interactive investor General Investing Account Review: Low cost fixed fee investing

Account: interactive investor General Investment Account

Description: The interactive investor (ii) GIA is an all-rounder with an attractive fixed fee pricing model. There's access to a wide range of markets including UK and international shares, bonds and ETFs. Capital is at risk. Capital at risk

Is Interactive Investor a good general investing account?

Yes, ii’s GIA won our award for best general investment account in 2023 and 2022. This is because of its excellent fixed-fee pricing, which makes it a good choice for investors with over £10,000 to invest. ii’s fixed fee keeps your total account costs low no matter how big your portfolio gets. You can also invest in a markets ranging from UK and international shares to funds, trusts, bonds and ETFs.

Special Offers:

New customers opening an ii General Investment Account (GIA) by 31 January, 2026, are also eligible for £100 in free trades. Like the ISA offer, no minimum deposit is needed.

You also get free investing for your friends and family. You can give up to 5 people a free investment account subscription with ii’s Friends and Family plan. You pay a single extra fee of £5 a month (free if you’re on the Super Investor plan), and their monthly cost is zero. Each member can invest up to £50,000 in an ISA or a general investing account with free regular investing and no account fees. However, they’ll still pay normal dealing commissions when they buy and sell investments.

Plus you can claim up to £200 when you refer a friend to ii. Recommend a friend or family member and get a £200 reward. Your friend will get their first year’s service plan with no account fees – saving £59.98. To qualify, your friend must transfer or fund their account with at least £5,000 in combined cash/investments. New pricing is due to start on 1 February, 2026.

Fees

A GIA with ii costs from £4.99 a month with its Investor Essentials plan. With this basic plan, trading on UK and US stocks is £3.99. There are two plans above that which include free trades. You can set up regular orders as small as £25 for free with ii’s regular investing service.

Is ii’s GIA Better than its ISA?

The GIA is better if you have lots of money to invest as the maximum you can put in an ISA tax-free each year is £20,000, so anything above that you should invest in a GIA. However, if you have less than £20,000 to invest each year, the ii ISA is better option as your profits will be tax free.

What is ii’s Platform Like to Use?

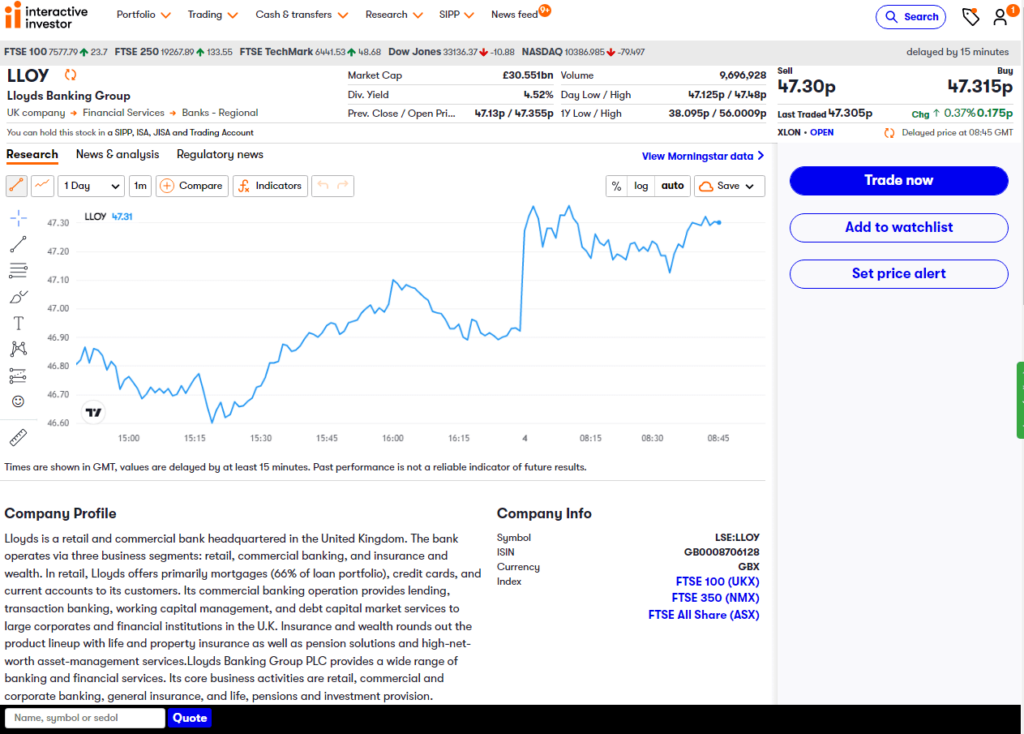

ii’s platform is very easy to use and it gives lots of market data on potential investments.

Pros

- Pick your own investments or use the model portfolios

- £1 minimum deposit makes it easy to get started

- Fixed account fee that does not increase with your investments

- Joint account options

Cons

- Fixed fee expensive for accounts below £1,000

- No lifetime ISA account

- No junior SIPP account

-

Excellent

(5)

Overall

5- Related Guide: Best General Investment Accounts (GIAs) Compared & Reviewed