Interactive Investor is a low-cost provider competing directly with the likes of Hargreaves Lansdown and AJ Bell offering general investment accounts, ISAs and pensions.

Interactive Investor Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

Capital at Risk

Interactive Investor Expert Review

Interactive Investor has come a long way in the 20 years or so I have been following them, especially recently as they are now part of ABRDN. The fixed fee pricing has always set them apart from competitors and can make having a large portfolio with them very cheap. In our Interactive Investor review, we explore the pros and cons of the platform and who it is suitable for.

Interactive Investor Review

Name: Interactive Investor

Description: Interactive Investor or II as its known is one of the UK’s largest self-determined investor platforms. II can trace its roots back to 1995 and the startup floated on the London stock exchange back in the year 2000 before being bought by the Australian business Ample in 2002. Today, Interactive Investor is a owned by abrdn with assets under administration of more than £50 billion and 400,000 customers to whom II offers share trading and investment services including, ISAs SIPPs and share dealing, alongside research and analysis. Including model portfolios, selected funds and thematic investments.

Why we like them

Interactive Investor differs from other investment platforms as it charges a fixed account fee, rather than a percentage of the funds you have on account. Which, over time, could save you thousands in costs.

Pros

- Fixed account fees

- Easy to use

- Good research

Cons

- No Lifetime ISA

- Expensive for very small accounts

- No derivatives for hedging

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Ratings Explained

- Pricing: Brilliant for medium and large investors, expensive for small accounts.

- Market Access: You’ll be hard-pressed to find something you can’t invest in.

- Platform & Apps: Very good, excellent data and usability.

- Customer Service: They are massive and mostly online, but you can call them directly, generally good.

- Research & Analysis: Loads, daily and weekly updates across all the asset classes they cover, with lots of analysts and opinions. No advice service though.

Capital at Risk

Interactive Investor Awards

Interactive Investor won “best investing platform” in our 2023, 2022 and 2021 awards.

Capital at Risk

Interactive Investor Facts & Figures

| ⬜ Public Company | ❌ |

| 👉 Number Active Clients | 400,000 |

| 💰 Minimum Deposit | £1 |

| 💸 Client Funds | £55 billion |

| 📅 Founded | 1995 |

Account Costs | |

| ➡️ Investment Account | £9.99 a month |

| ➡️ SIPP | £10 a month |

| ➡️ Stocks & Shares ISA | £9.99 a month |

| ➡️ Junior ISA | £0 |

| ➡️ Lifetime ISA | n/a |

Dealing Costs | |

| ➡️ UK Shares | £7.99 |

| ➡️ US Stocks | £7.99 |

| ➡️ ETFs | £7.99 |

| ➡️ Bonds | £7.99 |

| ➡️ Funds | £7.99 |

Capital at Risk

Is the Interactive Investor ISA any good?

Yes, we rate the Interactive Investor ISA as very good, especially for high-value accounts as the account costs do not rise with your portfolio value. Plus, there are DIY and managed ISA options. However, for smaller accounts the fixed monthly fee is expensive.

Interactive Investor won the 2022 Good Money Guide award for best stocks and shares ISA account as they offer one of the cheapest investment ISAs that provides access to over 40,000 shares and 3,000 funds, as well as investment trusts, ETFs and bonds. They are a good choice for people that want to take control of what they invest in.

The stocks and shares ISA is a way to invest in the markets through a government-approved tax-free wrapper. Individuals can invest up to £20,000 per annum in their stocks and shares ISA or indeed across several other ISAs.

In an ISA there are no capital gains taxes on trading profits and no tax is levied on the income from stock dividends or bond coupon payments. Stocks and Shares ISAs are open to all UK residents aged 18 or over, who can open a new Stocks and Shares ISA each year.

There are many securities, both domestic and international that are ISA eligible. However, an ISA can only contain pounds sterling which means that if you trade in overseas securities you will incur FX conversion charges.

II does not charge any additional fees for a Stocks and Shares ISA, over and above its standard trading account charges. Whilst competitors Hargreaves Landsdown and AJ Bell both charge annual custody fees based on the value of your holdings.

A mix of DIY and Managed ISAs

Interactive Investor, offers both a self-self stocks and shares ISA and a managed option.

The ii Managed ISA is a new offering from Interactive Investor, that allows customers to hold their investments within a tax-free ISA account managed by Interactive Investors’ experts.

The new product is designed to combine the tax benefits of a Stocks & Shares ISA with professional investment management from Interactive Investor.

The Managed ISA is designed for investors who want to hold investments in a tax-efficient ISA wrapper, but who don’t have the time, or inclination, to research and select investments themselves.

By using the Managed ISA, investors can let Interactive Investors’ professionals handle the investment decisions.

How does the managed ii ISA work?

Getting started with the Interactive Investor Managed ISA involves few simple steps.

- Select your risk level by answering some quick questions about your investment goals and risk tolerance.

- Based on your inputs, Interactive Investor will recommend a managed portfolio matched to your risk profile.

You will then need to open and fund the account, which can all be done online at ii. - Interactive Investors’ experts will then monitor and adjust the portfolio over time to keep it aligned with your stated investment objectives.

For clients that are already on the ii Investor plan, the Managed ISA is included in their current monthly subscription fee of £11.99 per month, which includes one commission-free trade. Additional trades are charged at £3.99 each.

Managed ISAs versus DIY

The key benefits include:

- Time savings by not having to research/pick investments yourself

- Professional expertise from ii managing your ISA portfolio

- The convenience of a managed solution included in your existing ii subscription

- Ability to view and track your managed investments anytime

- Tax-free growth potential by holding in an ISA account

Usually the main draw back of managed ISAs is that you can’t pick your own investments. However, you can run your own investments along side ii’s managed ISA.

How does the II managed ISA compare to the competition?

Interactive Investor believes that their flat monthly fee charging structure will save ISA investors money over the long term.

According to calculations on their website, £50,000 held in an ISA with the platform for 30 years, would have grown to almost £1.20 million, assuming a growth rate of 5.0% per annum, in a mixed portfolio of funds and shares.

That’s up to £45,000 more than you would have returned at rivals like Hargreaves Lansdown, AJ Bell, Fidelity, and Barclays Smart Investor, according to the Interactive Investor data.

In terms of ISA fees Hargreaves Lansdown offers a a tiered fee structure based on the value and type of investments held.

Those fees start at 0.45% for sums up to £250,000 invested in funds, falling to 0.1% between £1.0 and £2.0 million, with no charges levied for investment amounts over £2.0 million.

There are no additional fund dealing charges.

Money that’s invested in UK and international shares and ETFs, in a Hargreaves Lansdown ISA, attracts a maximum monthly fee of £3.75 and trading charges start at £11.95 per deal, with volume discounts down to £5.95 applied one month in arrears.

AJ Bell levies a fee of 0.25% of the first £250,000 invested. However, that scales down to zero if you have more than £500,000 in your account.

Share deals, including ETFs, are charged at £5.00 per trade, which falls to £3.50 if you traded 10 times or more in the prior month. Whilst fund trades cost £1.50 a pop.

Wealthify, a hybrid investing platform, backed by Aviva, offers fees that average out around 0.76% per annum.

That includes all dealing and administrative charges, the creation of a personal savings plan, built by their in-house experts, and ongoing adjustments to the portfolio, to keep that plan on track.

Capital at Risk

Is the Interactive Investor SIPP any good?

Interactive Investor is the best SIPP for buying funds because of the flat fee. Both Bestinvest and Hargreaves Lansdown do not charge for buying and selling funds, but fees are high at 0.4% on the first £250,000 in your SIPP portfolio. The only downside of Interactive Investor is that you pay £7.99 for each fund trade, but you can reduce this to £3.99 by upgrading to a Super Investor for £19.99 a month which still works out cheaper than paying 0.4% on your portfolio if you have around £250k in invested in funds.

If you do not want to invest in shares and only want to invest in funds, then the cheapest SIPP for for funds and ETFs, is Vanguard who is one of the cheapest fund SIPP providers. Its SIPP has a low account fee of just 0.15% per year, capped at £375, investors also have to pay fund management costs of around 0.20% per year on average. But, your choices are limited to Vanguard funds, which makes the account more of a personal private pension than a SIPP account with complete control and flexibility.

A SIPP is a self-invested pension plan a way of saving and managing money for your retirement in a tax-efficient fashion. A SIPP can run alongside an occupational pension scheme or stand-alone and it provides the same tax benefits and flexible retirement option as other defined contribution pensions.

The main selling points of a SIPP are that they provide access to individual stock and shares from the UK and abroad and that you, the pension holder, make the investment decisions.

In terms of fees, Interactive investor charges £19.99 per month a charge that combines their £9.99 account service and an additional £10.00 fee for SIPP administration.

II calculates that their flat fee structure could save you as much as £94,000 in charges over the pension lifetime when compared to competitor offerings which is a significant sum.

SIPP account holders can open a Stocks and Shares ISA and trading account at no extra cost and also qualify for one free trade per month.

Capital at Risk

Pension Builder

In 2022 Pension Builder replaced the Funds Fan product which is being retired for new customers and going forward II will have just three membership plans and price points.

The £9.99 per month Investor account, Pension Builder at £12.99 per month and the Super Investor membership for £19.99 per month.

Super Investors will now be able to trade in US shares for just £3.99 per deal, and will also get access to the friends and family initiative (that Interactive Investors introduced in November) for free.

Speaking about the new products, revised charges and simplified membership options, Richard Wilson, Chief Executive Officer of Interactive Investor said that:

“Simplicity and great value have always been at the heart of our offering to investors, and we are pleased to be delivering even better value by enhancing our price plans.”

Adding that

“A monthly subscription plan in pounds and pence is familiar to so many people in areas ranging from streaming media to fitness and mobile phone services. We allow people to pay for their investment platform in the same transparent and modern way.”

Capital at Risk

Is Interactive Investor GIA better than their ISA?

Interactive Investor’s GIA is better than an ISA if you have lots of money to invest as you only tax-free allowance of £20k per year for individual savings accounts, so anything above that you should invest in a general investment account. However, if you only have a small amount of money to invest (less than £20k) you are better off investing it in an II ISA, rather than an II GIA as in an ISA your profits will be tax free.

II’s GIA won our award for best general investment account in our 2023 and 2022 awards as they offer an excellent fixed-fee pricing model, which is a good choice for investors with over £10,000 to invest. Interactive Investor’s fixed-fee model means that your total account costs remain low no matter how big your portfolio gets. You can also invest in a huge range of markets, from UK and international shares to funds, trusts, bonds and ETFs.

Capital at Risk

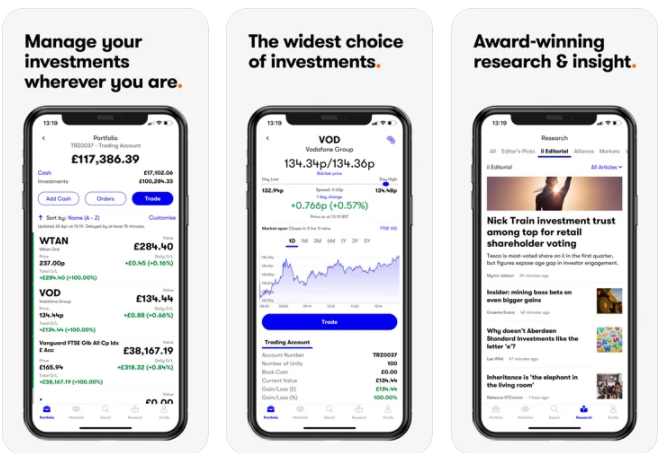

Is Interactive Investor’s app any good and is it safe?

Interactive Investor’s app is one of the best ways to invest on mobile based on our matrix as it has loads of research, screeners and market data. It’s also safe and secure as it’s regulated by the FCA. Plus as Interactive Investor is regulated by the FCA and owned by ABRDN, an LSE-listed company currently worth £2.7bn, the II investment app is one of the safest around.

Interactive Investor is a good investing app for active investors who want to make their own investment decisions and will be adding a lot of funds as well as shares to their portfolio as fees are capped. II’s app also has a wide range of news and analysis with a particular focus on educational videos and investment editorials.

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA

- Account charge: Shares £0, funds 0.45%

- Dealing fee: £3.99 – £5.99

App Fees: It costs £9.99 a month for a general investing account with Interactive Investor. Dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

If you want level-2 pricing, you can also add Quotestream for £20 per month.

Capital at Risk

How safe is dealing shares on Interactive Investor?

Share dealing on Interactive Investor is very safe as they are regulated by the FCA so if they go bust your free cash is protected by the FSCS and your shares are held in safe custody with CREST and can be transferred to another investment platform.

Interactive Investor is a low-cost share dealing platform that offers investors access to over 40,000 shares. II won the 2021 and 2023 Good Money Guide award for Best Investment Account.

Interactive Investor is a great choice for anyone who wants to buy and sell shares on a regular basis and has a large portfolio.

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- Account types: GIA, ISA, SIPP, JISA

- Share dealing account charge: £4.99 per month

- Share dealing fee: £3.99 – £5.99

Dealing Fees: Interactive Investor share dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

Special Offers:

- One free trade per month – One buy or sell order is free every month, after that, the cost is between £3.99 and £5.99 depending on what plan you are on.

- Free investing for your friends and family – You can give up to five people a free investment account subscription with Interactive Investor’s Friends and Family plan. You pay a single extra fee of £5 a month, and their monthly cost is zero. Each member can invest up to £30,000 in an ISA or a general investing account with free regular investing and no account fees. However, they will still pay normal dealing commissions when they buy and sell investments.

- Get £200 when you refer a friend to Interactive Investor – Recommend a friend or family member to ii and get a £200 reward. Your friend will get their first year’s service plan for free – saving £120. To qualify, your friend must transfer or fund their account with at least £10,000 in combined cash/investments. However, your friend will not receive the usually monthly free trade.

Capital at Risk

Is buying ETFs on Interactive Investor good for beginners?

I would say if you are a complete beginner, then there are better brokers for buying ETFs than Interactive Investor as they have a fixed fee plan, which can diminish returns if you have less than £1,000 to invest. If you are new to ETF investing you see our ETF platform comparison here.

Interactive Investor won our award for best ETF investing account in the 2022 awards. You can choose from over 1,000 ETFs to invest or use their expert picks in the Super 60 and ACE 40 lists.

A good ETF investing platform for larger accounts, as costs are fixed and do not increase with your portfolio.

- ETFs available: 1,000

- ETF account charge: £4.99 per month

- ETF dealing charge: £3.99

- Account types: GIA, ISA, SIPP, JISA

ETF Fees: Interactive Investor ETF dealing commissions are a free trade every month, then charged £3.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

Capital at Risk

Can you buy index funds through Interactive Investor?

Yes, you can invest in a huge range of index funds (including Vanguard funds) when you have a GIA, ISA or SIPP account with Interactive Investor.

Interactive Investor offer a wide range of index tracker funds. You can either pick your own or choose from some featured funds from their Super 60 investment list.

A good choice for large index fund portfolios, as they offer good coverage and the fixed-fee model means that the bigger your account size gets, your costs stay the same.

Fees: *Fund dealing commissions are a free trade every month, then charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

Capital at Risk

How many funds are available on Interactive Investor?

You can invest in over 3,000 funds with Interactive Investor, but if that sounds daunting, ii publishe their most popular funds and have “Quick start”, “Super 60” and “ACE 40 ethical” best buy lists to help you pick the best funds for your portfolio.

Interactive Investor won best fund platform in our 2022 awards as you can invest in over 3,000 thousands of funds with help from II’s impartial experts that have selected ideas for a wide range of active and passive funds, investment trusts, and exchange-traded funds (ETFs). The ii Super 60 fund selections are designed to suit all investors, while our ACE 40 list highlights the best-in-class ethical funds.

Capital at Risk

Is the Interactive Investor junior ISA (JISA) any good?

Yes, Interactive Investor’s JISA is a great way to invest for your children if you have an investing account with ii as it’s free and you can invest in a huge range of shares, bonds and funds.

If you have an investing account with Interactive Investor, you get a free Junior stock and shares ISAs account for your children. You can invest in over 40,000 shares, bonds, funds or pre-built portfolios. So if you are looking for a free self-select JISA it is one of the cheapest and most flexible investment ISAs for children on the market at the moment compared other large investment platforms like AJ Bell (who charge 0.25% a year). You also get one free trade per month, after that it costs £5.99 per deal, compared to AJ Bell’s £9.95 per share deal.

Capital at Risk

Does Interactive Investor have a good range of Investment Trusts?

Yes, Interactive Investor has a wide range of investment trusts, and they regularly update the most popular trusts with their customers which can help picking which ones to invest in.

Investment trust fund dealing commissions are a free trade every month, then charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

II has a long association with the investment trust market. Investment trusts are closed-end funds that follow a specific investment mandate. Investment trusts are listed on the stock exchange and their shares trade in the same way that other stocks do.

However, unlike open-ended funds such as ETFs, the value of the shares in an investment trust are driven by the supply and demand for the shares in the trust rather than the values of the underlying investment.

That said investment trusts typically trade and are valued at a premium or discount to the NAV or Net Asset Value of those underlying investments.

You can invest in as many investment trusts as you wish. Though most investors will try to select the best funds in a particular space or theme.

II provides plenty of information about the best-performing Investment trust over various times frames and which funds have proven most popular with II clients, and articles on the sector and investing in it.

II’s flat fee charges apply once again so thats£9.99 per month for a trading and or ISA account, inclusive of one free trade per month and additional trades charged at £7.99 each. SIPP holders pay an additional £10.00 per month admin fee on top of the £9.99 charge.

Capital at Risk

What’s the difference between an OEIC and unit trust on Interactive Investor?

You can buy OEIC’s on Interactive Investor and as opposed to united trusts which you trade like a companies shares, new shares are created or deleted in an open-ending investment trust when investors buy or sell them.

Interactive Investor charge a low, flat fee of £9.99 per month for investing in open-ended investment companies. This covers OEIC investing for Stocks and Shares ISA, Junior ISA and Trading Account (you can also add a SIPP for an extra £10 per month).

Open-ended investment company dealing commissions are a free trade every month, then charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

Capital at Risk

Ethical Investing

Interactive Investor offers some pre-selected and pre-packaged investment ideas and styles to their customers. One of which is Ethical Investing the firm have selected 140 funds that allow clients to invest in both the UK and abroad from an ethical perspective.

Alongside equity-centric vehicles, there are bond, money market and property funds to choose from. These are complemented by a clutch of specialist ethical investments.

The list of funds was created with the help of independent research house SRI and data from fund specialists Morningstar, and the II ethical overlay encompasses ESG and sustainability factors.

Costs are the same as other II investment products, which is a flat fee of £9.99 per month including one free trade and additional trade at £7.99 per deal thereafter. And of course, if you dealing bin overseas securities then you may incur FX conversion charges.

Capital at Risk

International Investing

You can trade in international stocks and shares with Interactive Investors and you can check if stock is available by typing the name into the search for an investment box on the II website and it will return any matches from the list of securities that Interactive Investors offers.

Account-holders get one free trade per month and each subsequent trade costs £7.99. The only other charges are for any FX conversions required to settle the trade or to convert sale proceeds back into sterling for example.

You can trade shares from across Europe and North America as well as Asian markets such as Hong Kong, Australia and Singapore. The coverage is not as extensive as that offered by some rivals for example Hargreaves Landsdown, though their charges are likely to be higher than II’s unless you are trading 20 times a month or more.

Capital at Risk

Charges & Fees

Interactive Investors chargers flat monthly fees to account holders that start at £9.99 with additional admin charges of £10.00 per month for SIPP administration. All account holders receive one free trade per month and additional deals are charged at £7.99 per trade.

If you are trading in overseas securities you will also pay FX conversion fees which vary based on the size of your transaction. There are occasional special offers and research and ideas are provided free of charge.

The flat fee per month structure differentiates Interactive Investor from its peers many of whom charge fees on the monetary value of your portfolio, based on either a fixed-rate or sliding scale.

It could be argued that the monetary flat fee approach doesn’t penalise success in that you pay no more, or indeed less, for the service regardless of your investment performance.

Whereas under a percentage fee scheme the bigger your portfolio the more you could potentially end up paying

Capital at Risk

Refer a friend

II offers a refer a friend scheme which rewards existing customers with £100.00 for each friend they introduce to the company, who opens an account and deposits £10,000 or more in either stocks, investments or cash, or a combination of all three.

The rewards are credited to your II trading account and not SIPPs or ISAs.

Friends that are introduced benefit from 12 months of IIs free service plan which is worth £120.00 to them, so it’s a win win situation.

Refers can only introduce a maximum of 6 friends under the scheme and referral fees can be reclaimed if the friend closes their account within a year of their introduction. You can’t refer yourself and you will need to wait 10 days to receive your rewards.

Capital at Risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.