Yes, if Wealthify were to go bust your funds are protected by the FSCS up to £80k and your portfolio can be moved to another general investment account.

Wealthify General Investment Account Review

Name: Wealthify General Investment Account

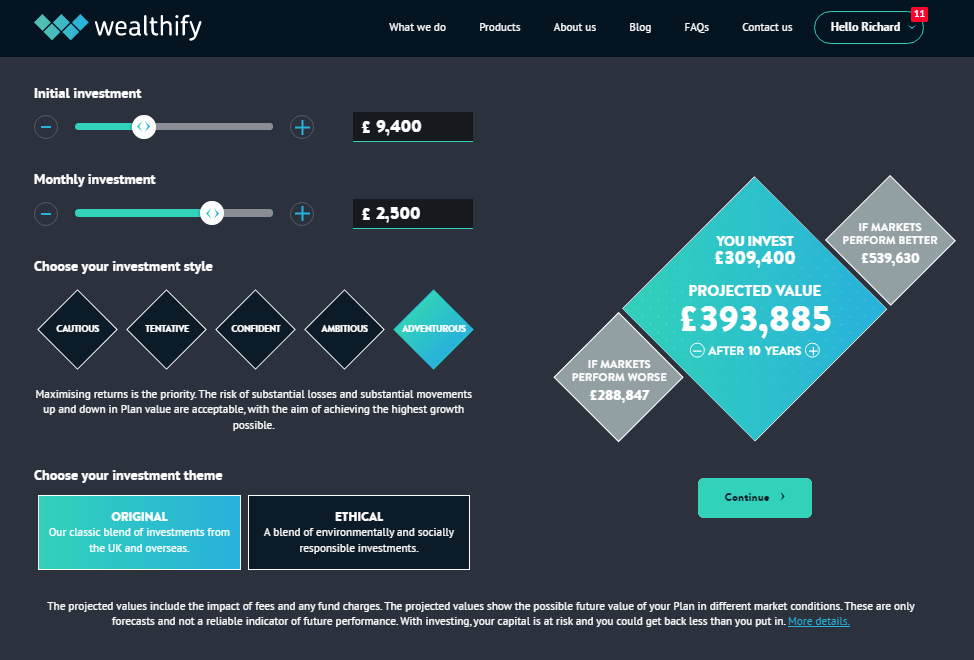

Description: Wealthify, part of the Aviva Group, lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments.

Capital at risk.

Summary

- Investments: Pre-made portfolios

- Minimum deposit: £1

- Account types: GIA, ISA, Pension

- Account charge: 0.6% annual charge

- Dealing fee: £0

Fees:

It costs 0.6% to start investing with Wealthify, which is one of the cheapest robo-advisor general investment account fees. There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans.

Special Offer:

- £50 when you refer a friend – You can get a unique link when you have a funded Wealthify account to use to recommend them to friends. To get the £50 bonus, your friend needs to invest at least £250 for three months.

Investing Platform:

Wealthify’s investment platform lets you fine-tune your portfolio based on risk, giving good visuals of what it may be worth in the future.

Pros

- Managed portfolios

- Low minimum deposit of £1

- Low account fee of 0.6%

Cons

- Cannot trade individual shares or ETFs

-

Pricing

(4.5)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.2- Expert opinion: Wealthify reviewed & rated