Spreadex Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Expert Review

I’ve been using Spreadex now for at least 20 years now. I’ve worked with them professionally and know them socially. So in my updated 2024 review of Spreadex, I’m going to highlight what sort of broker they are and what type of traders will get the most from their trading platform and service.

Spreadex Review

Name: Spreadex

Description: Spreadex is a financial spread betting broker that has been in operation since 1999. It was founded by ex-city trader Jonathan Hufford and unlike many of its peers, it is not based in London, but instead is headquartered in St Albans Hertfordshire. Spreadex offers both financial spread betting and CFD trading from the same account. The company has some 60,000 account holders and offers access to more than 10,000 financial instruments, including UK small-cap shares, where it is something of a specialist.

Is Spreadex a good broker?

Spreadex is one of the most established spread betting brokers. They focus on providing excellent customer service through experienced dealers and a trading platform built from scratch in-house. A good choice for those that like to spread bet.

Pros

- Spread betting & CFDs

- Smaller cap stock trading

- Great customer service

Cons

- Not publically listed

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.4Ratings Explained

- Pricing: Super competitive and not afraid to undercut the competition.

- Market Access: Excellent, lots of access to exotic derivatives and smaller cap stocks.

- Platform & Apps: All developed in house and quick to add new features.

- Customer Service: Personal service is what sets Spreadex apart from other brokers.

- Research & Analysis: A good mix of technical indicators on the platform and daily briefings from the financial dealing desk.

There are two types of broker in the derivatives world, those who spot a gap in the market and try to exploit it, and those that are in it for the love of the business. With my broker’s hat on, and in my expert opinion, they are the latter. You can tell by the quality and turnover of their staff, the fact that they generate the majority of their business from referrals rather than a massive digital market budget and the longevity of their service, that if you are going to trade, they are a broker worth putting your business through.

Market access

First off, what can you trade? Spreadex started off offering financial spread betting, which (as I hope you’ll know if you are reading this review) is a tax-free way to trade the financial markets. Trades are structured as bets so you don’t have to pay capital gains tax on your profits. However, as the appeal of trading with a UK-based broker (for regulatory and financial security purposes) has increased, Spreadex introduced CFD trading for non-UK residents a few years ago.

You can trade over 10,000 markets with Spreadex, so, if you are more adventurous than most who just seem to want to tap away on Tesle and Netflix these days, they also have a huge range of smaller-cap shares to trade. A lot of brokers don’t offer these, as the majority of clients stick to the top ten traded instruments and tend to add markets when clients request them. However, going back to my point earlier about service, Spreadex has a huge range of markets available to trade, before you need them, not after you ask for them.

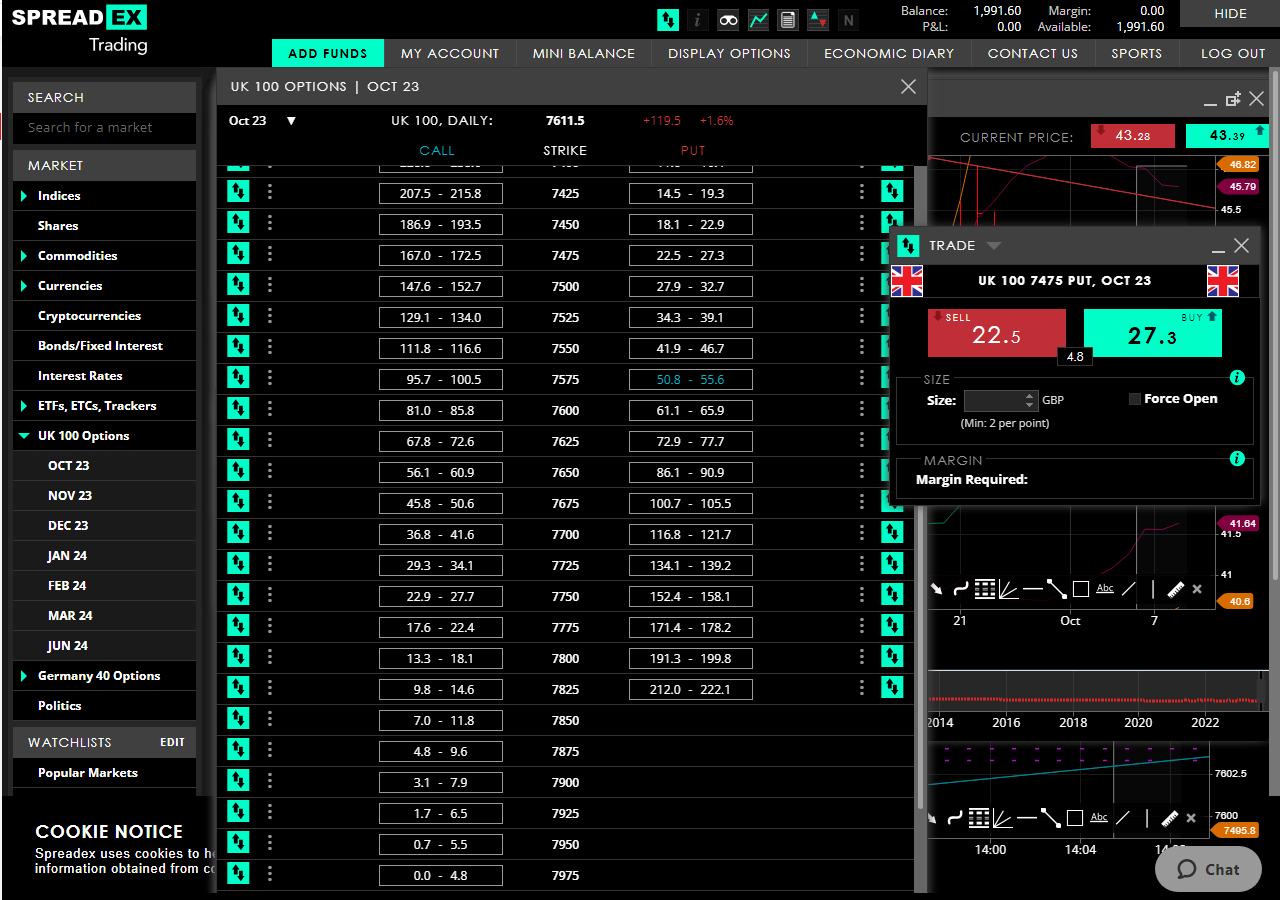

They also have a very good range of indices, with access to Asian and European markets, as well as the major UK and US markets. Options trading is fairly limited, you can only trade on the FTSE 100 (UK100) and DAX 40 (German 40), but you can write options (go short) with Spreadex, whereas some brokers only allow you to buy options.

You can trade the usual commodities, currencies, bonds and fixed-income markets (I don’t know why I still find the phrase Bund, Bobl and Shatz funny when looking at treasuries watchlists after all these years). If you want to have a punt on themes rather than individual assets Spreadex has a wide range of ETFs for placing sector bets on things like Healthcare, Cannabis, CyberSecurity and so on so you don’t have to buy a load of individual shares. However, most of the ETFs are US based, there are not that many UK or European ETFs which can be traded in the morning without having to wait for the Americans to get out of bed. There are also a few ETFs, that track markets like Saudia Arabia (where an outright index isn’t always available).

Spreadex Pricing, Charges & Fees

There isn’t much to say about pricing when it comes to reviewing decent brokers these days because they are all about the same, and that is to say, very competitive. Spreadex earns money by widening the spread from the bid/offer price and including commission in that. For UK stocks, this is 0.1%, so for example, if you buy 10,000 Lloyds shares with Spreadex, the spread will be 49.21/49.33 instead of 49.26/49.28. So £10,000 worth of Lloyds would cost you £4,933 instead of £4,928. So a £5k trade will cost you £5, a £10k trade will cost you £10, a £100,000 trade will cost you £100, and so.

With US stocks Spreadex have also recently capped the spread on larger stocks at $3.5 to make trading the US market cheaper. For example, they mark up spreads by 0.15% for stocks like Tesla, but the spread is capped at 3.5. So, if Tesla shares are $16922.5 offered, then if they were marked up by 0.15% the Spreadex offer price would be $16948 (rounded). But because spreads are capped at $3.5, you would buy at $16926. So if you are trading at £1 per point as a spread bet that is a saving of £22 on roughly a £17k trade versus a broker who charges the same but hasn’t capped their spreads.

If you are holding positions in the slightly longer term Spreadex charge 3% over under SONIA, which is not quite the cheapest, but still very low compared to other brokers like eToro for example, that charges 6.4% over/under SONIA. To put that in perspective, if you have £10,000 exposure with eToro with SONIA at 4% for a year, it would cost you £1,400 in overnight funding, but with Spreadex only £650.

For the major FX, commodity, and index markets, Spreadex are pretty much inline with everyone else.

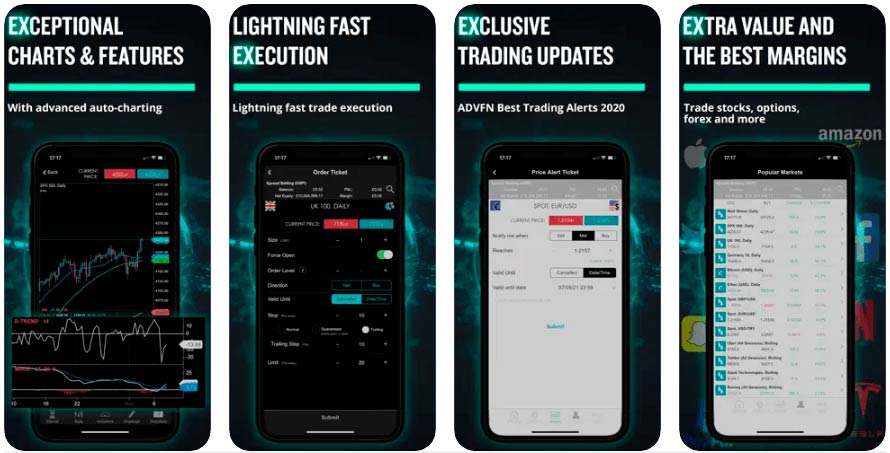

Platform and apps

Way back when I first opened my account, I remember being sent a VHS video of a very charming curly-haired man standing on Primrose Hill (I think) with the City as a backdrop explaining the pros and cons of spread betting. But Spreadex has come a long way from just providing voice brokerage to having one of the best trading platforms out there.

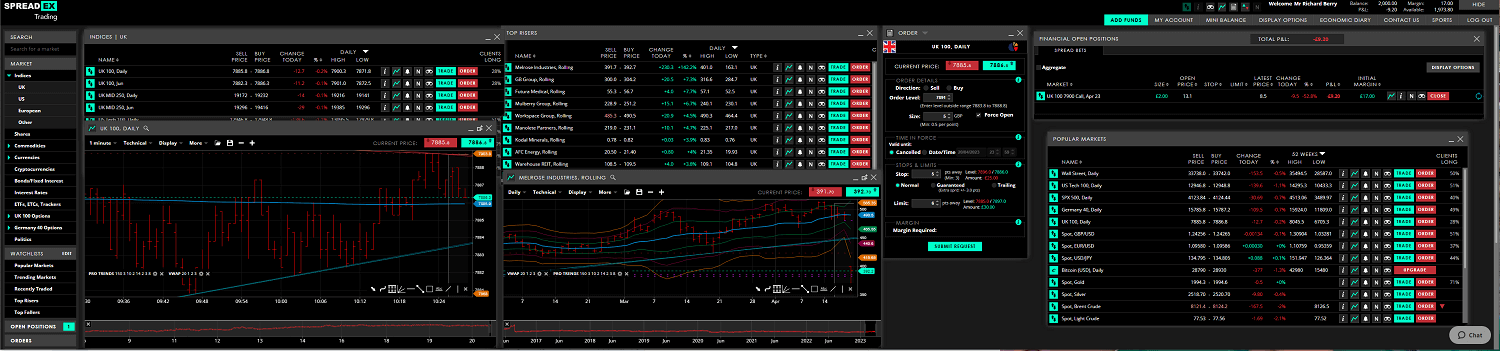

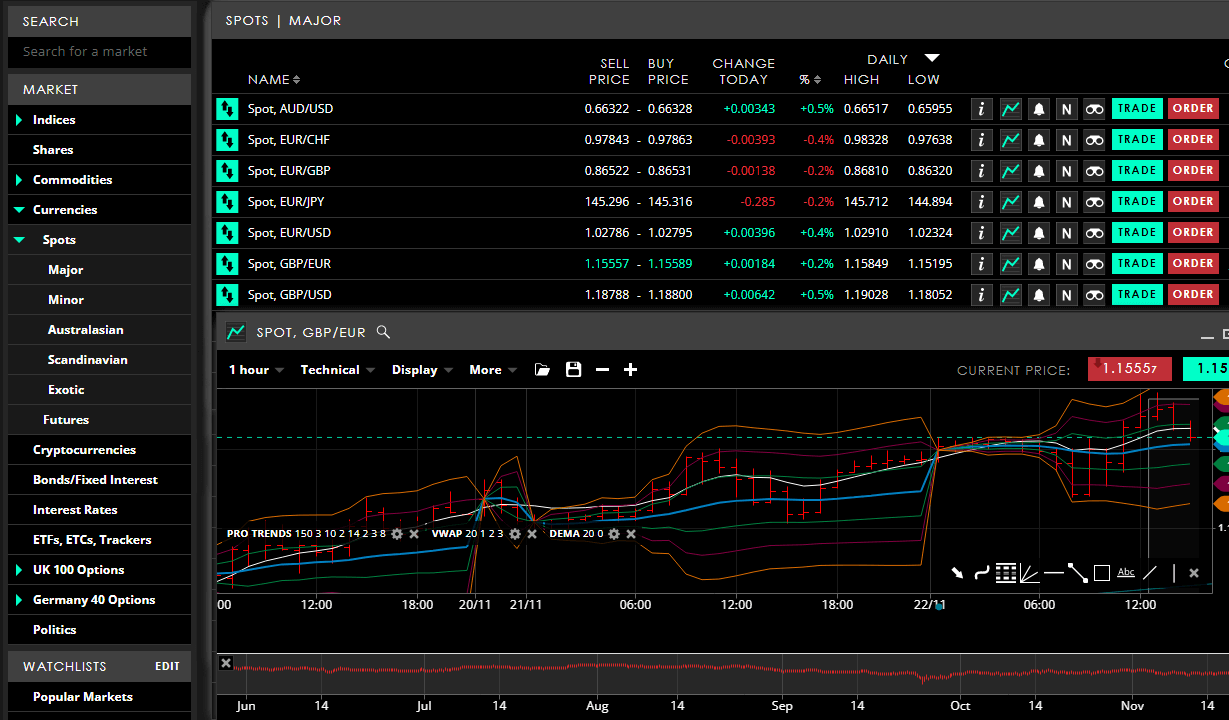

One thing I particularly like about the Spreadex trading platform is that it has been built and innovated inhouse. For exmaple, they have added the ability to overlay Pro Trend Lines, which automatically, add support and resistance levels, which takes a bit of the guesswork out of potential entry and exit points. You can also, overlay the VWAP, a price point, particularly useful, as it’s what hedge funds use for working daily orders that are well above the normal market size.

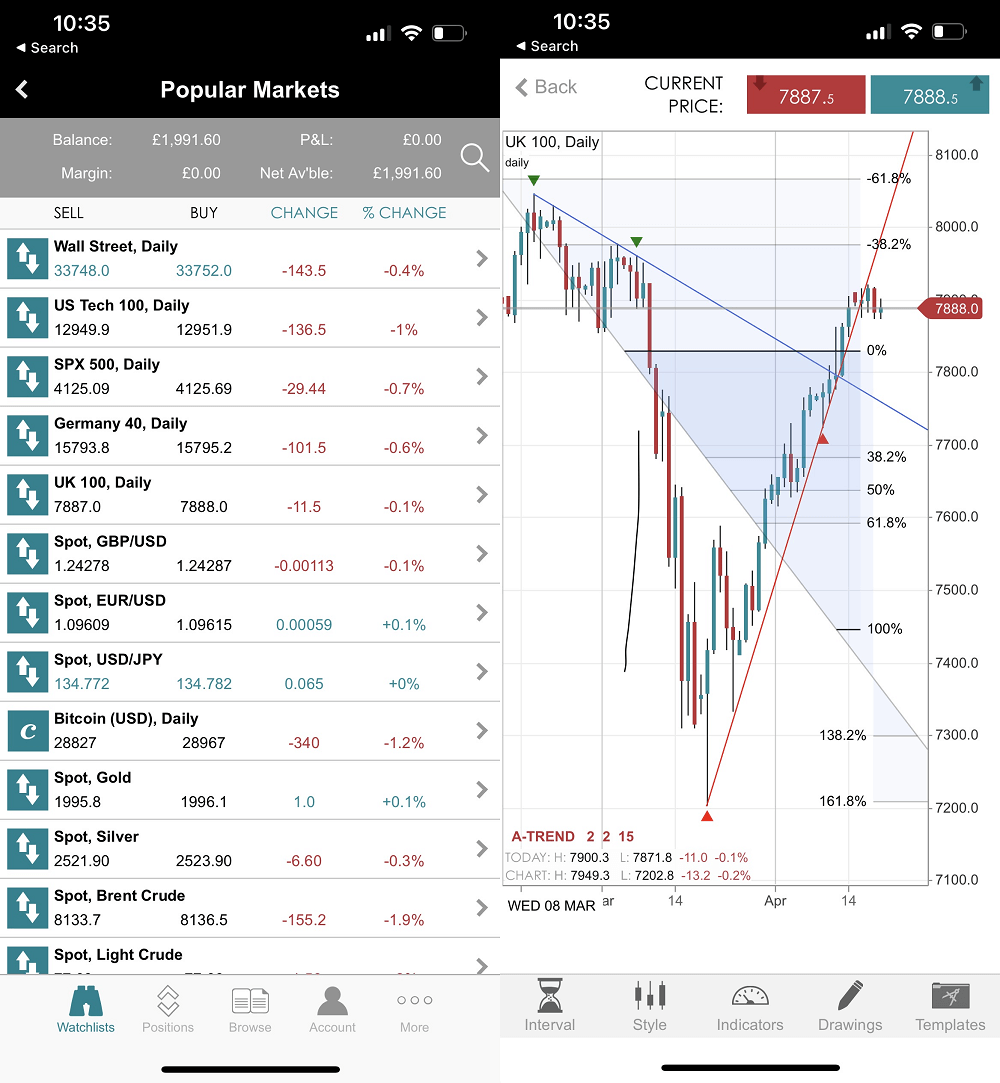

A nice feature of the Spreadex app is that you can change the columns from just change, to monthly and yearly high and low. Plus, should you, for some reason, want to do technical analysis on your phone instead of a proper computer, you can add indicators, free draw and overlay indicators like Fibonacci ranges whilst out and about.

There is a huge amount of technical indicators for advanced traders, but for beginners, they have all the usual range of risk management tools like stops, guaranteed stops (which protect you if the market gaps), trailing stops (so you can lock in profits the more profitable a position gets) and price alerts. More relevantly, though, if you are a beginner, and you don’t understand something, instead of having to wade through a quagmire of online educational resources, you can pick up the phone and ask for something to be explained.

It’s really a very good all-round trading platform that can cater for large customers as well as beginners. It’s simple, and modular so you can create your own desktop environment (if you’re trading on multiple screens). Plus, along with the rest of the world, Spreadex is now integrated with TradingView.

Research and analysis

There is also enough news flow to keep you informed and up-to-date with market news without getting overloaded. Through the app and web platform, you get access to the economic calendar of market-moving events, news filtered by product from Thomson Reuters, and trading updates from Spreadex dealers, highlighting the day’s key factors, and what traders should be aware of.

Customer service

One thing that has driven me mad over the past few years is that trading platforms seem to have become massively self-serving. In that, they are only interested in getting more customers, and onboarding traders, so that they can say they have seen massive growth and a race to the bottom for pricing. What this means, of course, is that there is too much emphasis on the platform and not enough on the client. For example, if you try and phone up most brokers, you can’t actually get through to anyone to ask a simple question from someone who knows what they are talking about. But, when writing this review, I needed clarification on a couple of points. First I used the chat box on the trading platform and got through to someone almost immediately, without even a whiff of an automated chatbot. Then, when I phoned the dealing desk for something else, the phone was picked by one of their dealers, who was very helpful and sent all the info I needed via email a few minutes later. For retail traders, you don’t really get that anywhere else.

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Awards

Spreadex have always done very well in our awards, they most recently won “best customer service” in our 2023 awards and have previously won “best spread betting broker” in 2019.

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Video Demo

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Facts & Figures

Spreadex Total Markets | 10000 |

| ➡️ Forex Pairs | 54 |

| ➡️ Commodities | 20 |

| ➡️ Indices | 17 |

| ➡️ UK Stocks | 1575 |

| ➡️ US Stocks | 2110 |

| ➡️ ETFs | 160 |

Spreadex Key Info | |

| 👉 Number Active Clients | 4000 |

| 💰 Minimum Deposit | 0 |

| ❔ Inactivity Fee | 0 |

| 📅 Founded | 1999 |

| ⬜ Public Company | ❌ |

Spreadex Account Types | |

| ➡️ CFD Trading | ✔️ |

| ➡️ Forex Trading | ✔️ |

| ➡️ Spread Betting | ✔️ |

| ➡️ DMA (Direct Market Access) | ❌ |

| ➡️ Futures Trading | ❌ |

| ➡️ Options Trading | ✔️ |

| ➡️ Investing Account | ❌ |

Spreadex Average Fees | |

| ➡️ FTSE 100 | 1 |

| ➡️ DAX 30 | 1 |

| ➡️ DJIA | 2.4 |

| ➡️ NASDAQ | 2 |

| ➡️S&P 500 | 0.6 |

| ➡️ EURUSD | 0.6 |

| ➡️ GBPUSD | 0.9 |

| ➡️ USDJPY | 0.9 |

| ➡️ Gold | 0.3 |

| ➡️ Crude Oil | 0.28 |

| ➡️ UK Stocks | 0.1% |

| ➡️ US Stocks | 0.15% (max $3.5) |

64% of retail investor accounts lose money when trading CFDs with this provider

Is Spreadex’s trading app any good?

Yes, the Spreadex trading app is suitable for high-volume traders and for those who want access to a broad range of markets on mobile.

Yes, the Spreadex trading app, as with the main trading platform, offers some of the best customer service and is suited to traders who just require a click-and-trade app and won’t be using it for research or signals.

The watchlists, highlight, popular market, the risers and fallers, but there is not much in the way of cluttered educational content or analysis. you can view market updates, weekly analysis, and financial trading blogs, but these are just links to webpages from the app.

One good feature I found when testing it though is that you can talk directly to customer support via live chat through the app. This is one area where Spreadex has always excelled as a smaller UK broker, offering good customer service where you can get in touch with someone who knows what they are talking about quickly.

Overall, the app is a good compliment to Spreadex’s service.

64% of retail investor accounts lose money when trading CFDs with this provider

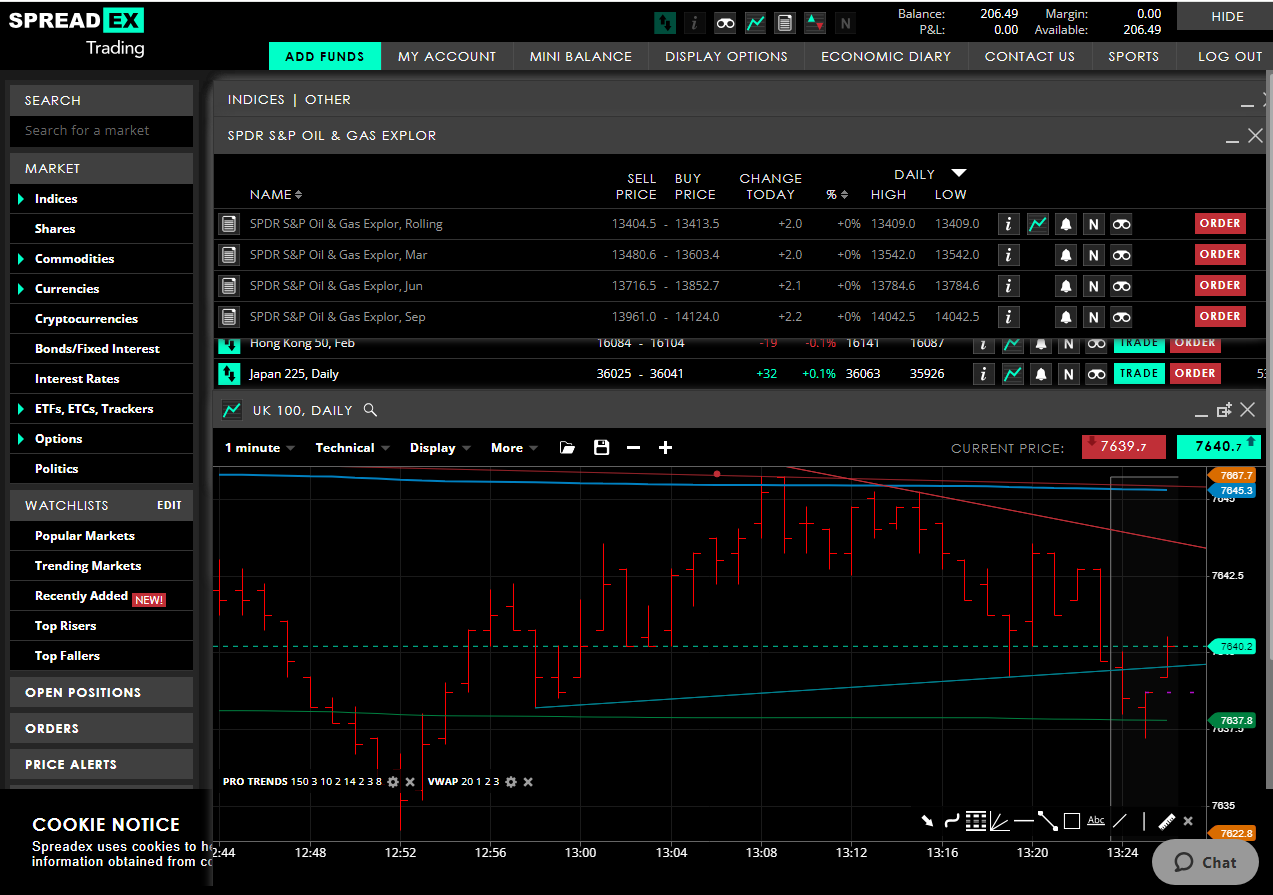

Is Spreadex’s trading platform any good?

Yes, spreadex’s trading platform is great for experienced traders, plus they have an excellent bank of dealers for phone trading.

Yes, Spreadex is one of the most established online trading platforms and excels in providing personal service to a high-value customer base. I’ve been using them for nearly twenty years now and when I tested them for this review and over the years, the trading platform has remained simple yet effective.

It has been entirely developed in-house from St Albans, just outside of London and you can trade directly from charts on the platform or overlay a range of indicators and macroeconomic data.

It’s nice to see a trading platform these days that doesn’t rely completely on Tradingview for charting.

You can add pro trading indicators like the VWAP and also save and edit chart templates allowing you to have a consistent view of the markets and the indicators that you like to use.

Overall, Spreadex is a suitable online trading platform for those that know what they are doing that is backed up by experienced dealers, from an established and trusted UK brokerage.

64% of retail investor accounts lose money when trading CFDs with this provider

Is Spreadex good for indices?

Yes, indices are the most popular asset class with Spreadex’s predominantly UK-based clients as opposed to other brokers like Pepperstone where forex is more popular for international clients.

Reduced Index Trading Spreads

CFD and spread betting broker Spreadex has trimmed the spread on its US 100 tech index contract which closely follows the performance of the Nasdaq 100 index. The spread on this very popular index contact will narrow to as little as 1 index point during the peak US session.

The US Tech 100 contract reflects price changes in an index that contains the touchstone stocks of 2024.

Magnificent 7 Stocks such as Apple (AAPL), Meta Platforms (META), Nvidia (NVDA), Microsoft (MSFT) Alphabet (GOOG) Advanced Micro Devices (AMD) and Broadcom (AVGO.

These stocks have been the driving force behind the rally in US equities year to date.

Interest in and the sentiment around technology have been buoyed by the promise of generative AI and the impact it could have on our day-to-day lives.

However, investors recently appeared to lose confidence in the prospects for the Tech sector and the US 100 index fell by as much as -7.00% in April, with Nvidia falling by -10.00% in a single session, though both instruments have now partially recovered.

Tighter spreads but not the tightest

Spreadex decision to trim the spread on the US Tech 100 is to be welcomed.

However, the 1.0 spread on the contract could still look expensive when compared to its broader-based rivals, the S&P 500 and Russell 2000.

The US 500 contract has a spread of 0.4 points and the Russell 2000 contract from 0.3 points at Spreadex.

That difference in pricing is likely down to levels of volatility within the respective indices, though it is worth noting that the S&P 500 and the Russell 2000 include the major Nasdaq 100 stocks.

Competitive Index Trading Spreads

So how does Spreadex’s new US Tech 100 spread compare with the competition?

Well, a spread bet on IG’s daily US Tech 100 carries a spread of 1.0 index points between 14.30 and 21.00 London widening to 2.0 points between 21.00 and 14.30 the following day, though for between 22.00 and 23.00, the spread widens to an unpalatable 5.0 points.

At City Index spread in the US Tech 100 starts at 3.0 points, whilst rival CMC Markets offer spreads on the index from 1.0 point.

The width of a spread can be an important factor, particularly for very active traders, whose marginal profitability can be significantly boosted by tighter trading conditions.

Conversely, of course, the price maker sees a reduction in income when spreads narrow, though they hope to make up for the slimmer margin through an increase in turnover.

For many index traders, however, it’s more about being directionally correct than anything else.

But of course, an extra couple of points in PnL at the end of a trade is always welcome.

64% of retail investor accounts lose money when trading CFDs with this provider

Does Spreadex have a demo trading account?

No, rather frustratingly Spreadex does not offer a demo account of its trading platform. However, if you want to test their platform, and get an idea of functionality you can open a live account without having to deposit funds. This will give you access to the Spreadex live trading platform so you can get an idea of pricing, order execution and their charting package.

No Spreadex demo

It’s a bit annoying really and I think lets Spreadex a bit down here, because most traders want to “kick the tyres, before the light the fires” and start executing real trades.

However, as I have said many times before, I really like Spreadex as a broker, but if you want to test trade with them you have to do it with real money. That being said, the minimum deposit is very low, so if you want to put some trades on you can just deposit a very small amount and put some tiny trades on.

Demo view

If you don’t want to open a live Spreadex account you can see what their trading platform looks like in the screenshot below. Or read on for brokers that do offer demo accounts.

Spreadex demo account alternatives.

If you only want to place virtual trades and not risk any real money you can open a demo account with any of the below brokers. Or you can read our full demo account reviews and comparison.

| Demo Account | Virtual Balance | Length | Markets | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|---|

| £10,000 | 12 weeks | 13,500 | See Demo | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| £200-£50k | 60 days | 20 | See Demo | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| £10,000 | No limit | 17,000 | See Demo | 70% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| £10,000 | No limit | 12,000 | See Demo | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| $100,000 | 20 days | 1,000+ | See Demo | 65% of retail investor accounts lose money when trading CFDs with this provider | |

| $1m | No limit | 7,000 | See Demo | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| $100,000 | No limit | 2,976 | See Demo | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| £1-£1m | 30 days | 578 | See Demo | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| £10,000 | 12 weeks | 13,500 | See Demo | 69% of retail investor accounts lose money when trading CFDs with this provider. | |

| £100,000 | 30 days | 2,100 | See Demo | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| £200,000 | 14 days | 3,981 | See Demo | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

Is Spreadex good for forex trading?

Yes, Spreadex is particularly good for forex spread betting, which is a form of trading where you do not have to pay capital gains tax on your profits.

Spreadex focuses on tax-efficient forex spread betting but has recently added the ability for traders outside of the UK to use their platform by trading Forex CFDs. The platform has recently had a facelift and provides a very clear overview of the major markets, with clear order tickets, with key fx pairs trading info prominently displayed.

One of the key benefits of Spreadex’s forex trading platform, is customer service. They have experienced dealers, that you can quickly get through on the phone, or via the platform’s chat functionality, plus voice brokerage. The ability to trade forex over the phone is something that few brokers offer nowadays, so it’s good to know that you still can, if you need to.

Forex Trading Platform

The desktop version of the forex trading platform is tabular which saves automatically on exit so you can spread it over multiply screens in one browser, window or detach modules to run separately. Spreadex, have built the trading platform in house, and they have some very good charting functionality where it is quick and easy to overlay technical indicators, that other forex brokers do not offer like VWAP.

Usability

It’s a good platform to get started on as you can trade forex from as little as £0.5 a point. One advantage of spread betting on forex is that your P&L will be in £, so you do not have to worry about FX fees on your resulting profit and loss. Spreadex also offers guaranteed stop losses, for added risk management and trailing stops, which move along with your profitable positions. For forex traders, that look at futures levels, you can also work limits with a time limit, so you don’t need to worry about leaving GTC orders open indefinitely.

64% of retail investor accounts lose money when trading CFDs with this provider

What is spread betting on Spreadex?

Spreadex offers two types of spread betting. Financial spread betting, which is betting on the financial markets and sports spread betting, which is buying and selling an outcome in sports.

Spreadex is one of the last spread betting brokers to offer a mixture of financial and sports spread betting, for those who want to trade the FTSE during the week and the Footie on the weekend. I’ve used both services for nearly 20 years and have seen them mature along with the industry.

Overall, Spreadex is an excellent spread betting broker for those who want personal service and the ability to speculate on financial as well as sports markets.

- Spread betting markets available: 10,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 3% +/- SONIA

- Pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

Based in St Albans, just outside of London Spreadex offers a simple but innovative spread betting platform for trading a wide range of assets. Spreadex has always focused on customer service, winning business from referrals and maintaining long-term relationships with their clients.

It’s a testament to the business that they build their own technology in-house and are reserved with marketing campaigns.

They offer access to over 10,000 markets and recently Spreadex has reduced spreads across the major assets and still offers access to smaller-cap stocks compared to some of the other providers.

The spread betting platform does have some good charting options, such as adding pro trading tools like WVAP and pro trend lines, as well as the usual obligatory technical indicators like Bollinger Bands and Moving Averages. You can see what percentage of clients are long on watchlists and you can quickly go to a specific time point on a chart.

There is also a wide range of ETFs, ETCs and Trackers to spread bet on for sector speculation, and you also have the option to trade political markets.

64% of retail investor accounts lose money when trading CFDs with this provider

Does Spreadex offer commodity spread trading?

You can trade commodities as a spread bet or CFD with Spreadex, but you cannot trade futures spreads. The difference between the spread in commodities trading for futures is that it’s the difference in price between the front and forward months. Whereas in spread bets and CFDs the spread refers to the difference between the buy and sell price of a commodity (which is often wider than the DMA on exchange price to incorporate commission).

64% of retail investor accounts lose money when trading CFDs with this provider

Is Spreadex on TradingView?

Yes, in December 2022 Spreadex entered a partnership with one of the world’s biggest charting and social trading platforms, TradingView.

Established in 2011 TradingView now has more than 30 million users globally who use its state-of-the-art charting services, and swap ideas and information with like-minded peers.

Trading View also allows users to code their own indicators and scripts in its proprietary coding language Pine, and these tools and indicators can also be shared with other users.

Spreadex traders will now be able to deal directly on their Spreadex accounts from either their TradingView terminal or its mobile apps.

- Want to spread bet on TradingView? Compare spread betting brokers on TradingView

Tom Salmon, Head of Trading at Spreadex, said:

“Our customers will now be able to benefit from a seamless integration between two of the most popular services in the industry,”

“We are absolutely delighted to be able to provide a service using the latest tech that clients want. With our customer-centric approach, we know that this will help our customers to make more informed trading decisions.”

What is TradingView?

TradingView is headquartered in Chicago and its charting service has proved to be immensely popular among technical traders.

It offers a wide range of charting styles, and access to many of the world markets and asset classes, with both free and paid subscription services available.

TradingView has targeted both individual traders and brokerage firms over the last decade, providing them with charting services and trade connectivity.

As well as screening tools, news and informative articles on trending topics, known as snaps, alongside curated watchlists called sparks.

For those Spreadex clients who use the Trading View platform already, or who feel comfortable in a coding/social trading environment, the new tie-up is likely to be well received.

And even those who are not so computer-literate will likely still find themselves using the service, which is quite intuitive to navigate around, even for beginners.

64% of retail investor accounts lose money when trading CFDs with this provider

Can you trade options on Spreadex?

Yes, you can trade options with Spreadex, but you are limited to only a few indices. If you want to trade options as a spread bet, then you are much better off with IG. Or if you are a more sophisticated trader, Saxo and Interactive Brokers offer DMA on exchange options trading across all asset classes.

With Spreadex you can trade options as a CFD of spread bet and spreads for UK 100 and Germany 30 start from 4 points with a minimum stake of £2. Whilst you are limited on what you can trade online, Spreadex will let you trade options on the major markets.

- Options markets available: 5+

- Options costs: OTC (built into the spread)

- Minimum deposit: £1

- Account types: CFDs, spread betting

64% of retail investor accounts lose money when trading CFDs with this provider

Is it better to spread bet or trade CFDs with Spreadex?

I would say if you are in the UK it is better to spread bet with Spreadex rather than to trade CFDs. Pricing and market access is exactly the same and the only reason Spreadex started offering CFDs in 2017 was so that they could offer financial trading to non-UK customers.

Overall Spreadex is a good CFD broker for traders that want to trade on major and minor shares and put more of a focus on customer service than technology.

- CFD markets available: 10,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 3% +/- SONIA

- CFD pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

Spreadex has been providing trading since 1999, but only recently introduced CFD trading in 2017. The trading platform, whilst quite basic, does represent what Spreadex is good at, which is the major markets and customer service. Being a smaller CFD broker they have a bank of experienced dealers who can work orders for you and provide support for the CFD app and platform.

Recently Spreadex has become much more competently priced, offering UKX CFD trading with 1 pips spreads, 0.6 pips on EURUSD and 0.2% on UK shares. There is no minimum deposit and no inactivity fee.

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex FAQs

Spreadex is a financial and sports bookmaker for UK clients and also offers contracts for difference for European traders (who are not eligible for capital gains tax breaks from financial spread betting).

For large amounts, you can request funds to be sent back to your account from Spreadex the same day. But, for smaller transactions, it can take between 1 hour and 3 days to receive funds. This depends on your bank, and how complete your AML documents are.

Spreadex offers financial spread betting which works by letting you place bets on the movement of financial markets. Instead of buying a certain amount of shares in a company, you bet an amount (either in pounds or pence) per point a share price moves.

Yes, Spreadex is a legit and safe trading platform as they are regulated by the FCA and are well established and well respected within the brokerage industry. Spreadex also ranks very highly in our awards for customer service and support.

64% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.