To invest in the SSE Composite Index (Shanghai Stock Exchange), SSE 180, SSE 50 or SSE Mega-Cap Indexes you need a share dealing account that gives you access to emerging markets or a trading platform that offers access to Asian markets.

Compare the best brokers for trading the SSE Composite Index

To compare brokers for investing view our investment providers and trading platform comparison tables.

If you’re looking to trade Chinese Shanghai Stock Exchange Index (SE 180, SSE 50 and SSE Mega-Cap Indexes), we’ve compiled a list of the best brokers for trading the SSE. All brokers in this list are authorised and regulated by the FCA.

What is the SSE index?

The Shanghai Stock Exchange Index (SSE) or Shanghai Composite index as it’s sometimes known, is the major, broad based benchmark, for listed Chinese equities. It comprises all of the Chinese “A” and “B” shares that are traded on the Shanghai exchange. It is a good way to invest in China.

A shares are typically the shares of domestic Chinese companies whilst B shares are shares of foreign companies that are listed on the Shanghai exchange. A shares are traded in the Renminbi, however, B shares are often priced and traded in foreign currencies (usually the US$) , rather than the Yuan.

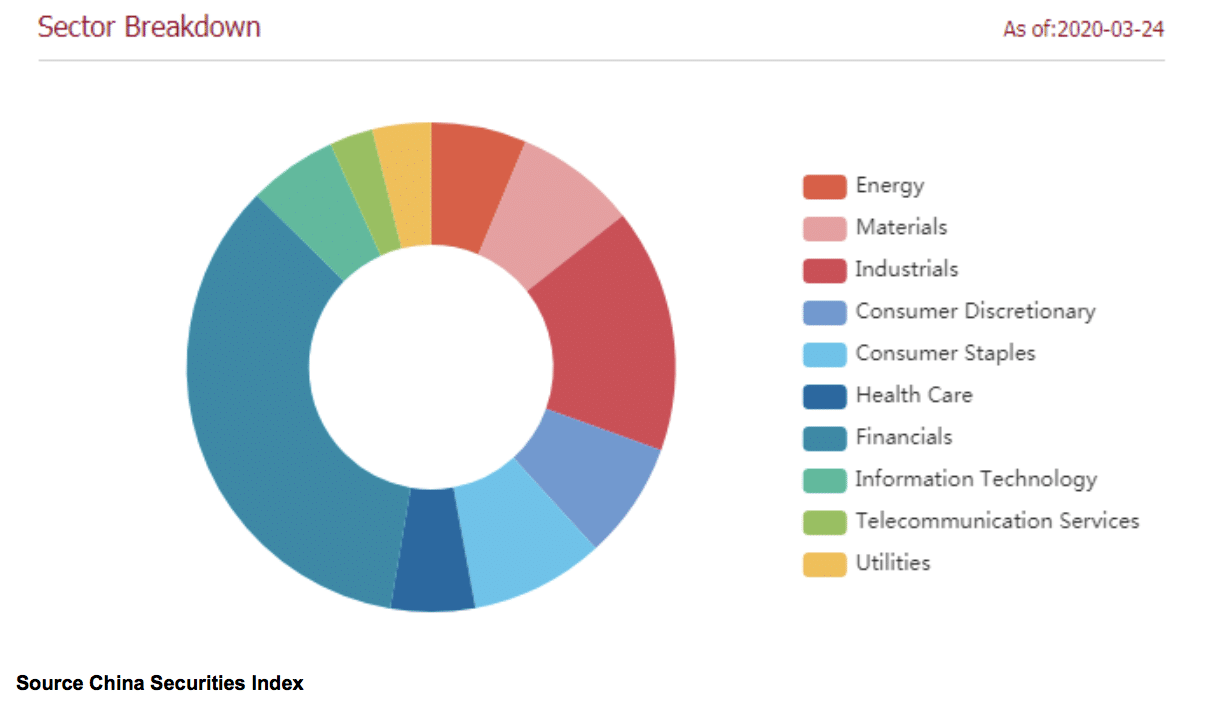

In total there are 1,549 shares within the SSE index that are drawn from ten major sectors; they are broken down as follows, with financials having the biggest weighting within the index.

SSE Index sector breakdown

Source China Securities Index

The index was first launched as far back as July 1991, though it has really only risen to prominence since the mid-noughties.

Chinese equities became more accessible for mainstream investors with their inclusion and increasing weighting within the all-important MSCI indices, against which trillions of dollars’ worth of investment funds, globally, are benchmarked.

How can you trade the SSE with CFDs and Spread Betting?

Now that the SSE index has become part of the investment and trading mainstream retail clients are able to get involved and take a view or position on the index and its constituents. Perhaps one of the best ways to do this, particularly for short term traders is by using a CFD or Spread Betting Broker, and trading one of their margin products on Chinese equities.

Most CFD brokers and Spread Betting firms don’t make a specific market in the Shanghai Composite Index itself, However they do offer CFDs and Spread bets over other Chinese equity indices, and a range of instruments that track Chinese equities, such as ETFs, more on which in a moment.

Remember that when you trade CFDs or Spread Bets on a financial instrument you are never the owner of the underlying rather you are merely speculating on the performance of the instruments price and you are doing so on a leveraged or geared basis. That is your CFD broker or Spread Betting provider gears up the money on your trading account allowing you to take a larger position in the markets, than your deposit would otherwise allow.

CFDs or Contracts for Difference, are classified as trades whilst Spread Bets, as the name implies are treated as bets.

And therefore, there are different tax treatment implications for any profits or losses made through them. For example, profits made from Spread Betting are exempt from UK capital gains taxes (at the time of writing) but these privileges only extend to individual UK taxpayers and not to corporations or those individuals who pay tax abroad.

How can you invest or trade in the SSE with ETFs?

ETFS or Exchange Traded Funds are open-ended vehicles designed to track or mirror the returns generated by a specific index, sector, instrument or strategy. They are known as tracking or passive investments because they do not try to outperform their benchmark; Instead they aim to track or copy its returns as closely as possible.

ETFS trade like individual shares and the value or price of an ETF will move in line with changes in the price of the underlying instruments that it is tracking.

Unlike the share prices of closed-end investments vehicles such as investment trusts whose prices move based on the supply and demand for the individual share of that fund or trust.

In actual fact there are no ETFs that specifically track the entire Shanghai Composite Index, however, there are plenty of exchange traded funds that track a range of other Chinese equity benchmarks. As well as indices which track many of the major large cap components of the composite index.

Asian markets are increasingly taking their lead from China, the Hong Kong, Singapore, Tokyo and Sydney markets regularly reference and take their cues from Shanghai and with an increasing penetration and dual listings abroad, the largest Chinese companies are becoming pace setters in sectors such as technology and ecommerce. China of course is among the world’s top three economies alongside those of the USA and European Union.

The table below lists a dozen of the largest and most actively traded Chinese equity ETFs, which are ranked by Assets Under Management or AUM, at the time of writing. It also includes details of average volumes traded, and the most recent closing prices, at the point the table was created.

| Symbol | ETF Name | Total Assets ($MM) | Year To Day Performance |

| MCHI | iShares MSCI China ETF | $7,306.52 | -7.10% |

| KWEB | KraneShares CSI China Internet ETF | $5,549.53 | -8.74% |

| FXI | iShares China Large-Cap ETF | $4,911.47 | -5.14% |

| ASHR | Xtrackers Harvest CSI 300 China A-Shares ETF | $2,068.74 | -7.78% |

| GXC | SPDR S&P China ETF | $835.53 | -7.45% |

| CQQQ | Invesco China Technology ETF | $792.19 | -11.98% |

| YINN | Direxion Daily FTSE China Bull 3X Shares | $659.09 | -33.20% |

| CXSE | WisdomTree China ex-State-Owned Enterprises Fund | $591.43 | -12.09% |

| KBA | KraneShares Bosera MSCI China A 50 Connect Index ETF | $368.89 | -11.14% |

| CWEB | Direxion Daily CSI China Internet Index Bull 2x Shares | $348.95 | -28.60% |

| CHIQ | Global X MSCI China Consumer Discretionary ETF | $312.65 | -7.89% |

| CNYA | iShares MSCI China A ETF | $300.22 | -9.85% |

| YANG | Direxion Daily FTSE China Bear 3X Shares | $189.55 | -6.47% |

| PGJ | Invesco Golden Dragon China ETF | $172.77 | 0.71% |

Source ETF database and Good Money Guide Research

The largest of these China equity tracking ETFs is the iShares MSCI China ETF, which tracks a basket of large cap Chinese equities that are accessible to international investors.

iShares of course is a division of Blackrock one of the world’s largest investment managers the fund was launched back in March 2011, so it has a long-standing track record.

Its stable mate and number two in the list above with the ticker:FXI, is the iShares China Large-Cap ETF. This fund tracks an index or basket of large cap Chinese equities that are listed and traded in Hong Kong rather than in Shanghai.

That nuance in terms of the listing of the underlying securities highlights an important distinction in Chinese markets, in that not all instruments and investments are open to non-Chinese nationals. And for obvious reasons the funds that track Chinese equities are focused on those instruments that foreigners can access.

The Hong Kong stock exchange is electronically linked to mainland Chinese exchanges so at least in theory there should be little or difference in the price of equities listed in both venues. And if any do occur then they should be arbitraged away quite quickly.

Nonetheless there are differences in the performance and returns of these two funds despite the similarities between their makeups. But that is exactly what makes the Chinese markets so interesting to traders because there are opportunities to make trades that don’t really exist anymore in western markets.

How can you invest in shares listed on the SSE if you are in the UK?

If you are looking to make a long-term investment into Chinese equities rather than just trade the prices of the underlying instruments, then ETFs are likely to be your best option due their relatively low costs and annual fees, and their daily liquidity.

To invest in an ETF, you can contact the fund provider directly. However, it’s probably going to be more convenient for you to buy and sell ETFs, as you would other stocks and shares, and that’s through your stockbroker.

If you don’t currently have a dedicated stock broking account you can compare broker platforms here and or compare ETF accounts to discover more about dealing in ETFs.

However, if you want to invest in individual Chinese equities you will need to check with your broker about their coverage and custody arrangements, and the charges involved therein.

As we noted above overseas investors are not able to access all Chinese markets and listings. However, many of the large cap Chinese companies are investable and they often have listings in China, Hong Kong and on US exchanges as well.

As ever when investing in overseas markets it’s important to do your research and remember that you will need to consider the likelihood of FX exposure when you make an investment that’s priced in currency other than your own.

If you are in any doubt about the suitability of investing in Chinese equities, then you should seek the appropriate financial advice.

Alternative Indices For SSE (SSE Composite) Index Trading

You can read about the major indices in our guide to the best indices for index trading.

- Dow Jones Industrials Average (US 30)

- Standard & Poor’s 500 (S&P 500)

- Nasdaq (Composite and Nasdaq 100)

- Dow Jones Industrials (DJIA)

- UK FTSE 100 (FTSE 100)

- CAC 40 (France 40)

- DAX (Germany 30)

- Japan 225 (Nikkei 225)

- Hong Kong (Hang Seng Index)

You may also be interested in:

- Best brokers for trading Apple Shares

- Best brokers for trading Brent Oil

- Best brokers for trading GBP/JPY

- Best brokers for trading Lloyds Shares

- Best brokers for trading NASDAQ 100, US-TECH 100

- Best brokers for trading RBS Shares

- Best brokers for trading United States Natural Gas Fund UNG

- Best brokers for trading USO-oil fund

- Best brokers for trading VXX Volatility

- Best brokers for trading Dax 30, Germany 30