Once in a while, it pays to analyse government bond yields.

These are prices of credit, of sovereign borrowers. Throughout history many sovereign entities (especially those managed by profligate Kings and Queens) had spent vast sums beyond the limit of taxation. Naturally, history is littered with sovereign defaults.

Surely this sort of thing wouldn’t happen now, right? Sadly, fiscal defaults have always stayed with us. Readers with some memory would immediately recall the scary ‘PIIGS’ debt crisis back in 2011 – a fiscal crisis that nearly tore the European Union apart (Note: PIIGS stands for Portugal, Ireland, Italy, Greece, and Spain).

For example, investors at the time viewed Italy as some sort of a basket case: Slow growth, high unemployment, and high debt levels. Extremely bearish macro outlook drove investors and speculators to short the Euro, Italian stocks (especially banks), and Italian bonds. Only through gritted teeth and sheer luck did the EU resolve the PIIGS debt crisis. In that febrile macro climate, gold shot up to $1,800/oz, then a record high.

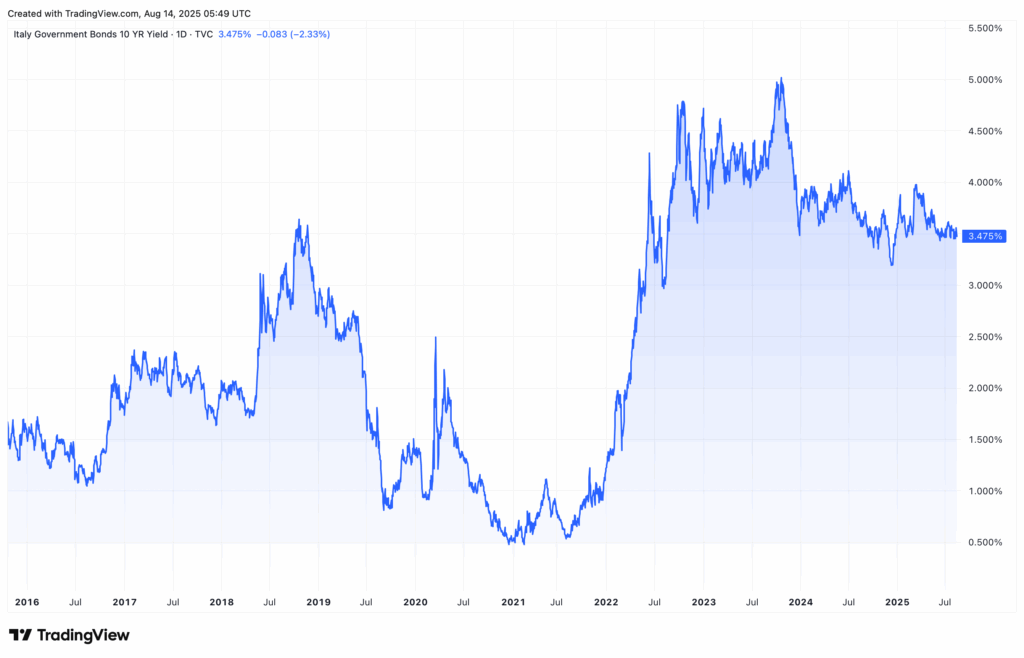

But things have shifted substantially since. The Italian economy has stabilised; its 10-year bond yield is currently steady around 3.5 percent, which is 150bps below its 2023 peak (see below).

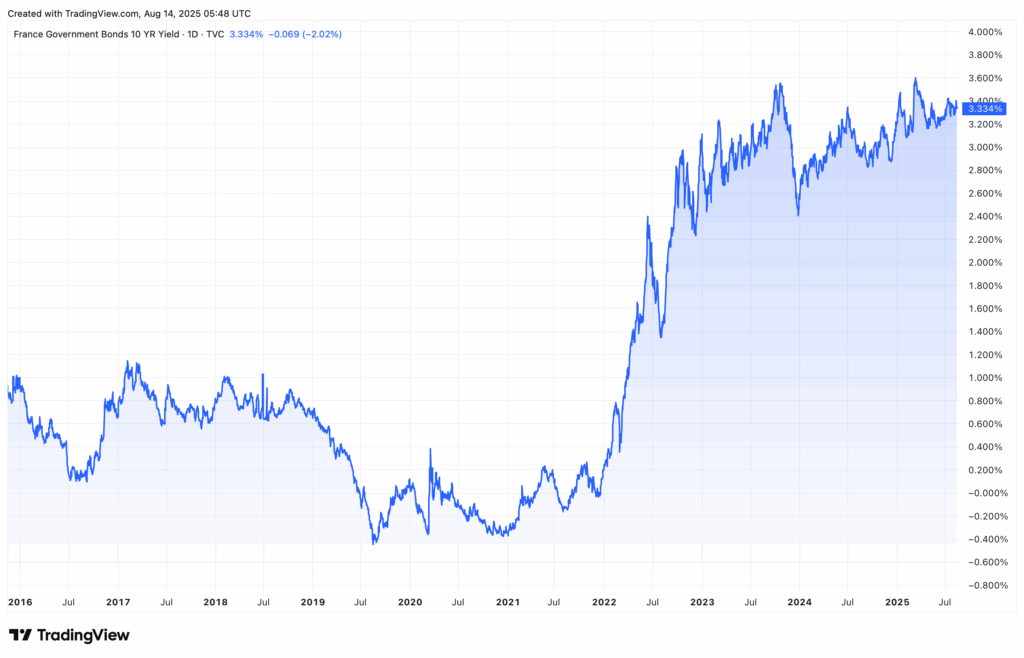

Seemingly, the fiscal debt epicentre is slowly migrating elsewhere. Take France. The Fifth French Republic is on its third prime Minister since January 2024 (shades of post-Brexit UK?). You can read a summary of the country’s policy drama here. Political instability always leads to negative market reactions. How can investor be confident on a country’s governance when minister after minister are marched out of office in quick succession?

As a result, the market is continuously slapping higher yields on French bonds. Look at the unmistakable uptrend of the French 10-year Bond Yield below. At 3.33 percent, these French Obligations assimilables du Trésor (OATs) are yielding just 0.1 percent below that of Italy’s.

Chartwise, this rate of worrying rise is setting the yield up for a northerly breakout at around 3.6 percent.

Given this tightening spread (between Italy-France), Italian shares are unsurprisingly more bullish than French’s. Compare the performance of the iShares MSCI France (EWQ) against that of iShares MSCI Italy (EMI).

The latter is appreciating at a steeping pace into new long-term highs; whilst the MSCI France is struggling to clear the 2024 highs. In other words, structural instability has market consequences. Yesterday’s weeds, under suitable conditions, can become today’s flowers.

Another strong performer is iShares MSCI Spain (EWP), another PIIGS country. The single-country ETF has gained nearly 50 percent YTD.

Margin Debt Soaring Despite High Borrowing Costs

What about the US? In the Age of Trump the nation’s 10-year bond yield is hovering at around 4.2 percent. This is nearly 1 percentage point higher than Italy’s. (As a comparison, UK’s 10-year gilt yield is at 4.6 percent.)

Why is America’s borrowing costs higher? Three reasons:

- “Moderately restrictive” monetary policy (see Powell’s July FOMC speech)

- Higher-than-expected inflation (above 2 percent target, with tariffs impact to be assessed)

- Reasonably strong economy

Despite this elevated borrowing cost, the US stock market has defy the burden of credit to rocket into one record high after another. Stock indices put on another good performance last week.

I have mentioned in several previous Weekly Macro that the buying signal in equities is strong. Many global markets soared to new all-time highs despite a) higher tariffs and b) economic uncertainties. One needs to pay great attention to markets when they move in a diametrically opposite direction (up) against the prevailing opinion (bearish).

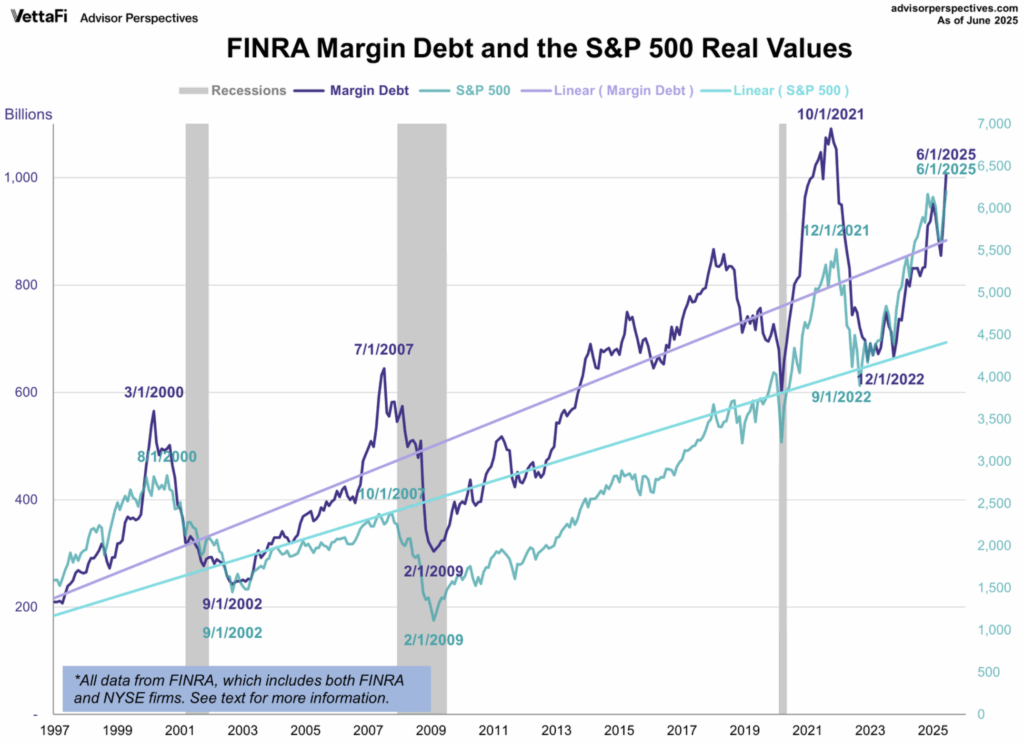

US June’s margin debt – debt used to leverage and magnify stock positions – crossed $1 trillion for the first time since 2021 (see below). This suggests investors are loading up risky assets massively and constantly, possibly aided by Fear Of Missing Out (FOMO).

Source: Advisors Perspective

Who isn’t FOMOing when many stocks have surged nonstop in the second quarter?

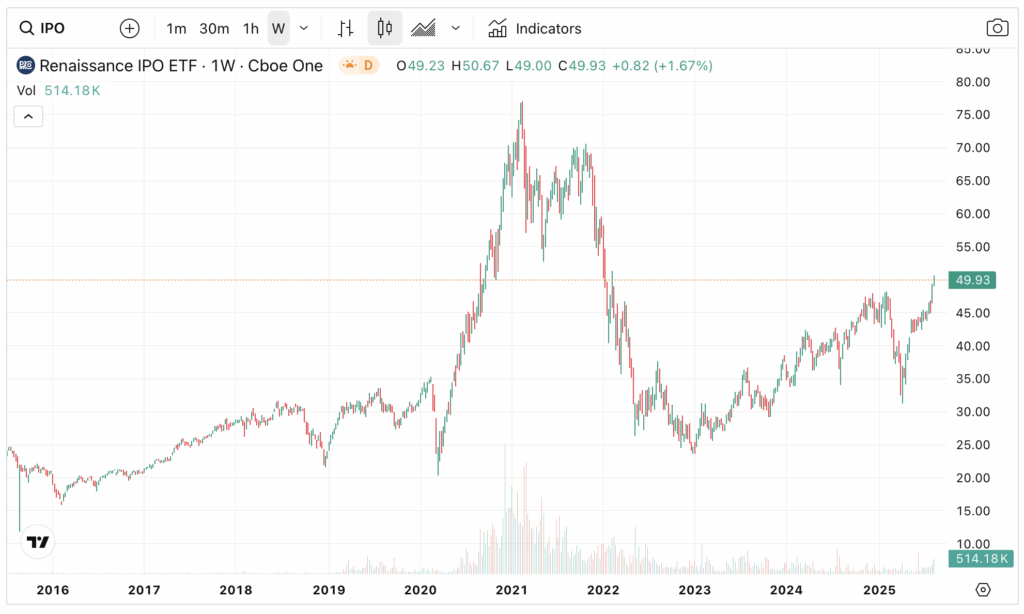

IPOs, another sign of market conditions, are hot and gaining. Many newly-listed stocks are experiencing large one-day pop (such as Bullish, ticker: BLSH). Look at the exchange-traded fund that only track IPOs (Renaissance IPO, ticker: IPO); prices are surging to the highest level since 2022 (see below).

Another high-beta bet is emerging markets. Investors are flocking into EM assets in order to:

- Diversify away from the US$

- Ride high-beta rallies

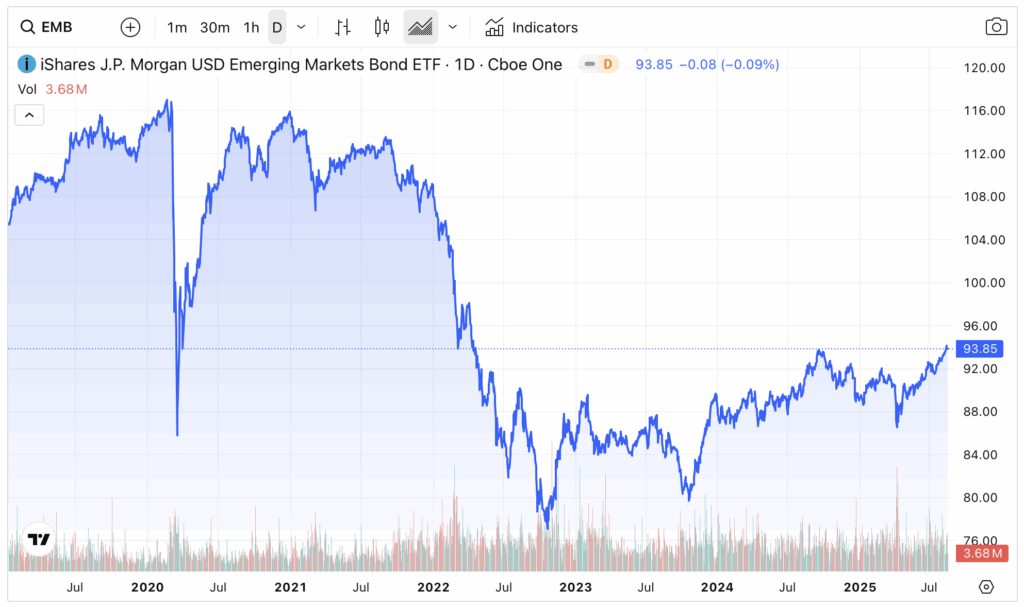

EM bonds are outperforming those from advance economies. The $13 billion iShares JP Morgan Bond ETF (EMB, factsheet), which hold bonds from Argentina, Ecuador, Ghana etc, is up 8 percent YTD. Prices rallied to the highest level since 2022. A further base breakout is developing at a$94 (see below).

And if we are talking about speculative risk sentiment, how can we ignore crypto?

Ethereum (ETHUSD), the second largest crypto asset by market cap after Bitcoin, soared to new multi-year highs this month. The $500-billion asset broke the psychological $4,000 resistance level and immediately jumped 20 percent to $4,800. Overbought, a healthy consolidation back to that former resistance – now potentially support – is underway.

Concluding Remarks

The point of highlighting all these charts, from several distinct asset classes, is to show readers that the powerful risk rally since May is touching almost every corner of the financial market. There were several psychological stages to this intermediate bull run.

- Disbelief (Apr) – What will Trump do again?!

- Gentle Hope (May) – Am I Missing Something?

- Optimism (June) – TACO, time to buy!

- FOMO (July/August) – I can’t afford to miss it!

Many assets have rewarded investors handsomely in the past few months, despite the so-so economy. The big question is, have assets outrun their upside potential? Given the strong price momentum, this could be the case for some assets. Equally, speculative money could easily rotate into other underperforming assets that have yet to join the bull run. This may prolong the rally.

Of course, having a healthy stack of cash on the sidelines is a good idea. This enables investors to take advantage of any correction in the near term. Employing stop-losses is a must to protect profitable positions.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please ask a question in our financial discussion forum.