Forex on eToro is expensive but can be less risky than other platforms because of their leverage controls.

eToro Forex Trading Platform Review

Product Name: eToro Forex Trading

Product Description: There are two aspects to eToro’s forex trading offering that makes it stand out. Social trading where you can copy other forex traders trades and the ability to set your own leverage. As forex trading is notoriously difficult, and I would say that the majority of eToro’s client are early-stage traders, the ability to reduce the amount of leverage is a very useful.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro a good forex broker?

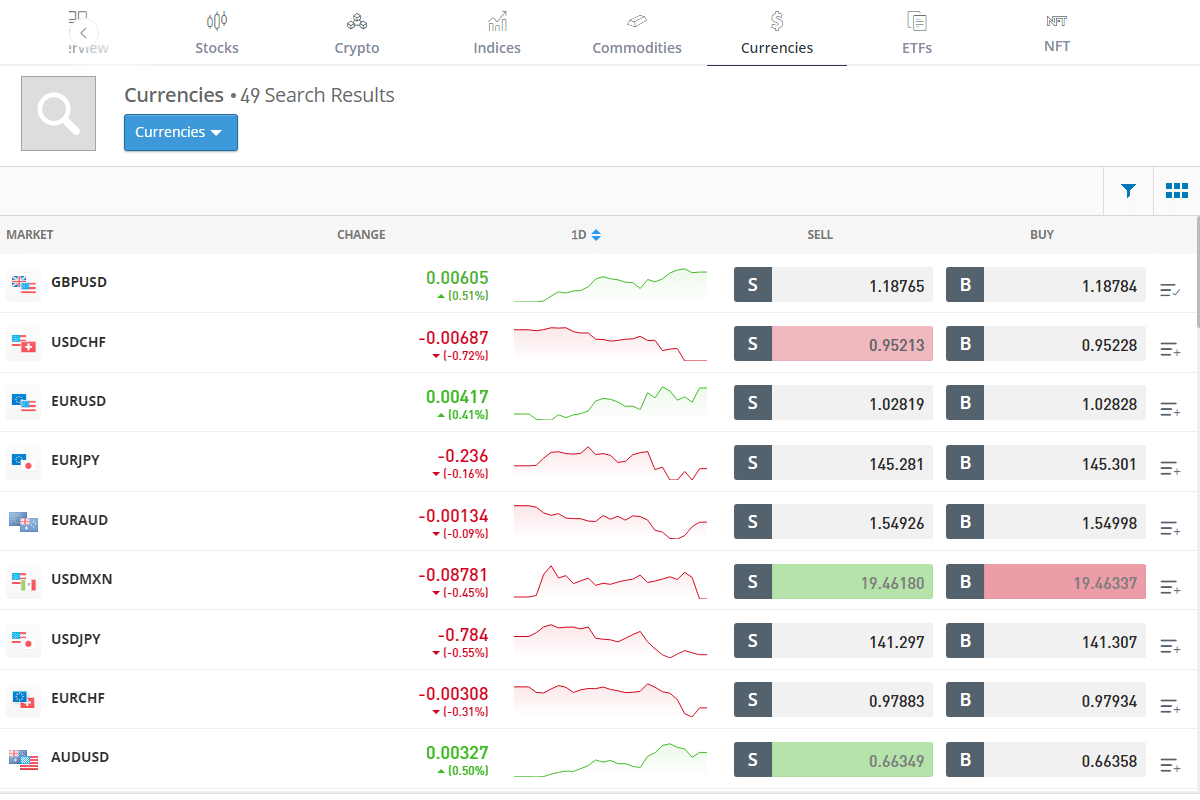

You can trade forex on eToro, but to be honest it is quite expensive and more of an investment/stock trading platform. If you are solely a forex trader there are more specialist FOREX trading platforms available.

Forex Leverage Control

When you reduce your leverage it means you reduce your risk, by putting up more margin when trading forex. So, for example, when you open a forex dealing ticket, your leverage is set at 30x, but you can reduce this to 1x. Meaning that if you want to speculate on $1,000 of GBPUSD, on 30x leverage, you would only have to put up $41 in initial margin, meaning you are potentially risking $959 that you don’t have. But, if you set your leverage to 1X yo have to put up the whole, $1,000 which reduces the temptation to take on excessive risk, with money you do not have.

Forex Copy Trading

The other feature that is unique to eToro is the ability to follow other forex traders through copy trading. However, it should be noted, though that if you are planning to trade forex by copying what other traders do it can be as hard as choosing your own trades. Just because a trader has done well in the past or if you think their trading ideas look good it does not mean they will be profitable in the future. Social trading is really only good for idea generation, which means you ultimately have to decide if you agree or disagree with another traders outlook.

Pros

- Social and copy forex trading

- Easy-to-use forex platform

- Can change your FX leverage

Cons

- Accounts must be in USD

- High FX conversion charges

- Limited FX market range

-

Pricing

(3)

-

Market Access

(4)

-

App & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com