The cryptomarket is in a cyclical upswing, sparked by a surge in Bitcoin investing. Many investors are tempted by high gains in the sector. This guide shows how you can gain exposure to the market. But bear in mind of the risk here. Prices are extremely volatile in the sector. Nerves of steel are required when investing in crypto instruments.

Cryptocurrencies Boom

$146,000 per Bitcoin. That’s the Bitcoin prediction that JP Morgan projected earlier this year. To reach this level, Bitcoin would have to rally more than 300 per cent from the current level of $33,000.

In many ways, such ‘outlandish’ predictions are not uncommon during a massive bull market. Bitcoin skyrocketed 700% last year to $40,000. Surely with such great upward momentum behind it, gaining another 300 percent shouldn’t be too difficult?

A limited supply, bullish sentiment, and rising institutional participation all combine to elevate bitcoin prices. According to some research, a large number of bitcoins are being withdrawn from market. Just over the past 30 days, Glassnode estimated this number to be 270,000 (see below).

This is a classic supply squeeze. Prices spiked as the shortage deepens. Grayscale Trust, for example, bought nearly 16,244 bitcoins earlier this week. This is a multiple of what digital miners could deliver.

Moreover, everyday we hear stories about a rise in institutional participation in this hot market. Institutions like BlackRock and Goldman Sachs are all clamouring to get a piece of the action. For example, Blackrock is attempting to position its funds to acquire exposure to Bitcoin, possibly via futures.

Source: Glassnode (via Twitter)

Blockchain uptake rise

Moreover, the payment system behind Bitcoin – blockchain – is being studied globally. Central banks and big payment companies are all attempting to internalise part of the ledger technology into their system. They are experimenting with digital coins.

For example, 2021 is likely to see higher usage of the Central Bank Digital Currency (CBDC). Just recently, the Bank of France conducted experiments with the distributed ledger system.

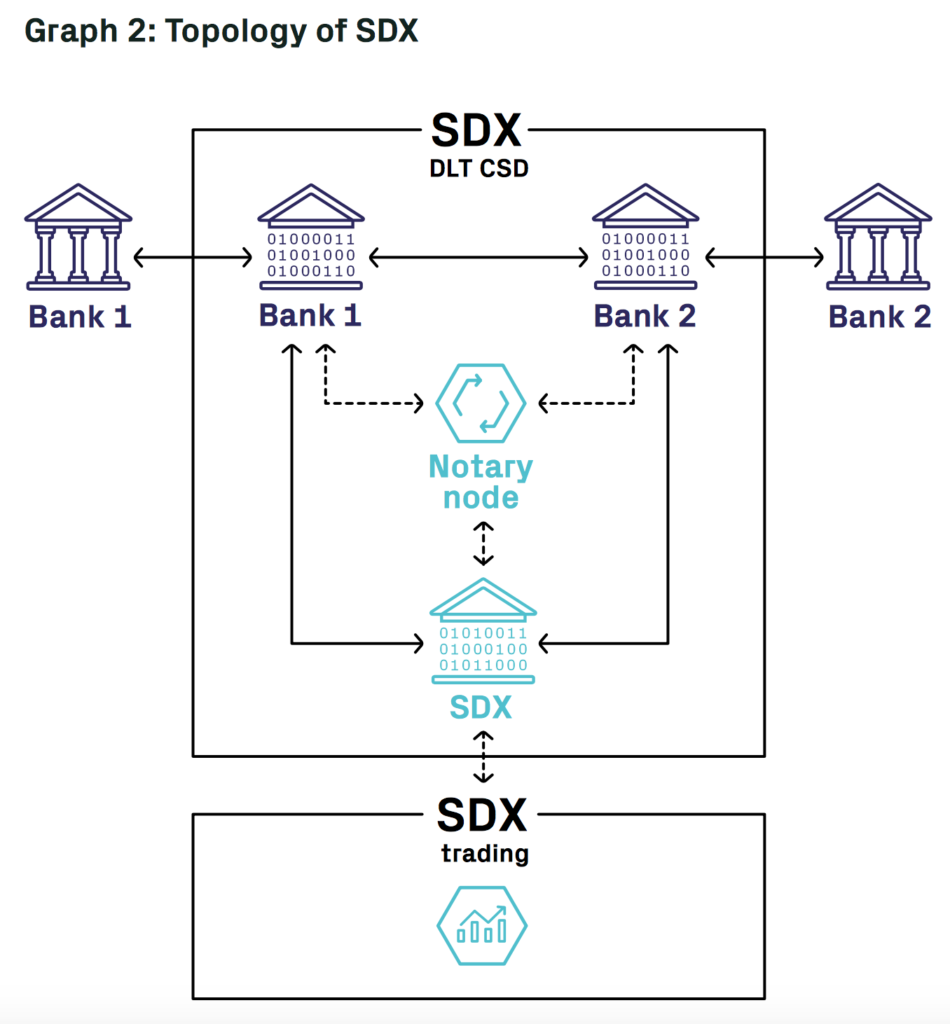

In Switzerland, the SIX Digital Exchange (SDX) completed its pilot study under Project Helvetia. It ‘plans to launch soon, offering issuance, trading, settlement, management and custody of tokenised assets, ie assets that exist on a DLT platform, settled with a privately issued digital coin.’ A flow chart of what they are trying to do is showed below.

Trading between banks will be settled with tokenised SDX coins. The description of the project can be accessed here.

In other words, the next 12 months will see an increased take-up of this technology among policymakers. In the commercial world, even some holiday rental platforms are gradually experimenting with the blockchain technology.

All these developments are exciting and positive for the digital ecosystem.

Retail Investors: How to Participate?

Retail investors in the UK have been barred from using crypto derivatives to speculate on cryptocurrencies since early January. This is understandable. Crypto prices are notoriously volatile. Coupled with high leverage, many investors in these products could lose a large amount of money.

While crypto derivatives are out of reach, there are some other avenues for investors to participate in the cryptocurrency market. We list three below.

1. ETFs

For investors wishing to gain exposure to blockchain and crypto coins, exchange-traded funds is preferred. Why? Because an ETF has diversification benefits and it lowers the portfolio volatility.

One such ETF is the Amplify Transformational Data Sharing fund (BLOK). According to its fact sheet, the fund “seeks to provide total return by investing at least 80% of its net assets in the equity securities of companies actively involved in the development and utilization of blockchain technologies.”

Related Guide: Where to buy ETFs

The $550-million fund contains about 56 stocks, including Microstrategy (MSTR), Marathon Patent (MARA), Square (SQ), Paypal (PYPL), Hive Blockchain (HIVE), among others. The stock is bullish with some acceleration to the upside (see below).

Another ETF is the $2 billion ARK FinTech Innovation ETF, with ticker ARKF. Its fact sheet shows 10% of its holdings are geared to blockchain stocks. Its biggest holding is Square (SQ).

In the UK, investors may look at the Invesco Elwood Global Blockchain ETF (BCHN LN). This $550-million fund is based on the Elwood Global Blockchain Index, which ‘offer exposure to listed companies that participate or have the potential to participate in the blockchain or cryptocurrency ecosystem.’ Prices have been riding the crypto uptrend (see below).

2. Stocks and Shares

Next we turn to stocks and shares related to the crypto-market. To pick – and profit – from blockchain-related stocks, you will need to understand two things:

- The business behind the stock

- The price risk

Related Guide: Where to buy stocks and shares

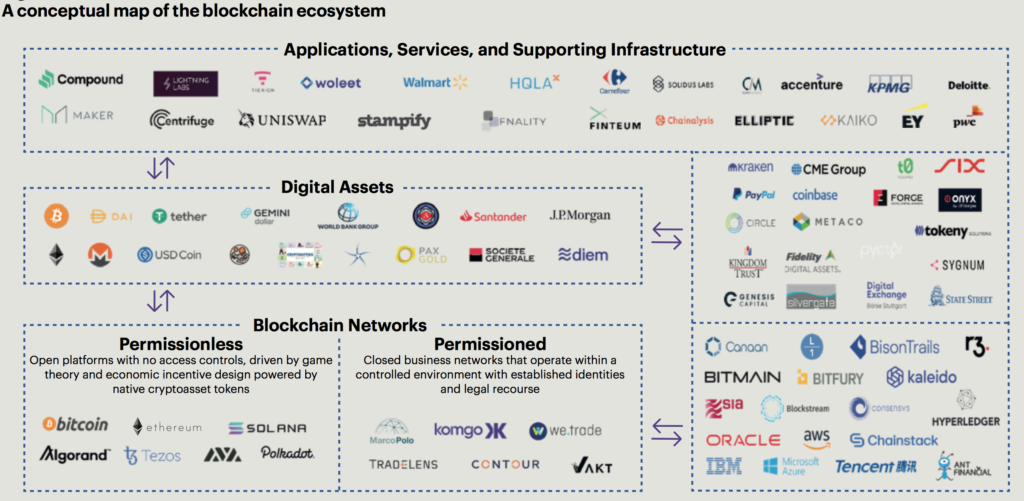

Moreover, investors have to research the blockchain ecosystem and compare which companies are better. This is a major undertaking. Some investors may not have the time or expertise to do it. Look at some of the possibilities:

Source: Invesco

Just understanding the ecosystem is not easy. Things move quickly all the time.

Apart from blockchain related stocks, in the US, there is a group of crypto-miners which mines digital assets for profit. The two largest are Riot Blockchain (RIOT) and Marathon Patent (MARA).

The thing about these miners is that their share price are geared to movement of Bitcoin prices. This makes them hyper-volatile. Risk is magnified in both directions. Moreover, they are small. Most are below $2 billion in market cap.

3. IPOs

The third avenue is via IPO.

The first example is Coinbase, one of the largest crypto-exchanges in the world. The firm filed with the US Securities and Exchange last month to prepare for an IPO in 2021. The company profits from the transactions on its platform. During a bull market, the volume of transactions rockets. Hence a listing would be a good way to expand the business. (A list of crypto exchanges can be found here.)

The second example is Bitmain. What do miners need these days? Computing power. Lots of it. Ergo manufacturers of these machines are booming too. A bit like shovel makers during the gold rush. One of the beneficiaries is the China-based Bitmain. Some are saying the firm is valued at US $40-50 billion.

For investors, however, what matters is the valuation for the company and whether we are in an upswing. Note that every instrument in the crypto-space is volatile. Prices can go up hundreds of percent and down by half in a matter of days. So when to buy is equally important.

Related Guide: Where to invest in IPOs

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.