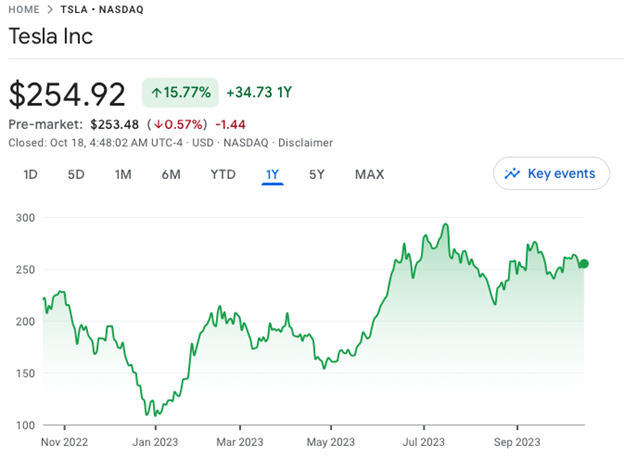

This year, Tesla (NASDAQ:TSLA) shares have produced strong gains. However, in recent months, they’ve pulled back a little, losing about 15% of their value. So, why are the shares dropping? And where’s Tesla stock likely to go from here?

What’s driving Tesla’s share price weakness?

There are several reasons Tesla shares have fallen recently.

Less demand

Firstly, there has been some concern in relation to levels of demand for new vehicles in a ‘higher-for-longer’ interest rate environment. When interest rates were low, a Tesla was very affordable. However, with car finance interest rates now much higher than they were, it’s a different ball game. Add in the fact that a lot of consumers are starting to feel the pinch from higher interest rates, and there is a fair bit of uncertainty in relation to near-term demand for Tesla’s electric vehicles (EVs).

Poor delivery numbers

Secondly, Tesla’s delivery numbers for Q3 came in below expectations. For the third quarter, the company delivered 435,059 vehicles, below the 440,000-455,000 level that most analysts had been expecting, and 31,000 lower than the deliveries figure for the second quarter of 2023. Tesla said that the quarter-on-quarter decline in deliveries was due to factory shutdowns, which crimped production.

Slipping sales

Concerns over market share have probably also had a negative impact on the EV stock lately. Earlier this month, it came to light that while EV sales in the US rose above 300,000 for the third quarter, Tesla’s market share slipped to its lowest on record (50% versus 62% in Q1). This drop in market share came despite the fact that the company has been lowering its prices in an effort to solidify its foothold in the highly competitive EV industry.

AI Sentiment

Finally, general market conditions have most likely had an impact on the stock. In the first half of 2023, sentiment towards growth/tech stocks like Tesla was very bullish. This was due to excitement around artificial intelligence (AI) – an area of technology that Tesla has a lot of exposure to. However, in recent months, sentiment towards these types of stocks has cooled a little as bond yields have risen. This has resulted in some profit taking.

What’s next for Tesla shares?

As for where Tesla shares will go from here, it’s hard to know.

Plenty of analysts remain optimistic in relation to the stock’s outlook. For example, in September, analysts at Morgan Stanley upgraded the stock to ‘overweight’ from ‘equal-weight’ and raised their share price target to $400 from $250. Their view was that Tesla’s Dojo technology – which is designed to power AI models for autonomous cars – gives the EV firm an “asymmetric advantage” and could boost its market cap by over $500 billion.

However, not everyone is so bullish on Tesla and the stock has been getting more attention from short sellers lately. According to securities lending data firm Hazeltree, between June and August, Tesla was the most-shorted large-cap stock in the US every month.

Personally, I expect Tesla shares to resume their upward trend at some point in the not-too-distant future. I think the company has a lot of growth potential. That said, I expect the shares to be volatile. So, investors need to right-size their positions here to manage their risk levels.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognized as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please ask a question in our financial discussion forum.