Crypto staking allows investors to earn rewards by participating in the validation of transactions on a blockchain network. Choosing the right exchange is crucial for maximising staking benefits. But as with all cryptocurrency investing it is risky and there is chance you can lose all your money.

| Name | Logo | GMG Rating | Customer Reviews | Staking Crypto | Rewards | CTA | Feature | Expand | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 3.3

(Based on 3 reviews)

|

Staking Crypto 128 |

Rewards 15% |

Features:

|

Coinbase Expert Review: Safety in numbers of a listed crypto exchange Provider: Coinbase Verdict: Coinbase is a cryptocurrency exchange that lets you buy and sell various cryptocurrencies like Bitcoin, Ethereum, Cardano and Solana. Coinbase was listed on the NASDAQ exchange in 2012 and claims to have over 273 billion assets on account in over 100 countries and process $185 billion in quarterly volume. Is Coinbase good for Crypto investing? Coinbase is one of the largest cryptocurrency exchanges with over 100 million users and is publically listed on the NASDAQ exchange (COIN). It offers access to large selection of cryptocurrencies that can be traded on it’s crypto exchange or withdrawn to a cryptocurrency wallet. Coinbase is a little more sophisticated than eToro. Yet it’s still easy to use thanks to its clean interface. And there is a wide range of crypto-assets available to investors. As with eToro, you can invest in Bitcoin, Ethereum, Cardano, and many other digital assets. On the downside, Coinbase has a slightly more complex fee structure. When buying or selling crypto, the cost of the trade is calculated at the time you place your order and is determined by several factors including your location, the size of the order, the selected form of payment, and market conditions such as volatility and liquidity. Overall though, the platform is quite well suited to beginners. It’s worth noting that earlier this month, Coinbase won approval from the UK’s FCA as a registered virtual asset service provider (VASP). Pricing: It’s expensive, when Iwas testing the app I bought some Bitcoin to test the app, I was charged over 3% in commission, that’s far more than eToro who at the moment only charge 1%. But having said that, I did double my money as Bitcoin had a bit of a rally after my original review, so it’s not all bad, if it goes up that is… Market Access: Coinbase offers the most cryptocurrencies compared to other exchanges, which makes them a great venue if you are interested in spreading your risk or looking for more volatile cryptos with a higher risk/reward ratio. App & Online Platform: No complaints here, just does what it’s supposed to. No stand out features or research though. Customer Service: Pretty good. I had a question, they answered it. Sorted. Research & Analysis: No research on the app, but then again, brokers only provide research to get people interested in markets and I don’t think I’ve had a conversion about money in the last 12 months that hasn’t included crypto in some way so no stimulus needed. One thing I do like about Coinbase though is that it’s a US company listed on the NASDAQ so in theory, if there are any problems with it that should be reflected in the share price.

The test: Why should investors be more cautious when investing in crypto assets with Coinbase I knew I should have sold when Bitcoin reached $100,000! When I reviewed Coinbase back in July last year, I some bought Bitcoin and Ethereum to test the app, and then forgot all about it. As Bitcoin has reached record highs, it jogged my memory and I was delighted to see when I logged back in that it’s now worth double. But I still think cryptocurrency is an imaginary asset and should be treated with extreme suspicion, here’s why. I don’t really like crypto as an investment, I think it’s daft. Yes, there is money to be made from crypto, but not necessarily if you are investing in it. Yes, some will make huge amounts from exchanges like Coinbase, and they will be the most vocal about the merits of digital currencies as an asset class. But no, not everyone or even the majority will make money. However, it it fairly undeniable that Bitcoin is now mainstream and that as major funds start buying it and it becomes easier to trade on regulated stock exchanges it does have a place in most people’s portfolios. But it’s the hype that is driving crypto prices, rather than the use case. The young though are taking massive risks and dangerously putting all their eggs in one baskets. And most worryingly being heavily influenced by people ramping crypto prices and coins on social media. The mentality of following the herd is not new, two decades ago when I first started out as a stockbroker it was mining and oil stocks. Companies would raise money on the stock market from people buying new shares to drill a hole in the ground. If they struck gold or “black gold” the share price would go through the roof, but if they didn’t it would be worthless. Then it was tech stocks, same story, The City filled their boots as it wasn’t really about what the company was worth or even if they made any money, it was about how many people were buying them, and what the perceived future value could be. Then carbon credits, which although a real thing, crooks in call-centres in Spain basically made up to cold-call and pressure sell investors into buying them on the basis they would be worth more in the future. All very Wolf of Wall Street, it wasn’t even stuffing people into an investment for high commissions it was just lying and stealing money.

Next came binary options, which I actually quite liked as they were a form of limited risk short-term bet on the movement of a market. In theory, the perfect way to day trade. The market is either going to do one of two things during the day, go up or go down, so you just placed a bet on what you thought was going to happen and your risk was capped based on your stake. This I felt was slightly safer than CFDs and spread betting because with those your potential losses are unlimited (or were at the time before negative balance protection and leverage caps). Plus one of the major mistakes that traders make is not cutting their losses (another is banking profits too soon). But the problem with binary options wasn’t the product it was the fact that they were not regulated by the FCA. Reputable firms in the UK did offer them in a regulated environment to their customers, but, then, the carbon credit scammers moved on to binary options, and set up basic platforms without hedging any underlying risk and stuffed punters full of welcome bonuses and “trade ideas”, again just lying and stealing. So, now that binary options have been banned, where have the scammers gone? Crypto, that’s right. But then, the FCA’s in their ultimate wisdom, decided to ban retail traders in the UK from trading through spread bets and CFDs. Now clearly in some respects, this was a good thing because trading a product on leverage which has price moves of 50% a day is clearly very high-risk and will almost definitely result in high financial losses for the majority of people that trade them. But what happened, was that because the FCA didn’t want to take responsibility for regulating crypto, it was binary options scams all over again. Honestly and with no hyperbole, I have just received a call on my mobile whilst writing this review from a Germany number asking me “how my investments are performing and if I’d heard of crypto”. I get these at least twice a day. I don’t even bother answering my phone anymore. But, if there is a market, people are going to want to trade it and you just have to look at any analytics to see that crypto is what people want to invest in and trade. As it becomes a more regulated financial asset, it will become safer to buy and hold, but not nesseicarly as an investement. The FCA is taking steps to regulate providers to ensure that customers are treated fairly, but you still don’t get FSCA protection. If you want to buy cryptocurrency you have two options really, you could go with a provider like eToro or Revolut, who are regulated by the FCA for other products or you can go with one of the massive VC backed crypto exchanges. I used Coinbase, but it isn’t the cheapest though as when I did some test trades the fees were 3.84% for buying Bitcoin and Ethereum compared to eToro’s 1% and Revolut’s 2.5%. Coinbase does offers the most cryptocurrencies to trade though, 150 versus 120 and 30 respectively. Coinbase is at least a public company so you can keep an eye on their finances to see how likely it is they are going to go bust. Coinbase is currently traded on the NASDAQ and at the time of writing worth $14bn, (although the share price is down 85% since they IPO’d in April 2012). eToro and Revolut are still private companies (not for the want of trying to IPO mind). I’ve traded crypto as a derivative before it was banned (although you can still trade crypto with a professional account), I’ve traded $50m clips of FX, worked £10m positions when trading stock CFDs, but oddly enough, I felt more nervous when depositing £500 into Coinbase to buy some Bitcoin for that review. I even used my secondary bank account, because I did’t want the transaction on my main personal account, just in-case when we came to re-mortgage “the computer says no” because they viewed me as some sort of crypto bro. I’m still not sure about crypto, but this shouldn’t really be about crypto it’s about Coinbase, after all they are just giving people what they want. They are not forcing anyone to buy crypto (Twitter, Youtube and Instagram do that), they are just making it easy. And it is easy, it’s an incredible piece of tech, like Betfair was to gambling and what the LSE was to share trading, if you want to trade it you can. But it’s still in it’s infancy as a regulated product and so as an “investor” you are not protected if anything goes wrong. Coinbase say they provide FDIC insurance if someone hacks them and nicks your crypto (up to $250k), but this doesn’t cover you if you get hacked, or Coinbase goes bust. Unlike buying stocks in the UK where you are covered by the FSCS and shares and investments are held in nominee accounts in a very well-established and highly-regulated banking infrastructure. In the immortal words of Mark Corrigan,

If you want to have a punt on crypto, you pays your money, you takes your chances, caveat emptor. Pros

Cons

Overall4.4 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Staking Crypto n/a |

Rewards n/a |

Features:

|

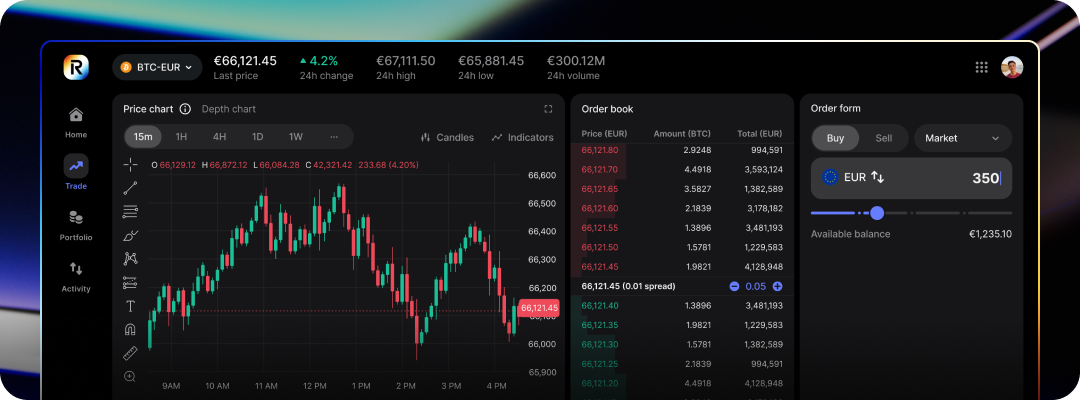

Interactive Brokers Cryptocurrency Trading Expert Review Account: IBKR Crypto Trading Description: Interactive Brokers, offers cryptocurrency trading for its UK clients through Paxos that allows individuals, institutional investors, and financial advisers, to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). This is in addition to other more traditional investment products, such as stocks, options, futures, currencies, bonds, funds, and ETFs. All from a single unified platform. Is Interactive Brokers Good For Crypto Trading? Interactive Brokers has partnered with the Paxos Trust Company, a New York-based regulated trust company and custodian with expertise in digital assets, securities and payments, to provide cryptocurrency brokerage. Interactive Brokers’ UK clients will have a unified view of their IBKR securities brokerage account and their crypto account at PaxosTrust Company. This means clients will be able to manage their cash, trade cryptocurrencies, and invest in other asset classes, all from a single trading screen. Gerald Perez, Chief Executive Officer at Interactive Brokers (U.K.) Limited said of the new service: “Interactive Brokers offers a wide selection of global investment products, sophisticated technology and competitive pricing,” He added “Introducing cryptocurrency trading gives UK clients enhanced flexibility to invest across markets and asset classes while also adding exposure to digital assets.” Platforms for newbies and pros There are two types of crypto account for UK traders on Interactive Brokers Basic Crypto lets you trade and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin through the IBKR platform. There are no additional or separate funding transactions are required and IBKR handles all required cashiering for you automatically, and unvested cash is always kept in your IBKR brokerage account. Crypto Plus lets you fund your crypto account, trade using non-marketable limit orders, and enjoy 24/7 trading. You will be able to hold USD in addition to cryptocurrencies in a dedicated Paxos account with access to 24/7 trading and place non-marketable buy limit orders. With Crypto Plus, all trading of crypto will require prefunding of your dedicated Paxos account and you will be responsible for managing all fund movement between your IBKR brokerage account and your Paxos crypto account. You can also trade crypto immediately when you transfer funds to your dedicated Paxos account during normal US banking hours. I opted for Basic Crypto so my cash would stay with IBKR rather than a third party, as I prefer to know who I’m dealing with. To enable crypto investing permissions on IBKR you have to complete a fairly basic questionnaire to prove that you understand the risks involved, which only takes a few minutes. You also have to prove that you are a sophisticated or professional investor. And then, just to be double careful, you’re not getting a severe case of FOMO, you have to wait 24 hours before you are able to buy cryptocurrencies on Interactive Broker (this is a regulatory requirement introduced by the FCA in 2023).

Overall, Interactive Brokers continues to be one of the cheapest places to trade anything. You can see in the below cost comparison below Coinbase and eToro execution costs are very low.

There are several benefits to trading crypto on IBKR: Consolidated platform: Clients can access a wide range of global investment products, including cryptocurrencies, on a single sophisticated trading platform, eliminating the need for multiple platforms. Competitive pricing: Cryptocurrency commissions are low at 0.12% – 0.18% of trade value, depending on monthly volume, with a minimum of $1.75 per order. There are no added spreads, markups, or custody fees. Currency conversion: Clients can convert GBP or other currencies to USD (the denomination for cryptocurrencies on the platform) at tight spreads as low as 1/10 of a PIP. Efficient portfolio management: Financial advisers can easily allocate a percentage of client assets to cryptocurrencies and manage their clients’ portfolios more efficiently. However, it’s important to note that cryptocurrency is still a very high-risk investment and even tough the costs of trading are lower, there is a high possibility that crypto could become worthless. Interactive Brokers (U.K.) Limited is registered with the Financial Conduct Authority as a crypto assets firm under the relevant regulations. Pros

Cons

Overall4.8 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 3.3

(Based on 7 reviews)

|

Staking Crypto 30 |

Rewards 14.86% |

Features:

|

Crypto.com UK Review 2026: Low Trading Fees and GBP Cryptocurrency Trading Provider: Crypto.com Verdict: Crypto.com offers a broad crypto trading experience with competitive maker-taker fees and a wide GBP market selection, avoiding FX charges. The app is easy to use with limit orders and curated baskets like Blue Chip Tokens for diversification. However, customer support is largely automated, research tools are limited, and fees rise quickly after free deposits. Summary Pricing – There is a 2.99% fee for using a credit or debit card to deposit funds which is quite steep. You can use Open Banking but only with ClearBank and BCB. There is also a withdrawal fee of £1.90 with a minimum amount of £70. A maker-taker model applies so if you are providing liquidity through limit orders your rates will be lower than if you are dealing at market. Crypto commission rates typically start from 0.25% to 0.08% for makers and 0.5% to 0.18% for takers. If you join the Level Up program, and pay a monthly subscription you can get these trading fees reduced and earn 1.5% cash on deposit too, but rates are higher than that in the bank. Market Access – You can trade around 150 cryptocurrencies in GBP, which is great because you don’t get stung with USD FX charges where you are required to convert GBP into USD. You can also trade crypto baskets, which is a collection of cryptocoins all lumped into one. For this review, I bought £100 worth of the Blue Chip ETF Tokens baskets, which is mainly Bitcoin with a few others added in like Ethereum, Solana, Cronos and Ripple. Mainly because I like diversification, and I’m only buying crypto for the sentiment value and that basket was the best performing over a year, and judging from the charts on Crypto.com seems to consistently outperform Bitcoin over 3 months, 6 months and a year. You can also set the basket to rebalance to keep the ratios right.

App & Platform – Crypto.com’s website is simple to use, almost too simple if I’m honest, I’d like to see more bid/offer spreads on the pricing pages. The Crypto.com app is better as you can work limit orders (as opposed to just market, so it’s cheaper). Customer Service – As far as I found the support is mainly a bot, which did answer my questions quickly. When I asked the customer service bot about this it couldn’t quite understand the question. There is no telephone number, which is not surprising for a crypto exchange. Research & Analysis – On the crypto.com app there is an “Insights” tab, which is not available on the website, which gives you crypto news as well as signals. Where you can trade from the feed, however, I’d take those with a pinch of salt and do your own research before deciding what to buy and sell. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Pros

Cons

Overall4.2 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 1.0

(Based on 2 reviews)

|

Staking Crypto 21 |

Rewards 21% |

Features:

|

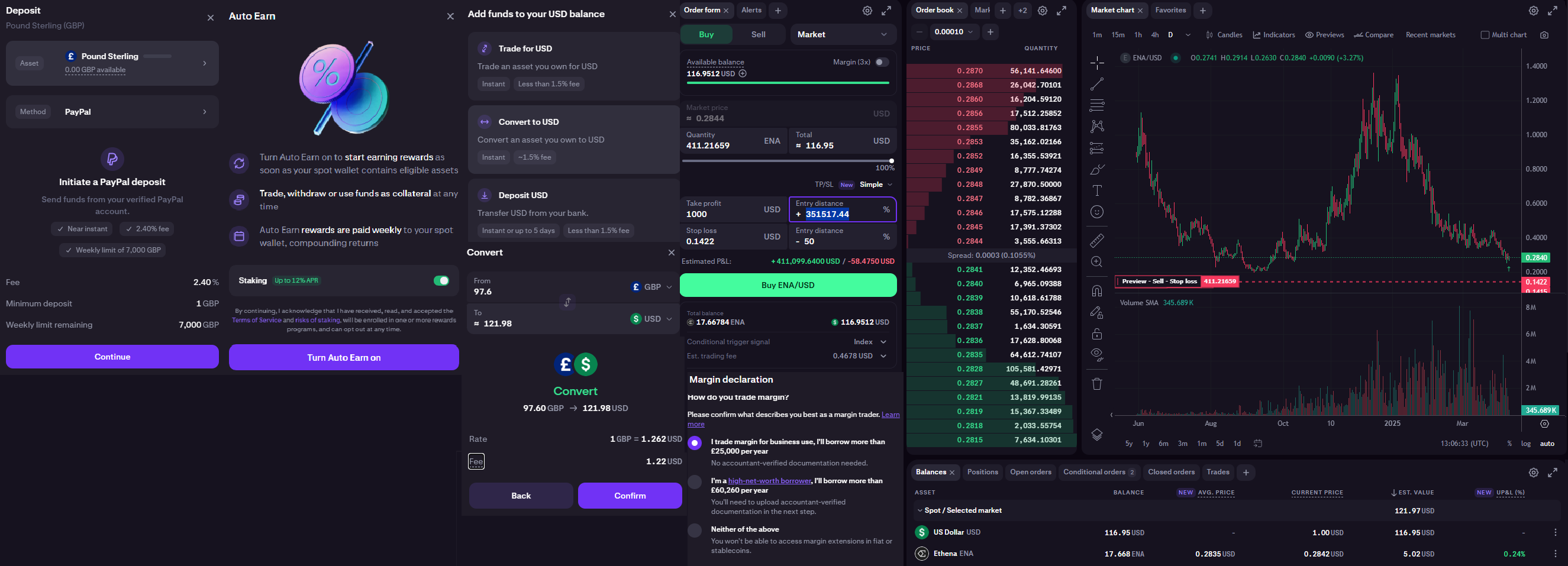

Kraken Pro Expert Review: TikTok Testing & Trading Provider: Kraken Verdict: Kraken is one of the world’s largest cryptocurrency firms and recently launched a “Kraken Pro” platform. When you’ve signed up to Kraken, you can access Kraken Pro with no extra charges. The new Kraken Pro trading platform brings all of the firm’s services together in one place. It is designed to be accessible to all traders, be they retail, professional or even institutional clients. Is Kraken Good for Cryptocurrency? The Test: For now, this is a quickfire test of just the Kraken Pro platform because I have spent all day testing crypto platforms and I’m knackered.. I think my bank would be a little concerned if I used my account for any more crypto deposits today, so I’m funding my Kraken Pro account via PayPal, which comes with a 2.4% fee, but that’s OK because I’m only putting in £100. You’ll see why in a minute. If you are depositing more, it would be sensible to use Plaid Open Banking, because it’s cheaper. I opened my Kraken account years ago, so I didn’t have to wait for the 24-hour cooling off period. Whilst I waited for my funds to be processed, I turned on the Auto Earn options. This means that whatever eligible crypto I own, I can stake it automatically (and also use it as collateral) and earn rewards of up to 12%, which are paid weekly. If I’m honest, I’m unconvinced by the whole “crypto as an investable asset class” idea because I think crypto is mainly driven by sentiment. But that doesn’t mean there is opportunity. So when deciding what cryptocurrency to buy on Kraken (there are over 300 of them) I turned to the most rampant ramping source possible, TikTok. I Googled how to search for the most popular cryptos on TikTok and the first video was of a teenager very convincingly talking about the best cryptos to buy during a market crash. I decided to follow his first tip – Ethena. He was going through his “top picks” with “massive discounts right now” but didn’t say what discount it was or even what the fiat value should be. But as he has 1.2 million followers I assumed that some other people may be listening to him and also buying the same coins. Which would mean that sentiment may drive them up. The first one he mentioned was Ethena at an apparent 73% discount. Which looked like it had been ramped towards the end of 2024 but was now trading on what technical analysts would call “support” although I don’t think that is necessarily relevant here. But first I’d have to convert my GBP into USD, which is instant, but comes with a 1.5% ($1.22) fee. So my £100 is now $121.98 which at the GBP-USD mid-rate of 1.2804 is £78.10. So I’m already down 22%, and I haven’t even lost any money on crypto yet! This is because of the conversion rate that Kraken applies, as crypto is generally priced in USD. There are quite a few order options when you buy, which is great if you’ve got size but I don’t so it’s pointless working an iceberg, which pecks away at the market bit by bit of setting a limit below, so I just went balls in at the market. But not that deep because I put a stop loss in 50% below. I have zero expectations of this growing gradually, but rather hoping for some sort of social media pump and dump to drive it higher so put my take profit in 350,000% higher, hoping to nick $1,000 profit if that happened. Either way it meant I didn’t have to add Ethena to any watch list to keep track of it. 🤞 You can actually trade that coin on 3x margin, but I’m not daft enough for that. T-20 trading AIM stocks was fun enough and at least they had fundamental value, well some of them at least. I think when it comes to crypto, you pays your money, you takes your chance. What Does Kraken Pro Look Like?

What is Kraken Pro Like to Use? You can configure Kraken Pro, customising the layout to suit your trading style, using the platform’s trading and data modules as required, inside the drag-and-drop desktop interface. Kraken Pro’s functionality is more suited to experienced users. You can also switch seamlessly between trading and staking products and services. You can track and monitor all of your positions and performance from one clear and consolidated portfolio view. All of which is powered by real-time data. The platform allows you to search for the top gainers and losers and the most actively traded and newly listed cryptocurrencies. That comes alongside a dedicated charting package that lets you compare four markets simultaneously and apply a range of indicators to those instruments. At the same time, you can monitor live order books and stream time and sales data to keep up to speed with market trades. Kraken Pro’s user interface is intuitive to navigate around and use. You can drill down to surface a token or coin from the platform’s markets view, which displays a heat map of the available asset classes. So, for example, clicking on the heatmap icon for layer 1 protocols brings up tokens such as NEAR. Clicking on that icon brings up a chart and an order entry box, alongside the order book in the NEAR/USD pair. There is a series of how-to guides and walk-through videos. As well as information on order types and dedicated API documentation. Kraken also prides itself on answering and attempting to resolve support queries quickly. Who is Kraken? Kraken was founded in San Francisco back in 2011. The firm operates in more than 190 countries and is regulated in various jurisdictions, including the US, UK, Canada, Australia and Europe. Kraken is one of a select group of businesses authorised by the UK Financial Conduct Authority (FCA) to offer cryptoasset services in the UK. Kraken offers trading in more than 300 individual cryptocurrencies and crypto pairs. Kraken’s trading volume in 2024 was more than $207 billion and it has more than 9 million unique clients. Despite recent market volatility, cryptocurrencies seem to be enjoying a new lease of life, and there is growing interest among both professional and retail traders. That is perhaps driven in part by a change of heart among US regulators and moves by the White House to establish a US national cryptocurrency reserve. It may take some time for that thaw to spread across the Atlantic, but dedicated cryptocurrency enthusiasts haven’t ever paid much attention to national borders. Kraken UK FCA-Authorised as an Electronic Money Institution Kraken was one of the first crypto exchanges in the UK to offer GBP-BTC trading, in 2014, and has been authorised as an e-money institution by the UK’s FCA. Whilst this doesn’t mean you get the same protections as if you were buying shares on a stock exchange, it does mean that Kraken is one of a handful of Bitcoin brokers that the regulator has deemed responsible enough for UK crypto investors. It’s worth noting, though, that crypto is largely unregulated in the UK. Kraken currently offers 300+ cryptocurrencies in the UK and hopes to make it easier than ever for the 7 million crypto traders in the UK to invest in digital assets. In early 2025, Kraken received a MiFID regulatory licence to buy and sell crypto derivatives within the European Union (EU). The cryptocurrency exchange gained the licence through buying a Cypriot investment firm which had recently received the licence from the Cyprus Securities and Exchange Commission (CySEC). The move allows Kraken to offer crypto derivatives products to traders resident in the 27 EU countries, aiding its plans to expand across the continent. The buyout came after Kraken had acquired Crypto Facilities, a UK FCA-registered crypto futures platform, in 2019. The acquisition of the new licence follows the firm’s launch of Kraken Pay in January 2025. This service allows users to send payments internationally using more than 300 cryptocurrencies and fiat currencies. In December 2024, rival exchange Coinbase enabled Apple Pay, allowing for immediate conversions between fiat currencies, such as dollars and pounds, and cryptocurrencies. FCA data shows the percentage of people in the UK who own some crypto rose to 12% in 2023 from 10% in 2022. The average value held rose from £1,595 to £1,842 over the same period. In 2024, the financial watchdog reiterated its rules against selling cryptocurrency derivatives such as exchange-traded funds (ETFs) to retail investors in the UK. Pros

Cons

Overall4.5 |

||||||||||||||||||||||||||||

|

GMG Rating |

Customer Reviews 4.6

(Based on 511 reviews)

|

Staking Crypto 11 |

Rewards n/a |

Features:

|

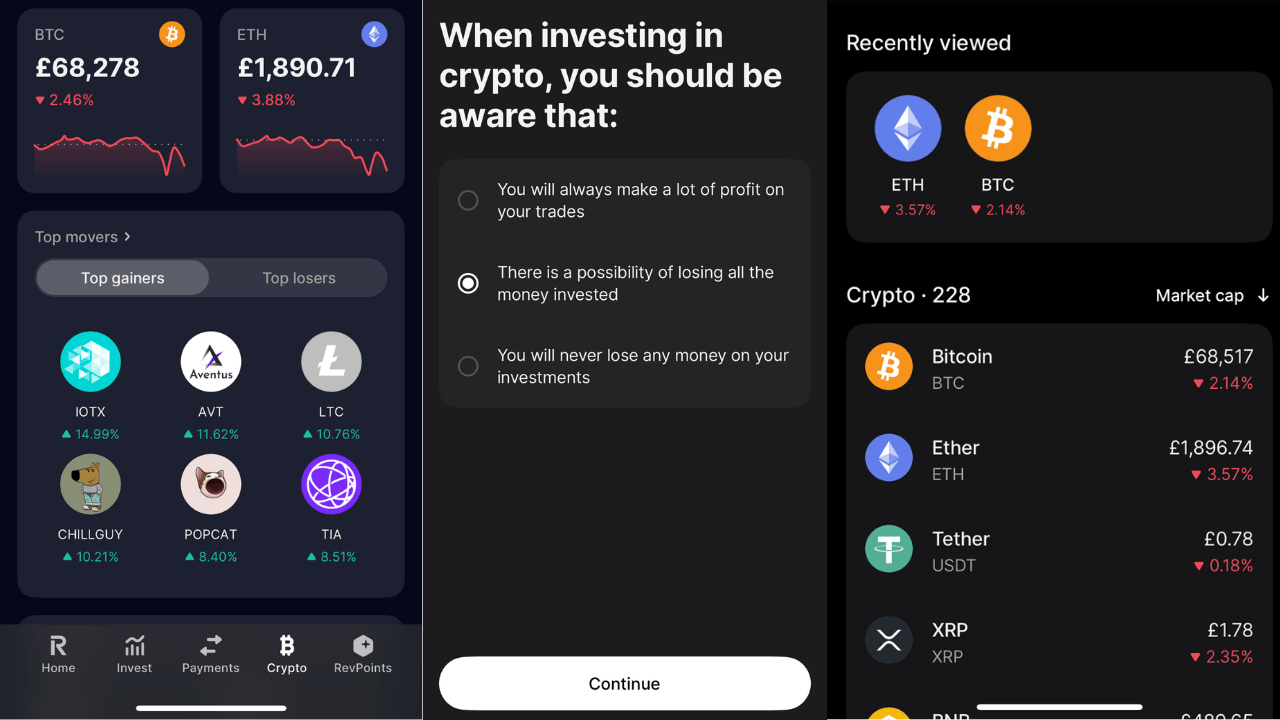

Revolut Cryptocurrency Review: Banking and digital assets all in one Account: Revolut Cryptocurrency Investing Description: Revolut X lets you trade crypto on a stand alone app. As Revolut is now a bank more than a crypto exchange, its app is a good way to dabble in the crypto markets if you just want to buy a small amount of the most popular cryptocurrencies. Capital at risk Is Revolut good for cryptocurrency investing? Revolut is a good choice if you are just dabbling in cryptocurrency and don’t need anything too complicated. Market Access: Revolut X lets you trade 400+ pairs to trade in real-time with USD, EUR, or GBP with instant visibility of how your portfolio is performing and decide your next trade with token details and a live order book. On the baking app you can buy, sell, and send over 228 digital currencies at the touch of a button, with no hidden fees. But, Revolut’s cryptocurrency service is not regulated by the FCA in the same way as investing in the stock market. As you will find out when you take the “how well do you understand crypto” quiz when you try to buy cryptocurrencies on the app. App & Online Platform: It’s pretty easy to buy crypto on Revolut, it took me about 3 minutes to login, acept the terms and conditions that I may lose all my money and buy some Bitcoin and Ethereum. If you want to know which is best, we’ve just written a guide on Bitcoin versus Ethereum. However, it’s a bit annoying that it’s app only and you can’t use it on a laptop or desktop. If you are trading crypto on Revolut X it is also available on desktop if you want to see more detailed market analysis. You’ll find technical indicators, TradingView charts, and top-traded, top-gaining, and top market cap coins.

Revolut Fees: Versuse eToro & Coinbase For Crypto Revolut X does not charge if you are a (taker) selling, but there is a 0.09% charge if you are buying (making). The difference is based on if you are making or taking liquidity from the exchange. Revolut has recently reduced it’s commission for buying and selling cryptocurrency for trades above £20,000 from 1.49% to 1.29%. From 24 March 2025, Revolut has also removed the minimum trading limit, so you can now make trades below £1.49. In real-terms that means if you bought £100k worth of Bitcoin it would save you £180 compared to the previous pricing structure. It’s a decent saving. but won’t really make a difference, especially as if you buy £100k of one of the most volatile digital assets in the world the price will probably have changed by that much before you have read your confirmation notification. Fees are pretty high, if you are just buying a small amount. To test the app, I bought £200 worth of each I was charged a whopping £2.98, which is 1.49%. That’s very high compared to buying share,s which are largely commission-free these days. However, Revolut has recently reduced their crypto commission for trades above £20,000. It’s not as cheap as eToro’s 1%, but it’s certainly a lot cheaper than Coinbase.

Customer Service: Obviously, there is no phone number (Revolut has far too many customers for a call centre to handle), and no in-app live chat feature, but there are direct links if you need to report any fraud or banking issues. Research & Analysis: You get access to some fairly standard articles and news feeds on crypto but nothing unique. There are links to the cryptocurrencies official websites and the white papers, so you can do your own more thorough research.

Pros

Cons

Overall4.3 |

What happens when you stake your digital assets on a crypto exchange?

When you stake your crypto-assets on a crypto exchange, you lock them up to support a blockchain network’s operations, such as validating transactions or enhancing network security. This process is typically associated with Proof of Stake (PoS) blockchains like Ethereum, Cardano, and Solana. On the exchange, you select a staking program for a supported cryptocurrency. Your assets are then locked for a specified period, or in some cases, they may be available for flexible staking.

While staked, your assets contribute to the network’s functionality, and you earn rewards, usually in the form of the same cryptocurrency. Rewards depend on the amount staked, the staking duration, and the network’s reward rate, often expressed as an Annual Percentage Yield (APY). However, staking involves risks. The locked funds are illiquid, so you cannot access them during the staking period.

Additionally, if the crypto’s price drops, the value of your stake decreases. Some networks also implement penalties, known as slashing, which could result in losing a portion of your stake due to validator errors. Crypto exchanges simplify staking by managing technical details and pooling user assets but charge fees for the service. Despite the risks, staking is a popular way to earn passive income from idle crypto holdings.

Cryptocurrency Exchanges For Crypto Staking Compared

Here are some of the top crypto exchanges available to UK residents that offer staking services:

1. Kraken

- Overview: Kraken is one of the longest-running platforms in the industry, known for its robust security measures and a wide range of supported cryptocurrencies.

- Staking Features: Offers staking for various cryptocurrencies with competitive yields.

- Pros:

- 200+ supported coins.

- Low fees for active traders.

- High-quality educational guides and tools.

- Cons:

- Some trading features unavailable to UK users.

- High fees for credit and debit card purchases.

2. Coinbase

- Overview: Coinbase is a user-friendly platform ideal for beginners, offering a range of cryptocurrencies and staking options.

- Staking Features: Provides staking for cryptocurrencies like Ethereum (ETH), Cardano (ADA), and Solana (SOL).

- Pros:

- Easy-to-use interface.

- Educational resources for beginners.

- Secure storage options.

- Cons:

- Higher fees compared to some competitors.

- Limited customer service options.

3. Uphold

- Overview: Uphold is a multi-asset platform allowing users to trade cryptocurrencies, stocks, and precious metals.

- Staking Features: Offers staking for over 30 cryptocurrencies with varying annual percentage yields (APYs).

- Pros:

- Supports a wide range of assets.

- User-friendly interface.

- Crypto debit card with rewards.

- Cons:

- Higher spreads compared to some exchanges.

- Limited advanced trading features.

4. Crypto.com

- Overview: Crypto.com offers a comprehensive suite of crypto services, including trading, staking, and a crypto debit card.

- Staking Features: Provides staking with competitive interest rates, depending on the cryptocurrency and lock-up period.

- Pros:

- Extensive range of supported cryptocurrencies.

- Additional features like an NFT marketplace.

- Competitive fees.

- Cons:

- Complex fee structure.

- Customer support can be slow during peak times.

5. Gemini

- Overview: Gemini is a regulated cryptocurrency exchange known for its strong security measures and user-friendly platform.

- Staking Features: Offers staking for select cryptocurrencies, allowing users to earn rewards on their holdings.

- Pros:

- High-security standards.

- Intuitive mobile and web applications.

- Educational resources available.

- Cons:

- Limited selection of staking options.

- Fees can be higher than some competitors.

When selecting a crypto exchange for staking, consider factors such as the range of supported cryptocurrencies, staking rewards, fees, security measures, and the platform’s reputation. Always conduct thorough research to choose the platform that best aligns with your investment goals and risk tolerance.

How Crypto Staking and Stock Lending Are Similar

Crypto staking and stock lending share some similarities in how they allow investors to generate passive income from their holdings, but they function differently due to the nature of the assets involved. Here’s a comparison:

- Passive Income:

- Both activities let you earn a return on assets you already own without selling them.

- In crypto staking, you earn rewards (often in the form of the staked cryptocurrency).

- In stock lending, you earn interest when your shares are lent out to other market participants.

- Locking or Lending Assets:

- In both cases, your assets are put to work:

- Staking: Crypto is locked up to secure a blockchain and validate transactions.

- Stock Lending: Shares are lent to borrowers, often for short-selling or meeting regulatory requirements.

- In both cases, your assets are put to work:

- Risk Exposure:

- You maintain ownership of the asset (crypto or stock) but assume risks:

- Staking Risks: Price volatility, slashing penalties (in PoS systems), or network failures.

- Stock Lending Risks: Counterparty risk (the borrower might default) and missing out on shareholder benefits like voting rights or dividends.

- You maintain ownership of the asset (crypto or stock) but assume risks: