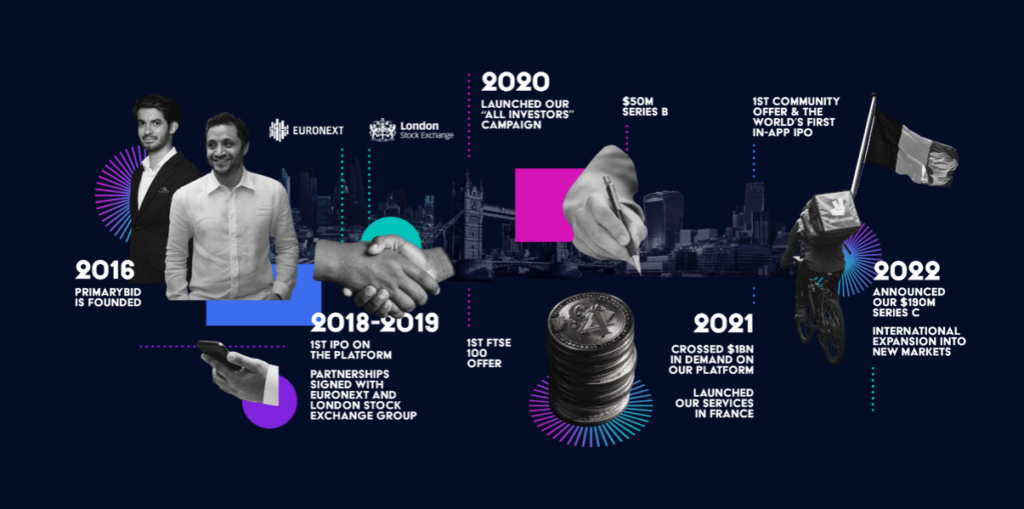

PrimaryBid, the London Stock Exchange-backed platform that enables people to invest in IPOs and secondary placings, in UK and European shares, have taken a big step towards realising their ambition.

PrimaryBid Series C Fundraising from Softbank

PrmaryBid has raised $190.0 million in new funding from venture capital backers including SoftBank’s Vision Fund II, Japanese based SoftBank is among the largest and most prolific backers of high profile start-ups and would-be disruptors in the world.

The Series-C round had been mooted in early January, but has taken until now to complete previous investors in PrimaryBid funding rounds have included ABN Ventures, Draper Esprit and Fidelity International Strategic Ventures.

Somewhat ironically PrimaryBid has not disclosed a specific valuation for the business, following this latest fundraising, though documents related to the process suggest that a figure of $650.0 million would be in the right ballpark.

Speaking about the funding round Anand Sambasivan CEO and Co-founder of Primary Bid said that Primary Bid will use the money to expand its operations, building out the range of products that it offers to companies and investors, these will include access to SPACs and retail bonds and he also hinted at the possibility of opening a US office.

How have PrimaryBid and their IPOs performed?

PrimaryBid has participated in 150 IPOs and secondary market placings over the last 18 months highlights include Deliveroo, Pension Bee and the US IPO of MCG Group, the owners of Soho House.

The performance of IPOs in the London market has been mixed, to say the least, Deliveroo (ROO), which floated in March 2021, at 390p has fallen in value by -55.0% in those 11 months, and currently trades at just 128.70p.

PensionBee (PBEE) listed in April 2021 at 175p has fallen by -15.0 % to trade at a current price of 143p, however, it printed as low as 122p in mid-January.

MCG Group (MCG), which was listed on the NYSE in mid-July at $14.0, has fallen by -32.46% and currently trades at $8.55.

Those figures compare to a 12-month loss of -38.80% in the Renaissance IPO ETF (Ticker IPO) that tracks the performance of a basket of recent IPOs.

There is no doubt that retail clients are not well served by IPO markets and their current structure, which heavily favours institutional investors, and following this latest fundraising round, PrimaryBid is in a position to try and change this.

Yet questions remain, in particular, what incentives or benefits are there to issuers for including retail investors in their IPO? And just how much real interest or demand is there in IPOs, among the average retail investors?

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.