Freetrade Customer Reviews

Pros: Simplicity Cons: Offer more stock buying functions Pros: The community Cons: web-app based services to compliment apps Pros: User friendly platform Cons: Add dividend information on stocks and implement auto re-invest feature. Pros: no/low cost trading. ease-ability of use. Cons: More detailed UX graph design which allows detail tracking of a stock price. Pros: User friendly Pros: Commission free trading Cons: Commission free trading Pros: iPhone App Cons: Fractional UK shares, Auto-Investing Pros: Easy to use app has a nice design Cons: Add more stocks Pros: New stocks Cons: Faster prices Pros: Ease of use Cons: Increase share coverage Pros: Well designed app Cons: Desktop trading, keeping promises on free shares Pros: Easy to use and great support Cons: ItÔÇÖs great, perhaps a guide on how to start or some webinars Pros: Very easy to use, very accessible, constant introductions to more stocks Cons: Improve ways to analyse your portfolio I.e. automate factor information Pros: Easy to set up and use Pros: Easy to use Cons: Better platform Pros: Stimulating UI Cons: Provide an options chain Pros: Low fees Cons: Better portfolio analysis Pros: Intuitive experience and easy access to trading via their app Cons: More stocks Pros: Easy to use Cons: Provide options trading Pros: the app and interface is easy to use Cons: Expand investing options Pros: Ease of use Cons: More information on dividends Pros: easy to use Cons: quicker trades. Pros: Very simple and easy to use and refer a friend scheme Cons: More functionalities on the app & a website Pros: Easy to use and cost efficient. Cons: The app is amazing, charts need to be improved and more information/ updates on companies. Cons: Analytics of shares, distributions, market information more accessible to users Pros: Elegant & simple UI Cons: Develop more features such as a browser / desktop based version Pros: Makes investing fun Cons: Tutorials within the app Pros: Customer support and the engagement between the business and customers (new stocks being released and anything they can do to make things better) they listen to customers. Easy to use mobile app, making it simple for all investors. Cons: A web desktop interface option for those that donÔÇÖt want to just invest via the mobile app. Pros: Easy of use and no fees Cons: Provide market cap data on companies Pros: user interface Cons: Provide dividend data Pros: Commission free and amazing app. Cons: Include LISA’s. Pros: Ease of use Cons: Provide analysis tools Pros: Simplicity Cons: Stop loss and TP Pros: Free Cons: More company information Pros: No fees to buy and sell shares. Can’t believe how expensive it is to buy shares using standard stock brokers Cons: Limit orders, European shares and more filter options in the app for activity Pros: Quick, easy and intuitive. Good support Cons: More wider portfolio Pros: great community Cons: Hire lots of good developers to get the app better and better Pros: Community Cons: More stocks Pros: No fees, easy to use, very good for beginners Cons: Better data and data visualization. A wider range of products (e.g. derivatives) would be interesting, but perhaps not feasible. Pros: Free commission trading Cons: Provide more statistics and advice Pros: Fees, ease of use Cons: Ux, more options and services, ed.material Pros: ItÔÇÖs fee Pros: Low barrier to entry (fees) Cons: Better more stable features and stock universe Pros: They keep things simple, as a beginner I feel like IÔÇÖm learning and able to invest without being overwhelmed by info. Cons: I want be able to purchase exact shares of a US company or buy enough shares to round up my portfolio to a whole number without working it out to a decimal point. Pros: ease of usability, able to scan quickly for info Cons: Add more features asap that competitors have Pros: No fees Cons: Offer more stocks Pros: Just so easy. Customer service is outstanding. Cons: Dividend reinvesting automatically Pros: Simplicity, speed of innovation, and community Cons: More shares, clearer business model, keep fighting against CFDs, and other leverage and option investment types Pros: Affordability Cons: Sipp accounts rollout Pros: Free trading Cons: Not much, carry on expanding abroad I guess Pros: The interface and ease of use Cons: Make it clearer how much you will take from the sale of a stock at the point of selling. The price is just a quote and you can end up losing money through their fees if you sell at a low price. Also make their graphs a lot clearer and add stock news. Pros: Community approach Cons: Simplicity and design Pros: Accessibility Cons: Market coverage, Cost for ISA Pros: No fees for trading Cons: Provide more stock info Pros: Ease and user experience Cons: N/A Pros: App is really easy to use Cons: n/a Pros: Community forum, ease of use Cons: Offer SiPPs and JISAs Pros: Growth potential Cons: Free ISA Pros: Easy to use Cons: Nothing Pros: The app Cons: More markets Pros: Easy to use and no commission fees Cons: Provide more information and news stories related to their stocks and EFTÔÇÖs to help inform choices without having to leave the app Pros: Easy to use app, good for my smaller investments Cons: More educational material on the app Pros: Ease of use Cons: Start SIPP accounts ASAP Pros: Easy app Cons: More stock choices Pros: Fees Cons: Wider range of stocks Pros: Low fees & ease of use Cons: Improve market coverage Pros: Referral program Cons: Make transactions more quicker such as withdrawing money Pros: Very easy to use, exciting Cons: Technical analysis, computer platform Pros: It’s so easy to use Cons: Show dividend information Pros: Simple, effective, approachable. They own who they are. Cons: IÔÇÖm incredibly happy with the current platform, however, IÔÇÖm looking forward to their expansion into Europe and the world. Pros: The app & info it provides Pros: Free trades Cons: Add more companies to there app Pros: Ease of use, super simple to use Cons: Keep adding more companies to invest in Pros: Ease of use Cons: Separate dividends from total cash Pros: Ease of use, simple to set up, low fees, great customer service, access to Freetrade community Cons: Improve their visuals of the investments, provide more details on stocks such as opening, closing, volume of trades, etc, nicer layout of your investment portfolio overview and returns Pros: Ease of use Cons: Different time periods on dashboard. News drop downs with your porfolio like apple stock Pros: Ease of use, no fees Cons: Provide automatic investment and an API Pros: Love the fact that they are targeting millenials and teaching them how wealth can be built Cons: Provide more company information Pros: Ease of Use, Low Fees Cons: Company Financial Information Pros: ItÔÇÖs free Pros: Very easy app and visual love it Cons: Add more companies inc US stocks Pros: Innovation in order to bring down costs for newer investors. Cons: Introduce Sipps Pros: Great ethos Cons: Further build out of features and platform Pros: Super easy to navigate a very intuitive app. Cons: A broader range of stocks on the platform. Also they could have more stock info on there (dividend yield etc) Pros: No fees for my purchases, free to buy and sell what I want instantly in the easy to use app Cons: Get more markets stocks available to purchase like Euro stocks Pros: Commission free investing! Cons: Provide more information on stocks i.e dividends history Pros: ease of use and cost Cons: Keep developing their app and keep trading freeTell us what you think of this provider.

Customer Reviews

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

3/5

5/5

5/5

3/5

5/5

5/5

5/5

5/5

5/5

2/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

4/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

4/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

4/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

4/5

5/5

5/5

5/5

5/5

4/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

5/5

Freetrade Expert Review

Freetrade Won Best Investing App In The Good Money Guide Awards

Provider: Freetrade

Verdict: Freetrade has shaken up the UK retail investment market in recent years. Offering zero commissions on share trades, it has been stealing market share from legacy investment platforms with lower costs and better app functionality.

Is Freetrade a good investing app?

Yes, Freetrade is a great investing app for those with a small amount of money who want a very low-cost way to start investing in UK and US shares and ETFs. As your portfolio grows you can upgrade for better execution and data. It’s most suited to medium and long-term investing.

Yes, Freetrade is a great investing app for those with a small amount of money who want a very low-cost way to start investing in UK and US shares and ETFs. As your portfolio grows you can upgrade for better execution and data. It’s most suited to medium and long-term investing.

Freetrade is one of the original and biggest commission-free investing apps in the UK. It now offers, GIAs, ISAs and SIPPs to over 1.5 million UK & European investors. It is possible to have a free account with end-of-day orders and limited stock data. Or you can upgrade to either a “standard” or “Plus” account for tax-efficient accounts, web access, reduced FX charges and most stock data.

Freetrade also won “Best Investing App” in the 2025 Good Money Guide Awards.

Freetrade offers a ‘freemium’ share dealing service and it’s mission is to get everyone investing by making it simpler and more affordable.

Founded in 2016, Freetrade launched its iOS app in the UK in October 2018, and since then it has grown at an impressive pace.

Freetrade’s popularity stems from two key features: commission-free trading for shares and exchange-traded funds (ETFs), and the ability to buy fractional US shares. These features have made investing more accessible and cost-effective, especially for beginners.

It’s worth noting that Freetrade won the 2021 Good Money Guide award for ‘Best Commission-Free Stockbroker’. It also won the 2019 Good Money Guide ‘People’s Choice’ award.

Pricing:

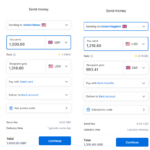

With Freetrade you can buy stocks with zero commissions.

However, if you’re buying US or European stocks, you’ll need to pay foreign exchange (FX) fees. These fees vary depending on the ongoing plan you choose.

There are three options when it comes to plans. These are:

Freetrade Basic – Free

Freetrade Standard – £4.99 per month billed annually or £5.99 per month billed monthly

Freetrade Plus – £9.99 per month billed annually or £11.99 per month billed monthly

As for how Freetrade’s fees compare to other platforms, they are pretty competitive. But there are lots of variables to consider here including the type of plan you have, the type of stocks you invest in (i.e. UK vs US stocks), and how many trades you make per month.

If you just wanted to buy a few blue-chip UK shares within a General Investment Account, you could potentially pay no fees at all (you would have to pay Stamp Duty on trades).

However, if you wanted to buy and hold UK shares in a stocks and shares ISA, you would be looking at annual charges of at least £59.88.

That’s not particularly high but it can be beaten. AJ Bell, for example, offers an annual charge of 0.25% for ISAs and this is capped at just £42 per year (this doesn’t include any trades).

Market Access: In terms of accounts, Freetrade offers three options, a General Investment Account, a Stocks and Shares ISA and a SIPP (Self-Invested Personal Pension). But, to open a stocks and shares ISA or SIPP you need to sign up for a premium plan.

Pros

- Zero commission

- No fees for a basic account

- Fractional shares

- UK Treasury Bills

Cons

- App only on the basic plan (no desktop)

- 0.99% FX fee for the basic account

- Relatively early stage company

-

Pricing

(5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

4.1Freetrade Facts & Figures

| ⬜ Public Company | ❌ |

| 👉 Number Active Clients | 1,600,000 |

| 💰 Minimum Deposit | £1 |

| 💸 Client Funds | n/a |

| 📅 Founded | 2018 |

| Account Costs | |

| Investment Account | £0 |

| SIPP | £11.99 per month |

| Stocks & Shares ISA | £5.99 per month |

| Junior ISA | ❌ |

| Lifetime ISA | ❌ |

| Dealing Costs | |

| UK Shares | £0 |

| US Stocks | £0 + 0.99% FX (basic) |

| ETFs | £0 |

| Bonds | ❌ |

| Funds | ❌ |

Freetrade News

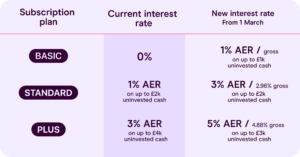

Freetrade Plus Accounts Can Earn Up To 5% Interest On Uninvested Cash

Commission-free share trading and investing app Freetrade’s new cash investment facility which offers easy access and attractive interest rates now pay up to 5% for Plus account holders. This is 0.5% more than the 4.5% current Bank of England Interest Rates. However, there are limitations: The high rate of interest only applies up to £4,000

Can you buy fractional shares on Freetrade?

Yes, you can buy Fractional shares on Freetrade. With fractional shares, you can buy a fraction of one US stock. So, for example, you could buy one quarter of a share in Amazon. This can be handy if you want to buy a stock that has a high share price. For instance, if a stock

Is Freetrade Safe?

Yes, you can consider Freetrade to be trustworthy. Freetrade is authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Meanwhile, all Freetrade accounts are covered by the Financial Services Compensation Scheme (FSCS), especially now they are owned by IG. I’ve been following Freetrade since its inception and test out the app every

Can you short on Freetrade?

No, you cannot short stocks on Freetrade, but you can still earn money from other people going short as the commission-free share trading platform has a share lending for its customers. Freetrade’s share lending program allows its users to lend out their eligible shares held in either a GIA, a general investment account, or SIPP,

Freetrade Investment ISA comes with a free share worth between £100 and £2,100

In this review, we look at Freetrade’s stocks and shares ISA offering, account options, fees and more. Whether you’re a beginner investor or an expert stock picker, our review will help you decide if Freetrade is the right investment platform for you. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker

Freetrade launches Gilt investing in 9 UK Government bonds

You can now buy Gilts on Freetrade, the investing app recently acquired by established stock broker IG. The great thing about adding gilts to a portfolio is that they are much lower risk than dealing in shares, and they are income-paying bonds backed by the UK government. Freetrade also launched UK Treasury bill investing, which

Investing in UK Treasury Bills on Freetrade with Adam Dodds, CEO

Freetrade has just launched UK Treasury Bills for their customers, which have previously only been available to UK investors in minimum order sizes of £500,000. So, I have a chat with Adam Dodds, the Freetrade CEO, about how to invest in UK Treasury Bills on Freetrade and how investors can benefit from them. With Freetrade

Freetrade’s valuation is cut by more than 60% from £650m to £225m

Freetrade the commission-free share investing app has undergone a dramatic cut in its valuation as it seeks to raise new cash through crowdfunding and is now valued at just £225 million. Freetrade has reduced its valuation ahead of a new crowdfunding campaign. In November 2021 the free share dealing service was valued at £650 million

Freetrade to start lending out customer shares to increase revenue

Commission-free share dealing platform, Freetrade, is venturing into the world of stock lending, a move that it says will help to support its low-cost trading and investing operations. Freetrade prepares the ground for a move into stock lending Freetrade has written to its customers introducing new terms and conditions which include a section notifying clients

Freetrade ticked off for Tiktok…

Freetrade, one of the fast-growing commission-free stock brokers claims to change the way we trade stocks and shares has been sanctioned by the FCA and is banned from social media promotions. Freetrade social media ban Freetrade has received a supervisory notice from the UK regulator which showed that Freetrade had been contacted by the FCA

Freetrade FAQ

Overall, Freetrade is a good platform that offers a broad selection of investments and very competitive fees and charges. But it’s not perfect. And it’s not going to be the right platform for everybody. As always, the best platform for you will depend on factors such as the size of your portfolio, the investments you like to own, and the extra features you are looking for.

Freetrade is an independent, privately-owned company.

No. While Freetrade offers zero commissions on trades, you still need to pay Stamp Duty, FX fees, and annual charges (if you choose a premium plan).

When you buy UK stocks with Freetrade, the company deducts Stamp Duty at a rate of 0.5%. This does not apply to investment trusts or shares listed on AIM.

The minimum investment with Freetrade is currently £2.

Yes, it does. But you can only access this with a ‘Plus’ account.

There is always investment risk when you buy shares or ETFs. So, if you trade through Freetrade, it’s possible that you could lose money. However, the platform itself should be regarded as safe. It is regulated by the FCA, and accounts are covered by the Financial Services Compensation Scheme (FSCS).

With Freetrade, customer assets are held in ring-fenced accounts. So, if the company goes bust, your assets will be returned to you or transferred to another broker. If you hold cash with Freetrade, you will be covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.