order execution types, but it’s very much for retail CFD traders compared to IBKR Workstation which is for professionals.

Market Access: Whilst Interactive Brokers does not offer the most CFD markets, they do offer one of the best ways to trade them. With IBKR CFDs you can trade with direct market access (DMA) on the exchange so you can place your orders directly on the order book at better prices than the bid/offer.

In reality, CFD brokers with the most markets are those that offer access to small or illiquid stocks which are probably not suitable for CFD trading anyway. But, IBKR offers access to the majority of stocks and markets most traders could need.

CFD Fees: The commission is charged post-trade so you get clean prices with no mark-up and IBKRs commission rates (added post trade) are the best around. Commission on UK stocks is 0.02% and 0.003% on US stocks.

Out-of-hours Trading: IBKR lets you trade CFDs on US stocks, indices, commodities and currencies overnight and on some parts of the weekend. Overnight trading starts from 8pm US ET time on Sundays and for those with US stock trading permission you get access to free overnight data.

CFDs on restricted ETFs: You can also trade ETFs as a CFD that you otherwise would not be able to invest in if based in the UK. One of the major drawbacks of ETFs listed in the US is they do not provide a Key Information Document (which tells you what is in them and how risky they are), so the UK regulators won’t let UK investors buy them as they are not transparent. However, with IBKR you can trade these as a CFD (which is an OTC product).

Pros

- Low-cost CFD trading

- Wide market range of CFD markets

- DMA CFD trading

Cons

- Better for advanced CFD traders

- Complex desktop platform

-

Pricing

(5)

-

Market Access

(4.5)

-

App & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.7Compare Interactive Brokers to other CFD trading platforms below:

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.