Moneyfarm Customer Reviews

Tell us what you think of this provider.

3/5

5/5

Pros:

Competency

Cons:

Value

4/5

Pros:

Ease of use

Cons:

All good

3/5

4/5

3/5

4/5

Pros:

Easy to use IT

Cons:

–

3/5

3/5

Pros:

Portfolio breakdown

Cons:

Keep up the good work

5/5

Pros:

Easy

Cons:

No

4/5

Pros:

money management

4/5

Pros:

Robo investment

4/5

4/5

5/5

Pros:

Easy to excess

Cons:

Change people’s lives

4/5

3/5

3/5

5/5

Pros:

Professional

Cons:

Money

1/5

Pros:

1000

Moneyfarm Expert Review

Moneyfarm Digital Wealth Management Review

Provider: Moneyfarm

Verdict: Moneyfarm is a digital wealth manager that aims to make personal investing simple and accessible. It was launched initially in Italy in 2012 by Italian bankers Paolo Galvani and Giovanni Dapra and entered the UK in 2016 and has big-name financial backers such as Allianz Global Investors, Cabot Square Capital, United Ventures and Poste Italiane.

Is Moneyfarm any good for wealth management?

Yes, Moneyfarm is more of a digital wealth manager rather than a robo-advisor as the portfolios are put together by investment managers, rather than automatically. The automation, as it where, is fine-tuning your portfolio to match your risk/reward choices. As opposed to other robo advisors you can also top-up your portfolio with individual shares and ETFs.

Fees: Moneyfarm charges 0.75% to 0.6% up to £100k then 0.45% to 0.35% over £100k. Moneyfarm investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%.

Market Access: You can invest in 7 pre-made portfolios, but also (unlike a lot of other digital wealth managers and robo-adviors) also buy individual shares, ETFs, bonds and mutual funds online. It’s a bit of a shame you can’t buy US stocks, But Moneyfarm is best really for setting up regular investments in a GIA, ISA or SIPP, then letting them grow over time without too much tinkering and speculating on Tech stocks.

App & Platform: It’s really easy to use, plus it puts you through your paces to make sure you understand what you are investing in. Apparently, my Moneyfarm investor profile is “pioneering”, which means I want to take on more risk for potentially better returns.

Customer Service: This is mostly online as you’d expect but solves all issues – I’ve had some good calls with MOneyfarm about how their producsts work over the years and they really know their stuff. If you want to find out more about their ethos, you can read my interview with the CEO Giovanni Daprà on how they are so much more than a robo-advisor.

Research & Analysis: Not much to speak of other than a few guides, but that’s ok, as I don’t really want Moneyfarm spamming me with stock trading ideas.

Pros

- Easy to use with low fees

- The ability to buy shares, bonds, ETFS & funds

- Diverse managed portfolios

Cons

- High £500 minimum investment

- 0.75%* account fee is relatively high

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

5Capital at risk

Moneyfarm Facts & Figures

| ⬜ Public Company | ❌ |

| 👉 Number Active Clients | 135K |

| 💰 Minimum Deposit | £500 |

| 💸 Client Funds | £3.9 billion |

| 📅 Founded | 2012 |

Account Costs | |

| ➡️ Investment Account | 0.25%-0.75% |

| ➡️ SIPP | 0.25%-0.75% |

| ➡️ Stocks & Shares ISA | 0.25%-0.75% |

| ➡️ Junior ISA | 0.25%-0.75% |

| ➡️ Lifetime ISA | ❌ |

Dealing Costs | |

| ➡️ UK Shares | £3.95 per trade |

| ➡️ US Stocks | £3.95 per trade |

| ➡️ ETFs | £3.95 per trade |

| ➡️ Bonds | 0.3% for Liquidity + |

| ➡️ Funds | £3.95 per trade |

Capital at risk

Moneyfarm News

Is Moneyfarm cash ISA safe?

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Moneyfarm’s Stocks & Shares ISA Comes With A £1,000 Transfer Offer

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Is Moneyfarm’s GIA a good investment account?

Moneyfarm is a trusted investment account based on our metrics of regulation, size and products. The GIA is not as good as the Moneyfarm ISA for your first £20k invested each year though as you have to pay capital gains on any profits outside of your ISAs. Moneyfarm’s GIA is a digital wealth manager and makes

Moneyfarm rivals Nutmeg with 160,000 clients following Willis Owen acquisition

Moneyfarm has acquired investment platform Willis Owen, with the deal set to bring its managed portfolios to more than 160,000 clients in total. In a statement announcing the deal the digital wealth firm said it is set to manage more than £5 billion in assets after the transaction is completed in early 2025. This puts

Moneyfarm relaunches free advised portfolio review service

Moneyfarm has relaunched its portfolio review service, which allows investors to speak to an adviser to get a better understanding of their investments. In an email announcing the update, the digital wealth manager stated the free service is intended to give its customers a “holistic overview” of their investment positions. The session offers a breakdown

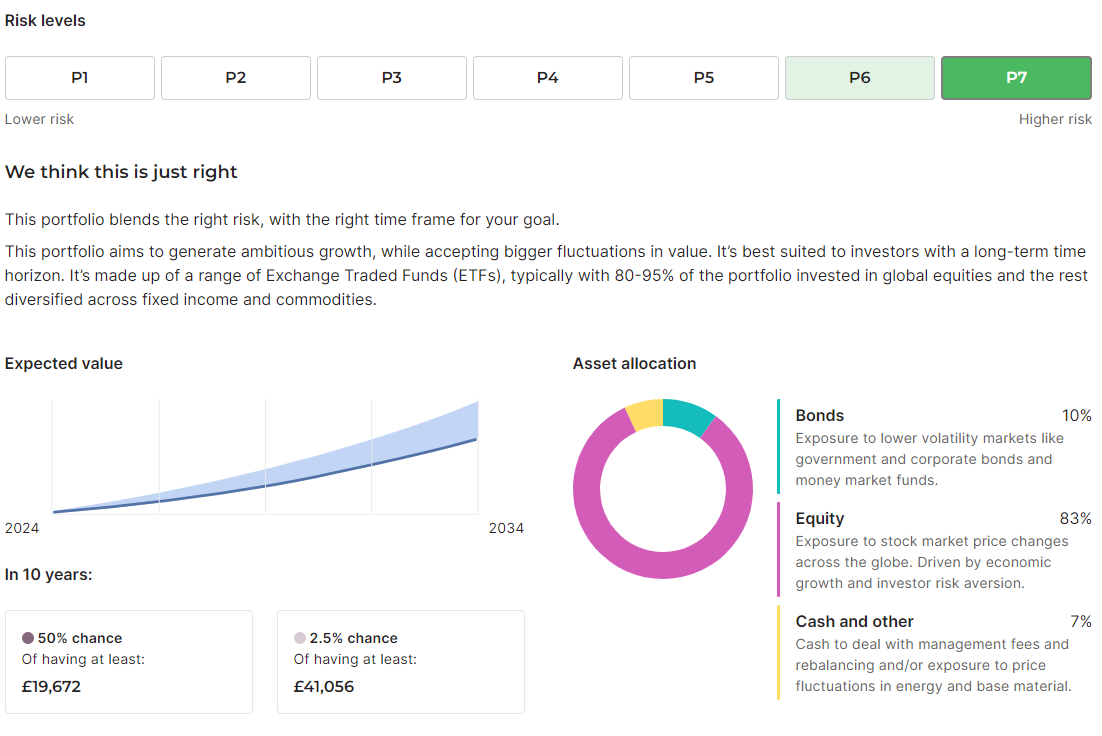

Moneyfarm adds higher risk equity “portfolio 7” for investors chasing higher returns

Moneyfarm has added a new higher risk, full equity, option for its investors. The firm’s Portfolio 7 option has been reconfigured to a 100% equity allocation, aimed at providing possibly higher returns to clients of the digital wealth manager with higher risk profiles. The robo-advisors platform’s Portfolio 6 option has also been rebalanced to slightly

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.