Spreadex Customer Reviews

Tell us what you think of this provider.

Customer Reviews

Very good

Treading account,

Spreadex is the best for Treading.

Sport trading

I have got a Professional Financial Times subscription from Spreadex

Fair easy app

Good app plenty promotions

Macro awareness

I have got a free Pro Financial Times subscription

excellent online company

100% trusted company…….fast and excellent customer service and payouts…..never 1 issue ever with anything with spreadex…..

Good platform people back up even better

Most platforms work pretty well these days, the same with Spreadex, what set them apart is the speed of answering the phones to trade.

Good platform people back up even better

All platforms work well these days same at Spreadex, what sets them apart is when you need to call.

Utterly dependable

I use Spreadex almost every day, for betting on UK and US stocks. From the initial stock search, to the execution of orders and the fast closure of positions, the system works brilliantly. I have other accounts, but Spreadex is by far the best.

Trusted Operator

I have been using Spreadex Financials since 2007 and happy with the results. Good technical set up and orders/limits/trades executed as expected. Highly recomended.

Most enjoyable

I feel that Spreadex have your interest at heart, yes, even as a betting platform. I hope to have a long journey with them.

Definitely recommend

So easy to process your requirements and great customer service and exciting benefits

Excellent

Brilliant service

Change over to spreadex!

Quick pick up of phone, knowledgeabe, courtious, friendly…I feel very comfortable with this service, even when losing! which is not for very long, ha ha.

Perfect

Excellent company and staff

Very helpful

Always gives good advice and good deals .

best bookmaker by far

worked in the industry for a decade and gambled most of my life and Spreadex are best bookie by far with excellent customer service by people who actually seem to know what they’re doing and when the very rare occasion when the advisor cant help they explain and pass it on to the relevant person who can. site is also easy to use with different sports/markets being easy to find. keep up the good work and wouldnt change a thing

😊

Its real and fast play😊

Can use with trading view

Used SpreadEx for a few years.Good Platform and being able to use with trading view is an added bonus.

Very good free bets

Excellent real value free bets given out and prepared to stand a bet

Excellent availability for small caps

I stick to just small caps positions, and telephone orders in for improved pricing. It works very well, and the dealers are all helpful & efficient.

Very good

Great offers customer service

Great one-stop shop for trading

I’ve used Spreadex for years and they have always been impressed by their customer service. Great tools for traders.

Good spots betting App

All round a excellent App

Ok

Ok

Very good

Very good

Good

Good

4/5

5/5

Na

Na

check Sporting Index for way…

check Sporting Index for way forward!

Quick reaction when have probs…

Quick reaction when have probs from online support

Good

Good

Puts customer first

Puts customer first

Wider spreads and good range…

Wider spreads and good range of smaller companies but very contactable

No comment

No comment

have always used IG more…

have always used IG more find the platform easy enough to negotiate

Good

Good

Simple and straight forward

Simple and straight forward

generally good, i didnt like…

generally good, i didnt like it when they didnt answer a question about one of their charges as i lost money as a result

Wide range of trading options…

Wide range of trading options across all markets with clear tools and pricing

Good coverage of spreads

Good coverage of spreads

Fit for purpose

Fit for purpose

Top class

Top class

Easy accessible

Easy accessible

No thoughts

No thoughts

Exceptional value, offers and general…

Exceptional value, offers and general customer service

No view

No view

good

good

3/5

Good

Good

Very easy to use

Very easy to use

Cover a wide range to…

Cover a wide range to trade and easy to use.

Trusted company

Trusted company

excellect clear concise responsible broker…

excellect clear concise responsible broker narrow spreads informed and responsive customer support

Very good

Very good

5/5

Exciting

Exciting

Amazing platform

Amazing platform

Easy to use. Quick to…

Easy to use. Quick to respond to queries.

Great for shorter tax free…

Great for shorter tax free “trading”

Value

Value

Good platform

Good platform

5/5

EASY

EASY

Can never trade the small…

Can never trade the small caps i want to …when l want

Good for small capd

Good for small capd

Very good platform but slightly…

Very good platform but slightly simpler in terms of available features when compared to others. Excellent customer service.

Good platform but expensive.

Good platform but expensive.

Good

Good

good service and communications

good service and communications

Terrific range of instruments, fair…

Terrific range of instruments, fair spreads

Much the same as the…

Much the same as the rest.

Good value

Good value

Good for UK small caps….

Good for UK small caps. Has trailing stop losses and automatic email updates on share price movements.

Useful for occasional trades

Useful for occasional trades

good value, helpful customer service

good value, helpful customer service

Ok

Ok

haven’t used for a while

haven’t used for a while

Easy to use and great…

Easy to use and great support

Old school

Old school

4/5

Pros:

Easy access

Cons:

Reduce fees

5/5

Pros:

Easy to use

Cons:

Can’t think of anything

4/5

Pros:

good for sign up bonus

Cons:

continue with better offers for current customers

5/5

4/5

Pros:

Customer service

Cons:

Not sure

3/5

Pros:

None

Cons:

No opinion

3/5

Pros:

N/A

4/5

Pros:

Small cap dealing

Cons:

I am pretty satisfied with this service

3/5

Pros:

Ease of use and speed of execution

Cons:

Can’t think of anything

4/5

Pros:

Shorting

Cons:

Lower spreads on large cap companies

5/5

Pros:

Easy to use

Cons:

Include crypto

3/5

Pros:

Also does gambling

4/5

3/5

Pros:

n/a

Cons:

–

5/5

5/5

Pros:

intuitive layout

3/5

Pros:

No View

Cons:

No View

5/5

Pros:

Wide range of stock trades available, prompt settlement

Cons:

Making trading in some other markets easier such as Canada

4/5

Pros:

Ease of use

3/5

Pros:

meh

Spreadex Expert Review

Spreadex Expert Review: Financial Trading With Excellent Personal Service

Provider: Spreadex

Verdict: Spreadex is a financial spread betting broker that has been in operation since 1999. It was founded by ex-city trader Jonathan Hufford and unlike many of its peers, it is not based in London, but instead is headquartered in St Albans Hertfordshire. Spreadex offers both financial spread betting and CFD trading from the same account. The company has some 60,000 account holders and offers access to more than 10,000 financial instruments, including UK small-cap shares, where it is something of a specialist.

62% of retail investor accounts lose money when trading CFDs with this provider

Is Spreadex a good broker?

Spreadex offer some of the best personal service for large spread betting and CFD traders and has built a reputation for great tech and trading and as such won “best spread betting broker” in the 2024 Good Money Guide Awards.

Pricing: Spreadex is super competitive and not afraid to undercut the competition

Market Access: Excellent, lots of access to exotic derivatives and smaller cap stocks

Platform & Apps: All developed in house and quick to add new features

Customer Service: Personal service is what sets Spreadex apart from other brokers

Research & Analysis: A good mix of technical indicators on the Spreadex platform and daily briefings from the financial dealing desk.

Pros

- Spread betting & CFDs

- Smaller cap stock trading

- Great customer service

Cons

- Not publically listed

- No physical investing

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.462% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Facts & Figures

Spreadex Total Markets | 10000 |

| ➡️ Forex Pairs | 54 |

| ➡️ Commodities | 20 |

| ➡️ Indices | 17 |

| ➡️ UK Stocks | 1575 |

| ➡️ US Stocks | 2110 |

| ➡️ ETFs | 160 |

Spreadex Key Info | |

| 👉 Number Active Clients | 4000 |

| 💰 Minimum Deposit | 0 |

| ❔ Inactivity Fee | 0 |

| 📅 Founded | 1999 |

| ⬜ Public Company | ❌ |

Spreadex Account Types | |

| ➡️ CFD Trading | ✔️ |

| ➡️ Forex Trading | ✔️ |

| ➡️ Spread Betting | ✔️ |

| ➡️ DMA (Direct Market Access) | ❌ |

| ➡️ Futures Trading | ❌ |

| ➡️ Options Trading | ✔️ |

| ➡️ Investing Account | ❌ |

Spreadex Average Fees | |

| ➡️ FTSE 100 | 1 |

| ➡️ DAX 30 | 1 |

| ➡️ DJIA | 2.4 |

| ➡️ NASDAQ | 2 |

| ➡️S&P 500 | 0.6 |

| ➡️ EURUSD | 0.6 |

| ➡️ GBPUSD | 0.9 |

| ➡️ USDJPY | 0.9 |

| ➡️ Gold | 0.3 |

| ➡️ Crude Oil | 0.28 |

| ➡️ UK Stocks | 0.1% |

| ➡️ US Stocks | 0.15% (max $3.5) |

62% of retail investor accounts lose money when trading CFDs with this provider

Spreadex News

Spreadex Forex Trading Review

Spreadex is particularly good for forex spread betting, which is a form of trading where you do not have to pay capital gains tax on your profits. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning

Spreadex Options Trading Expert Review

Compare Spreadex to other options brokers below: Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker

Spreadex Trading App Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Spreadex Financial Spread Betting Expert Review

In this expert review, we test Spreadex with some live trades using real funds and explain if it is a good spread betting platform for those who want to trade with tax-free profits in the UK. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment

Spreadex CFD Trading Expert Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Is Spreadex good for indices?

Yes, indices are the most popular asset class with Spreadex’s predominantly UK-based clients as opposed to other brokers like Pepperstone where forex is more popular for international clients. Recently Reduced Index Trading Spreads CFD and spread betting broker Spreadex has trimmed the spread on its US 100 tech index contract which closely follows the performance

Does Spreadex offer commodity spread trading?

You can trade commodities as a spread bet or CFD with Spreadex, but you cannot trade futures spreads. The difference between the spread in commodities trading for futures is that it’s the difference in price between the front and forward months. Where as, in spread bets and CFDs the spread refers to the difference between

Does Spreadex have a demo trading account?

No, rather frustratingly Spreadex does not offer a demo account of its trading platform. However, if you want to test their platform, and get an idea of functionality you can open a live account without having to deposit funds. This will give you access to the Spreadex live trading platform so you can get an

Spreadex Trading Platform Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

China H-shares trading comes to Spreadex

Spreadex customers can now engage in China H-shares trading through the platform, following a recent update. China H-shares are shares of companies based in mainland China that are listed on the Hong Kong Stock Exchange. These typically have more liquidity than China A-shares, which are listed in the mainland, as they are easier for foreigners

Spreadex wins Best Spread Betting Broker at the Good Money Guide Awards 2024

Spreadex won Best Spread Betting Broker this year because of their consistently excellent customer service, as highlighted in reviews on our site. For a product as unique to the UK as financial spread betting, having a broker you can talk to is crucial, and Spreadex excels in adding value through personalized support. Richard BerryRichard is

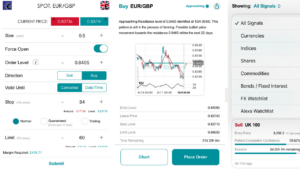

Spreadex adds Autochartist trading signals to platform and app

Spreadex has added trading signals to its platform, which provide trading suggestions to users based on chart patterns. The spread betting broker’s new trading signals, provided by third party market scanner Autochartist, give users trade ideas alongside risk management suggestions and take profit levels. Autochartist, founded in 2004, generates pattern completion graphics based on patterns

What does a financial trader do all day? We spoke to Spreadex to find out.

If you want to know what a stock broker does all day, you may be surprised to hear that it’s not as exciting, as it is in the movies. Well, it is sometimes. I started my career as a stock broker and it mainly consists of admin and helping clients by and sell stocks all

Spreadex Wins Best Trading Platform Customer Service in the Good Money Guide Awards 2023

Spreadex has always done very well in our awards, they most recently won “best customer service” in our 2023 awards and have previously won “best spread betting broker” in 2019. Andy MacKenzie from Spreadex said after collecting the award: This award means a lot. Firstly, it’s a reflection of the trust our customers place in

Spreadex offers its clients a new TradingView

Spreadex the St Albans-based Spread Betting and CFD broker has given its customers an early Christmas present. Spreadex adds TradingView trading Spreadex has entered a partnership with one of the world’s biggest charting and social trading platforms, TradingView. Established in 2011 TradingView now has more than 30 million users globally who use its state-of-the-art charting

Jonathan Hufford the founder of Spreadex steps down

News breaks this morning from the Hertfordshire headquarters of spread betting broker Spreadex, that the company’s founder and long-term MD Jonathan Hufford has stepped down from his position, though he will remain a director and board member at the business, in a non-executive capacity. Read our full review of Spreadex here How has Spreadex traded

Spreadex sponsors Fulham F.C.

Spread betting broker Spreadex has become Fulham F.C.’s principal partner over the next two seasons and engage in a number of fan and community initiatives. Fans at Craven Cottage will be getting used to the Spreadex logo as the Championship promotion contenders have signed the firm up on a two year deal. The deal, which

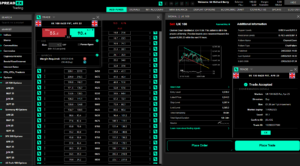

Spreadex Trading Video Walkthough & Live Trading Demo

Want to see what it’s like to trade on Spreadex? This video is a walkthrough of the Spreadex trading platform, it highlights key features, tools, and unique aspects of the platform while offering insights into Spreadex’s broader services. Key Features Highlighted Trading Tools: Users can trade directly from charts, offering enhanced convenience. Includes technical

8 new things you may not know you were able to do when trading with Spreadex

If you haven’t read our Spreadex review yet, here are a few new features you may not know you were able to do with the alternative spread betting broker: Get tighter spreads – Spreadex have new variable spreads on FX offer greater value for trading foreign exchange. E.g. trade EUR/USD from a 0.6 spread and

Jonathan Hufford, Spreadex MD, tells us how putting the client first leads to longer term broker relationships

Spreadex has always been regarded as a more gentlemanly broker within the spread betting community. Based just outside London in St Albans, offering one of the largest market coverages for financial trading and still with a trackside presents for traders looking for a punt on the weekends. We wanted to find out exactly how Spreadex

Spreadex wins best spread betting broker at EGR Awards

Spreadex, one of the oldest spread betting brokers in the business has won spread betting operator of the year at the EGR Awards 2017. Spreadex fit nicely into EGR’s (who mainly cover gambling companies) coverage because they are the only financial spread betting broker to offer sports spread betting. Which is basically the same as

Spreadex offers a 50% spread reduction on UK 100 Daily trades all this week

Leading spread betting broker Spreadex has a little treat for customers this week. If you are an existing customer you may well have received an email offering a 50% rebate on UK 100 Daily trades this week. Or FTSE 100 trades if you are not hindered by FTSE trade mark issues. The UK 100 most

Spreadex stops auto closing on daily spread bets

Thankfully Spreadex has stopped daily spread bets closing out automatically at the end of the day. Since spread betting began way back when brokers would offer daily spread bets, that expired at the end of the trading day, but in reality most clients would opt to have them roll over each day. This is good

Spreadex improve their charting package & reduces slippage

Spreadex, one of the leading spread betting brokers has improved it’s charting package. It’s been a long time coming as the Spreadex trading platform doesn’t go in for lots of flashing lights, dark brooding backgrounds or fancy dials. Instead they focus on clear and concise information displayed in an easy to digest format. The new charts are

Spreadex now one of the fastest growing European companies

Spreadex, one of the best spread betting brokers in the UK is one of 78 based in (and around) London to make it onto the FT’s list of fastest 1,000 European companies. Spreadex founded in 1998 was ranked 943 out of 1,000 on the FT’s list published on May 17th 2017 with key stats of: Revenue

Spreadex offering a free copy of Robbie Burn’s latest book ‘Trade Like a Shark’ when you open a new account

Spreadex, one of the leading spread betting brokers and the one generally regarded as having the best customer service has a nice little welcome gift at the moment for new customers. You can get a copy of Robbie Burn’s latest book ‘Trade Like a Shark’ by opening an account and placing just one trade. Robbie Burns

Spreadex FAQs

Spreadex is a financial and sports bookmaker for UK clients and also offers contracts for difference for European traders (who are not eligible for capital gains tax breaks from financial spread betting).

For large amounts, you can request funds to be sent back to your account from Spreadex the same day. But, for smaller transactions, it can take between 1 hour and 3 days to receive funds. This depends on your bank, and how complete your AML documents are.

Spreadex offers financial spread betting which works by letting you place bets on the movement of financial markets. Instead of buying a certain amount of shares in a company, you bet an amount (either in pounds or pence) per point a share price moves.

Yes, Spreadex is a legit and safe trading platform as they are regulated by the FCA and are well established and well respected within the brokerage industry. Spreadex also ranks very highly in our awards for customer service and support.

62% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.