I’ve used Interactive Brokers for about 20 years now, I’ve interviewed their founder (Thomas Peterffy), their UK MD (Gerry Perez), they have been a competitor (when I was a broker myself), a customer and a partner over the years. I’ve traded live with real money when thoroughly testing their platforms, including having in-depth conversations with their Head Of Product (Steven Sanders) to get inside insights on the best parts of the platform and services that some clients may not know about. In this review, I lay out my verdict on Interactive Brokers as an industry expert so you can decide if they are the right investing and trading platform for you.

IBKR Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Expert Interactive Brokers Review

Interactive Brokers Review

Name: Interactive Brokers

Description: Interactive Brokers is a major US online automated electronic broker company. The financial broker is listed on the Nasdaq Exchange with ticker IBKR. The firm operates in 150 electronic exchanges in 33 countries, and offers trading in 23 currencies. Interactive Brokers has more than 1.75 million institutional and retail customers.

Why we like them

Interactive Brokers is an exceptional trading platform that offers institutional-grade trading capabilities to private clients around the world. IBKR has some of the lowest trading and investing fees and the widest market range in the industry.

Pros

- Very low dealing fees

- Wide market range

- Direct market access

- Complex order types

Cons

- Customer services can be slow

-

Pricing

(5)

-

Market Access

(5)

-

Apps & Platform

(5)

-

Customer Service

(3)

-

Research & Analysis

(5)

Overall

4.6Ratings Explained

- Pricing: Top marks as IBKR don’t charge a custody (account) fee and commission are the cheapest around.

- Market Access: Top marks again for the widest selection of markets available.

- App & Platform: Hard to beat – excellent range of instituional greade execution tools and simple apps for beginners

- Customer Service: IBKR let themselves down a bit here. If you are a big customer you get an account manager, otherwise online supprt is slow.

- Research & Analysis: Some of the best education, screeners and market data for free on their website and integrated into IBKR platforms.

There is one thing that IBKR gives you above all other brokers, and that is control. You can invest and trade in pretty much anything you want, in pretty much any account type, pretty much how you want.

If you are not familiar with Interactive Brokers (IBKR) they are American, but global, as most American things are, with the notable exception of their news, which always seems to be local. But I digress, IBKR was one of the first brokers to offer electronic trading to the masses. They were founded in 1978 and if you want to know more about the man who founded them and is still running the show, read my interview with Thomas Peterffy, the founder and chairman.

Highlights

The key things to focus on if you are considering opening an account with Interactive Brokers is that:

- They are cheap. No other investment or trading platform can match their discount commissions, FX rates and zero account charges.

- Huge market range. IBKR offer by far the best access to global stock exchanges around the world.

- They innovate and create. You can invest in so many different ways through IBKR, from their beginner IBKR LITE apps, to their institutional-grade desktop workstation trading platform they have some of the most advanced and easy-to-use features available to private investors.

Account Types

For us Brits, you can have an Investment ISA account, manage your SIPP, trade CFDs, on exchange futures and options, buy funds, buy physical shares, (then earn money by lending it out to people who want to bet against you and short it through their Stock Yield Enhancement Program).

You can earn money on your cash, you can buy bonds (high and low yielding), buy warrants, partake in placings, vote on company corporate actions. You can convert currency at 0.2%, which is cheaper than most specialist currency brokers or money transfer apps.

Foreign Exchange

Which actually segues me nicely to prove my control point. With most brokers you have to choose an account base currency (if you are in the UK that is probably going to be GBP) and when you trade, no matter what currency an asset is traded in your P&L will be converted to that base currency. But with IBKR you can run your account in multiple currencies.

So, if you put in GBP and trade the S&P for example, your P&L will be in USD. If you buy USD stock you get the option to attach a currency conversion to the transaction so you can convert exactly the right amount to cover the purchase, or you can choose to run a deficit in USD.

It’s not such an issue for small traders, as currency exposure, whilst important to be aware of, isn’t the most pressing matter. But if you are running a net flat long/short global macro portfolio, then keeping on top of your currency exposure could be the difference between making money or not.

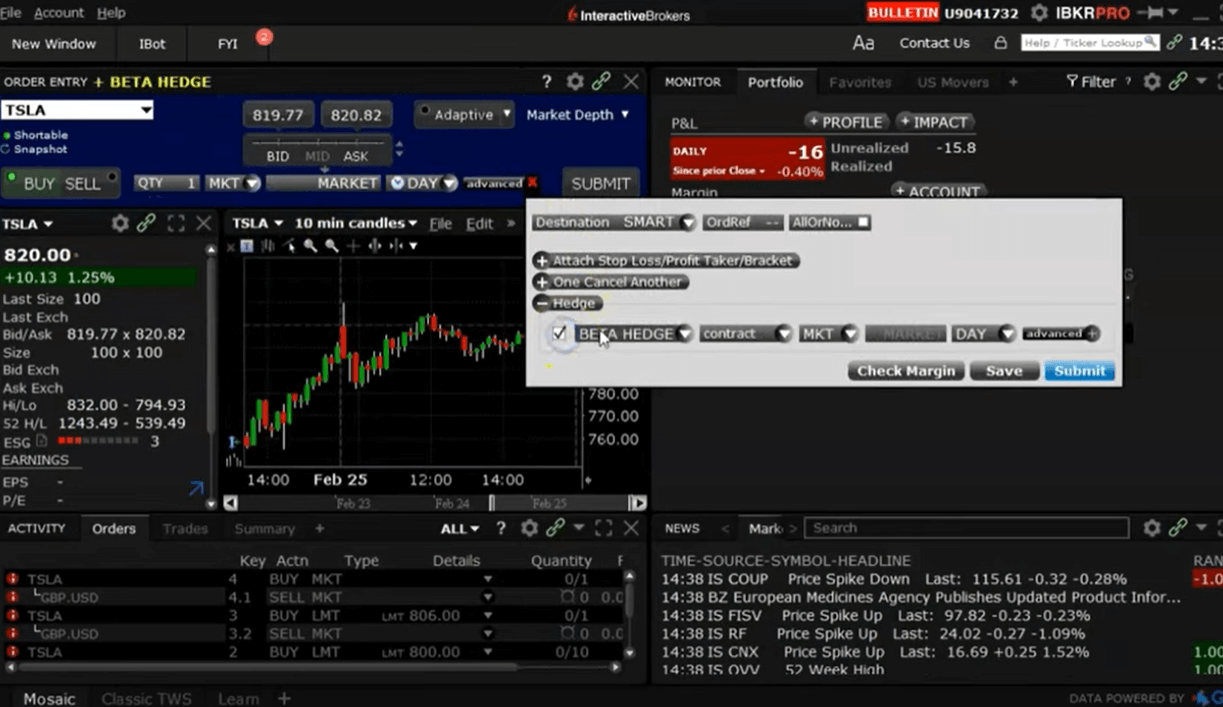

Desktop Trader

Through ScaleTrader, (one of the founder’s favourite features) IBKR also gives you some very advanced order functionality, the sort you usually only get with professional trading systems like Fidessa (for stocks) or TT (for futures).

If you’re building a big position and don’t want the market to know you’ve got a big order to work, IBKR’s order ticket will let you gradually feed that into the market (but only charge you for the single order).

You can automatically drop bids and offers into the market based on time and price to take advantage of volatile markets. You can also set it to scalp for quick profits in choppy markets.

Pairs Trading

You can trade one stock against another automatically by spread, percentage or price.

Why is that important? Because it can help you build a market-neutral portfolio and when we asked the boss of IBKR the habits he saw in his most profitable customers, (referring back to our interview with him for the third time) he said the ones that traded one stock against another, often did well.

Universal Account

You can of course do these things with other brokers, but what you can’t do is do them all in one place.

For this review, I spent a while talking to Steven Sanders, IBKR’s head of Marketing & Product Development, and he said in the twenty years, he’s worked for Interactive Brokers the thing he’s most proud of (other than it being founder lead and therefore very little red tape when you want to get things done) is the implementation of the Universal Account, where everything is done from one account.

What’s amazing to me is that nobody else really offers it. Ten years ago when I was a derivatives broker at Man Financial, we offered everything that IBKR did, but all on separate platforms. We have a couple of big accounts, £20m upwards, that we were always trying to lure back from IBKR with our personalised voice brokerage where you could phone us up we’d take care of your complicated orders for you.

But times change, there is still demand for bespoke voice brokerage, but not as far as Interactive Brokers are concerned. They do offer it from specialists desks if needed, but most trading and investing is done online.

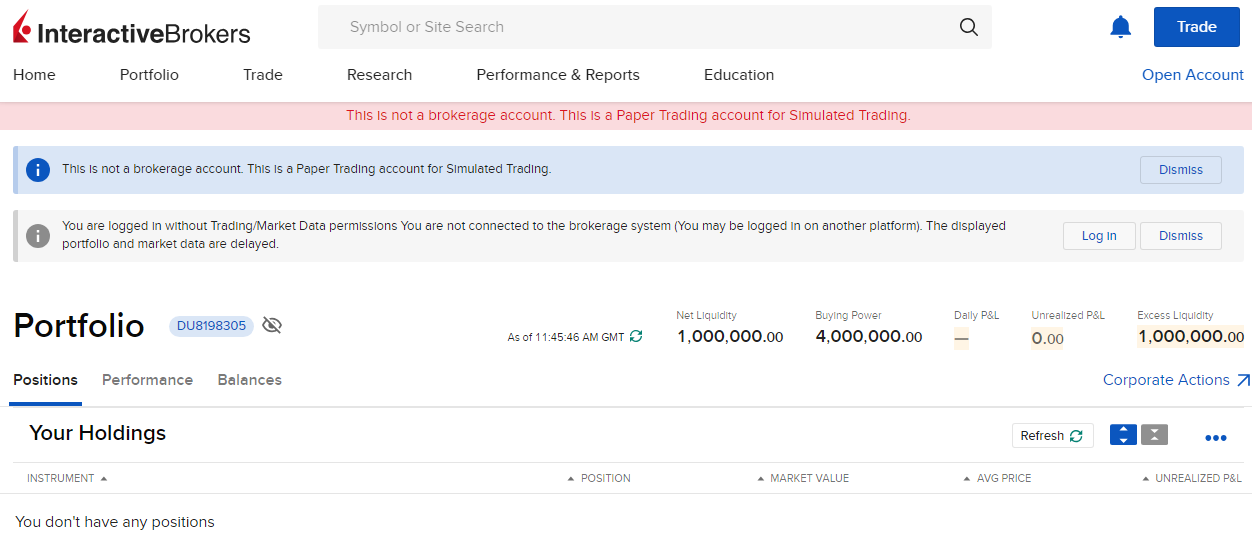

Demo Account

Interactive Brokers does have a demo account, but they call it a free trial instead. This is odd, because you don’t actually have to pay to have an account with IBKR. In fact, Interactive Brokers is one of the only trading platforms that does not have a custody fee for investing in a GIA, SIPP and ISA.

If you want to know more about that, you can listen to my podcast with Gerry Perez, the UK MD, who explains, how they offer such amazing market access for such little cost.

You get a cool $1m to paper trade with on the Interactive Brokers demo account or “Paper Trading version” as they call it. You get access to the easy-to-use investors portal and the more complex IBKR TWS provides delayed market data, simulated trading and access to all of our unique tools and offerings, including the IBKR Risk Navigator, the Volatility and Probability Labs, Portfolio Builder, Research and News.

But, to be honest, I didn’t find the demo account very good, lots of information was missing and I couldn’t place a trade. I’m not sure why, and actually, that’s going to be a bit of an issue for Interactive Brokers because demo accounts are a great way to get clients interest, and in a world where so many brokerages a vying for the same business, even small hiccups like that can cause a massive drop off rate in opening an account.

Usually, IBKR’s technology is first-rate, but the demo account isn’t up to scratch. I didn’t use the paper trading account, just the live trading platform with real market orders.

Customer Service

It’s not all great, it takes a while to get through on the phone to customer service, and it has a slightly outsourced feel about it (if you know what I mean).

The desktop trading platform, despite its exceptional functionality, is also a bit “Windows 95”. But if you don’t need all the bells and whistles, the web based platform, or app has a more modern feel to them.

Options Strategy Builder

Options trading is gaining in popularity in the UK, mainly because of the press attention they derived from meme stocks (where US traders punt via options). But they are still a very complicated product. So what Interactive brokers has down is create a strategy builder product, that essentially reverse the process of putting on options strategy trades.

You tell strategy builder what you think the market is going to do. For example, either, go up, stay still, not move for a while, or volatility will increase and it will create an options strategy around that. Instead of you having to know what strategy to put in place or working out the individual options legs.

IMPACT Ethical Investing

In tune with moving with the times, Interactive Brokers has also released the IMPACT app to help people investing in ESG and impact sectors, so they can put their money to good.

You can see the IMPACT dashboard on desktop, but it also operates as a standalone app that connects directly to your IBKR account and scores your portfolio based on how ethical the stocks you hold in it are. Ratings come from FactSet and Refinitiv, and there is this excellent feature that allows you to swap into more ethical stocks.

If one of your holdings is flagged as not that ethical, the app will suggest another one and at the click of a button, it will sell your shares and calculate how many new shares of a more ethical but similar company to buy and do it all for you. If you’re in the US, you can also make charitable donations directly on the app.

Beginners

There is no doubt that Interactive Brokers is a proper trading platform, for those who know what they are doing and cater mainly to the more sophisticated investor. But they are making an effort to open their services up to the newer breed of investor and trader.

It’s standard now among many fintechs, but IBKR were actually the first to offer “no commission trading”, they also offer fractional shares through IBKR LITE and IBKR Pro accounts and have removed the monthly minimum account charge.

The hope of course is that by onboarding investors when they just start, they can look after their investments for the next 40 years, just as they have been doing for their existing clients for the last 40 years.

Interactive Brokers runs a Student Trading Lab where students from 600 schools and universities take part in a $1m paper trading account for the purposes of getting a better understanding of the markets. No broker these days can tell you what to buy or sell, but IBKR GlobalAnalyst, helps you hunt out undervalued opportunities, across the world, not just in the US.

IBKR offer a Trading Academy, podcasts, webinars and blogs for beginners and experienced traders so that new customers survive the markets to become long-term clients.

Plus, they are cheap.

24-Hour ETFs At Interactive Brokers

Interactive Brokers has a list of 24 selected ETFs available to trade around the clock from Sunday evening, east coast time, through to the close on Friday, by adding these funds to its US overnight trading facility.

Clients who are permissioned to deal in US stocks, are able to trade these ETFs 23.50 hours a day, 5 days per week, allowing them to react to news stories, macroeconomic and geo-political events as they happen, rather than waiting for US markets to open.

The trading hours and ETFs are available to both retail and institutional clients alike and are traded via the firm’s IBEOS system. Trades can be submitted using multiple order types.

The range of ETFs is pretty broad and includes firm favourites such as SPY, QQQ, DIA and IWM, which track the S&P 500, Nasdaq 100, Dow 30 and Russell 2000 indices respectively. You can also short those indices by trading the SH, PSQ, DOG, and RWM inverse ETFs.

62.5% of retail investor accounts lose money when trading CFDs with this provider

IBKR Awards

In our annual awards Interactive Brokers have won:

- Best Trading Platform -2023

- Best Bond Broker – 2023

- Best Futures & Options Broker 2023 & 2020

- Best Options Broker – 2022

- Best DMA Broker – 2022

- Best Prime Broker – 2022

- Best Algo & API Trading – 2022

62.5% of retail investor accounts lose money when trading CFDs with this provider

IBKR Video Review, Live Trades & Verdict

In this video review of Interactive Brokers we trade live on a real account and highlight some of the key platform features.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers Facts & Figures

IBKR CFD Markets | Over 5230 |

| 👉 Forex Pairs | 100 |

| 👉 Commodities | 20 |

| 👉 Indices | 13 |

| 👉 UK Stocks | 500 |

| 👉 US Stocks | 3500 |

| 👉 ETFs | 1100 |

IBKR Key Info | |

| 👉 Number Active Clients | 1750000 |

| 💰 Minimum Deposit | $0 |

| ❔ Inactivity Fee | $0 |

| 📅 Founded | 1977 |

| ⬜ Public Company | ✔️ |

| 🏢 HQ | Greenwich, Connecticut |

IBKR Account Types | |

| ➡️ CFD Trading | ✔️ |

| ➡️ Forex Trading | ✔️ |

| ➡️ Spread Betting | ❌ |

| ➡️ DMA (Direct Market Access) | ✔️ |

| ➡️ Futures Trading | ✔️ |

| ➡️ Options Trading | ✔️ |

| ➡️ Investing Account | ✔️ |

IBKR Average Costs | |

| ➡️ FTSE 100 | 0.005% |

| ➡️ DAX 30 | 0.005% |

| ➡️ DJIA | 0.005% |

| ➡️ NASDAQ | 0.005% |

| ➡️ S&P 500 | 0.005% |

| ➡️ EURUSD | 0.0008% |

| ➡️ GBPUSD | 0.0008% |

| ➡️ USDJPY | 0.0008% |

| ➡️ Gold | 0.0007% |

| ➡️ Crude Oil | 0.0007% |

| ➡️ UK Stocks | 0.02% |

| ➡️US Stocks | 0.003% |

62.5% of retail investor accounts lose money when trading CFDs with this provider

Is IBKR good for shares dealing and do you actually own stock on Interactive Brokers?

Yes, Interactive Brokers is good for share dealing in the largest companies on stock exchanges, but there are limitations when it comes to smaller-cap stocks. You do buy the physical shares (unless you are trading as a CFD. But if you are mainly dealing in smaller or penny stocks a traditional platform like Hargreaves Lansdown or Interactive Investor will give you better access.

- Related Guide: Best Share Dealing Accounts Compared & Reviewed

Interactive Brokers is an excellent account for sophisticated share dealers who want to manage their own portfolio with complex order types actively and need access to a wider range of investment products like derivatives, options, and futures. They also offer fractional share dealing if you only want to start trading a small amount.

One of the most advanced share dealing platforms for beginners and professional investors.

- Investments: Shares, ETFs, funds & bonds

- Minimum deposit: £500

- Account types: GIA, ISA, SIPP, CFD

- Share dealing account charge: £0

- Share dealing fee: 0.05%

Fees: Interactive Brokers does not charge share dealing custody fees and minimum share dealing commissions are £1 in the UK or 0.05% of the deal size.

62.5% of retail investor accounts lose money when trading CFDs with this provider

How can you trade ETFs with Interactive Brokers (IBKR)?

You can trade ETFs with Interactive Brokers as a CFD or physical investment in a GIA, SIPP or ISA. Unfortunately, they do not offer financial spread betting on ETFs like IG.

Interactive Brokers has a very advanced platform and execution capacity for international investing on over 150 ETFs. Interactive Brokers’ reimburses clients for commissions paid on ETF shares held for at least 30 days. IBKR Lite clients always pay $0 commissions on ETFs.

An excellent ETF investment platform for professional traders and complex portfolios.

- ETFs available: 1,050

- ETF account charge: £0

- ETF dealing charge: 0.1%

- Account types: GIA, ISA, SIPP, CFDs, futures & options

Fees: Interactive Brokers minimum dealing commisssions are £1 in the UK or 0.05% of the deal size.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Can you trade CFDs with Interactive Brokers (IBKR)?

Yes, you can trade CFDs or contracts for difference with Interactive Brokers, but you have to go through some quite arduous suitability tests to ensure that you understand the risks involved.

IBKR offers CFD trading on around 5,200 markets including 100 forex pairs, 20 commodities, 13 indices, and thousands of international stocks. I’ve traded through IBKR a fair bit and there is no doubt that Interactive Brokers CFD offering is one of the best around.

Overall, Interactive Brokers is one of the best CFD brokers, most appropriate for experienced and sophisticated CFD traders. But it also has lighter versions of it’s platforms for newer traders that may want to stick with one platform as they become more experienced.

- CFD markets available: 7,000

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Equity overnight financing: 1.5% +/- SONIA

- CFD pricing: Shares 0.02%, FTSE 0.005%, GBPUSD 0.0008%

Whilst Interactive Brokers does not offer the most CFD markets, they do offer one of the best ways to trade them. With IBKR CFDs you can trade with direct market access (DMA) on the exchange so you can place your orders directly on the order book at better prices than the bid/offer. The commission is charged post-trade so you get clean prices with no mark-up and IBKRs commission rates (added post trade) are the best around. Commission on UK stocks is 0.02% and 0.003% on US stocks.

In reality, CFD brokers with the most markets are those that offer access to small or illiquid stocks which are probably not suitable for CFD trading anyway. But, IBKR offers access to the majority of stocks and markets most traders could need.

You can also trade CFDs with the most types of order execution with IBKR, for instance, VWAP, pairs trading, time and price-sensitive order entry. These tools are most suited to professional and very high-volume traders, or hedge funds that are working very large orders and don’t want to scare the market. Most retail CFD traders will have no need for them, but it is representative of IBKRs overall service in that it provides an exceptional institutional-grade CFD platform to retail clients.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Does Interactive Brokers (IBKR) offer indices trading?

Yes, you can trade the global stock market and synthetic on-exchange indices as wither a futures contract, DMA option of equity as an ETF.

Interactive Brokers has transparent, low commissions and financing rates equity indices can be traded in lots as small as 1X the index level. Unlike the related futures, Index CFDs do not expire, saving rollover-related costs and risks.

- Indices available: 13

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Index pricing: FTSE 0.005%, DAX 0.005%, Dow 0.005%, NASDAQ 0.005%, S&P 0.005%

62.5% of retail investor accounts lose money when trading CFDs with this provider

Does Interactive Brokers have direct market access?

Yes, Interactive Brokers has one of the best DMA offerings for professional traders. IBKR offer direct market access to the most exchanges at the lowest cost of all the brokers we compare.

- DMA markets available: 20,000+

- Minimum deposit: £2,000

- DMA account types: CFDs, DMA, futures & options, investing

IBKR offers direct market access to 30+ market centres with low commissions from USD 0.25 to 0.85 per contract and a trading platform with advanced order execution types and futures tools.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Commodities Trading

With IBKR you can trade commodities on powerful, award-winning trading platforms as a CFD, ETF or on exchange futures and options. Execute commodity trades in over 100 order types from limit orders to complex algorithmic trading.

- Commodities markets available: 20

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Pricing: Gold 0.0007%, Oil 0.0007%

62.5% of retail investor accounts lose money when trading CFDs with this provider

Can you trade options on Interactive Brokers (IBKR)?

Yes, you can trade either American or European options on Interactive Brokers. IBKR has one of the best options trading platforms for all types of clients because of their market range and strategy builders let you create options trading strategies visually and with AI.

IBKR offers one of the most, if not the most advanced options trading platform for private clients, both for derivatives markets (indices, commodities and forex) and stocks and shares. They provide access to a huge amount of UK and international stock options, but where they really win business is by their execution capabilities.

- Options markets available: 10,000

- Options costs: from £0.6 per contract

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

62.5% of retail investor accounts lose money when trading CFDs with this provider

Does Interactive Brokers have a paper trading demo account?

Yes, Interactive Brokers’ demo account gives you $1m to paper trade with on over 7,000 markets with no time limit. You can trade on Interactive Brokers with the IBKR demo account. But there are some serious problems with it, but also some excellent features. I’ve tested the Interactive Brokers demo account and compared it to the live version so you can get the most out of their demo account.

The downloadable IBKR Workstation demo is excellent. The portal version I gave up on fairly quickly. That’s the problem with demo accounts. They only have a few minutes to capture your attention and the easiest one to access through IBKR is also the worst. The web-based portal has very limited functionality and you can only see stocks. If you want to trade indices, forex or commodities you can’t get any pricing. Far better is the downloadable IBKR Workstation, an absolutely epic trading platform that high-frequency trading hedge funds use. If you have the patience to download and install the software, it is probably the best demo trading platform around.

One of the benefits of the Interactive Brokers demo is there is no time limit to how long you can use it. But, on the downside it does not take into account fees when you trade.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Can you buy bonds on Interactive Brokers?

Yes, you can buy corporate bonds and Treasury bonds online with Interactive Brokers. However, as the majority of IBKR’s dealing services are online, there are better options for buying illiquid retail bonds. For example, Saxo has a dedicated bond desk for high-value bond investors and traders. You can see how Interactive Brokers compare in our bond broker comparison here.

Is Interactive Brokers Good For Bond Trading?

Yes, Interactive Brokers offers access to the most bonds out of all the brokers we compare. You can trade over 1 million bonds, with commissions as low as 0.1%. There is also no custody or account fee for holding bonds in a general investment account, stocks and shares ISA or SIPP.

Fees: Minimum dealing commissions are £1 in the UK or 0.05% of the deal size.

Interactive Brokers offers by far the widest range of bonds to invest in. You can trade over 1 million bonds with Interactive Brokers including UK, US, and international government bonds, over 26,000 US corporate bonds and thousands of UK corporate retail bonds.

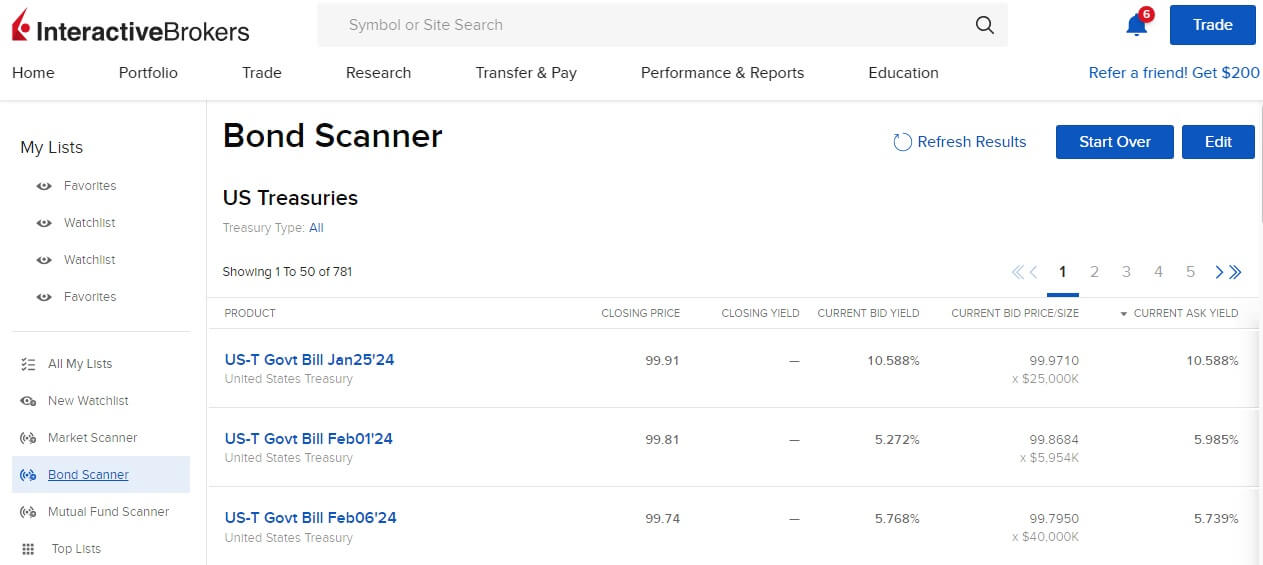

How to buy US Treasury Bonds on Interactive Brokers

To buy US T-Bills on IBKR follow these steps:

- Login to the IBKR portal or app

- Click on “Research” on the main menu

- Click on “US Treasuries” (there are currency 781 bonds listed)

- Click “View Results” at the bottom of the page

- You will then see a list of US Treasuries that you can buy on Interactive Brokers (shown below)

- Click on the bond you are interested in and then “Buy” to add to your portfolio.

Expanded Trading Hours for US Treasury Bonds

In a move that provides greater flexibility for its clients, Interactive Brokers has announced a major expansion of its trading hours, for US Treasury Bonds on its platform.

Clients can now trade these securities for up to 22 hours per day.

The new trading extended trading session opens at 8 pm Eastern Daylight Time (EDT) each evening and continues until 5 pm EDT the following day.

When Eastern Standard Time (EST) is in effect, the trading hours will be 7 pm to 5 pm EST the following day.

This is a significant increase from the previous 9-hour-per-day trading window.

The new, extended trading hours, are designed to cater to Interactive Brokers’ worldwide client base, who hail from over 200 countries.

In facilitating trading during local market hours ever, Interactive Brokers will allow its clients to react swiftly to news and events that impact global markets around the clock.

Treasury bonds are a “safe haven investment”, and a “go-to” instrument when geopolitical and macro themes are in play in the markets.

There are trillions of dollars worth of US treasury bonds in issue, making it one of the deepest most liquid markets in the world.

Thomas Frank, Interactive Brokers Executive VP, said of the extended trading hours:

“With clients globally, it’s essential we accommodate their needs and provide trading schedules suited to their locations, especially for a crucial market like US Treasuries,”

He added that

“This expansion represents a significant enhancement aligning with our aim to offer the most flexible and comprehensive trading environment possible.”

US Treasury bonds are among the world’s most sought-after assets due to their stability and perceived security, and the new 22-hour trading model gives Interactive Brokers’ clients the ability to manage their positions and take advantage of market conditions and newsflow twenty-two hours per day.

In addition to Treasuries, Interactive Brokers provides access to thousands of global bond issues spanning corporate, municipal, and sovereign debt.

These Instruments can be traded without markups, or built-in spreads, and analysed using the firms’s powerful search/filtering tools to match bonds to investment objectives.

The expansion of Treasury bond trading exemplifies Interactive Brokers’ client-first philosophy and its drive to deliver innovative solutions meeting the needs of investors worldwide.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Is Interactive Brokers a good trading platform?

Yes, we rank Interactive Brokers as the best online trading platform as it is exceptionally good for sophisticated trading. It offers by far the most access to the most markets through DMA futures, options, physical shares and CFDs. it also has the most advanced execution tools for retail traders, including complex order types such as VWAP, pairs trading, iceberg, and algorithmic trading.

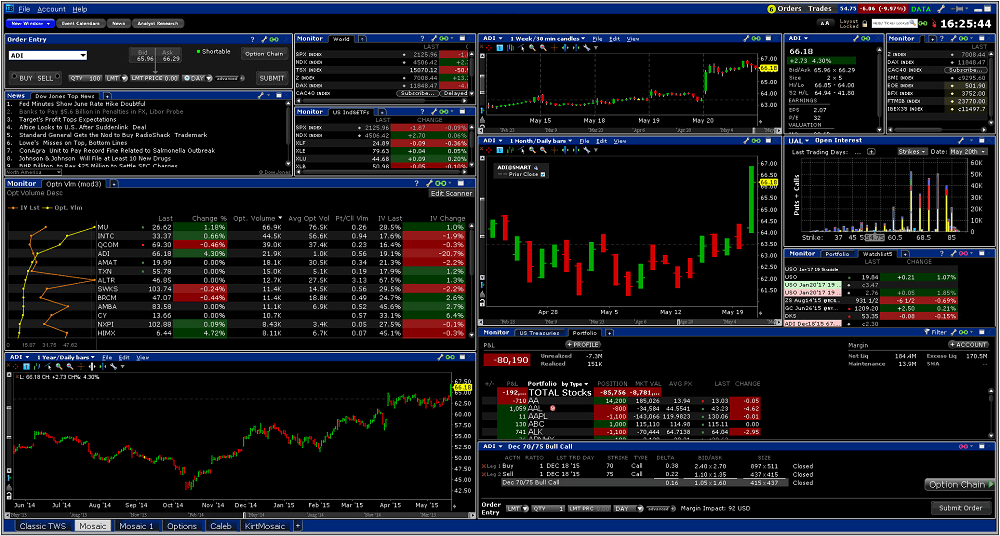

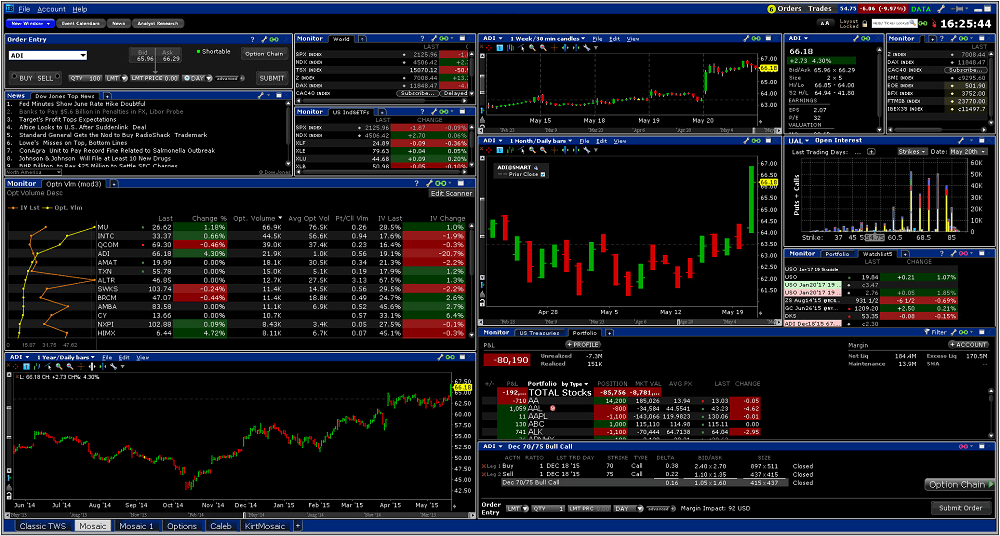

IBKR Workstation

What makes Interactive Brokers the best trading platform? In a word execution. In two words, execution capabilities. If you are a private professional trader there is no other trading platform that comes close to offering institutional-grade order types to retail traders.

Yes, when I was testing the trading platform, one thing that is immediately obvious though is that the desktop version is almost too good for retail traders and most will only use a small percentage of its capabilities. However, new traders should not be put off by its institutional-grade offering. The heavy-duty Interactive Brokers Trader Workstation is available as a download on PC, but there is also a simplified web-based version that is very simple to use called Portal.

On the web-based Portal trading platform, you can execute trades as physical deals, CFDs, futures and options (on the widest range of stocks). There are lots of webinars (with the founder Thomas Peterffy and his team) that cover trading strategy. You can also evaluate your portfolio based on how ethical your positions are. There are stock scanners, fund scanners, bond scanners, a fundamentals explorer for hunting out undervalued stocks and you can convert currency at some of the best exchange rates around.

IBKR also gives you more control over your currency exposure. Most other trading platforms automatically convert currency when you trade instruments outside your base currency but IBKR lets you do it manually on a per-trade or ad hoc basis.

Overall, Interactive Brokers, as the pioneer of the online trading industry, remains one of the best all-round online trading platforms for sophisticated investors and traders.

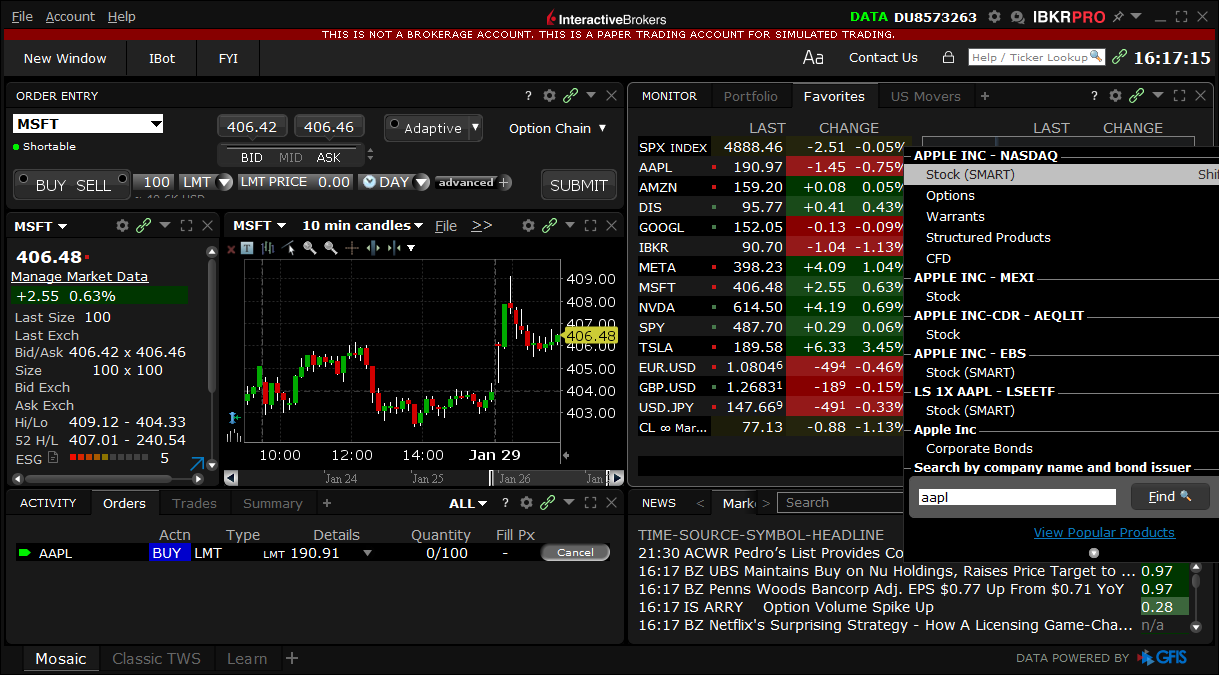

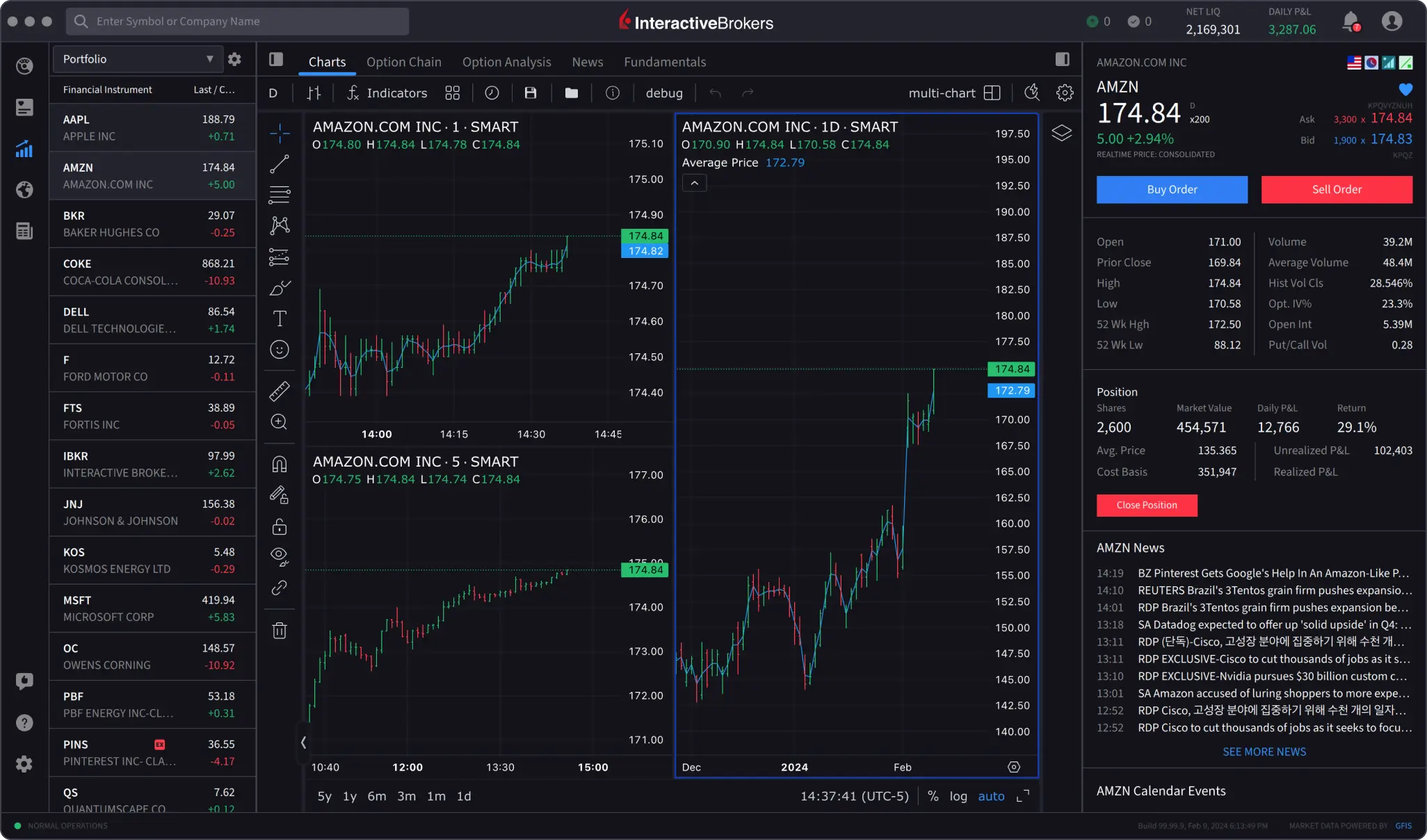

IBKR Desktop

In Feb 2024 Interactive Brokers unveiled its latest dealing platform, the new software, which is known as IBKR Desktop is described by the broker as a next-generation desktop trading application, which has been developed for both Windows and Mac (iOS) machines.

The new platform comes complete with a suite of advanced trading tools including two innovations:

MultiSort: a feature that allows users to sort data simultaneously using multiple factors. For example, fundamentals, technical indicators and historic price performance.

Traders can specify up to 10 different factors to sort by and can rank these factors by their relative importance.

Data revealed by the search updates dynamically expanding or contracting as fields are selected, excluded or enriched.

Option Lattice: This is a graphical display of an options chain, that visualises outliers in key data points such as open interest, the volume traded, and implied volatility.

Option traders can quickly switch between views in Option Lattice and can also look at the historical performance of the underlying security, that the selected options chain is over.

- Related Guide: Read our full Interactive Brokers review.

IBKR Desktop Training Guides

Interactive Brokers provides users with a comprehensive course about using IBKR Desktop and the features that the platform contains.

The course can be found at the IBKR Campus website under the Traders Academy section.

Further information on using MultiSort and or the Options Lattice can be found in the dedicated IBKR Desktop user guide.

Which we surfaced by simply using the search function on the Campus website to find MultiSort.

Innovation

Nasdaq-listed Interactive Brokers is one of the largest online trading businesses in the world.

The company, which was set up by its chairman Thomas Peterffy, 46 years ago, has a market cap of just over $45.0 billion and processes some 1.90 million trades per day.

The firm employs more than 2900 staff in offices located in North America, the UK, Europe, Asia and Australia, and operates in more than 150 securities markets across the globe.

Speaking about the launch of the new trading tools Milan Galik, CEO of Interactive Brokers said:

“Interactive Brokers has a rich lineage of delivering market-leading technology. Responding to our client’s requests for powerful trading tools in a user-friendly interface”

He added that

“We’ve leveraged our experience building cutting-edge trading solutions to create our latest-generation platform. With IBKR Desktop, traders of all levels can enjoy the advanced trading capabilities of Interactive Brokers”

If there is one criticism that could be levelled at Interactive Brokers it’s that some of its platform interfaces look dated and “clunky”.

However, that’s something the firm is now addressing with the launch of next-generation trading tools, such as the IBKR Desktop platform.

62.5% of retail investor accounts lose money when trading CFDs with this provider

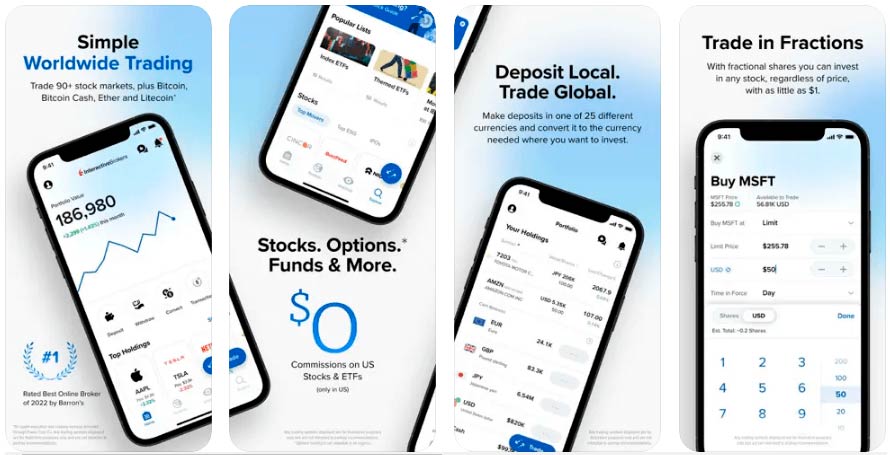

Does Interactive Brokers have a good trading app?

Yes, IBKR is one of the best app for sophisticated and professional traders is the IBKR Mobile as which replicates some of the functionality of the Interactive Brokers desktop TraderWorkstation platform.

As with the main trading platforms, Interactive Brokers’ trading apps are some of the best around. I tried all three different apps on offer, IBKR Mobile, IBKR GlobalTrader and IMPACT.

IBKR Mobile is the mobile version of the main trading platform and has the most functionality, where you can view your derivatives and investment portfolio, view charting, trade options, futures, and CFDs. You can also access the iBot feature which helps you search for things like dividend dates, corporate earnings reports, and economic events around stocks or markets you are interested in trading. Charting is initially simple, but under the settings, you can add indicators, show live orders, and annotations and change the bar size and chart type.

There is also the IMPACT lens features that measures your portfolio and gives it a ranking based on how ethical your positions are. The news section also lets you filter and search for IBKR news and analysis from The Fly Swawkbox, Real Vision (an excellent premium analysis vlog from Raoul Pal) and Bloomberg.

IBKR GlobalTrader has a slightly easier feel and is focussed more on stock traders. You get inspiration for investing in stocks, based on their sector, price moves, news flow. News is also filtered down based on the positions in your portfolio.

For more ethical investors the IMPACT app is focussed on helping you make more ethical investment decisions. You get access to the same markets to trade in by the app ranks your portfolio by how ethical they are. It will also show you a more ethical alternative, with a similar investment profile which you can switch to with the click of a button.

Overall, Interactive Brokers’ trading apps, are some of the best around with excellent functionality and access to one of the widest selection of markets and investment products around.

62.5% of retail investor accounts lose money when trading CFDs with this provider

Trading Cryptocurrencies on Interactive Brokers

Interactive Brokers’ new cryptocurrency trading offering (as of May 2024) will allow individuals, institutional investors, and financial advisers, to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

This is in addition to other more traditional investment products, such as stocks, options, futures, currencies, bonds, funds, and ETFs. All from a single unified platform.

Interactive Brokers is partnering with the Paxos Trust Company, a New York-based regulated trust company and custodian with expertise in digital assets, securities and payments, to provide cryptocurrency brokerage.

- Paxos has previously partnered with organisations such as Paypal and Mercado Libre.

- Interactive Brokers’ UK clients will have a unified view of their IBKR securities brokerage account and their crypto account at PaxosTrust Company.

- This means clients will be able to manage their cash, trade cryptocurrencies, and invest in other asset classes, all from a single trading screen.

Low-cost crypto investing

Overall Interactive BRokers continues to be one of the cheapest places to trade anything. You can see in the below cost comparison compared to Coinbase and eToro execution costs are very low.

| IBKR | Gemini ActiveTrader | Coinbase Pro | eToro | |

| Crypto Transaction Fee | 0.18% | 0.40% | 0.60% | 1.00% |

| Spread / Markup | None | None | None | None |

| Total fee | 0.18% | 0.40% | 0.60% | 1.00% |

| Cost of $1,000 trade | $1.80 | $4.00 | $6.00 | $10.00 |

There are several benefits to trading crypto on IBKR:

- Consolidated platform: Clients can access a wide range of global investment products, including cryptocurrencies, on a single sophisticated trading platform, eliminating the need for multiple platforms.

- Competitive pricing: Cryptocurrency commissions are low at 0.12% – 0.18% of trade value, depending on monthly volume, with a minimum of $1.75 per order. There are no added spreads, markups, or custody fees.

- Currency conversion: Clients can convert GBP or other currencies to USD (the denomination for cryptocurrencies on the platform) at tight spreads as low as 1/10 of a PIP.

- Efficient portfolio management: Financial advisers can easily allocate a percentage of client assets to cryptocurrencies and manage their clients’ portfolios more efficiently.

However, it’s important to note that cryptocurrency is still a very high-risk investment and even tough the costs of trading are lower, there is a high possibility that crypto could become worthless.

Cryptocurrency regulation in the UK

Interactive Brokers (U.K.) Limited is registered with the Financial Conduct Authority as a crypto assets firm under the relevant regulations.

However, it’s important to note that cryptocurrencies are unregulated in the UK, and are therefore not covered by the Financial Services Compensation Scheme (FSCS).

62.5% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers FAQ

Yes, very. We rate Interactive Brokers as safe as they are one of the largest investment platforms in the world and excel in almost every category compared to peers in our matrix. For UK customers funds are protected by the FSCS, and you can keep an eye on the company’s health by following its share price on the NASDAQ (IBKR:NASDAQ).

Yes, as well as providing brokerage services for banks, professionals and hedge funds beginners can also access similar pricing and market access through the Web Portal and IBKR mobile apps.

Yes, UK investors and traders can use IBKR. The UK entity is regulated by the FCA and has an office on Fenchurch Street in the City of London. Interactive Brokers offers, CFDs, futures and options and physical investing through a GIA, ISA or SIPP account in the UK.

There is no minimum deposit to open an account with Interactive Brokers. You can open an account without depositing funds, they once you are familiar with the platforms and investment features, you can deposit funds at a later date. It is also free to deposit funds via Wire transfer, or you can deposit via your Wise account.

No, Interactive Brokers does not offer financial spread betting. However, you are able to trade the spread between different futures contracts through futures spreads. You can see a list of brokers that offer financial spread betting here.

The current Interactive Brokers (NASDAQ:IBKR) share price is $118.8 which is a change of 0.23 or 0.19% from the last closing price of 118.8 with 839,554 shares traded giving NASDAQ:IBKR a market capitalisation of $50,025,029,965. The most recent daily high has been 119.24 and daily low 117.52. The NASDAQ:IBKR share price 52 week high has been 129.19 and the 52 week low 72.6. Based on the most recent NASDAQ:IBKR share price opening of 118.8, the current NASDAQ:IBKR EPS (earnings per share) are 6.31 and the PE (price earnings ratio) is 18.83.

IBKR share price pricing data last updated: 26/07/2024 16:00

Yes, Interactive Brokers has some of the best interest rates on uninvested cash. You can compare the best cash on uninvested cash rates from investment platforms here.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.