Retailers tend not to survive many recessions, let alone thrive. An exception is Next (LON:NXT). Formed in 1982, the LSE-listed retailer is now one of the largest in the country. Revenue last year totalled about £4.86 billion; earnings came in at £850 million. In the world of cut-throat competition and fickle shoppers, these results are exceptional.

Is Next (LON:NXT) a good investment in the long term?

Under the superb leadership of the CEO Lord Wolfson, Next’s agility and adaptability made it one of the best investments in the UK stock market. In the early nineties, Next traded at around £1 per share. At the end of October 2022, even after a YTD decline of around 30%, Next share prices still fetched £49. Unquestionably, Next long-term shareholders reaped plenty of rewards through capital appreciation and dividends (see below).

Source: Financial Times

The downside of buying now is that Next is no longer the small fashion retailer that it once was. To grow like it did before will require a monumental jump in revenue and market capitalisation. In the age of subdued consumer spending, this is unlikely in the near term. Yes, the case for buying Next remains strong, but expectations have to be lowered over the long term.

When is the best time to buy Next shares?

As a major clothing retailer with more than 500 physical stores, Next’s share price is vulnerable to the general economy and, more specifically, the consumer sentiment. History tells us that consumer stocks tend to plummet during straitened times. Financially weaker retailers that have over-expanded or over-leveraged during the boom times would have gone under. This creates both fear and opportunity for Next.

An example is the pandemic. Next’s share price halved in less than five weeks, from £72 to £36, when the shoppers were mandated to stay at home. But its thriving online business and a gentle recovery in footfall soon propelled the share price back to £80.

Therefore, the best time to buy Next shares is during a recession, when the outlook is poor.

Is the Next share price overvalued or undervalued at the moment?

Financial markets thrive on trends, be it up or down. In this respect, Next’s share is neither over- nor under-valued at the moment because investors are more concerned by the macro factors such as interest rates and cost-of-living crisis and geopolitical sentiment (Ukraine).

With a price-earnings ratio of around 8-9, Next’s share price is not particularly expensive. Its dividend yield is at a respectable 2.6%, which is a percentage point lower than that of Shell’s (covered yesterday).

If you look at Next’s revenue, it has grown by about £1.3 billion over the last decade. A positive – but lower – percentage is still expected over the long term. The company just reaffirmed its quarterly trading revenue guidance covering Aug-Oct. This brought about a little bounce in its share.

Source: Next Plc

Why has Next’s share price dropped recently?

All UK retail stocks have sold off markedly in recent months. The reason is clear: Macro concerns are stalking the retail sector.

Most analysts are expecting a significant slowdown in consumer spending as the cost-of-living crisis bites. Energy, food and most recently, interest and mortgage costs, have risen significantly. Clothing is often viewed as semi ‘non-essential’ and is therefore likely to suffer a drop in overall revenue.

Moreover, the global stock market is currently in the doldrums. This bearish sentiment will impact nearly all sectors on the downside, including consumer discretionary industries. Next’s share will find it difficult to go against the trend.

What is the Next’s share price prediction?

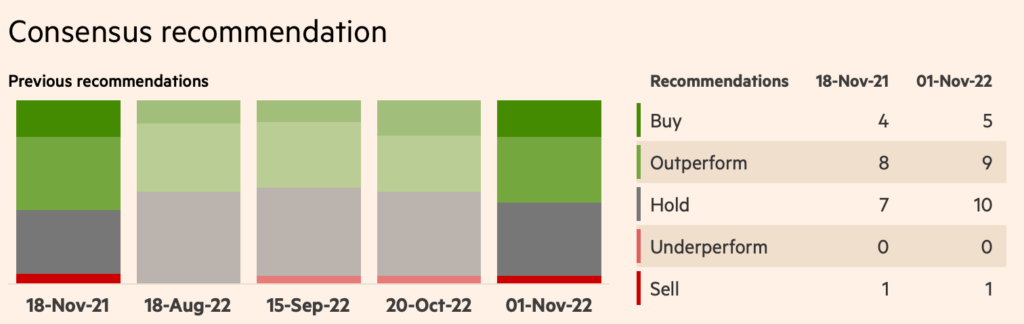

The weight of analyst opinions on Next is more balanced than, say, tech stocks.

Out of the 25 analysts recommendations, nearly half are placing a ‘Hold’ on Next’s shares while 9 analysts are holding ‘Outperform’ ratings on the retailer.

Source: Financial Times

More importantly, if you see the analysts’ price targets for the company, many are still significantly above the current share price. More price downgrades may be in the offing if brokers deem these price targets unreachable in the near term – and a drag on the share price.

| Date | Broker name | New | Price at time | Old price prediction | New price prediction | Prediction Type |

| 05-Oct-22 | Deutsche | Hold | 4,762.00 | 6,200.00 | 5,700.00 | Reiteration |

| 30-Sep-22 | Barclays | Overweight | 4,801.00 | 8,100.00 | 8,100.00 | Reiteration |

| 20-Sep-22 | Barclays | Overweight | 5,724.00 | 8,100.00 | 8,100.00 | Reiteration |

| 07-Sep-22 | JP Morgan Cazenove | Neutral | 6,048.00 | 7,280.00 | 6,000.00 | Reiteration |

| 06-Sep-22 | Jefferies | Hold | 6,188.00 | 6,350.00 | 5,500.00 | Reiteration |

| Averages | 5,504.60 | 7,206.00 | 6,680.00 |

How to buy shares in Next PLC (LON:NXT)

To buy shares in Next PLC (LON:NXT), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Next:

- Decide if you want to buy Next shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

If you are based in the UK you need a stockbroker that will allow you to invest or trade in UK listed shares. You can compare the cost for investing in Next shares in the below comparison tables.

How much does it cost to buy Next Plc shares (LON:NXT)?

Buying one LON:NXT share costs 8,812p. However, as well as the 8,812p cost of buying the shares you will also have to pay stamp duty, dealing and custody account fees for holding your shares with a broker. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

It’s also important to remember that share prices can move quickly, for example, the current LON:NXT share price is 8,812p which is a change of 124 or 1.43% from the last closing price of 8,812 with 413,693 shares traded giving LON:NXT a market capitalisation of £11,156,696,960. The most recent daily high has been 8,834 and daily low 8,658. The LON:NXT share price 52 week high has been 9,530 and the 52 week low 6,724. Based on the most recent LON:NXT share price opening of 8,812, the current LON:NXT EPS (earnings per share) are 6.55 and the PE (price earnings ratio) is 13.44.

Pricing data automatically updates every 15 minutes

Next share price FAQ (LON:NXT):

The answers to our frequently asked questions by people interested in buying Next shares about Next’s share price are automatically updated every 15 minutes.

What is the live Next share price?

The current Next share price is 8,812p

How much has Next’s share price moved today?

Next’s share price has moved 124p or 1.43% today.

How much was Next’s share price yesterday?

Yesterday, Next’s share price closed at 8,812p

How many Next shares are traded each day?

There were 413,693 shares traded in Next yesterday.

What is Next’s market capitalisation (market cap)?

Next has market cap of £11,156,696,960

What has been Next’s share price most recent daily high?

Next’s most recent daily high has been 8,834p

What has been Next’s share price most recent daily low?

Next’s most recent daily low has been 8,658p

How high has the Next share price been in the last year?

The Next share price 52 week high has been 9,530p

How low has the Next share price been in the last year?

The Next share price 52 week high has been 6,724p

What is Next’s earnings per share?

Next’s current earnings per share (EPS) is 6.55

What is Next’s price-earnings ratio (PE)?

Next’s current price-earnings ratio (PE) is 13.44

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.