Digital bank Monzo has today announced the launch of Monzo Home Insurance, a fully flexible combined buildings and contents insurance product tailored specifically for homeowners.

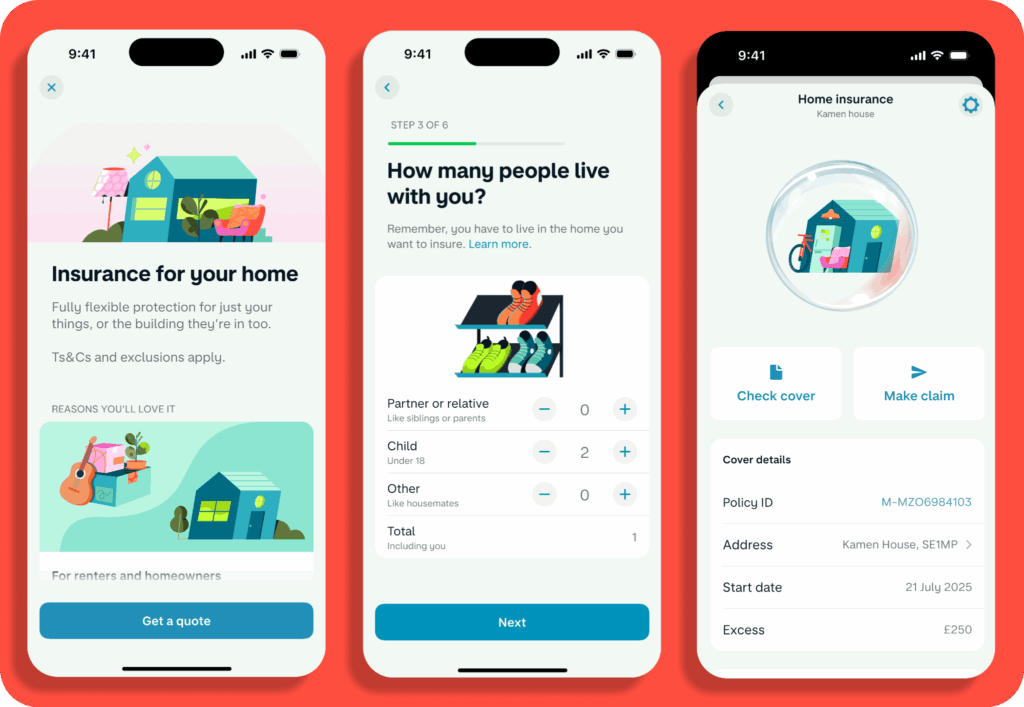

The new policy builds on the success of Monzo’s contents-only insurance for renters, which launched in April, and marks a significant step in the bank’s ambition to provide all-in-one financial services through its app. Available directly via the Monzo app, homeowners can now secure cover for their property and belongings in just minutes — with the option to adjust or cancel at any time without penalty.

Phoebe Hugh, Head of Insurance at Monzo, said: “Your home is your biggest asset and protecting it shouldn’t be a headache. Our customers told us they wanted something simpler — cover that fits their lives and changes when they do.”

Unlike traditional policies that lock customers into rigid annual contracts, Monzo Home Insurance promises full flexibility. The application process is designed to be fast, requiring answers to just six key questions. Customers can also customise their policy with optional extras like accidental damage or emergency cover, and see pricing changes in real-time.

Monzo’s offering includes up to £1 million in cover for structural damage due to fire, floods, subsidence, and natural disasters. Theft and damage of personal belongings inside and outside the home, including lock and key replacement, are also covered. Claiming can be done over the phone or, soon, fully within the app.

With over 12 million customers, Monzo continues to evolve its platform beyond everyday banking, now enabling users to budget, borrow, invest, track pensions — and insure their homes — all in one place.

The combined home insurance product will roll out to eligible Monzo customers over the coming weeks.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.