Plum Uses Automation to Help You Manage Your Money

Provider: Plum

Verdict: Overall, I think Plum is a decent app for saving. If you’re looking to access high-interest savings products, and comfortable linking the app to your bank account, it could be worth considering. For investing, I don't think it has the strongest offering. However, if you are just starting out in the investment world, and looking at starting a small portfolio of funds, it could be worth a look.

Is plum a good investment app?

Plum is a FinTech app designed to help you save and invest for the future. Via the app, you can access a range of high-interest savings products as well as a few different investment products.

Plum was founded back in 2014 by two friends, Victor Trokoudes and Alex Michael (both of whom were early employees at Wise), who set out to create an app that would enable people to save more money. Since then, it has come a long way – today it has more than 2 million users.

Note that currently, Plum can only be accessed via a smartphone app (iOS or Android). So, it’s not well suited to those seeking desktop functionality.

What does Plum offer?

Through the Plum app – which links to your bank account – you can access savings products such as Cash ISAs, fixed-term savings, and easy-access savings products. You can also access stocks, investment funds, and a pension.

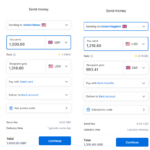

With Plum, there are several different membership plans (these are shown below). To access features such as fixed-term savings products and stock investing, you have to pay for a higher-level plan.

Saving with Plum

Plum currently offers users a range of innovative savings products. These include:

Auto Savers – With this feature you can use Plum’s technology to put money aside automatically. You can choose from several different savings strategies including roundups on purchases, rainy day savings (where money is put away when it rains), a 52-week savings challenge, a 1p challenge, and more.

Easy Access Savings Pockets – This is a fairly standard savings feature that allows you to access your money at any time.

95-Day Notice – With this product, you can obtain higher interest rates if you are willing to lock your money away for 95 days.

Plum Interest – Here, your money is invested in a low-risk money market investment fund.

Cash ISA – This is a tax-efficient savings account in which you can contribute up to £20,000 per year.

Lifetime ISA – This is a cash version of the Lifetime ISA. The annual allowance is £4,000 and it offers bonuses from the government when you make a contribution.

Is the Plum Cash ISA any good?

At the time of this review, the Plum Cash ISA was offering an interest rate of 4.98% AER (variable). That’s a pretty good rate, and higher than the rates on offer from many other ISA providers such as Marcus and Moneybox.

Note, however, that this rate included a bonus of 1.69% AER (variable) which was only on offer for new customers and if kept for 12 consecutive months. Meanwhile, the interest rate for ISA transfers was 3.29% AER (variable) – a fair bit lower.

It’s worth pointing out that it may be possible to achieve better returns than this over the long run by investing your money, either through Plum or another investment provider. Investing involves more risk than saving (the value of your capital will fluctuate), however, it tends to lead to higher returns in the long term.

Investing with Plum

In terms of investing, the Plum app offers two main options – stocks and investment funds. Currently, there are around 3,000 stocks available on the app along with about 26 different funds (offering different strategies such as tech stocks, ethical investments, etc.).

With stocks, there are no trading commissions, but you do have to pay FX charges and stamp duty fees. As for investing in funds, you’ll need a Plum Pro (£2.99/month) or Premium (£9.99/month) subscription. A Pro subscription gives you access to an introductory selection of funds while the Premium subscription gives you access to the full range of funds.

One important thing to point out here is that while you can invest in funds through a Stocks and Shares ISA on Plum, you can’t invest in stocks this way. In other words, you can’t invest in individual stocks tax-efficiently with this app. This is a major drawback of investing via this platform. If you were to invest in stocks and had some success (i.e. big gains), you could end up with a substantial Capital Gains Tax (CGT) bill. Overall, Plum’s Stocks and Shares ISA is quite limited. If you’re looking for a Stocks and Shares ISA with a wide range of investment options, you may want to consider another platform such as Hargreaves Lansdown, AJ Bell, or Trading 212.

The relatively small number of funds available could also be considered a drawback. On platforms such as Hargreaves Lansdown and Interactive Investor there are literally thousands of funds to choose from.

The Plum Pension

Plum offers access to a pension account. This is a Self-Invested Personal Pension (SIPP). Like other SIPPs, you can benefit from tax relief with the Plum pension. If you are a basic-rate taxpayer, a £100 pension contribution will only cost you £80.

There are only a few investment options with Plum’s pension accounts. Currently, there’s a global equity fund, a climate change focused fund, and then six different target retirement date funds. The lack of options here could be considered a drawback. Today, a lot of other SIPP providers, such as InvestEngine, Interactive Investor, and Hargreaves Lansdown, offer far more investment options.

What are Plum’s membership plans and fees?

Plum’s different membership plans are set out in the table below. The table shows which features are available on the different plans.

| Plan | Basic | Pro | Ultra | Premium |

| Cost per month | Free | £2.99 | £4.99 | £9.99 |

| Cash ISA | Yes | Yes | Yes | Yes |

| Stocks and Shares ISA | No | Yes | Yes | Yes |

| Easy-access savings pocket | Yes | Yes | Yes | Yes |

| No. of Auto Savers | 4 | 6 | 8 | 8 |

| Stock trading | No | Yes | Yes | Yes |

| Pension | Yes | Yes | Yes | Yes |

| 95-Day Notice Pocket | No | No | No | Yes |

| Ready-made investment funds | No | Yes | Yes | Yes |

If you are investing with Plum, there are some extra fees. Annual platform fees are 0.45% on the Pro and Ultra plans and 0.15% on the Premium plan. On top of this, the investment funds have small ongoing fees that vary depending on the fund you choose. In general, the overall investing fees are quite reasonable, but it may be possible to obtain lower fees with another provider such as Vanguard or AJ Bell.

As for the pension, users pay a product provider fee of 0.45% per year. This fee is charged annually, billed monthly and automatically reflected in your SIPP account balance. Fund management fees also apply – here there is an average annual fee of around 0.25%, depending on the fund(s) you choose for your SIPP. This is automatically deducted from the total value of the fund.

Is Plum safe?

Plum is regulated by the Financial Conduct Authority (FCA) and your savings are safeguarded in separate accounts. So, it should be considered relatively safe to use.

With Plum, eligible deposits in a Cash ISA or Easy Access Interest Pocket are protected up to £85,000 per eligible person by the Financial Services Compensation Scheme (FSCS). However, your Primary Pocket (your default pocket that serves as a central hub for all deposits and withdrawals to and from your Plum account) is not FSCS covered.

Of course, if you invest in stocks or funds with Plum or have a pension, you need to be prepared for the value of your capital to fluctuate.

| Money type | Where it’s held | Protection level |

| Cash ISA | Citibank, Lloyds, QNB | FSCS up to £85,000 per bank |

| Easy Access Savings Pockets | Investec Bank | FSCS up to £85,000 |

| 90-Day Notice Pocket | Investec Bank | FSCS up to £85,000 |

| Primary Pocket | Moduir FS Ltd | Safeguarded but not FSCS protected |

| Plum Interest | BlackRock | Segregated under CASS rules, FSCS may apply |

| Stock Investments | Alpaca | SIPC protection up to $500,000 per client |

Who owns Plum?

Plum is owned by Plum Fintech. This is a company that is owned by Plum founders Victor Trokoudes and Alex Michael and has received funding from a range of investors including BBVA, Venture Friends, Eurobank, and EBRD.

Is Plum a bank?

Plum is not a bank. Instead, it’s a FinTech app. With Plum, there are no branches you can visit. There is also no desktop version of the platform.

Can you really make money with Plum?

It’s definitely possible to make money with Plum, whether you are a saver or an investor. If you are a saver, you can generate interest on your money with one of its savings products. If you are an investor, you can potentially obtain decent long-term returns by investing in funds and stocks.

Is it safe to link your bank account to Plum?

Linking your bank account to Plum is generally safe. When you link your account, Plum only has read-only access. This means that the company can view your bank account data, such as the balance and transactions, but it can’t make any modifications or misuse the information in any way. Importantly, Plum never stores or has access to your bank login credentials and your personal data is safeguarded through state-of-the-art security measures.

Pros

- The app is easy to use

- Some really great features for savers

- High interest rates are available

Cons

- The investment offering is a little weak

- Not many funds are available

- Stocks cannot be held in a Stocks and Shares ISA

-

Pricing

(4)

-

Market Access

(3.5)

-

App & Platform

(4.5)

-

Customer Service

(5)

-

Research & Analysis

(3)

Overall

4

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognised as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please see his Invesdaq profile.