The UK arm of Denmark’s Saxo Bank, CFD & Forex broker Saxo Markets UK, has announced a new customer loyalty scheme under which clients will earn and collect points based on their level of trading activity.

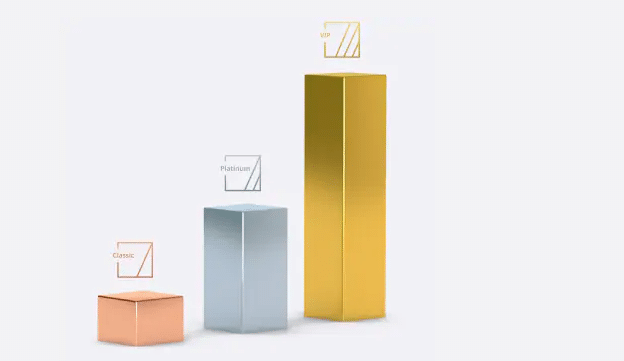

Existing customers of Saxo Capital Markets will automatically be enrolled in the scheme and Saxo will email its clients to tell them which of the three tiers (Classic, Platinum and VIP ) they are currently in, a classification based on their prior trading activity.

How to qualify for Saxo Capital Markets Rewards?

Every qualifying trade that a Saxo client makes going forward will earn them points. And as in the popular TV quiz show Play Your Cards Right, points earn prizes

Qualifying trades are trades that are sized at €10,000 or greater (or equivalents) in for example spot FX single stock CFD trading, physical share dealing and investments in bonds. Options trading and Futures dealing require a qualifying volume of a single lot.

A qualifying FX trade will earn 30 points whilst a bond investment will generate 320 reward points. For full details of the Saxo reward points schedule on their website.

Saxo clients will also be able to earn rewards through referrals and attending events. with 5000 points available for the referrer and the referee, if they become a client. Whilst attending a webinar or other event will earn clients 1000 reward points.

How are Saxo Capital Markets Rewards points allocated

Points totals are to be reviewed quarterly in arrears and clients that have accumulated sufficient points will be upgraded to the next tier in the program where there will access their rewards

For example, if you move from classic up to platinum (for which you need a minimum 120,000 points to qualify) you could enjoy discounts of as much as -30% on your pricing, enhanced technical and account support, and priority customer support.

Those in the VIP tier, which requires 500,000 points for membership, will enjoy a dedicated relationship manager, Saxo’s very best pricing, round the clock access to the banks trading experts. And the ability to speak Saxo’s strategists on a 1 to 1 basis. Alongside invites to exclusive events and the highest levels of technical, account and customer support.

Initially, there will be no demotion between tiers as Saxo is offering a 12-month grace to those clients who don’t accrue enough points over a quarter to maintain their status. But after that less active traders could find themselves moving south.

Reward points will be added to customer accounts automatically within 24 hours of trade

Rewards for retail and professional clients

The scheme doesn’t appear to take client classification into account

So in theory, retail customers could find themselves in the upper tiers and professional clients in the lower. Though we would imagine that any retail clients that qualified for the VIP level might well meet the criteria for professional status or be widely over-trading.

The new scheme is clearly intended to foster brand loyalty and to both reward and incentivise Saxo’s trading clients. We have some reservations about the concept of tiered pricing though larger volumes have generally always meant lower fees in FX, CFD and Stockbroking markets.

Just how the rewards program sits within the TCF (Treating Customers Fairly) obligations that Saxo faces under the FCA is a possible point for debate. As is, the idea that the largest number of points are accrued for referrals. But if you are an existing Saxo customer and you can benefit from the scheme then you will no doubt be happy to participate.

Customer retention has become increasingly important to brokers since the advent of ESMA’s leverage restrictions and MiFID II and we will no doubt see similar initiatives from other brokers in the months ahead.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.