Tickmill Customer Reviews

Tell us what you think of this provider.

Great broker

Tickmill is a great overall broker both for beginner and experienced traders.

Quick, efficient and honest service

Quick, efficient and honest service.

Lower spread

Tickmill is a Good brokers for beginners and advance traders they offer standard accounts and raw accounts. It has a lower minimum capital to start, low spread, good customer service and specially it has a multi national regulations and that you’ll know it is safe to use.

Excellent

Excellent service. On time payouts

Very good

Good for forex traders

Excellent

Excellent trading conditions and customer support

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Expert Review

In this Tickmill review we give our ratings based on their nearest peers and tell you what we think of them after testing them thoroughly. Plus we highlight the key costs, facts and figures of their accounts.

Tickmill Review

Provider: Tickmill

Verdict: Tickmill was founded in 2014 and offers CFD, forex and futures & options trading to 300,000+ traders via MT4 to, CQG and a range of other trading platforms on over 500 of the most popular traded markets.

Is Tickmill a good broker?

Tickmill is more than just a run-of-the-mill broker to grind the market out tick by tick. It offers well-thought-out CQG setups and DMA access on various exchanges for smaller or high-frequency futures traders.

Pros

- Lots of trading platforms

- Direct markets access

- Low trading costs

Cons

- Subscriptions for DMA

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.1Ratings Explained

- Pricing: Tight pricing, especially on CQG where you can trade DMA with micro futures.

- Market Access: Not huge, but fine for active traders on the main markets.

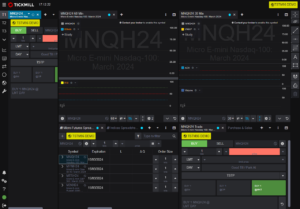

- Platform & Apps: All third-party – but a really good CQG set-up.

- Customer Service: Local dealers and account managers in London.

- Research & Analysis: A good team of in-house analysts providing daily market outlooks.

Grinding the markets down, tick-by-tick…

There are a couple of great lines in the movie Rounders – which are quite relevant to trading – Matt Damon opens with, “It’s like any other job, you don’t gamble, you grind it out.” And that’s pretty much the markets as they are a full-time job if you are a high-frequency or regular trader. There is no dipping your toe in to see how you get on, you either commit to learning how they work, or you become another risk warning statistic.

It’s not just me that thinks that, a while ago, I interviewed Jamie Ross of Henderson’s EuroTrust about how he invests for his £320m fund and he said that one of his favourite books was Thinking in Bets, by Annie Duke, a professional poker player. And that one of his favourite expressions was “if you look around the table and you don’t know who the patsy is, you’re the patsy” Damon opens with this line too, “If you can’t spot the sucker in your first half hour at the table, then you are the sucker.” The same is true of trading, if you look at the order book and don’t know what’s going on, you’re in trouble.

However, whatever you may see on social media, the markets are not geared against small-time traders, there is no massive conspiracy against you. The markets move with the ebb and flow of demand and sentiment, it’s not a zero sum game, you can win without someone else losing. Sure there may be a bit of spoofing and some algos working in the background, but generally, the only thing that causes retail traders to lose money is, themselves.

To paraphrase the true grinder Joey Kinish from Rounders, “you don’t trade for the thrill of victory… you trade for money… you gotta have the stones to chase the markets, not pipe dreams”.

And I think that’s where Tickmill fits into the brokerage world. It’s there to provide access to the most popular and tradable markets, through a huge range of platforms. It’s up to you how you choose to trade them, you can grind it out, tick by tick with an algo or scalping on micro lots.

Before this review, I interviewed the Tickmill UK CEO Duncan Anderson, (it’s well worth a watch if you want to know what Tickmill as a company stands for) and spent an hour or so going through the platforms with Marco Aichner who has been with Tickmill for around 5 years (and in the markets for 20). So I was able to test some of the things that make Tickmill stand out, which if you don’t know much about them you wouldn’t know.

Markets Access

First off what can you trade? Tickmill provides access to the most popular markets through CFDs, forex, and on-exchange futures and options. It’s their futures trading offering that I think makes them stand out because not many retail brokers offer this and futures contracts are getting smaller in size, so they can be traded by a more diverse range of traders.

Tickmill’s USP here is that can trade futures as big or small as you want on exchanges like CBOT, CME, COMEX, NYMEX, EUREX, ICE FUTURES EUROPE (Financials) or The Small Exchange. Access to The Small Exchange is particularly good because the contracts are tiny.

You can see the contract specs when you are logged into CQG by hovering or right-clicking, but as an example, trading 1 lot of the mini S&Ps is about a $20k contract, but trading the micro minis is a tenth of the size around $2,000. This is particularly good for those getting started in high-frequency trading.

You do get live and level two data from each exchange – but you must subscribe to each individually.

Pricing

Tickmill are competitive on pricing and certainly in the top ten. Interactive Brokers is cheaper (but doesn’t offer CQG, only their own platforms), Saxo Markets (another retail futures broker) is more expensive.

Futures trading commissions are 85 cents on mirco lots and $1.30 on an e-mini contract. You do have to pay for platforms though, so it’s better for regular traders who can make full use of them and want DMA access to the most traded smaller futures contracts. It’s worth noting though that, unlike other brokers, Tickmill includes order routing and clearing fees in their commission.

You can also keep FX conversion costs down by choosing to have your accounts in several different base currencies: USD, EUR, GBP, PLN, CHF

Customer Service

Client support is very good, dealers can move orders for customers, if they for one reason or another are not able to trade themselves. If there is a problem and a client wants to get flat the client services team can handle it. When setting up my account, I had direct communication from a sales rep as opposed to an automated string of e-document requests.

Tickmill say that they are aiming to complete heavily on customer service because they want three things

- To make their product offering as simple as possible

- To provide inspirational trading ideas by creating templates and frameworks to help clients

- To be there when they are needed by providing personal customer service.

Research & Analysis

This is a big deal because Tickmill charges commissions on trades, and actually say on their email signature: “We want traders to succeed”.

![]()

So the better the research and analysis they can provide the better chance their customers have of making money and the more money their clients make, the more money Tickmill earns from them in commission, so everyone is happy, as they say.

When putting together their offering, and bear in mind that they say they are built “by traders for traders” they asked what would they have wanted 10-15 years ago when they first started trading and have put together quite a comprehensive set of research and analysis tools including:

- Market news – searchable on CQG

- Autochartist – trading signals and technical analysis

- Signal Centre – trading ideas (now owned by Acuity Trading)

- Webinars – free courses run by their expert analysts

- Trading masterclasses – fine-tune your strategies

- Education hub – get to know the basic

Overall, a good choice for retail traders who want to trade the most liquid futures markets on a robust trading platform with low costs.

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Facts & Figures

Tickmill Total Markets | 578 |

| ➡️Forex Pairs | 62 |

| ➡️Commodities | 6 |

| ➡️Indices | 10 |

| ➡️UK Stocks | ❌ |

| ➡️US Stocks | 500 |

| ➡️ETFs | ❌ |

Tickmill Key Info | |

| 👉Number Active Clients | 327,000+ |

| 💰Minimum Deposit | 100 USD/EUR/GBP |

| ❔Inactivity Fee | ❌ |

| 📅Founded | 2014 |

| ℹ️ Public Company | ❌ |

Tickmill Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ✔️ |

| ➡️Futures Trading | ✔️ |

| ➡️Options Trading | ✔️ |

| ➡️Investing Account | ❌ |

Tickmill Average Fees | |

| ➡️FTSE 100 | 0.9 |

| ➡️DAX 30 | 0.91 |

| ➡️DJIA | 2.52 |

| ➡️NASDAQ | 1.93 |

| ➡️S&P 500 | 0.39 |

| ➡️EURUSD | 0.1 |

| ➡️GBPUSD | 0.3 |

| ➡️USDJPY | 0.1 |

| ➡️Gold | 0.09 |

| ➡️Crude Oil | 0.04 |

| ➡️UK Stocks | ❌ |

| ➡️US Stocks | 0 |

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Video Review

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill News

Does Tickmill have futures?

Yes, you can trade futures on Tickmill. In fact, one of the best aspects of Tickmill’s futures account is your ability to trade DMA and in smaller trade sizes with micro lots. Tickmill’s CQG is a good choice for smaller futures traders wanting DMA for scalping or high-frequency trading. What makes their CQG offering stand

Tickmill’s Demo Account Lets You Test Drive MT4 & CQG

In our Tickmill demo account review, I tell you what I like and dislike about them. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge

Tickmill introduces Agenatrader for DMA traders

In November 2023 Tickmill introduced a new trading platform, Agenatrader which facilitates DMA or direct market access to exchanges such as the CME or Chicago Mercantile Exchange, one of the world’s largest derivatives marketplaces. The new platform provides advanced trading tools and functionality including more than 150 trading indicators, on-chart trading, contingent and connected order

Is Tickmill any good for commodities?

One of the best things about trading commodities on Tickmill is the CQG trading platform which provides excellent DMA futures execution. Expert opinion: Tickmill reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning

Is Tickmill an ECN & DMA broker?

When you trade futures with Tickmill they are operating in an ECN capcity and passing orders directly through to an exchange. However, if you are trading CFDs or forex, depending on what jurisdiction your account is regulated in they may not be operating an ECN model. Tickmill offers both on-exchange currency futures which are suitable

Does Tickmill offer options trading?

Yes, you can trade options on Tickmill, but you are limited to just Micro E-mini S&P 500 and Micro E-mini Nasdaq 100 contracts. If you want to trade on exchange options you are better off with a full service options broker like Interactive Brokers, or if you want CFD options IG, has good market coverage

Does Tickmill have indices trading?

Yes, you can trade on exchange index futures with DMA through CQG with Tickmill, or trade OTC indices via contract for difference. You get better pricing with the futures, but trade sizes are not as flexible. Expert opinion: Tickmill reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker

Is Tickmill legit for CFD trading?

Yes, it’s fine to trade CFDs with Tickmill in the UK as they are regulated by the FCA, so your funds are protected by the FSCS. Expert opinion: Tickmill reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in

Does Tickmill offer MT4?

Yes, you can trade on MT4 or MT5 with Tickmill, but CQG is better. Tickmill actually has very good market coverage on MetaQuotes, but there are better MT4 brokers to compare. Expert opinion: Tickmill reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original

Is Tickmill’s trading app andy good?

Tickmill does have a real trading app and they are a regulated futures and CFD broker with an office in London and authorised by the FCA (Financial Conduct Authority). Expert opinion: Tickmill reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison

What trading platforms does Tickmill offer?

Loads, when you are setting up your account you can choose from around 12 trading platforms and add-ons. But, I’d say Tickmill’s CQG set up is the best for experienced traders. You can of course trade CFDs and Forex on MT4 with Tickmill, however, Tickmill probably has the widest range of trading platforms on offer

Is Tickmill regulated in the UK?

Yes, Tickmill UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom. This means that it is a trust broker in the eyes of the FCA for regulatory purposes. As an FCA-regulated broker, Tickmill is required to segregate retail client funds from the company’s own funds. This means that

Duncan Anderson Tickmill UK Ltd CEO on CFDs vs Futures plus API, algo & high frequency trading

What’s fascinating about brokers is that, on the surface, they all seem to do the same thing, which is providing access to the markets. It’s becoming harder and harder to compete on price because, there is only so low they can go and if it becomes a complete race to the bottom, brokers won’t make

FAQ:

Here are the answers to some of the most commonly asked questions people ask about Tickmill.

Yes, we rate Tickmill as a good broker as they are regulated by the FCA, offer direct market access to futures and options and have discounted commissions.

Yes, Tickmill is safe and legit, they have been in business since 2014, are regulated in multiple jurisdictions and have over 300,000 active customers. To find out more about them you can watch our Tickmill CEO interview.

Yes, beginners who understand the risks of futures and options can trade in small sizes with micro-mini futures contracts.

Yes, Tickmill UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom. This means that it is a trust broker in the eyes of the FCA for regulatory purposes. As an FCA-regulated broker, Tickmill is required to segregate retail client funds from the company’s own funds. This means that your funds are covered by the FSCS, as a member of the Financial Services Compensation Scheme in the UK, all clients of Tickmill UK Ltd are covered in the event of default by Tickmill UK Ltd. Clients are covered up to the value of £85,000.00.

You can see Tickmill’s entry in the FCA register here.

Where else is Tickmill regulated?

As well as being regulated by the FCA in the UK, Tickmill brands are also regulated in these regions:

- UAE: Tickmill is a trading name of Tickmill UK Ltd, which is authorised and regulated by the Financial Conduct Authority (FCA) of the United Kingdom and the Dubai Financial Services Authority as a Representative Office. See this on the UAE public register of firms here.

- Cyprus: Tickmill Europe Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC). See this on the Cyprus Securities and Exchange Commission register here.

- Seychelles: Tickmill Ltd is regulated by the Financial Services Authority of Seychelles (FSA). View Tickmill’s enter here.

- Asia: Tickmill Asia Ltd, which is authorised and regulated by the Labuan Financial Services Authority. You can see Tickmill on the FSA list of money brokers here.

- South Africa: Tickmill South Africa (Pty) Ltd, which is authorised and regulated by the Financial Sector Conduct Authority (FSCA). You can see Tickmill’s entry on the FSCA by clicking the OTC Derivatives Providers link on this page.

Tickmill is not currently regulated in America so cannot onboard US traders.

For more information please read our full Tickmill review, or you can watch our interview with the CEO of Tickmill UK Ltd Duncan Anderson. In it, we discuss the importance of Tickmill being regulated in muti-jurisdictions and what products it offers for different types of clients.

To see how Tickmill is trusted against other brokers you can view our trading platform comparison tables.

Yes, Tickmill provides DMA access to futures exchanges through multiple trading platforms like CQG. You can see why using an ECN broker is important here.

No, Tickmill does not accept US clients even though they offer futures trading which is regulated in America. Tickmill also offers CFDs which are illegal in the USA. As Tickmill is not regulated by the CFTC, so if you are a US citizen and want to trade futures see our comparison table of best US futures brokers.

In the UK Tickmill is not a market maker they are a STP broker. When you are trading futures your trades are executed directly on exchange. They also state that “All clients’ trades are sent directly to be filled in by liquidity providers, with no interference from Tickmill. There’s no dealing desk involved and Tickmill does not trade against the clients.” This should also apply to CFD trading.

However, Tickmill’s exeuciton policy varies from region to region where regulations are different. For example, on their international website, Tickmill say that they operate a hybrid execution model and state that they are both a market maker and offer straight-through processing of orders.

This means that depending on what regulated entity you are trading through Tickmill could be running a b-book.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.