Today's Balanced Commercial Property Trust Limited share price is 95.8 (as of 14/11/2024 17:15) which is a change of 0.1 or 0.1% from the last closing price of 95.8 with 6,273,396 shares traded giving Balanced Commercial Property Trust Limited a market capitalisation of 672,085,100. The most recent daily high has been 96.2 and daily low 95.15. The Balanced Commercial Property Trust Limited share price 52 week high has been 96.9 and the 52 week low 65.3. Based on the most recent Balanced Commercial Property Trust Limited share price opening of 95.8, the current Balanced Commercial Property Trust Limited EPS (earnings per share) are 0.05 and the PE (price earnings ratio) is n/a.

Featured Brokers For Buying Balanced Commercial Property Trust Limited Shares

It currently costs 95.8 to buy one share in Balanced Commercial Property Trust Limited (as of 14/11/2024 17:15) which is a change of 0.1 or 0.1% from the last closing price of 95.8. To buy shares in Balanced Commercial Property Trust Limited you will need a stock trading platform like City Index.

| Name | Logo | Markets | Share Spreads | GMG Rating | Customer Reviews | CTA | Tag | Feature | Expand |

|---|---|---|---|---|---|---|---|---|---|

|

Markets 13,500 |

Share Spreads 0.08% |

GMG Rating |

Customer Reviews 3.8

(Based on 124 reviews)

|

Visit Platform 69% of retail investor accounts lose money

City Index Reviews |

Featured |

Account Types:

|

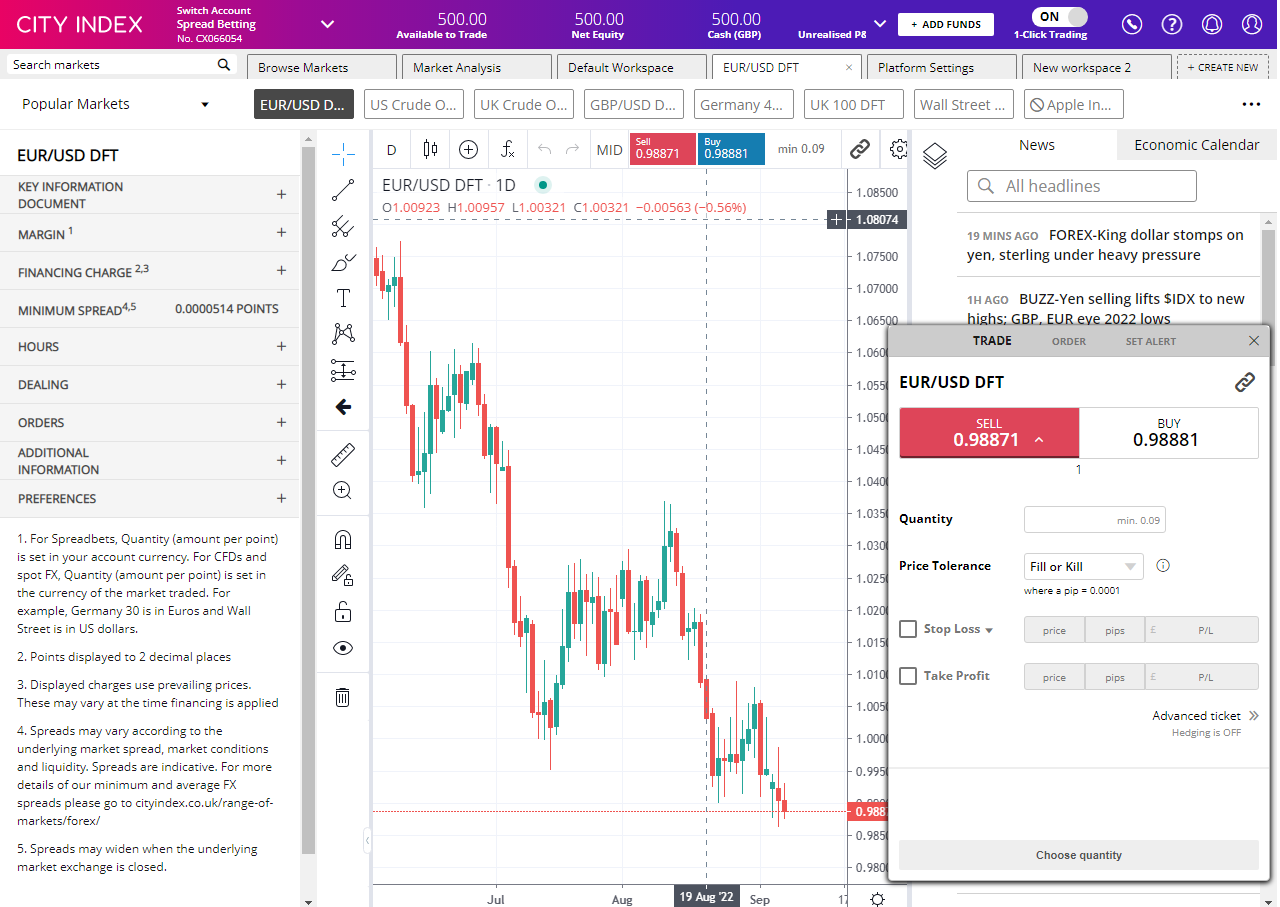

City Index Spread Betting Expert Review: Best Spread Betting Broker 2025 Account: City Index Financial Spread Betting Description: City Index is one of the best spread betting brokers and is suitable for all types of traders looking for a tax-efficient way to speculate on the financial markets. City Index also won our “Best Trader Tools” award in 2023 and “Best Trading App” in 2024 and “Best Spread Betting Broker” in 2025.. Is City Index a good spread betting broker?

I would say that overal,l City Index is a better spread betting broker than CMC Markets, especially if you are trading a broad range of shares, particularly smaller cap shares. CMC Markets is more focussed on the most liquid markets like EURGBP and indices and can have tighter pricing. But, for an all-round service, City Index is a better spread betting broker for most UK traders. Spread bets at City Index are available on 12,000 markets including, 23 equity indices, thousands of UK and international stocks and ETFs, 19 commodities, bonds, and interest rates, and an industry-leading 182 FX pars. City Index also has an options desk for spread betting on index and populare stock options. When I tested City Index’s spread betting account Performance Analytics really made it stand out which is unique to City Index. Whilst other brokers provide post-trade analysis, When StoneX (City Index’s parent company) acquired Chasing Returns, they were able to exclusively provide a huge amount of data to help their customers stick to a trading plan and provide insights into what can make them a better spread bettor. As with most spread betting brokers, City Index clients trade via two-way bid-offer prices the difference between the bid and offer representing the spread. These vary by product and contract but in the FTSE 100 index City charges a minimum spread of 1 index point and on the Germany 30 or Dax it charges 1.20 points. You can trade Spread Bets on leading equity indices up to 24 hours per day. For stock trading, spreads of 0.8% for UK and 1.8 cents per share are built into the price.

Pros

Cons

Overall4.9 |

| Name | Logo | GMG Rating | Customer Reviews | Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.2

(Based on 1,105 reviews)

|

Annual Fees 0% – 0.25% |

Dealing Commission £3.50 – £5 |

See Offers Capital at risk

AJ Bell Reviews |

Features:

|

AJ Bell Share Dealing Review Provider: AJ Bell Share Dealing Verdict: AJ Bell is a low-cost online investing platform and is the cheapest share dealing platform for buying and selling shares for the UK do-it-yourself (DIY) investor. They also offer plenty of investment ideas, including investment guides and equity research. Summary A great choice to deal shares with low costs in a variety of investment accounts.

Fees: AJ Bell share dealing account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 when there were 10 or more online share deals in the previous month. Special Offers:

Pros

Cons

Overall4.2 |

||

|

GMG Rating |

Customer Reviews 3.8

(Based on 1,774 reviews)

|

Annual Fees 0% – 0.45% |

Dealing Commission £5.95 – £11.95 |

See Offers Capital at risk

Hargreaves Lansdown Reviews |

Features:

|

Expert Review Account: Hargreaves Lansdown Share Dealing Description: Hargreaves Lansdown offers access to the widest selection of stocks for share dealing accounts in the UK. The platform also has one of the best research portals for analysing stocks. Is it expensive to buy and sell shares on Hargreaves Lansdown? Hargreaves Lansdown is not as expensive as it used to be as there is no account charge for holding shares in a general investment account and a max of £3.75 in a stocks and shares ISA. HL does still cost more than competitors like AJ Bell and Interactive Brokers to buy and sell shares, but the account running costs can be lower because of the monthly cap. HL won the Best Stock Broker in our 2024, 2022 awards, and in 2021, it won Best Full-service Stockbroker for their all-round approach to customer service.. Another added bonus of dealing shares through HL is that their clients benefit from price improvements for best execution. HL say they reach out to multiple brokers to get the best prices for a trade and clients can make a saving of £18 per trade on average. This is particularly relevant if you are dealing with cap UK shares, which is where Hargreaves Lansdown excels. Overall, Hargreaves Lansdown is an excellent choice for most types of share dealing on UK and international markets. Pros

Cons

Overall4.9 |

||

|

GMG Rating |

Customer Reviews 4.1

(Based on 125 reviews)

|

Annual Fees 0.4% – 0.08% |

Dealing Commission £1 – 0.08% |

See Offers Capital at risk

Saxo Reviews |

Features:

|

Saxo Share Dealing Review: Lower fees and professional grade tech Account: Saxo Share Dealing Description: Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Is Saxo any good for share dealing? Yes, you can deal shares directly on exchange with Saxo. In fact, Saxo is one of the best DMA brokers for trading shares inside the bid/offer price as you can place your orders directly on the order book. Saxo’s platform has share dealing on more than 50 stock exchanges around the world with 22,000 shares available for investors. Making it one of the most diverse investment platforms for share dealing in the UK. Its forte is on the trading side for traders that need direct market access and are more price-sensitive to bid/offer spreads. Saxo is a good share dealing platform for sophisticated and advanced investors who also need direct access to capital markets. Fees: Saxo Markets charges a share dealing commission based on a percentage of transaction size. They are very competitive though, and UK share dealing commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders. As Saxo is a prime broker with a retail and institutional client base, they are one of the best share dealing platforms for larger customers. However, there are some downsides. Firstly they do not offer acesss to smaller cap shares on their trading platform like brokers Spreadex and IG, who have a much braoder range of shares to trade online. Secondly, you cannot trade shares as financial spread bets (where profits are free of capital gains tax). Finally, the cost of dealing shares with Saxo is higher than with a broker like Interactive Brokers. But Saxo wins hands down when it comes to customer services, research and analysis. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,347 reviews)

|

Annual Fees £0 |

Dealing Commission £3 |

See Offers Capital at risk

Interactive Brokers Reviews |

Features:

|

Interactive Brokers Share Dealing Review Provider: Interactive Brokers Share Dealing Verdict: Interactive Brokers is an excellent account for sophisticated share dealers who want to manage their own portfolio with complex order types actively and need access to a wider range of investment products like derivatives, options, and futures. They also offer fractional share dealing if you only want to start trading a small amount. Summary One of the most advanced share dealing platforms for beginners and professional investors.

Fees: Interactive Brokers does not charge share dealing custody fees and minimum share dealing commissions are £1 in the UK or 0.05% of the deal size. Pros

Cons

Overall4.3 |

||

|

GMG Rating |

Customer Reviews 3.9

(Based on 695 reviews)

|

Annual Fees £0 – £96 |

Dealing Commission £0 |

See Offers Capital at risk

IG Reviews |

Features:

|

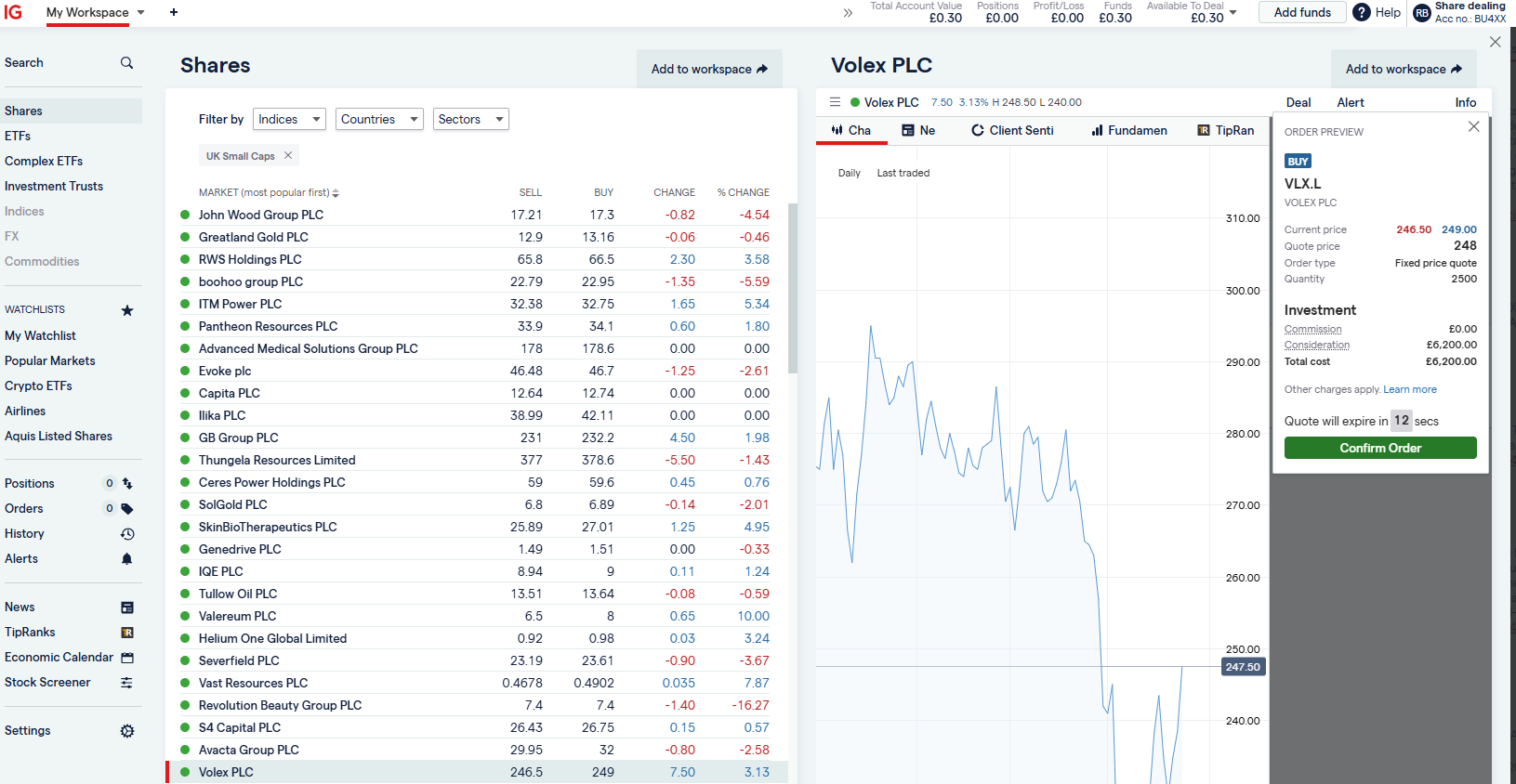

IG Share Dealing Expert Review Is an IG share dealing account any good? An excellent share-dealing platform for those who want to deal shares regularly in the short and long term. You also get access to a huge range of UK small-cap shares, where you can request quotes from marketmakers via RSPs. This is something that is not available from other trading/investing platforms like CMC or Trading 212. An IG share dealing account is different from a spread betting or CFD trading account in that you actually own physical shares as opposed to trading derivatives. The ability to deal in shares with IG means that you can invest in companies for the long term alongside your short-term higher-risk speculation. An excellent share-dealing platform for those who want to deal in shares regularly in the short and long term.

Pros

Cons

Overall4.4 |

||

|

GMG Rating |

Customer Reviews 4.3

(Based on 1,123 reviews)

|

Annual Fees £59.88 |

Dealing Commission £3.99 |

See Offers Capital at risk

interactive investor Reviews |

Features:

|

Interactive Investor Share Dealing Review Provider: Interactive Investor Share Dealing Verdict: Interactive Investor is a low-cost share dealing platform that offers investors access to over 40,000 shares. II won the 2021 and 2023 Good Money Guide award for Best Investment Account. Summary Interactive Investor is a great choice for anyone who wants to buy and sell shares on a regular basis and has a large portfolio.

Dealing Fees: Interactive Investor share dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free. Special Offers:

Pros

Cons Fixed-fee expensive for very small share dealing accounts below £1,000

Overall4.3 |

Is Balanced Commercial Property Trust Limited A Good Investment?

The below Balanced Commercial Property Trust Limited share price analysis and market data includes key financials, earnings estimates, peer performance, dividends, news and a company profile that will give you an indication as to whether this stock is a buy, sell or hold.

Overall,

Overall,