Edward Sheldon takes a closer look at Hargreaves Lansdown’s 5 funds to watch in 2020

To help UK investors choose the best funds to invest in, investment provider Hargreaves Lansdown recently released its annual fund research report ‘5 funds to watch in 2020.’ This report highlights five funds across different areas of the market that Hargreaves’ analysts believe could perform well in different investment environments.

Here, I’ll take a closer look at the five funds Hargreaves Lansdown has selected and examine the strengths and weaknesses of each.

Aviva UK Listed Equity Income

In the UK equity income space, Hargreaves has picked out the Aviva UK Listed Equity Income fund. This fund’s objective is to deliver an income return of at least 110% of that of its benchmark, the FTSE All-Share index, while growing investors’ capital over the long term. Fees are 0.49%* per year through the Hargreaves Lansdown platform.

There are a number of things I like about this equity income fund. Firstly, the portfolio managers of the fund focus on companies that are cash generative, pay dividends and benefit from competitive advantages, which is a sound long-term investment strategy in my view. Secondly, the fund is not an ‘index hugger.’ Looking at the most recent factsheet, the top five holdings at 31 December 2019 were Intermediate Capital Group, Phoenix Group Holdings, St. James’s Place, BHP Group, and Melrose Industries. Clearly, the portfolio managers aren’t afraid to stray from the benchmark. Third, it currently has a high yield of around 4.3%.

The performance track record of this fund is solid, but not spectacular. For the five years to 31 December 2019, it returned 7.71% per year. That’s a decent return and a higher return than its benchmark generated (7.54% per year), however, a number of other UK income funds such as Man GLG UK Income, TB Evenlode Income, and Franklin UK Rising Dividends, performed significantly better. Overall, I see the Aviva UK Listed Equity Income fund as a solid choice for UK equity income, however, there are income funds I’d pick before it.

Those looking for a cheaper index fund alternative here may want to consider the Vanguard FTSE UK Equity Income Index. It has an annual fee of just 0.14%* through Hargreaves, however, it is more focused on high-yield stocks.

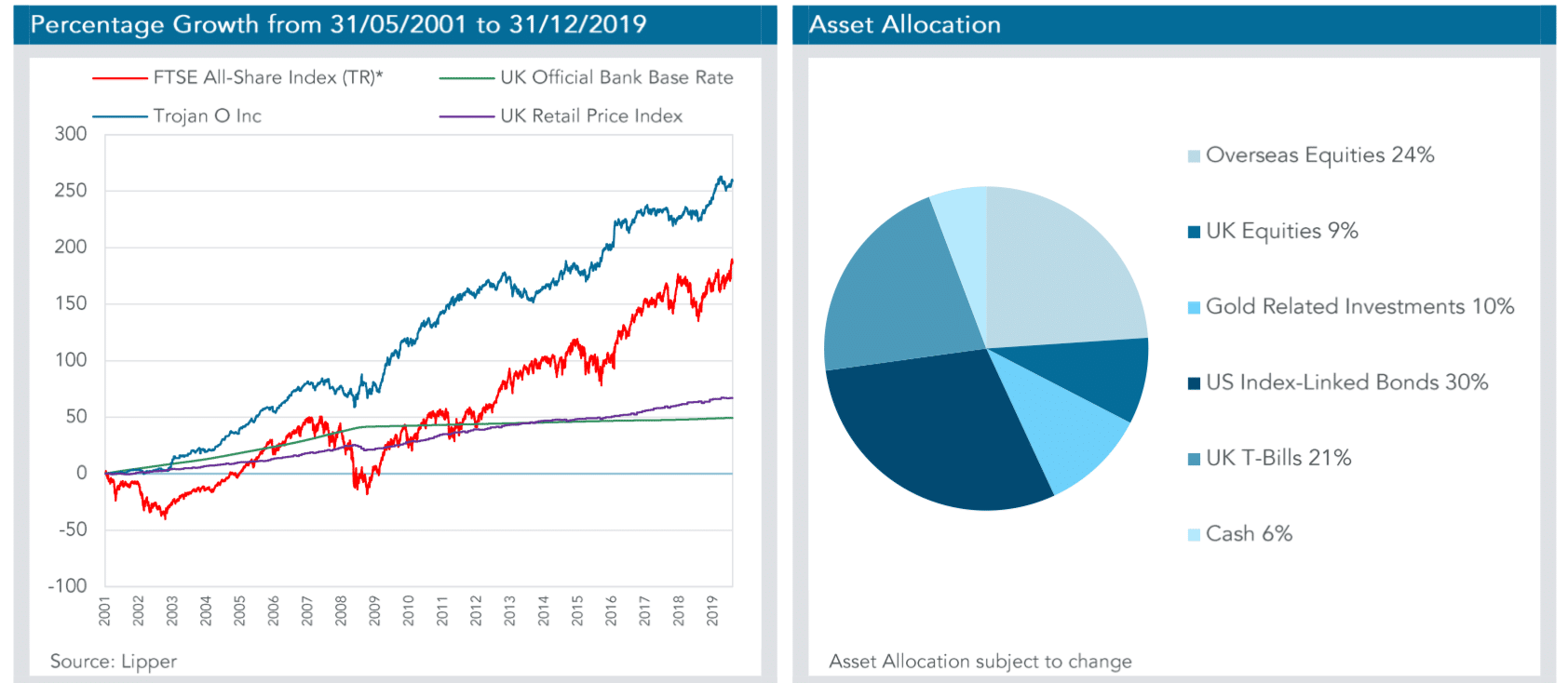

Troy Trojan

Also in the UK equity income sector, Hargreaves’ analysts highlighted the Troy Trojan fund. This is a rather unique fund that has the flexibility to invest in UK stocks, international stocks, gold-related investments, bonds, and cash. Its objective is to generate capital growth in excess of inflation over the long term, while limiting volatility. Fees are 0.62%* per year.

From a defensive point of view, this fund certainly looks interesting, in my opinion. Not only does it have significant exposure to fixed income and a healthy weighting to gold-related investments, but it also has exposure to a number of defensive stocks such as Unilever, Nestle, and Procter & Gamble. As such, if global equity markets were to fall in 2020, this fund could outperform others that are more growth focused.

Source: Troy Asset Management. Data as of 31 December 2019.

It’s worth noting that the recent performance track record of this fund is not fantastic. Looking at its 31 December 2019 factsheet, the fund underperformed its benchmark, the FTSE All-Share index, over one, three, five, and 10 years. However, the fund does have an excellent track record when it comes to minimising downside risk – since 2002 its worst annual return is just -3.1% – which reinforces my view that it could be a good defensive portfolio holding.

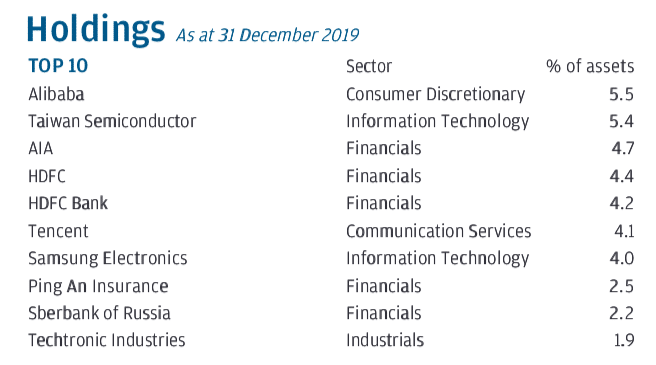

JPM Emerging Markets

Hargreaves Lansdown’s next pick is the JPM Emerging Markets fund. This is a 5-star Morningstar-rated equity fund which, as its name suggests, is focused on the world’s emerging markets. Hargreaves’ analysts believe this fund is a “great choice for adding a bit of spice to a portfolio.” Fees are 0.62%* per year.

If you’re looking to capitalise on the rapid growth of the emerging markets, the JPM Emerging Markets fund is a great choice, in my view. The fund offers exposure to fast-growing countries such as China and India, as well as exciting companies such as Alibaba, Tencent, and Samsung Electronics. Its performance track record is very good as well – for the five-year period to the end of 2019, it returned 9.83% per year versus 7.25% per year for its benchmark, the MSCI Emerging Markets Index.

Source: JP Morgan. Data as of 31 December 2019.

Of course, it’s important to remember that emerging markets can be extremely volatile at times. So, risk management is crucial here – I wouldn’t want to be overly exposed to this kind of fund. I’ll also point out that the fund has high exposure to China (38.4% of the fund at 31 December 2019) which is another risk to consider, given the uncertainty associated with the coronavirus and the ongoing trade war.

Those looking for an index fund alternative here may want to consider the iShares Emerging Markets Equity Index. It has a lower annual fee of just 0.16% per year*.

- Don’t like any of these funds? See our picks of the best global growth funds.

Jupiter Strategic Bond

For fixed income exposure, Hargreaves has highlighted the Jupiter Strategic Bond fund. This is a flexible, ‘go-anywhere’ bond fund that seeks to invest in the best fixed income opportunities globally. Its objective is to provide income with the prospect of capital growth to provide a return higher than the Investment Association’s Sterling Strategic Bond Sector average over the long term. Fees are 0.55%* per year.

The investment case for this fund really depends on your view of where we are in the economic cycle and the trajectory of interest rates in the near term. If major central banks continue to lower interest rates, as they have done in the last 12 months, this fund should perform well, as bond prices are inversely related to interest rate movements. However, if interest rates were to resume their upward trajectory, this fund’s performance could be disappointing, as bond prices fall when rates rise.

It’s worth noting that while this fund outperformed its benchmark over the five-year period to 31 December 2019 (a total return of 21.7% vs 20.2%), there are plenty of bond funds on the Hargreaves Lansdown platform that generated higher returns.

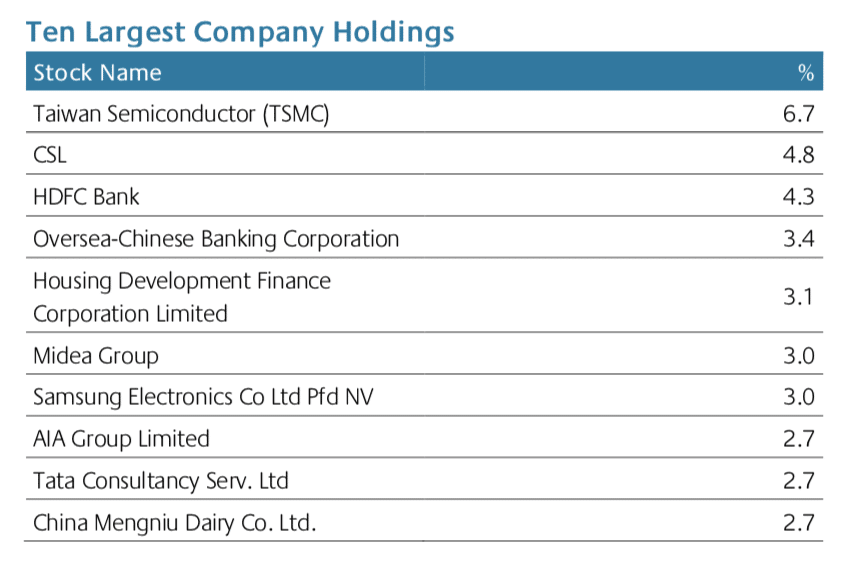

First State Asia Focus

Finally, the last pick from Hargreaves Lansdown is the First State Asia Focus fund. This equity fund invests the majority of its capital in companies based in, operating in, or have their economic activity mainly in the Asia Pacific region including Australia and New Zealand (but excluding Japan). Fees are 0.75%* per year.

Taking a closer look at this fund, there is a fair bit of overlap between it and the JPM Emerging Markets fund. Like the JPM fund, it has significant exposure to China and India. And examining the individual holdings, the two funds hold many of the same stocks such as Taiwan Semiconductor, HDFC Bank, AIA, and Samsung Electronics.

Source: FSSA Investment Managers. Data as of 31 December 2019.

Nevertheless, this fund certainly looks to have potential due to the rapid growth of economies in Asia. While it doesn’t have a long-term performance track record due to the fact that it was only launched in August 2015, its performance since inception has been good. For the three-year period to the end of 2019, it returned 44.1% versus 31.1% for its benchmark, the MSCI AC Asia Pacific ex Japan Index, meaning it was in the top quartile of funds in its sector. Key risks to consider include the fund’s exposure to China (20% of the fund at 31 December 2019) and Hong Kong (13%). The latter has been significantly impacted by political protests recently.

Overall, I see the First State Asia Focus fund as a good choice for those looking for long-term exposure to Asia. However, given the overlap between this fund and the JPM Emerging Markets fund, I feel that one of the two is probably sufficient for those seeking emerging markets exposure.

Those looking for an index fund alternative here may want to consider the iShares Pacific ex Japan Equity Index. Its annual fee is significantly lower at just 0.25%*.

* Plus Hargreaves Lansdown’s platform fees.

Edward Sheldon owns shares in Unilever and St. James’s Place.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognized as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.