The Woodboise share price may be falling because of a lack of interest in the stock after a potential pump-and-dump scam. In this analysis, we explain what this is, how it works and how to avoid getting sucked in to small cap investors promoting stocks and “talking their own book”.

⚠️Be careful if you’ve seen an advert or article hyping a stock

Back in October 2022, we noticed that Google is still failing to stop scam stock market pump and dump adverts and that Woodbois shares were a target. The company has acknowledged this and addressed it with the relevant authorities and regulators.

For years, we’ve been calling for tighter restrictions on who can advertise on Google especially when it comes to financial services. Recently, I highlighted how it took Facebook, 1,024 days to remove a scam advert we had reported on its platform.

Some progress has been made. You now have to be regulated by the FCA to promote speculative products, which I said was an absolute blessing for decent brokers because it meant that they were no longer competing with offshore brokers in the Google Ads bidding war, which should reduce their new client acquisition costs.

Even the FCA is trying – they have joined Instagram to warn of scams, and also banned retail investors from trading crypto on leverage. But it’s not enough to stop these scams from cropping up under the radar.

I think the only solution is for the FCA to fine Google and other advertisers every time they unwittingly make money from a scam. It is not hard for Google to recognise an advert that is a financial promotion or talks about the stock market.

I know that Google already filter adverts that focus on financial products, so we know they can do it. The phrase, with great power, comes great responsibility comes to mind and they need to increase the number of manual checks on who they allow to advertise on their platform.

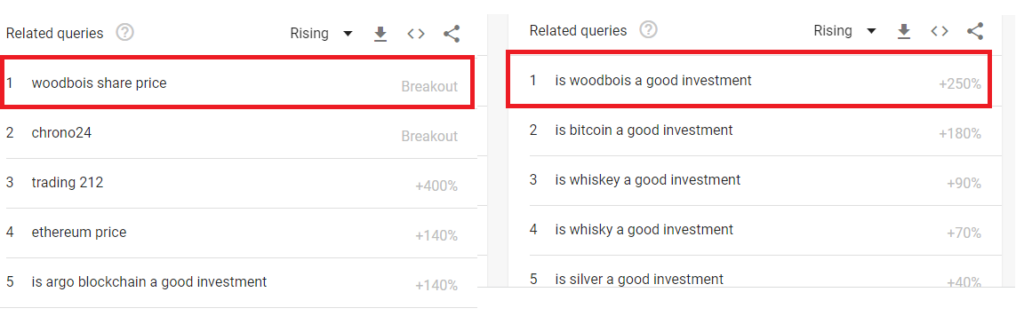

I bring this up again because I came across a scam advert a few days ago, but I also noticed whilst checking Google Trends and seeing that “is woodbois a good investment” was one of the highest-rising search terms of the past few days. Over the last seven days, searches for “woodbois share price” have had a breakout. Yes, they have recently updated the market with decent results, but they have also, for some time now been the subject of pump and dumpers (as reported in the Motley Fool).

My main point for writing this is to warn people of the fake news that has been created around a company, the second is to highlight that Google has zero oversight on who they let advertise on their network.

The way pump and dump scams work are that the scammers buy up a load of cheap shares, usually a penny stock in the UK or a pink sheet stock in the US with market caps below £100m. They then flood social media, and bulletin boards or put up fake adverts to a piece of fake analysis that encourages buyers to buy a stock. Then, as the stocks are illiquid (doesn’t trade that often) even the smallest of buys can push the price up. Then as unwitting investors buy the stock, the people who advertised it’s potential gains sit on the offer (the price at which people buy shares) selling the stock for more than they paid for it.

Woodbois is a real company listed on the London Stock Exchange currently valued at around £3,696,200 as of (as of 16:29 30-Jun-2025). According to it’s bio, they are “engaged in the business of forestry and timber trading. The Company’s business is focused on the production, processing, manufacture and supply of softwood, hardwood and related products throughout Africa and across the globe.”

Cannacord recently upgraded the stock price target and Woodbois is also regularly analysed on the Motley Fool.

There is nothing new about “people talking their own book” – which basically means, saying how great a stock is that they have bought in the hope that other people will buy it. When other people buy it, that creates demand, and when there are more buyers than sellers the price goes up.

But, the digital version is on a much larger scale. It is particularly prevalent in crypto where new coins are made up and then people buy them because influencers on TikTok, and Instagram are paid to say it is a good idea.

Here is an example of how it has been done with Woodbois.

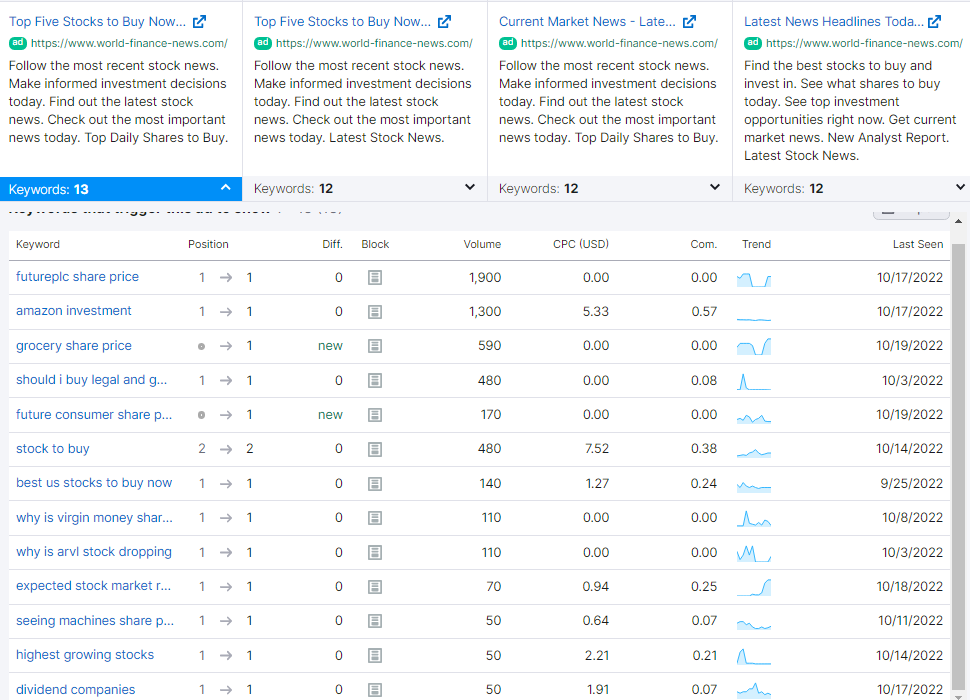

Scammers set up fake Google ads to target people who search for the best stocks to buy or information on the stock market.

You can see from this data taken from SEMRush what adverts the scammers are running and also what keywords they have used to display the advert on Google search.

Despite the site having other content related to the stock market, every single one of these adverts goes to an article published about Woodbois.

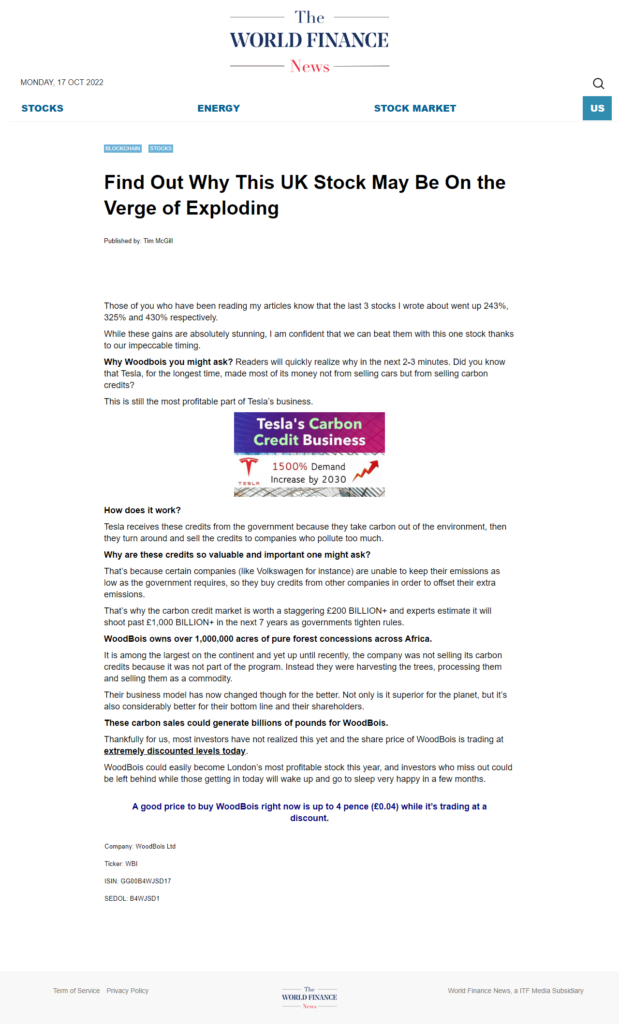

Users then click through to a website that claims to have expert analysis on why the stock will go up.

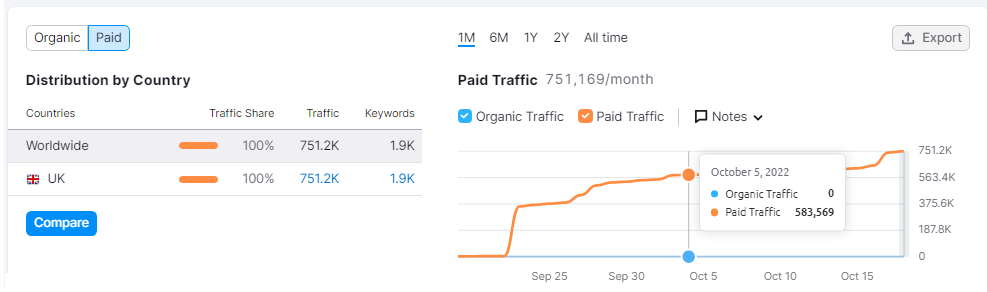

You can tell this is a fake website by also looking at the analytics from SEMrush. The website has no organic rankings or traffic and the only visitors have been from paid search starting in September 2022, and only targeting the UK where Woodbois is listed.

There is no author bio, there is no company attached the website in the terms and conditions or in the privacy policy.

For more information on how scams work you can also read:

- CFD scams – What are they and how to spot them

- How can major media outlets still be hoodwinked into unwittingly promoting forex investment scams?

- Bond Scams: The rise of fixed income scams and how to avoid them

- Am I being scammed by a clone of a real investment firm?

- TikTok is the new haven for forex, bitcoin and investment scammers

If you suspect an advert is a scam you should:

- click the report scam button on the advert

- report it to the FCA here

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.