AJ Bell General Investing Account Review: Best Overall GIA 2024

Account: AJ Bell General Investing Account

Description: AJ Bell’s GIA offers share dealing in over 24 stock markets, bonds, ETFs and over 2,000 funds including a range created by its own team. The platform will suit those who are looking for low-cost investing when growing a small portfolio. Capital is at risk. Capital at risk

Is AJ Bell's GIA a Good Account?

Yes, AJ Bell’s GIA is one of the safest and cheapest ways to invest – outside your tax-free allowances in SIPPs & ISAs – for longer-term investors in the UK.

AJ Bell won our award for Best Investing Account 2024 due to its excellent market access, low costs and customer service scores in our annual survey.

Fees: AJ Bell charges 0.25% of the value of your investments for a general investment account, but share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £9.95 for shares but drop to £4.95 where there were 10 or more online share deals in the previous month.

Market Access: AJ Bell’s GIA is most suited to investors who want the cheapest overall investment platform for starting to grow a small investment portfolio. It offers share dealing in over 24 stock markets, bonds, ETFs and over 2,000 funds (of which around 500 are investment trusts), including a range of the company’s own funds that have been created in-house so you can invest by how much risk you want to take, or by theme or region.

App & Platform: Both apps and web version are really simple to use, no complaints.

Customer Service: Top notch, you can actually phone someone up to ask a question.

Research & Analysis: As well as being a super ealy platform for beginners AJ Bell is also a serious platform for serious investors and this in reflected in the quality of their research. There are some really in-depth reports on funds and shares, plus you get a free subscription to Shares Magazine worth £220 a year by maintaining a balance of £4,000 or more across your AJ Bell investing accounts.

Special Offers: Recommend a friend, and you’ll both get £100 gift vouchers. If you recommend a friend to AJ Bell and they invest more than £10,000 in a SIPP, ISA or LISA, you’ll each get an Amazon gift card worth £100.

Switch your share dealing account and receive up to £500 to cover exit fees. If you transfer your share dealing GIA valued at more than £20,000 to AJ Bell, it will help cover any exit fees charged by your current provider. AJ Bell will cover £35 per investment moved and up to £100 for general exit fees, up to an overall maximum of £500 per person.

What is AJ Bell’s Platform Like to Use?

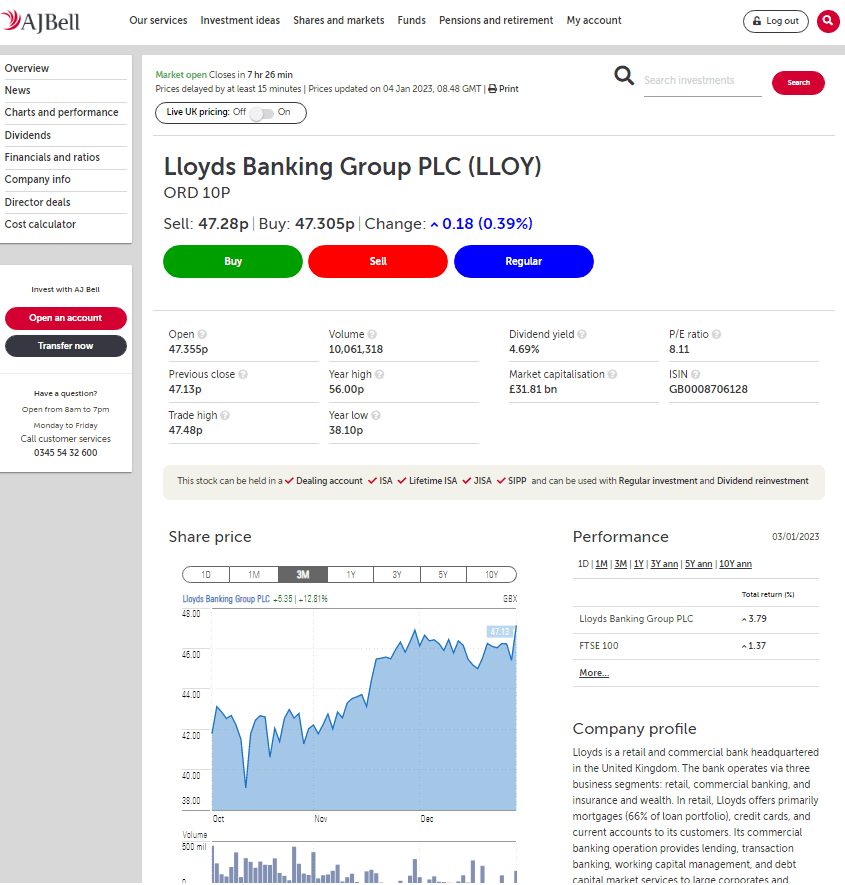

AJ Bell’s investment platform is functional and well laid out. Key share and fund information is available to view at the time of execution.

Pros

- Pick your own shares, funds and bonds or use the platform’s investing ideas

- Low account fees capped at £3.50 a month for shares

- Lots of account types

Cons

- High phone-dealing charges

- Limited hedging options

-

Excellent

(5)

Overall

5- Expert opinion: AJ Bell reviewed & rated