I used to have a Range Rover, well it was a Sport. Blue with a silver roof, but I lived in Surrey with a drive so it was easy to insure. When I drove into London for lunch with my old boss we walked to my car afterward and when he saw it he just said, “I wouldn’t park one of those around here it’ll get nicked.” We were on the Kings Road, he drives a Bentley Continental convertible. The cheek I thought, but it’s basically the reason you can’t insure a Range Rover in London, because they get nicked all the time.

Data released by the DVLA reveals that Range Rovers are among the most frequently stolen vehicles in the UK. Despite efforts to prevent theft, criminals continue to target and successfully break into these vehicles. Consequently, insurance companies have raised policy prices and, in some cases, stopped offering coverage for the Range Rover series altogether.

Can you insure a Range Rover in London?

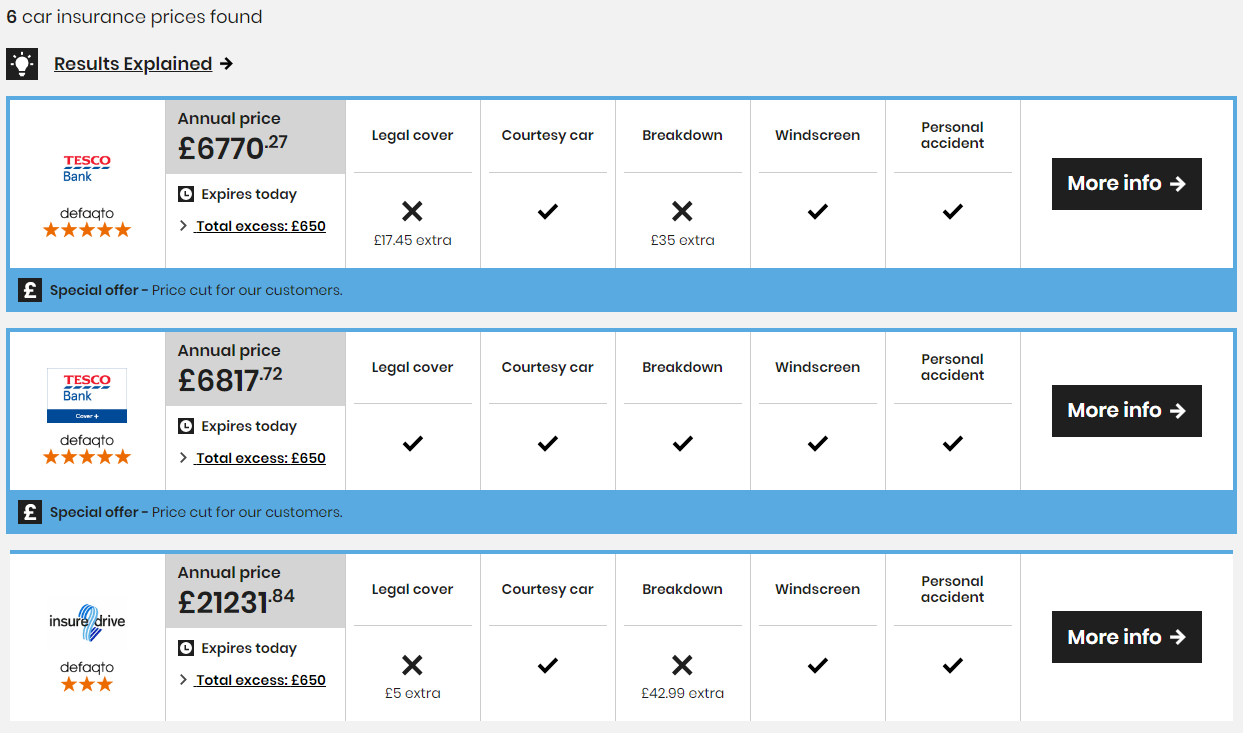

Yes, but it’s expensive. I’ve just had a look on Confused.com and priced up getting my old Range Rover Sport insured at the flat in Clapham South I used to live in when I first met my wife.

Bear in mind it is a 2015 model and is now worth about £21k, according to the insurer. The first two quotes are not too bad, £6,770 and £6,817 from Tesco. But the third is laughable, £21,231 from a firm called “insuredrive”. It reminds me of when I was 17 trying to get my grandma’s Nissan Mirca insured.

Granted I do have a couple of speeding fines, and my wife is added as a named driver.

If you wanted a new full-size Range Rover, 3.0 D300 MHEV SE Auto 4WD Euro 6 (s/s) 5dr 2022 (72 reg), for example, and what to insure it in London, you get a very alarming message telling you that confused.com can’t possibly help with something so ridiculous and to call a specialist immediately.

So there you go.

If you drive a Range Rover in London, people will not only think you are an idiot for driving a vulgar and ostentatious car, but they will also know that you are a complete mug and have paid through the nose to insure the beast.

But that’s really the point of owning a Range Rover anyway.

If you want to insure a Range Rover in London, you need to talk to a specialist insurer like Adrian Flux, car insurance comparison sites will not be able to process the risk.

Why are Range Rovers so hard to insure in London?

Range Rovers are hard to insure because they are very attractive to steal (and quite often are) because of:

- Keyless Entry Vulnerabilities: Some Range Rover models come equipped with keyless entry systems, which can be vulnerable to hacking or signal relay attacks. Thieves can use specialized devices to intercept and amplify the signal from the car’s key fob, allowing them to unlock and start the vehicle without needing the physical key.

- High Resale Value: Range Rovers have a high resale value, making them lucrative targets for thieves looking to steal and then sell the stolen vehicles or their parts on the black market.

- Limited Security Features: While Range Rovers typically come with advanced security features, some older models or versions may lack the latest anti-theft technology, making them easier targets for thieves.

- Lack of Physical Deterrents: Range Rovers may not always be equipped with physical deterrents like steering wheel locks or wheel clamps, which can make it easier for thieves to steal the vehicle.

- Professional Criminals: Some thefts of Range Rovers are orchestrated by organized criminal groups with the knowledge and tools to overcome security measures and quickly steal the vehicles.

- High Demand for Parts: Even if thieves don’t steal the entire vehicle, Range Rover parts, such as wheels, tires, airbags, and entertainment systems, can be in high demand in the black market, providing an additional incentive for theft.

- Geographic Factors: Certain areas or neighborhoods with higher crime rates may experience more frequent Range Rover thefts due to the presence of opportunistic criminals.

How can you make it easier to get your Range Rover insured in London?

To mitigate the risk of Range Rover theft, owners can take several precautions, including:

- Investing in aftermarket security systems and tracking devices.

- Parking in well-lit and secure areas.

- Using steering wheel locks or wheel clamps.

- Storing the key fob in a signal-blocking pouch to prevent relay attacks.

- Keeping the vehicle’s software and security features up-to-date.

- Installing a GPS tracking system to assist in recovery if theft does occur.

None of this will really help you though if car thieves kick in your front door and nick the keys. A neighbour, had his Vogue stolen this way. There were even massive gates on the drive. But they just smashed straight through them.

So all in all you can’t really blame insurers for not wanting to take on the risk. But at the end of the day, that’s what they are they for. To take on your risk for you and for that, if you want to insure a Range Rover in London you must pay a premium. A big one.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.