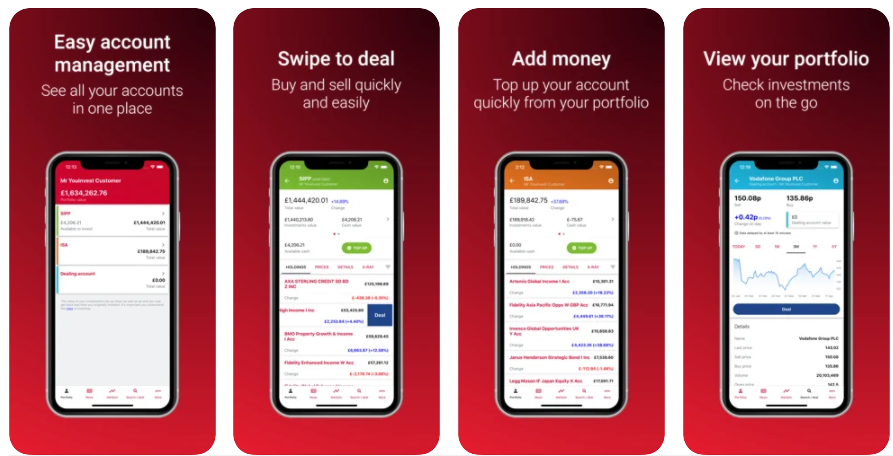

AJ Bell does have an investing app, which is a good way of checking on your investments when out and about. But, I have to say, it’s a bit clunky compared to full-service brokers like Interactive Brokers or even new apps like CMC Invest. It’s not as good as the main website, as you don;t get the full screeners or research, plus it’s an absolute pain to log in to as for some reason it seems to always wipe my login info.

AJ Bell Investing App Review

Name: AJ Bell Investing App

Description: AJ Bell’s investing app is a good choice for anyone who is more interested in keeping costs at a bare minimum whilst still having access to a huge range of markets and account types. It’s not quite as suitable for very active investors as II and HL due to the lack of execution order types, but for those who just want to build a portfolio without trying to time the market too much, it is a very good option.

Capital at risk

Summary

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £500

- Account types: GIA, ISA, SIPP, JISA, JISA, JSIPP

- Account charge: 0.25% annual charge

- Dealing fee: Shares £3.50 – £5, funds £1.50

Fees: AJ Bell charges 0.25% of the value of your for a general investment account, but share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 where there were 10 or more online share deals in the previous month

Special Offers:

- Recommend a friend, and you’ll both get £100 gift vouchers – When you recommend a friend to AJ Bell that invests more than £10,000 in a SIPP or ISA, you and your friend can get One4All gift vouchers worth £100.

- Switch your share dealing account and receive up to £500 to cover exit fees – If you transfer your share dealing general investment account valued at more than £20,000 to AJ Bell they will help cover any exit fees charged by your current provider. They will cover £35 per investment moved and up to £100 for general exit fees, up to an overall maximum of £500 per person.

- Free subscription to Shares Magazine worth £220

Get a free subscription to Shares (worth over £220 per year) by maintaining a balance of £4,000 or more across your AJ Bell investing accounts.

App:

Pros

- Pick your own shares, funds and bonds or use their investing ideas

- Low account fees capped at £3.50 a month for shares

- Lots of account types

Cons

- High phone dealing charges

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4.5)