Hargreaves Lansdown General Investment Account: Excellent All-Rounder

Account: Hargreaves Lansdown General Investment Account

Description: Hargreaves Lansdown (HL) has plenty of account types including a GIA and several types of ISA, plus an excellent research portal. There's access to thousands of UK and international shares, funds, ETFs, investment trusts and corporate bonds. Capital is at risk.

Capital at risk

Is HL's GIA a Good Account?

HL is good for investors looking for more than just somewhere to buy and sell shares. The platform offers the most account types of all the investment platforms we compare, including a GIA, stocks and shares ISAs, lifetime ISAs, and junior ISAs. Plus, it has one of the best research portals to help you choose your own investments. And it boasts some of the widest market coverage, including thousands of UK and international shares, over 3,000 funds, ETFs, investment trusts, and corporate bonds.

Fees

There is no account charge for shares in a GIA with HL. Funds are charged at 0.45% for the first £250,000. There’s no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month.

Is HL’s GIA Better than its ISA?

It makes sense to open a GIA only after you have exhausted your ISA allowance. With the GIA from HL, you can invest as much as you like but with an ISA you’re limited to £20,000 a year in the tax-free wrapper.

What is HL’s Platform Like to Use?

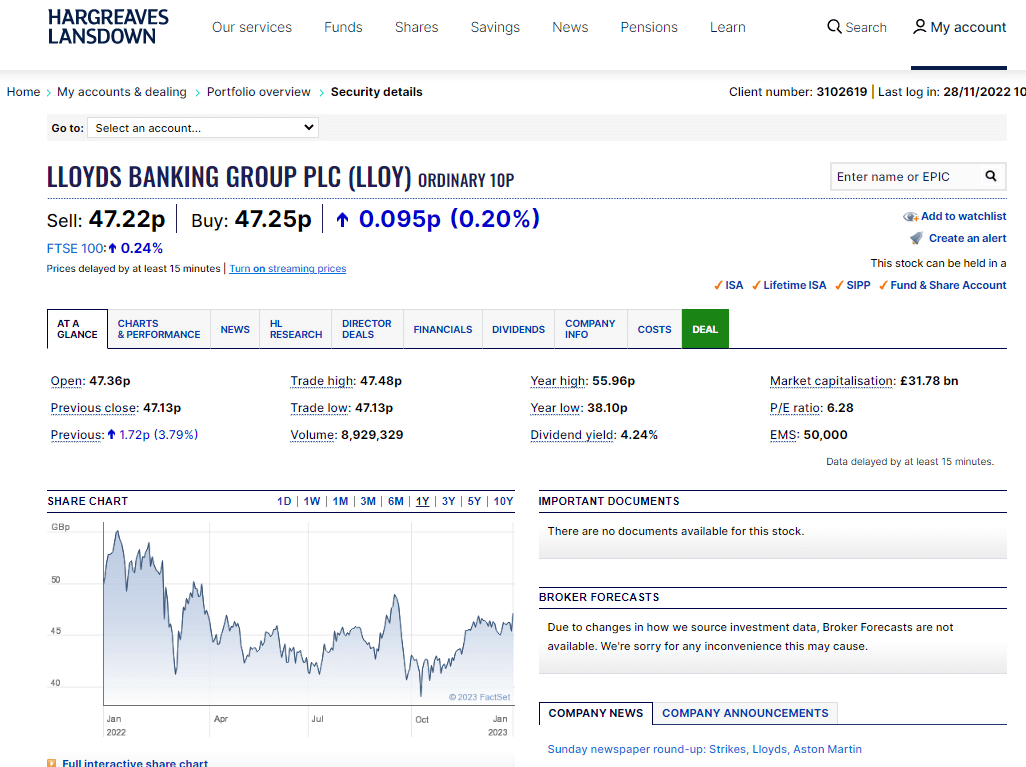

HL’s investment platform is one of the best around. HL provides a huge amount of technical and fundamental data to help you choose investments.

Pros

- Thousands of UK and international shares, bonds & funds

- Ready-made portfolios with different levels of risk

- Excellent research and analysis

- An established and listed company on the LSE.

Cons

- Can be expensive for large fund portfolios

- Data not as good as it used to be

-

Excellent

(5)

Overall

5- Expert opinion: Hargreaves Lansdown full review