In 2023, it has paid to own well-known technology stocks like Apple, Microsoft, and Amazon. It’s these kinds of stocks that have generated the bulk of the stock market’s gains.

Looking ahead to next year, however, it could pay to have some capital in other – more under-the-radar – areas of the market as many experts expect the market rally to broaden out. With that in mind, here are four stocks that are hidden gems for investors in 2024.

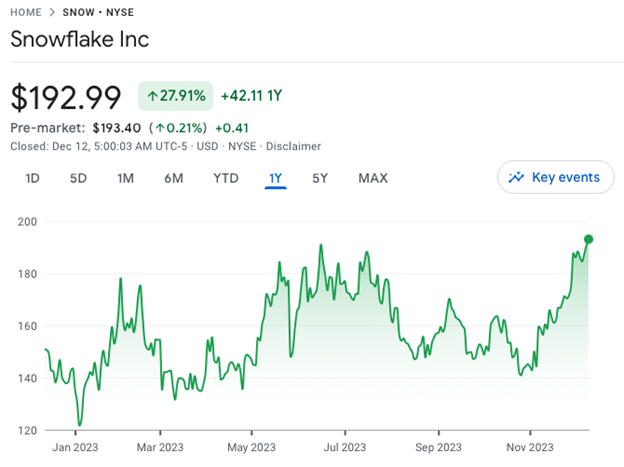

Snowflake

When it comes to cloud computing stocks, most investors tend to focus on Amazon, Microsoft, and Alphabet. This is understandable as these are the three biggest players in the industry.

However, there are some other exciting players in this market that shouldn’t be ignored. Snowflake (NYSE:SNOW) – which offers cloud-based data storage and analytics services via a Software-as-a-Service (SaaS) model – is one of them.

From an investment perspective, Snowflake has a lot going for it right now.

For a start, revenues are rising at a rapid pace. For the year ending 31 January 2024 (FY2024), Wall Street expects year-on-year revenue growth of 35%.

Secondly, the company is now starting to generate profits. For FY2024, a net profit of $285 million is forecast versus a net loss of -$797 million a year earlier.

Third, after crashing from $400 to $120 between the second half of 2021 and the first half of 2022, the stock is now trending up again, meaning it has positive momentum.

It’s worth pointing out that Snowflake is a higher-risk tech stock. It can be volatile at times.

I think it has a huge amount of potential in today’s data-driven world, however.

Analysts at Citigroup just raised their price target from $191 to $235.

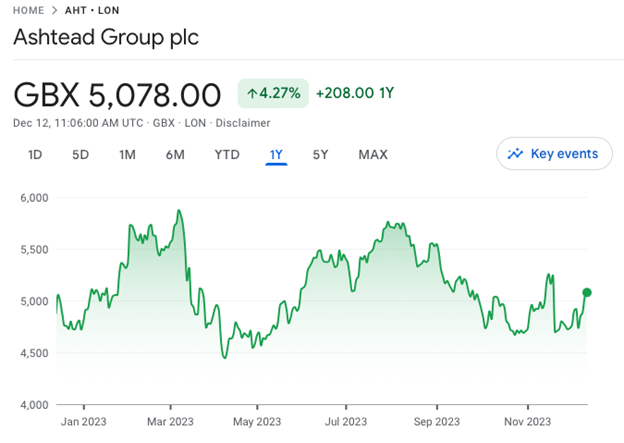

Ashtead

If the market rally does broaden out next year, the Industrials sector could benefit. And one stock that stands out here is Ashtead (LON:AHT). It’s an under-the-radar UK company that is engaged in the rental of construction equipment.

Ashtead looks well-positioned as we head towards 2024. Today, the company generates the bulk of its revenues in the US. And 2024 is looking set to be a bumper year for construction in the US due to all the construction-related bills that have been passed recently (the Infrastructure Bill, the Inflation Reduction Act, the CHIPS Act, etc.).

Ashtead could also potentially benefit from the growth of cloud computing and artificial intelligence (AI) in the years ahead. That’s because these technologies are leading to the construction of more data centres in the US. Overall, the company has many growth drivers.

Now, construction is a cyclical industry. So, an economic downturn is a risk here.

However, with the stock trading at a very reasonable price-to-earnings (P/E) ratio of 16, the risk/reward proposition for 2024 looks compelling at present.

Analysts at Morgan Stanley have a price target of 6,720p

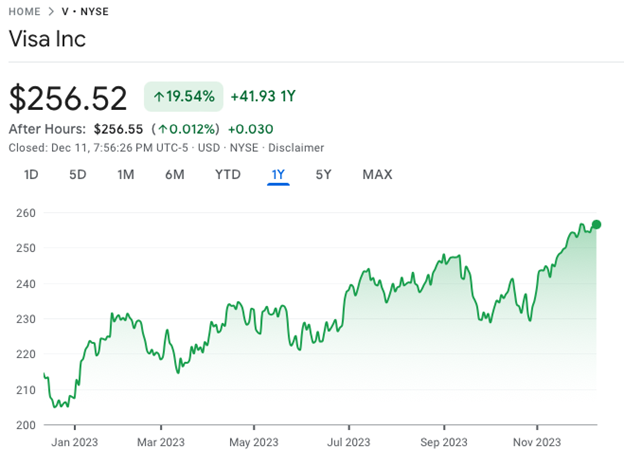

Visa

Turning to the financial sector, one stock that hasn’t received much attention lately – but looks very interesting heading into 2024 – is Visa (NYSE:V). It’s one of the largest electronic payments companies in the world.

Visa looks interesting for a couple of reasons. Firstly, a lot of consumers are turning to credit cards right now as they’re running out of cash. This should benefit the company. It’s worth noting that Visa doesn’t have any credit risk – it simply operates the payments network.

Secondly, the stock has recently broken out to new all-time highs. Back in mid-2021, Visa shares rose up to $250. However, they then spent more than two years consolidating those gains. Now that the stock has broken out above the $250 mark, it’s in ‘blue-sky’ territory, which is bullish as there’s no overhead resistance.

Visa does have an above-average valuation (the P/E ratio is about 26). However, this is a high-quality company with strong competitive advantages, solid top- and bottom-line growth, and a healthy balance sheet. So, I think it’s worth a premium to the market.

Analysts at Jefferies just raised their price target from $280 to $295.

Volex

Finally, in the UK small-cap space, investors may want to check out Volex (LON:VLX). It’s a fast-growing manufacturing company that has operations globally.

Volex is no ordinary manufacturing business. With a focus on manufacturing for the electric vehicle (EV), data centre, and healthcare industries, it’s poised to benefit from a number of structural growth drivers in the years ahead.

For the year ending 30 April 2024, analysts expect Volex’s revenue to rise 16% to $841 million. For the following financial year, analysts expect its top line to rise another 16% to $976 million.

This strong level of growth doesn’t seem to be reflected in the company’s valuation, however. At present, Volex has a forward-looking P/E ratio of just 12. That’s a low multiple for a growth company.

Of course, manufacturing is another industry that is cyclical. So, weak economic conditions are a risk here in the short term.

However, with exposure to both the EV and data centre markets – which should see strong growth in 2024 – there are reasons to be optimistic in relation to the outlook.

Analysts at HSBC have a price target of 510p for Volex – well above the current share price.

Edward Sheldon owns shares in Snowflake, Ashtead, Visa, Volex, Apple, Microsoft, Alphabet, and Amazon.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognized as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please ask a question in our financial discussion forum.