‘Higher for longer’ was the common view back in 2022. That changed last year when banks started collapsing (remember the swift demise of Silicon Valley Bank and Credit Suisse?)

Investors turned dovish on rates last autumn after a batch of weak data. That view launched a gigantic market party shortly after. The global blue-chip equity barometer – US S&P 500 Index – rose a stunning 25 percent in the Nov-Jan quarter. Nvidia (NVDA) soared by a $1 trillion; many speculative stocks jumped (see Bitcoin below).

However, the market could be getting ahead of itself. The global economy is doing fine, but not at the blistering pace that the market is pricing in. Corporate profits on some sectors may stagnant this year. Any missteps in earnings are punished severely. For example, Adobe (ADBE) plunged 14 percent last Friday on weak revenue guidance.

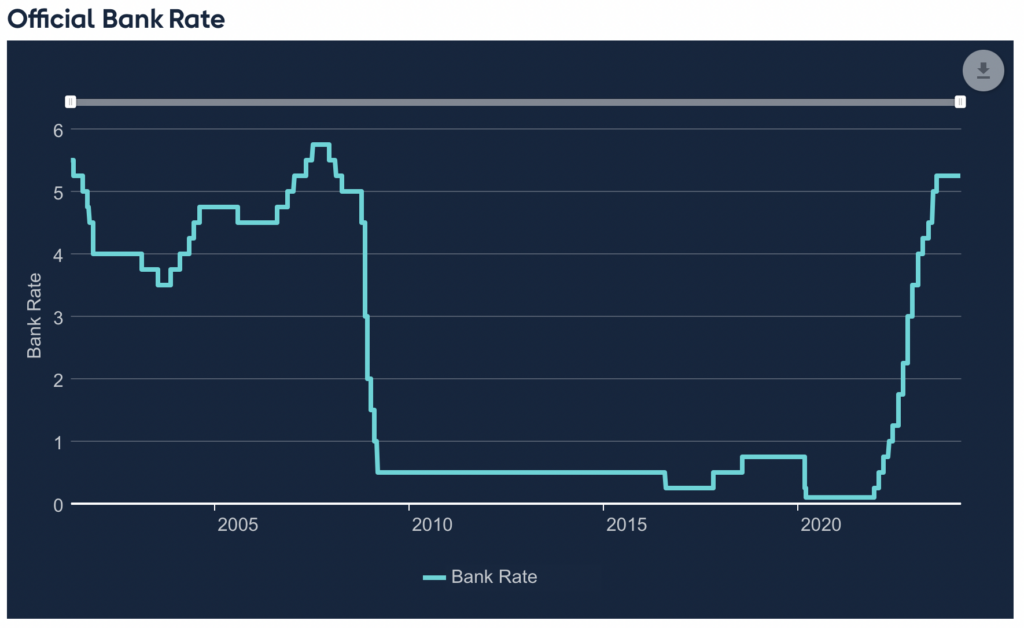

This week, the Fed and Bank of England are expected to maintain the policy rates at 5.25-5.50 and 5.25 percent respectively. Earlier, the European Central Bank held the policy (refinancing) rate at 4.5 percent.

If central banks continue to hold the borrowing costs at these restrictive levels longer than expected, something is going to give. Be forewarned.

Source: Bank of England

Instrument of the Day (Bitcoin): ETF-fuelled rally taking a short break?

There is no asset more speculative than Bitcoin.

In recent years, the king of crypto latched on to the global macro landscape and its prices have benefited hugely from any improvement in investor sentiment. This sentiment is running really hot recently as US stocks hit new all-time highs.

The fact that any Joe Public could get their hands on BTC via the newly-listed Bitcoin exchange-traded funds only added fuel to the fire.

Take the iShares Bitcoin Trust (IBIT, product brief). When it launched in the last week of January, its assets under management (AUM) were a meagre $2 billion.

Six weeks later, this AUM swelled to $15.9 billion – an eight-fold increase. At this furious rate of capital inflows, Bitcoin prices are expected to go only one way: Up.

And up it went. In March Bitcoin surged to its highest level ever; each digital coin fetched a mind-boggling US$74,000. Even after a modest setback, each Bitcoin still changed hands for US$68,000.

Should we buy the so-called ‘digital gold’ now? Only if you can withstand the volatility of its price movements.

Bitcoin is notorious for its inexplicable price dives and sudden explosive rallies. While leveraged positions were mostly wiped out in these crazy price swings, Bitcoin’s long-term returns are nothing short of spectacular.

If interested, I do have to slap a bog-standard warning here though – “you may get back less than you originally invested”.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.