- Safely connect to FCA regulated wealth managers

- Get regulated advice to help you make better financial decisions

- Make more of your money with an expert wealth manager

- No costs or fees for using our service to grow your wealth

| Name | Logo | Minimum | Initial Fees | Ongoing Fees | Customer Reviews | CTA | Tag | Feature | Expand |

|---|---|---|---|---|---|---|---|---|---|

|

Minimum £250,000 |

Initial Fees 1%-2% |

Ongoing Fees 0.6%-1.5% |

Customer Reviews 5.0

(Based on 95 reviews)

|

Featured Wealth Manager |

Features:

|

Saltus Expert Review: Best Wealth Manager 2025 Provider: Saltus Verdict: Saltus won “Best Wealth Manager” in the 2025 Good Money Guide Awards for it’s tailored financial planning and investment services. With over £7.5 billion under advice, it combines institutional-style investment strategies with bespoke advice. Saltus has consistently outperformed its peers, as measured by the ARC Private Client Indices, while maintaining strong client satisfaction and retention. Summary

Saltus takes a highly personalised route from the outset, matching clients with advisers who align with their goals and communication preferences. Their planning process includes robust cashflow modelling and tax optimisation, resulting in comprehensive strategies that span life planning and investment management. Their investment performance, as independently benchmarked by the ARC Private Client Indices (ARC PCI), is particularly impressive. Saltus has outperformed peers over 3, 5, and 10-year periods across cautious, balanced, growth, and equity risk categories—all while generally taking less risk. For instance, their Growth strategy delivered an annualised 7.7% return over five years to the end of 2024, compared to 5.3% for the ARC benchmark. Fees are competitive and decline as portfolios grow, with no exit charges and transparent upfront costs, especially for larger portfolios. An average ongoing cost for a £1.5m client portfolio is around 1.28% (including financial planning), and investment-only clients benefit from reduced charges. The fees can vary depending on the solution recommended but the below assumes the use of Saltus Asset Management’s core investment strategies. Additional, third-party fund charges (non-Saltus) are not included in the figures and will depend on the investment strategy selected. Financial Planning & Investment Management: Investment Management Only: Client satisfaction is high, reflected in a Net Promoter Score (NPS) of 59.57—well above the financial services average—and a 97% client retention rate. A good choice for high-net-worth individuals seeking top-tier financial planning and strong, risk-adjusted investment performance. Pros

Cons

Overall5 |

|||

|

Minimum £500 |

Initial Fees £0 |

Ongoing Fees 0.25%-0.75% |

Customer Reviews 4.6

(Based on 2,564 reviews)

|

Features:

|

Wealthify, part of the Aviva Group, won “Best Robo-Avisor” in the 2024 Good Money Guide Awards as it lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments.

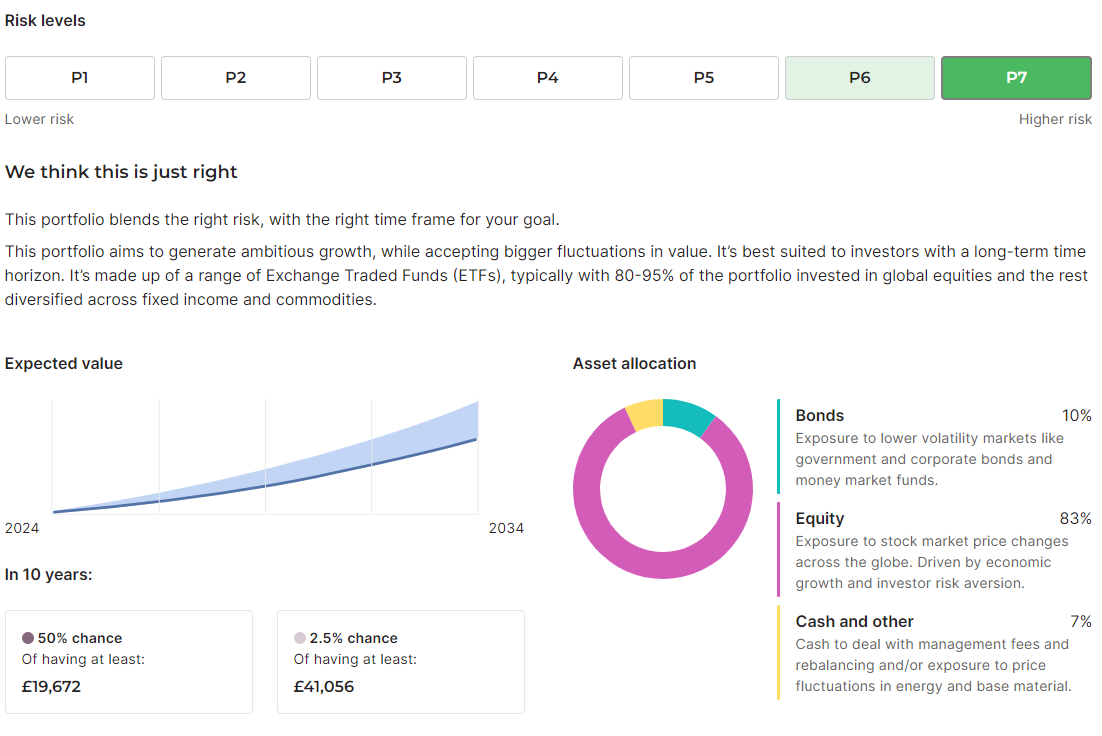

Wealthify Digital Wealth Management Review: Best Robo-Advisor 2025 Provider: Wealthify Verdict: Wealthify won best “Robo-Advisor” in the 2025 Good Money Guide Awards as they offer simple, low-cost investment accounts made of pre-made diverse Original or Ethical investment plans. Owned by Aviva, customers can set their own risk/reward threshold and invest through a general investment account, stocks and shares ISA, junior ISA or pension. Wealthify Tested: Investing Isn’t A Sprint, Or Even A Marathon Anymore, It’s A Triathlon…

Investing used to be like a marathon, you’d have an annual four-hour meeting with a wealth manager who would recite your fund prices from the back of the FT, before rolling your portfolio over for his annual commission, but now it’s even harder work. To make investing interesting, robo-advisors like Wealthify (or ‘digital wealth managers’ as they prefer to be called) have been trying to democratise it and make investing open for everyone. They say, “look, investing can be fun, if you don’t want it to be a marathon, we’ll make it a triathlon instead”. Which, as you know takes roughly about the same amount of time as a marathon, but is a swim, a bike ride and then a run. This closely translates into investing similes as, “it’s still a massive slog, but we’ll make it more interesting by giving you an app (like Strava) so you can track your performance in real-time and give you variety by risk and region”. So, by democratising investing, robo-advisors have actually made it harder. You have to make more decisions, be more involved, and you’ve now got an app so you’ll constantly be looking at (and therefore tweaking), your ISA and pension. When actually, what you should be doing is investing, then do nothing. Or should you? The Value Of Compounding A while ago I interviewed the then Wealthify CEO, Andrew Russell, and one thing we discussed was how important it is to encourage people to start investing, instead of just saving. Because without the benefit of compounding returns in the long-term if you just save and don’t invest, your money will be worth less. He told me:

Clearly, if you tried to convince the young to start investing by explaining how compounding works, you’d have no customers at all. But one, thing Wealthify does really well is straight off the bat tell people how much their money “could” be worth in the future, particularly for regular investing. Which is a very powerful message to send, and one that should always be front and centre. Generally, the earlier you start investing, no matter how small, the better off you will be. When I was setting up an account, I said I would invest £1,000 initially, then £250 a month with one of their Confident plans, which Wealthify said after 25 years could be worth £122k (or £173k if the market performed better than expected). Think of the rubbish you spend £100 a month on. When I retire, I might be able to buy a Caterham, although I’ll be too old to drive it then.

It’s not entirely clear where this prediction comes from when they give it to you, but presumably, it’s based on historic returns from the various plans. Obviously, ‘past performance is not indicative of future results’ As if the market tanks (which it always does at some point) you’re going to be sitting on a loss. But before robo-advisors came along, if you wanted to open an account and invest with low-to-medium risk you had to go to the bank and sit down with an advisor, fill in a load of forms, and nod in bemusement as they explained why the Asia ex-Japan emerging markets fund would potentially make you more money than a treasury based fund of funds. I remember doing it, and it was exhausting, and I had just come back from working on the NYMEX oil trading floor in New York, so was in the business even back then. Thankfully now though, it’s so easy to open an account and invest, and that’s where the real democratisation of investing is. The way people are invested is basically the same, with diverse portfolios spread across asset classes and regions, albeit cheaper, with the use of low-cost funds instead of active fund managers. People have always been able to invest monthly, with even very modest amounts. But what makes investing accessible is not how it’s done, but how easy it is to get started. Even up to a few years ago, if you wanted to open an ISA account with Hargreaves Lansdown, you had to fill in a paper application and post it back. Simple Apps & Platforms Both are very easy to use with good portfolio projection tools. When setting up my Wealthify account, I didn’t even have to put in a password to get started. I managed to fund my account without getting my debit card out of my pocket, by directly linking my bank account, another massive bonus for regular investors (because if you pay by debit card and it expires, your contributions stop). I think overall it took less than five minutes to get a plan set up and funded. It’s a very slick app and website, and everything is where you expect it to be. There will always be a debate around active versus passive fund management, but the performance difference between wealth managers is generally very slim as there is a fairly standard way to create risk and region-based portfolios. Plus, if you want to beat the market, you have to take on more risk. If you just want to beat inflation, you probably won’t beat the market. Wealthify Fee Comparison One of the main advantages of robo-advisors is how cheap they are compared to traditional wealth managers (because you don’t get personal advice) and Wealthify is one of the cheapest of the bunch. Wealthify account fees are 0.6% a year of your portfolio, versus Nutmeg & Moneyfarm’s 0.75%. So if you have £100k on account, you’ll be paying Wealthify £600 as opposed to £750 for the other accounts. Over a 23-year period, that is a saving of £3,450 (and that doesn’t take into account compounding returns if you reinvested that saving). Wealthify pensions are a little cheaper, as Wealthify fees reduce to 0.3% on the portion of your pension balance over £100,000. You do, of course, have to pay fund fees on top, which are actually quite cheap with Wealthify. Wealthify say their average fund fees are 0.16% p.a. (Nutmeg & Moneyfarm are about 0.2%). Fund fees are the costs of the assets in the Wealthify plans, which are managed by investment professionals. These are higher for Ethical Plans, where the average investment costs are 0.70% p.a. Market Access: You are limited to their own pre-made portfolios, but they are suitably diverse, and you can set your risk level. You can invest through a GIA, Stocks and Shares ISA or Private Pension. Unfortunately, there is no Lifetime Investment ISA to take advantage of the Government’s 25% top-up bonus. But you can invest for your children as well with a Junior Stocks and Shares ISA. Wealthify plans are made up of funds from Vanguard, L&G, HSBC, Fidelity and Mercer. All those funds charge a fee for choosing and managing the assets that the funds are invested in. If you want to know what is in the funds, you can look it up on Trustnet, see for example the HSBC America Index Fund (which is currently 28% of the Adventurous plan). So actually, just like everyone else, your investments are quite heavily linked to US tech stocks like Apple, Microsoft, Alphabet, Amazon, Tesla and Warren Buffet’s Berkshire Hathaway. Ethical investing: For the more ESG and ethically minded, you can still invest in an Ethical Adventurous plan, but assets include funds with “sustainable” in the title, like the Liontrust Sustainable Global Fund that contains stocks like 3i, a British company worth around £33bn takes a pragmatic approach to sustainable investing by influencing company boards to ensure that they assess their material environmental and social impacts and dependencies and, where relevant, support them in developing plans to mitigate ESG risks and invest in value creation opportunities that may arise. Despite that, 3i has performed well, over the last three years. Wealthify As A Business I also really like Weathify as a business. It seems there are new investing apps being set up every week, all with different USPs. But most are woefully underfunded and you have to wonder how many times they will be going back to Seedrs and Crowdcude to tap up investors because their burn rate is extortionate as they have yet to onboard a meaningful number of customers to generate revenue, or even, god forbid, make a profit. Wealthify has gone through that, but come out the other side. They were founded by Michelle Pearce-Burkestarted with £500k from Richard Theo in 2015, then a further £1m from crowdfunding on Seedrs in 2016, followed by £15m from Aviva in 2017. Even though I have invested with Wealthify, I wish I had also invested in Wealthify, but that’s a whole other story and one with a completely different risk appetite. Aviva Backed For More Security Being Aviva owned is great for clients because it offers a huge amount of financial security, and of all the robo-advisors out there only Wealthify and Nutmeg (JP Morgan), have the backing to ensure that they may still exist in twenty years time. This is important because investing isn’t like using a credit card or buying car insurance, where you can switch every year. When you invest, you may well be with that provider for fifty years. When I interviewed Linsey Rix, the head of UK Savings and Retirement at Aviva, one of the reasons they were so interested in Wealthify was it gives them a chance to get people investing, who may have been put off by the established and grown-up nature of Aviva. She told me:

You can tell Wealthify is owned by one of the bigger boys like Aviva as well, because even though it is very easy to set up an account, they are still heavy on the compliance. I actually failed the suitability test. I filled it in as though I was a beginner investor and was told I couldn’t invest because I didn’t understand the risks of stock market investing. Although, I re-took it with a greater appreciation for risk and was granted permission to create a plan. But it’s a good example, of how whilst everyone should be able to invest, not everyone should actually invest. After all, just like training for a triathlon, if you do it with friends it is easier, and just like investing if you take an active interest in your health you will be healthier and wealthier in the long run. Customer Service: Rated highly for support from real people in Wales, so you can handle most issues online, but also have the ability to phone straight through for more complex issues. Research & Analysis: Some good analysis around portfolio rebalancing, although it’s mainly passive commenatry updating on performance rather then ideas on what to invest in. But this is not surprising as Wealthify is very much a “invest and forget platform”. So much so that When I tested the platform and set up some regular investments, I am genuinely surprised when I log on and see them. The way a long term investing account should be. Pros

Cons

Overall5 |

||||

|

Minimum £1 |

Initial Fees £0 |

Ongoing Fees 0.3%-0.6% |

Customer Reviews 4.4

(Based on 235 reviews)

|

Features:

|

Moneyfarm Digital Wealth Management Review Provider: Moneyfarm Verdict: Moneyfarm is a digital wealth manager that aims to make personal investing simple and accessible. It was launched initially in Italy in 2012 by Italian bankers Paolo Galvani and Giovanni Dapra and entered the UK in 2016 and has big-name financial backers such as Allianz Global Investors, Cabot Square Capital, United Ventures and Poste Italiane. Is Moneyfarm any good for wealth management? Yes, Moneyfarm is more of a digital wealth manager rather than a robo-advisor as the portfolios are put together by investment managers, rather than automatically. The automation, as it where, is fine-tuning your portfolio to match your risk/reward choices. As opposed to other robo advisors you can also top-up your portfolio with individual shares and ETFs. Fees: Moneyfarm charges 0.75% to 0.6% up to £100k then 0.45% to 0.35% over £100k. Moneyfarm investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%. Market Access: You can invest in 7 pre-made portfolios, but also (unlike a lot of other digital wealth managers and robo-adviors) also buy individual shares, ETFs, bonds and mutual funds online. It’s a bit of a shame you can’t buy US stocks, But Moneyfarm is best really for setting up regular investments in a GIA, ISA or SIPP, then letting them grow over time without too much tinkering and speculating on Tech stocks. App & Platform: It’s really easy to use, plus it puts you through your paces to make sure you understand what you are investing in. Apparently, my Moneyfarm investor profile is “pioneering”, which means I want to take on more risk for potentially better returns. Customer Service: This is mostly online as you’d expect but solves all issues – I’ve had some good calls with MOneyfarm about how their producsts work over the years and they really know their stuff. If you want to find out more about their ethos, you can read my interview with the CEO Giovanni Daprà on how they are so much more than a robo-advisor. Research & Analysis: Not much to speak of other than a few guides, but that’s ok, as I don’t really want Moneyfarm spamming me with stock trading ideas.

Pros

Cons

Overall5 |

||||

|

Minimum £50,000 |

Initial Fees £0 |

Ongoing Fees 1.1% |

Customer Reviews 4.7

(Based on 85 reviews)

|

Features:

|

JM FINN Wealth Management Review Provider: JM Finn Verdict: JM Finn provides bespoke wealth management services, including discretionary portfolio management, advisory services, and financial planning. JM Finn cater to high-net-worth individuals, families, trusts, and charities looking for long-term investment strategies and financial advice. Is JM Finn a good wealth manager? Yes, we rate JM Finn as a very good wealth manager who offer a high-quality, personalised investment management service that aims to meet the individual demands of today’s private and professional investors. JM FINN won our award for best wealth manager in 2024, 2023, 2022 and 2021. JM FINN also have one of the lowest minimum account opening thresholds with clients being able to open an account from £50,000. Fees: JM Finn’s charges a flat 1.1% annual management fee, based on the value of the assets under management, plus additional charges for specific services. Pros

Cons

Overall5 |

||||

|

Minimum £500,000 |

Initial Fees 0.25%-3% |

Ongoing Fees 0.4%-1% |

Customer Reviews 4.0

(Based on 17 reviews)

|

Features:

|

7IM Wealth Management Review Provider: 7IM Verdict: 7IM provides wealth management, investment management, and financial planning services to individuals, families, charities, and institutions. Their services include discretionary portfolio management, retirement planning, and a range of investment products designed for long-term growth and wealth preservation. Is 7IM a good wealth manager? A good all-round wealth manager for clients with £500k upwards. A simple pricing structure also helps keeps costs low. 7IM has a solid reputation for combining innovative technology with traditional wealth management services. They are known for their client-centric approach and transparent investment strategies. Their use of cutting-edge technology, such as their platform for managing investments, sets them apart in the wealth management space. Fees: 7IM has an initial charge for advice, research and arranging investments which is tiered from 3% to 0.25% f the sum invested as set out below: Up to £300k – 3% 7IM ongoing fees are charged based on a % of the relevant investment funds as per the table below: £300k to £2m – 1.0% Pros

Cons

Overall5 |

||||

|

Minimum £250,000 |

Initial Fees 0.25%-3% |

Ongoing Fees 0.4%-1% |

Customer Reviews 4.4

(Based on 9 reviews)

|

Features:

|

Partners Wealth Management Expert Review Provider: Partners Wealth Management Verdict: Partners Wealth Management provides tailored financial planning and wealth management services to high-net-worth individuals, families, and professionals. PWM specialize in retirement planning, estate planning, tax-efficient investing, and holistic financial advice to help clients meet their long-term goals. Is Partners Wealth Management a good wealth manager? PWM is known for its personalized approach, working closely with clients to create comprehensive financial plans. Their advisers are highly experienced, and the firm consistently receives positive feedback for its attentive service and ability to adapt strategies to individual circumstances. Fees: PWM typically charges fees based on the assets under management and may include additional costs for specific services like financial planning and advice. The exact costs depend on the client’s portfolio and needs, and it’s recommended to consult with PWM for a personalized fee structure. PWM initial fees are charged when opening an account: Up to £300k – 3% PWM ongoing fees are based on client assets under management and scaled as below: £300k to £2m – 1.0% Pros

Cons

Overall5 |

How our wealth manager finder works

1. Find

Tell us what you need a wealth manager for in our interactive questionniar.

2. Choose

Select which wealth managers you would like to compare and connect with.

3. Reviews

Read reviews based on what other people think to help you choose.

As Featured In

❓Good Money Guide Shortlisted Top Rated Wealth Managers Based On:

- Over 30,000 votes and reviews in the annual Good Money Guide awards

- Our team’s experiences evaluating the wealth managers products and services

- In-depth comparison of the features that make these wealth managers the best

- Exclusive interviews with the wealth manager CEOs and senior management

- Find out more about our review process in the How We Test Providers page.

Our review team has had extensive hands-on experience with each company, looking at factors like fees, account charges and investments.

What Is A Wealth Manager? & What Do They Actually Do?

A wealth manager helps you invest your assets in a wide and varied set of investments. They instruct you on the best course of action for tax efficiency in your businesses or handling inheritance as well as sound financial planning for retirement.

A wealth manager’s day to day responsibilities will vary depending upon which type you choose. If you choose a larger, well established firm then your wealth manager may be more like a client manager. These prioritise communication with yourself and other clients and leaves the investment and detail of the work to teams within the organisation.

However, if you choose a smaller wealth management firm you may find that you have more interaction and influence over what happens with your money. They may also be more hands-on with your investments and finances.

Questions you should ask your wealth manager

- Who will be managing my money?

- Who will I be in contact with?

- How much input will I have?

Further reading: Our guide on what to ask a prospective wealth manager.

Many independent financial advisers also offer wealth management services which can help you find the best returns. The finder form here includes both wealth managers and financial advisers who could help you with your needs.

Traditional wealth managers versus digital wealth management platforms

Wealth managers are individuals or companies that help you invest for your future via a tax-efficient pension, ISA or general investing account. In this guide, our team has split the best UK wealth managers into two categories:

- Digital wealth managers: best for small and new portfolios

- Traditional wealth managers: best for larger portfolios

Digital

- Digital wealth managers are also known as robo-advisors and provide online platforms which automate the majority of the services offered by traditional wealth managers.

- However, despite being known as robo-advisors portfolios are managed and run by humans.

- You can invest in a smaller but cheaper range of pre-made portfolios

Traditional

- Traditional wealth managers help you invest large amounts of money.

- They can give you advice on tax, international investments and complex portfolios.

- They’re most suited if you have over £250k to invest.

Wealth Management vs Private Banking

Wealth management is a type of financial management arrangement where a wealth adviser or manager is tasked with taking over your portfolio. They ensure it gains value, is taxed efficiently and you are gaining the most value from assets like property. They can also help you plan your finances for retirement.

Private banking usually involves financial institutions offering select services and products to customers with high net worth or clients they would consider as ‘exclusive’ Different financial organisations will have different thresholds and conditions on who they would consider high net worth individuals and high-value clients.

Benefits for private banking clients could involve better rates, investing advice and access to services faster.

Wealth Management vs Financial Planning

Financial advisors offer advice on investment advice in return for financial compensation. Their services only rarely extend into account management although so do offer more hands-on services.

Financial planners can also advise on things like budgeting, cash flow, saving and investing. Unlike wealth managers, they don’t offer services only to highly wealthy individuals and would be more likely to work with someone whatever their overall financial status.

Wealth Management vs Investment Banking

Investment banking is the arm of a bank responsible for investing assets and creating capital returns on behalf of governments and businesses.

Investment banks are normally subsidiaries of retail street banks like Barclays and HSBC.

These retail banks tend to use 'investment banking' as the coverall phrase to explain their activities in investing.

Some investment banks offer services to clients like investment management and investment ISAs but their services are not as far-reaching as those a wealth manager could give you.

Wealth Manager Charges & Fees

Wealth managers and advisers will normally charge you a fee as a percentage of the total value of the assets they will be managing.

Depending upon the experience, expertise and specialisms of the wealth manager this could be anywhere between 0.5% – 2.0%.

Some also charge a commission on top of the fees, which is a percentage of the return investments that the wealth managers are responsible for will take.

This will generally be lower than the actual fees and could even drop if you invest larger amounts with them.

What Changes In Your Finances Wealth Managers Can Help With?

You may have come into money quickly perhaps via an inheritance, investing or trading or perhaps you’ve received a windfall through a large bonus from work.

Whatever the reason, if you’ve got access to a large amount of money at one time it may be something you feel you need help with. A wealth advisor could offer viable strategies and options to help you earn the best returns on your money while being a single point of contact for you to liaise with.

If that’s the case, calculate how much you have available to invest and in what forms before you get a quote.

-

Tax Planning With A Wealth Manager

Finding ways to reduce your outgoings earned from assets or from investing is one way to ensure that your investments are worth more to you over time.

If you have a varied and diverse portfolio including traditional stock market investments, property and business interests it can be both complex and time consuming to ensure that your tax affairs are as efficient as possible.

You might find that a wealth manager is the simplest solution to your problem and that the tax savings they can offer you are worth more to you over time than the fees they charge. A wealth manager could work with your accountant in your business and utilise tax-efficient investments like your pension to unlock tax relief in financial years to come.

If you're older, they could also help insulate your taxable estate assets as much as possible from tax for beneficiaries. -

Consolidation Or Expansion Of Several Financial Accounts

If you're a self-managed investor and have been active for some time, you may have active accounts with several different services and with many brokers. Using multiple brokers can end up becoming difficult to manage.

Difficulty may arise if you are manually and personally trying to keep track of every investment in each account. It could also mean higher costs overall by keeping your investments separate over consolidating them together.

You may find that it is substantially cheaper and more time-efficient to find a wealth manager who can take over and consolidate investment activities.

This could be especially true if you have assets outside of traditional financial investments to look at too.

A wealth manager could help you to achieve this consolidation and ensure that it is done so both quickly and cost-efficiently. -

Retirement Planning With Wealth Management

Retirement planning can be complex but a wealth manager could help you strategise your retirement in advance and ensure that you have a strategy to unlock the value in your assets efficiently and in a timely way to last throughout your retirement years.

A good wealth manager can help you to;

- Understand how much you will need to maintain your lifestyle into retirement - Ensure tax efficiency on your pension balance - Manage and consolidate savings, investments and more towards your pension pot - Locate and consolidate your forgotten pensions held by multiple providers - Take a steady income throughout your retirement so you can maintain your standard of living - Explain retirement options for your income after you stop work

Retirement can be a time when you have the opportunity to access the most money all at once than ever before. Getting the advice from an expert in advance of and during this critical process can help ensure that you are in the best possible position when you can retire. -

One-Off Advice From A Wealth Manager

One-off wealth management advice can help many people improve the overall health of their assets and finances.

A wealth manager or adviser may be able to help you reduce your taxable income if you have completed a tax return and are facing a bill larger than you expected.

An independent financial adviser may be able to help you identify suitable investments to take on if you have suddenly come into some additional capital, through inheritance or via other means.

You can usually find wealth managers or financial advisers who can work with you on a one-off basis or advise or manage your wealth until it is safely invested on your behalf.

The arrangement of payment for the services of your wealth manager will vary depending upon your needs but many are usually willing to work for a one-off fee.

UK Wealth Manager FAQs:

JM FINN, Partners Wealth Management and 7IM are all well-established wealth management firms. Wealth management services are also offered by some investment platforms like Hargreaves Lansdown but are also available from smaller and more localised firms and professionals. Complete our request a callback for to compare the wealth managers we have interviewed, reviewed and compared.

We have ranked JM FINN as the best wealth manager in 2023. You can choose the best wealth manager for your needs by comparing multiple quotes and services in our wealth manager comparison tool. Good Money Guide can help you obtain quotes from multiple wealth managers by completing one form with some details about the services you require.

Wealth managers make money by charging an upfront fee for managing your money or by charging an annual fee based on the investments they manage for you. Fees and charges will vary by wealth management firm and depending upon the size and composition of your portfolio.

Unless frequent face to face meetings are very important to you selecting a wealth manager by comparing only those closest to you may mean you miss out on the best service and ultimately the best performance and returns on your assets.

We compare some of the best known and most well-recognised wealth managers in our comparison table. They are all authorised and regulated by the FCA and can provide personalised quotes upfront based on your needs and to allow you to check them against each other.

A number of brokers such as Freetrade offer commission-free trading. However, it’s important to be aware of other costs. Freetrade, for example, charges £3 per month for its Stocks and Shares ISA and £9.99 per month for Freetrade Plus (which offers access to more investments). It also charges FX fees of spot rate +0.45% on international shares.

In terms of investing in funds, some brokers such as Hargreaves Lansdown allow you to buy and sell funds commission free. However, these brokers generally charge an annual custody charge on fund investments. Hargreaves Lansdown, for example, charges 0.45% per year on fund holdings up to £250,000.

Yes, you can look at performance tables and results of their team of fund managers if they represent a larger organisation.

Checking the past performance of smaller wealth manager isn’t easy though. As their activities take in such a wide-reaching approach to wealth creation that gaining specific insights can be very difficult. However, they should be able to provide you with some indication of their historic success stories and client testimonials.

How do you keep in touch with your clients?

It wouldn’t be wise to choose a wealth manager on the assumption that you will have a weekly face to face catch up with them if they are unable to offer this or only deal with clients over the phone after an initial introductory meeting.

What are the services do you offer?

One question you will want to ask is whether wealth managers offer the right services to suit your needs. It would be pointless signing up the services of a wealth manager without first ensuring that the services they offer meet your specific needs.

Is it Clear What I am Looking for and Want You to Take on?

While bringing on an expert to help you can be beneficial in helping you to find new perspectives on personal wealth generation you also need to make sure that the wealth manager you choose fully understands your outlook.

If you are looking for long term returns through property investments and short term gain with steps to keep business taxation affairs efficient but your wealth manager focuses on investing as the primary strategy, neglecting the methods you see as important, then you may find you wish to switch to another sooner.

Be clear on your aims and goals upfront and ensure that you ask them about their preferred areas of expertise and focus.

How much do you charge & what is your pricing model?

You will need to be completely clear on pricing upfront, as this will help you better compare wealth managers that can help you.

Understanding whether wealth managers operate on a flat fee or commission-based payment model will also help you to understand which offers the best value for money based on the overall value of your portfolio.

Pricing, how often you are charged and what forms of payment they accept is something that wealth managers should be clear on with you upfront.

Wealth managers will normally have a minimum value or fund that they are willing to take on. You should check what this is when making contact with potential managers. If your net worth is lower than they normally work with, other services may better suit your needs.

Wealth Management CEO Interviews

Wealth Management Guides

Saltus stands out in the UK wealth management industry by blending personalised financial planning with a sophisticated investment approach more often found in institutional circles. Founded in 2004, the firm manages over £7.5 billion in assets and holds Chartered status for its financial planning division, reflecting high standards in advice.

Saltus stands out in the UK wealth management industry by blending personalised financial planning with a sophisticated investment approach more often found in institutional circles. Founded in 2004, the firm manages over £7.5 billion in assets and holds Chartered status for its financial planning division, reflecting high standards in advice.

For years people have been trying to make investing interesting, but it’s not, it’s dull. Trading is fun, high-risk, fast, dangerous and like sprinting. But, like trying to run too fast, especially when you hit 40, you’ll probably injure yourself just as in trading, you’ll probably lose money.

For years people have been trying to make investing interesting, but it’s not, it’s dull. Trading is fun, high-risk, fast, dangerous and like sprinting. But, like trying to run too fast, especially when you hit 40, you’ll probably injure yourself just as in trading, you’ll probably lose money.