-

Reviews By Richard Berry

- Updated

Investing apps are the mobile version of an investment account’s platform. They let you buy and sell shares, bonds, exchange-traded funds (ETFs) and funds on the move, through a general investing account (GIA), stocks and shares ISA, SIPP or pension.

| Name | Logo | GMG Rating | Customer Reviews | App Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

| GMG Rating | Customer Reviews 4.3 (Based on 1,119 reviews) | App Annual Fees £59.88 | Dealing Commission £3.99 | See Offer Capital at risk | Features:

| interactive investor App Expert Review: Best Fixed-Fee Investing AppAccount: interactive investor investing app Description: interactive investor’s (ii’s) app is good for active investors who want to make their own investment decisions and will be adding a lot of funds as well as shares to their portfolio – since fees are capped. The app also has a wide range of news and analysis with a particular focus on educational videos and investment editorials. Capital is at risk. Is ii's App Any Good and is it Safe? The app is one of the best ways to invest on mobile, based on our analysis, as it has loads of research, screeners and market data. And as ii is regulated by the FCA and owned by ABRDN, an LSE-listed company currently worth more than £2.8bn, the ii app is one of the safest around. Fees It costs from £4.99 a month for a GIA with ii. With the basic plan, trading on UK and US stocks is £3.99. There are two plans above that which include free trades. If you upgrade to a Super Investor account (£19.99 a month) you get 2 free monthly trades. Regular investing is free. If you want UK Level 2 share pricing, you can also add Quotestream for £20 + VAT per month. Special Offers Free investing for your friends and family. You can give up to five people a free investment account subscription with ii’s Friends and Family plan. You pay a single extra fee of £5 a month, and their monthly cost is zero. Each member can invest up to £30,000 in an ISA or a general investing account with free regular investing and no account fees. However, they’ll still pay normal dealing commissions when they buy and sell investments. Get £200 when you refer a friend to ii. Recommend a friend or family member and get a £200 reward. Your friend will get their first year’s service plan for free – saving £120. To qualify, your friend must transfer or fund their account with at least £10,000 in combined cash/investments. What is the App Like to Use? Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.8 (Based on 1,616 reviews) | App Annual Fees 0% – 0.25% | Dealing Commission £0 | See Offer Capital at risk | Features:

| InvestEngine is one of the best investment platforms for buying ETFsProvider: InvestEngine Verdict: InvestEngine is one of the cheapest ways to buy ETFs as they offer zero account fees for DIY investors as well as low-cost simple managed ETF portfolios. They also have a managed ETF investment service, for those that want help with what to invest in. Is InvestEngine any good? Yes, InvestEngine won “Best ETF Platform” in the 2025 Good Money Guide Awards. InvestEngine makes it really simple to get started by investing in ETFs with zero commission, although the market range is a bit limited if you are looking for more complex asset classes. Plus, they also have a managed service for those who want an expert to build a diverse portfolio of ETFs for them. Pricing: Top marks as it is actually free to buy and hold ETFs in a GIA and ISA (although keep in mind you have to pay ETF charges to the exchange). Plus, the InvestEngine SIPP is free and managed accounts are very low cost too Market Access: InvestEngine only offer about 763 ETFs on their platform so are marked down a bit here. However, they do offer enough to build a diverse portfolio of exchange-traded funds. Platform & App: Both are well built and easy to use, intuitive and cross-device Customer Service: InvestEngine are easy to contact through chat (even on weekends) plus an active community board. There is no published phone number on the site though. Research & Analysis: There are some good insights on their blog, with fairly active social channels (mainly investing tips or product highlights). Pros

Cons

Overall4.5 | ||

| GMG Rating | Customer Reviews 4.8 (Based on 275 reviews) | App Annual Fees 0% | Dealing Commission £1 | See Offer Capital at risk | Features:

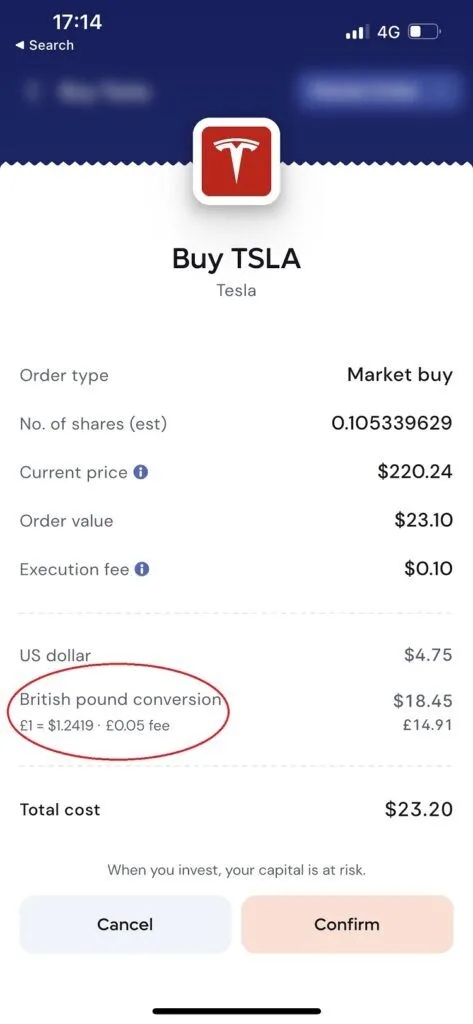

| Lightyear Is An Easy To Use Investment App With Very low FeesProvider: Lightyear Verdict: Lightyear is one of the better free investing apps as they provide access to US stocks and local markets with FX fees as low as 0.35%. Lightyear is a new investment app that offers low cost investing in UK, European and US shares. The company was founded by one of the first Wise (Transferwise) employees, Martin Sokk with a similar objective of making investing as cheap and easy as possible. Is Lightyear good for investing? Lightyear is a simple and approachable way to invest in stocks and ETFs without unnecessarily large fees. A very well-designed low-cost investing app with discounted FX charges, limit and recurring orders for investing in local and international markets. Special Offer: Sign up with a promo code GOODMONEYGUIDE deposit at least £50 and get 10 trades for free. T&Cs apply. Capital at risk. Fees: Lightyear is very cheap for investing, there is no account fee for a general investing account and only £1 commission for buying UK shares and a max of $1 for US stocks. Lightyear make their money on the FX Fees. With Lightyear, they apply the FX fee on top of the interbank rate, so you can actually see the amount you are charged for the conversion. When I interviewed Martin Sokk he told me Lightyear aims to expand into different countries quickly, so they can help people to invest in their local stock markets, but also in America, which is where a large percentage of people want to buy stocks. And rightly so, US shares are all household names, and one of the key drivers for investing is to buy companies you love and use. Lightyear will make money charging 0.1% per trade (or $1 what ever is bigger) and converting GBP, HUF & Euros, etc. into USD when people buy US stocks. They charge, 0.35%, which is higher than Interactive Brokers’ 0.02% but much lower than the 0.5% charged by AJ Bell, Saxo Markets and IG, or the 1% from Hargreaves Lansdown and Interactive Investor. FX, therefore, is a key part of Lightyear’s monetisation strategy because, if you charge very low commission and account fees you have to make money somehow. So Lightyear, aim to make it’s money in the background, initially from foreign exchange fees. FX is a very good way to make money, because, a) no-one really understands how the pricing works, and b) because you don’t see the charge, it’s built into the buy/sell spread. You can see in the below example what the fees would be when I bought some Tesla shares testing the app. Market Access: Lightyear has just added 1,300 new instruments, bringing the total up to almost 5,500. These include well-known UK names such as Rolls-Royce, easyJet and IAG; to defense ETFs, US stocks. This is great becuase one of my concerns about new investing apps is that they normally just cater to the most heavily traded apps. It’s great to see Lightyear providing wider market access. Plus, they are proactive about it too. Lightyear says they have put live 98% of non-complex US instruments asked for by customers in the past 3 months. One of the other really cool things about Lightyear is that you can listen to earnings calls directly on the app. Multicurrency account & order types Another point to make here is that you also get a multi-currency account, where you can hold foreign currency. The advantage of this is that you don’t need to do as many FX conversions which can help keep costs down. Related guide: Compare FX rates for buying US stocks from the UK. Lightyear comes with features like fractional US shares, limit orders, and regular investing. You can also quickly see which shares pay the highest dividends or make the most money relative to their share price to help you pick stocks. Progression to servicing local customers and local markets When Lightyear first started, you could only invest in a handful of UK stocks, and they were ADRs listed in the US denominated in USD, rather than the local listings on the LSE. So, you were paying an FX fee when you really shouldn’t have to, admittedly, there is no stamp duty so technically paying 0.35% on FX rather than 0.5% to HMRC is cheaper. Lighyear have a cash and investment ISA, but no SIPP account, but I suspect that is next on the “product roadmap”. But anyway, they’ve sorted that now, and if you want to invest in UK shares like Lloyds, you can actually buy them on the LSE, something that eToro is yet to do. With them, you still have to buy USD-denominated shares. I’ve mentioned how annoying that is many times and yet they continue serve themselves as a global broker instead of their customers as locals. It’s nice to see that Lightyear, fixed that problem early on. Like Transferwise, like Lightyear To draw on one final Transferwise comparison, it is very easy to use app-as-a-tool to help you start investing as cheaply as possible. The thing is though is that, transferring money is like car insurance. No-one really has any loyalty to their insurer, they just do it and move on. Investing is different. Investing is not like insurance, when you open an investing account, you could be using it for the next 30 years. I think there will always be a place for traditional investment platforms because they provide excellent customer service and brand loyalty, they are mature platforms for mature investors and fees will eventually come down, as they have done in the past. Same as with Simpsons Tavern, it may not be as good for you as veganism, but if it survives, people will continue to go because they like it. But, if low-cost investing apps are a gateway to getting more people to invest for their future, then they are the future too and will hopefully mature along with their customers, and Lightyear, in particular, is a great place to get started. Pros

Cons

Overall4.2 | ||

| GMG Rating | Customer Reviews 4.6 (Based on 2,564 reviews) | App Annual Fees 0.6% | Dealing Commission £0 | See Offer Capital at risk | Features:

| Wealthify's Investing App is Excellent for Beginners To Get StartedAccount: Wealthify investing app Description: Wealthify lets you invest in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments. The platform is a robo-advisor and it’s part of the Aviva Group. Capital is at risk. Is Wealthify a Good Investing App? Yes, Wealthify is an excellent app but it’s not as good as the web version, because it’s easier to explore the risk and performance tables and choose a portfolio on a bigger screen. Fees It costs 0.6% to start investing with Wealthify, which is one of the cheapest robo-advisor account fees. There are also investment costs of, on average, 0.16% for original plans and 0.7% for ethical plans. Special Offer: £50 when you refer a friend. You can get a unique link when you have a funded Wealthify account. If you use it to recommend the platform to friends, you could each get £50. To qualify, your friend must invest at least £1,000 in a Wealthify Plan in the first six months, and maintain at least that level for six months. Pros

Cons

Overall4.7 | ||

| GMG Rating | Customer Reviews 4.4 (Based on 934 reviews) | App Annual Fees £0 | Dealing Commission 0.05% | See Offer Capital at risk | Features:

| Interactive Brokers Investing App Expert Review: Best for International InvestingAccount: IBKR GlobalTrader app Description: Interactive Brokers’ (IBKR’s) GlobalTrader app is an excellent choice if you’re just starting out (as it is so cheap) but it can become more sophisticated as your portfolio grows and you want to access more advanced investment products. You can access thousands of markets around the world and have a wide range of investing tools. A good choice for most types of investors. How may apps does Interactive Brokers (IBKR) have? IBKR also has two other apps, which are both good – IBKR Mobile for experienced traders and IMPACT for ethical investors. Fees There is no account charge for general accounts at IBKR. When you buy and sell shares, minimum dealing commissions are £1 in the UK or 0.05% of the deal size. Special Offer $200 when you refer a friend to Interactive Brokers. IBKR clients can earn $200 for each qualified referral while giving their friend the opportunity to earn up to $1,000 of IBKR stock. What is the App Like to Use? Pros

Cons

Overall4.8 | ||

| GMG Rating | Customer Reviews 4.4 (Based on 235 reviews) | App Annual Fees 0% – 0.75% | Dealing Commission £3.95 | See Offer Capital at risk | Features:

| Moneyfarm Investing App Expert Review: Best for Simple Risk-Based PortfoliosAccount: Moneyfarm investing app Description: As a robo-advisor, Moneyfarm’s digital wealth management investing app makes personal investing simple as you don’t have to pick your own investments. You just decide how much risk you want to take. You can invest in any of the seven risk-based portfolios through a stocks and shares ISA, a pension or a GIA. Capital is at risk. Is your Money Safe in the Moneyfarm App? Yes, the Moneyfarm app connects to all your Moneyfarm accounts and lets you view your portfolio balance and performance while on the move. As Moneyfarm is a fairly passive investment account and not that complicated, you can also use the app for making deposits and choosing investment portfolios. Fees Moneyfarm investing account fees start at 0.75% for accounts between £500 and £50,000, then above £100,000 it costs 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%. What is the App Like to Use? Pros

Cons

Overall4.6 | ||

| GMG Rating | Customer Reviews 4.2 (Based on 1,094 reviews) | App Annual Fees 0% – 0.25% | Dealing Commission £3.50 – £5 | See Offer Capital at risk | Features:

| AJ Bell Investing App Expert Review: Best Low-Cost App for Investing in FundsAccount: AJ Bell Investing App Description: AJ Bell’s investing app is a good choice for anyone who is more interested in keeping costs at a bare minimum whilst still having access to a huge range of markets and account types. It’s not quite as suitable for very active investors as II and HL due to the lack of execution order types, but for those who just want to build a portfolio without trying to time the market too much, it is a very good option. Is AJ Bell's App as Good as the Platform? AJ Bell’s app is a good way of checking on your investments when out and about. But it’s a bit clunky compared to full-service brokers like Interactive Brokers or newer apps like CMC Invest. It’s not as good as the main website, as you don’t get the full screeners or research, plus I found it an absolute pain to log into – for some reason it seems to always wipe my login info. Fees AJ Bell charges 0.25% of the value of your investments for a GIA but share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 if you had 10 or more online share deals in the previous month. Special Offers Recommend a friend, and you’ll both get £100 gift vouchers. If you recommend a friend to AJ Bell and they invest more than £10,000 in a SIPP, ISA or LISA, you’ll each get an Amazon gift card worth £100. Switch your share dealing account and receive up to £500 to cover exit fees. If you transfer your share dealing GIA valued at more than £20,000 to AJ Bell, it will help cover any exit fees charged by your current provider. AJ Bell will cover £35 per investment moved and up to £100 for general exit fees, up to an overall maximum of £500 per person. Free subscription to Shares Magazine worth £220 a year. Get a free subscription to Shares by maintaining a balance of £4,000 or more across your AJ Bell investing accounts. What is the App Like to Use? Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 3.8 (Based on 1,759 reviews) | App Annual Fees 0% – 0.45% | Dealing Commission £5.95 – £11.95 | See Offer Capital at risk | Features:

| Hargreaves Lansdown Investing App Review: Excellent Full-Service Investing App for DIY InvestorsAccount: Hargreaves Lansdown investing app Description: The Hargreaves Lansdown (HL) app is suitable for anyone, from absolute beginners to experienced active investors, as you get a huge amount of information, data, research, market access and order types. This app was the best investing app in our 2022 awards. Capital is at risk. Is your Money Safe in the HL app? Yes, HL’s investing app is one of the best and most secure apps for investing, as the company is authorised and regulated by the FCA. Hargreaves Lansdown is one of the most popular investing apps in the UK. For instance, did you know that at its peak, the app and website were used every 9.6 seconds to top up an HL Stocks & Shares ISA. Fees: There is no account charge for shares in a general account with HL. Funds are charged at 0.45% for the first £250,000. There is no charge for buying funds, but shares are charged at a relatively high £11.95 per deal or £5.95 if you do over 20 deals per month. Hargreaves Lansdown has recently improved it’s app and now allows users to open several products directly. The HL app now allows clients to open its ISA, LISA and Fund & Share accounts through the app, with more products to become accessible shortly. In a LinkedIn post revealing the update, Hargreaves Lansdown product leader Michael Loberman said it came as part of the company’s “wider efforts to transform our app and web experience”. He added: “Keep an eye out for further changes in the coming months. Exciting times ahead!” In its latest quarterly trading update in November, Hargreaves Lansdown reported client numbers grew by 18,000 in the second financial quarter, up from 8,000 in Q1. The growth was attributed to new clients setting up SIPP, ISA and Active Savings accounts. The firm also revealed its clients had been switching their investments to cash in that update. Client cash balances rose to £12.7 billion during the three months to the end of September, up from £12.4 billion. The £300 million shift towards cash was driven by net selling of investments by clients in September on fears the government’s annual Budget could include a tax raid, which largely failed to materialise. Earlier in November, Hargreaves Lansdown launched its Global Income fund on the platform, bringing another easy-to-use portfolio building tool to do-it-yourself investors. The new Global Equity Income fund invests in a portfolio of dividend-paying companies around the world favoured by selected expert managers. In February the firm teamed up with rival platform Interactive Investor to open up the UK Gilt-edged or government bond auctions to retail traders through a partnership with market marker Winterflood Securities. The group’s revenue rose to £196.5 million in the second quarter of this financial year from £183.8 million in the previous three months, driven by increased dealing volumes and higher assets under administration levels. What is the App Like to Use? Pros

Cons

Overall4.9 | ||

| GMG Rating | Customer Reviews 3.6 (Based on 73 reviews) | App Annual Fees 0.12% | Dealing Commission 0.08% | See Offer Capital at risk | Features:

| Saxo Investing App Expert Review: A good app for beginners, a great app for professionalsAccount: Saxo Investing App Description: Saxo has two apps – SaxoTraderGO and now SaxoInvestor, which is aimed at beginners and is a trimmed-down version of its older sister. Saxo has some of the best pricing and order execution types. Capital is at risk. Are Saxo's Investing Apps Good for Longer-term Investors? SaxoTraderGO is a good choice if you are a sophisticated investor and want to manage every aspect of your portfolio actively and need an established platform. The SaxoInvestor app won Best Investing App in our 2024 awards as it helps connect new and beginner investors through a simple interface to one of the most advanced platforms in the industry. Saxo‘s competitive pricing and range of order execution types mean you can work large orders on the move as well as from the standard desktop platform. Even though Saxo is traditionally a trading platform for short-term speculation on the markets going up or down, it’s also an excellent choice for longer-term investors. That’s because Saxo is a well-capitalised company, heavily regulated in the UK and all the regions it operates in, and has excellent customer service for small and large customers. Fees Saxo charges €10 a month or 0.12% a year (whichever is higher) based on the value of your portfolio. If you have a VIP account this fee drops to 0.08%. Dealing charges are commission based as a percentage of transaction size. They are competitive, though, and UK shares trading commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders. Special Offers If you have £200,000 or more on account, you can apply for 30% lower transaction and account costs. For accounts with portfolios over £1m, you get even better pricing, direct connection to experts, 1:1 SaxoStrats access and event invitations. What Are the Apps Like to Use? The images below are from the SaxoTraderGO app. You can see the Saxo Investor platform in our dedicated hands-on review. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.5 (Based on 38 reviews) | App Annual Fees 0.15% | Dealing Commission £0 | See Offer Capital at risk | Features:

| Dodl Expert ReviewAccount: Dodl by AJ Bell Description: Dodl is a low-cost investment app provided by AJ Bell. The app fees are lower than AJ Bells, and they cater to newer investors by offering commission-free investing in AJ Bell funds, themed investments and a small selection of main market shares. Is Dodl a good investing app? AJ Bell Dodl is a great way for the next generation of investors to invest with a “low-cost, little effort” app which focuses on making investing easy. Which it does well, Dodl is very user-friendly, has great educational content and is one of the cheapest ways to start investing. Pros

Cons

Overall4.3 | ||

| GMG Rating | Customer Reviews 4.1 (Based on 14 reviews) | App Annual Fees £120 | Dealing Commission £0 | See Offer Capital at risk | Features:

| CMC Invest App ReviewProvider: CMC Invest App Verdict: The CMC Invest app lets you invest in major UK shares, US stocks and ETFs without having to pay commission when you deal. The app is free to use when investing in a general investment account, however, you can upgrade to a Plus account which includes a flexible stocks and shares ISA, access to UK mid-cap shares and a USD wallet. Summary

Fees: General investment accounts are commission and fee free. ISA accounts cost £10 a month and are included in the Plus plan. For US shares there is a 0.5% conversion fee. App: CMC Invest’s app gives you access to major stocks, and has a screener to help search for potential investments. Pros

Cons

Overall3.9 | ||

| GMG Rating | Customer Reviews 4.1 (Based on 14 reviews) | App Annual Fees £0 | Dealing Commission £0 | See Offer Capital at risk | Features:

| eToro's investing app is a great way to start investing for beginnersAccount: eToro Investing App Description: Overall, eToro has one of the best trading apps for social & copy trading. eToro’s trading app enables you to view and copy the portfolio of other traders. You can also see the social feed of what is being discussed and trade and invest (in USD only) a wide range of markets. An easy to use trading app to get started with. eToro’s trading app enables you to view and copy the portfolio of other traders. You can also see the social feed of what is being discussed and trade and invest (in USD only) a wide range of markets. Overall, an easy to use trading app to get started with. Is the eToro trading app any good? Yes, eToro has one of the best trading apps for social & copy trading and is safe to use for investing and trading as they are regulated by the FCA in the UK. However, there are a few things to be mindful of. Firstly, eToro is a new company that has grown quickly and spent a huge amount on marketing for new customers. When companies grow so quickly they also have a long way to fall if new clients and revenues dry up. But, as eToro is regulated by the FCA, UK customer funds are protected (up to £80k) by the FSCS if eToro were to go bankrupt. The other thing to consider is that whilst eToro offers investing for longer-term capital growth they also offer leverage products like CFDs and forex trading where it is possible to lose money quickly. These products are not really safe (as they are high-risk) or suitable for new investors and are more for experienced and sophisticated traders. Overall, eToro has one of the best trading apps for social & copy trading. It’s easy to sign up, easy to use and easy to start investing. A great place to start for new investors. Particularly as they offer fractional shares with zero dealing fees and no account charges. This means you can get started with very little money. There is also a great copy trading feature where you can see and follow what popular investors have in their portfolios. The only thing to watch out for is the high FX conversion fees when you convert GBP into USD when you fund your account. It’s also very handy if you need to sell your investments whilst out and about. You can sell stocks on the eToro app by clicking on the portfolio button in the menu, clicking your position and then clicking close. You can also sell stocks short on the app with CFDs, with the added advantage of setting leverage limits to reduce your risk. Overleveraging is one of the main reasons that people lose money when trading on margin. If you want to sell stocks short on the eToro app, just toggle the switch at the top of the trade screen from “Buy” to “Short”. Make sure you take into account the overnight funding charges, though, which are a bit more expensive on eToro compared to other brokers for short selling. One other advantage of eToro is if the app is not working, you can also trade and invest online, unlike some other investing apps that are just app only. So can always access the markets and your eToro account even if you don’t have your phone. eToro App Screenshots

Pros

Cons

Overall4 | ||

| GMG Rating | Customer Reviews 3.9 (Based on 678 reviews) | App Annual Fees £96 | Dealing Commission £0 | See Offer Capital at risk | Features:

| IG Investing App Expert Review: Best for a Mix Of Short & Long-Term InvestingAccount: IG Invest Description: IG’s investing app is a good choice if you’re a regular trader and are more interested in high-risk products like CFDs and spread betting but also want to invest in the long term. IG’s app offers a cheap way for you to include physical shares and funds in your portfolio without the need for multiple accounts. Capital is at risk Is IG Invest a Good Investing App? You can invest with the IG app, but I would say it’s more of a trading app than an investing app. You can invest via a GIA, ISA and SIPP account, which can be used on mobile. If you like to trade and invest, then IG is a good choice to use as an investing app so you have both types of account in one place. But if you only want to invest (and not do higher-risk trading) then a dedicated investing app like Hargreaves Lansdown, AJ Bell or interactive investor would be a better choice. Fees IG charges a flat custody fee of £24 a quarter (£96 a year) for its general account. However, if you have more than £15,000 in a Smart Portfolio managed fund or you place over three trades per quarter, that fee is waived. Standard dealing fees are £8 for UK and £10 for US shares. Smart Portfolio fees are 0.5% – capped at £250 per year. Fund management charges are 0.13% and transaction costs are 0.09%. Special Offer Free US stock investing. There is zero commission on US share trades and just £3 on UK share trades when you trade three or more times a month. What is IG’s App Like to Use? Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.6 (Based on 1,336 reviews) | App Annual Fees £0 | Dealing Commission £0 | See Offer Capital at risk | Features:

| Freetrade Won Best Investing App In The Good Money Guide AwardsProvider: Freetrade Verdict: Freetrade has shaken up the UK retail investment market in recent years. Offering zero commissions on share trades, it has been stealing market share from legacy investment platforms with lower costs and better app functionality. Is Freetrade a good investing app?

Freetrade is one of the original and biggest commission-free investing apps in the UK. It now offers, GIAs, ISAs and SIPPs to over 1.5 million UK & European investors. It is possible to have a free account with end-of-day orders and limited stock data. Or you can upgrade to either a “standard” or “Plus” account for tax-efficient accounts, web access, reduced FX charges and most stock data. Freetrade also won “Best Investing App” in the 2025 Good Money Guide Awards. Freetrade offers a ‘freemium’ share dealing service and it’s mission is to get everyone investing by making it simpler and more affordable. Founded in 2016, Freetrade launched its iOS app in the UK in October 2018, and since then it has grown at an impressive pace. Freetrade’s popularity stems from two key features: commission-free trading for shares and exchange-traded funds (ETFs), and the ability to buy fractional US shares. These features have made investing more accessible and cost-effective, especially for beginners. It’s worth noting that Freetrade won the 2021 Good Money Guide award for ‘Best Commission-Free Stockbroker’. It also won the 2019 Good Money Guide ‘People’s Choice’ award. Pricing: With Freetrade you can buy stocks with zero commissions. However, if you’re buying US or European stocks, you’ll need to pay foreign exchange (FX) fees. These fees vary depending on the ongoing plan you choose. There are three options when it comes to plans. These are: Freetrade Basic – Free Freetrade Standard – £4.99 per month billed annually or £5.99 per month billed monthly Freetrade Plus – £9.99 per month billed annually or £11.99 per month billed monthly As for how Freetrade’s fees compare to other platforms, they are pretty competitive. But there are lots of variables to consider here including the type of plan you have, the type of stocks you invest in (i.e. UK vs US stocks), and how many trades you make per month. If you just wanted to buy a few blue-chip UK shares within a General Investment Account, you could potentially pay no fees at all (you would have to pay Stamp Duty on trades). However, if you wanted to buy and hold UK shares in a stocks and shares ISA, you would be looking at annual charges of at least £59.88. That’s not particularly high but it can be beaten. AJ Bell, for example, offers an annual charge of 0.25% for ISAs and this is capped at just £42 per year (this doesn’t include any trades). Market Access: In terms of accounts, Freetrade offers three options, a General Investment Account, a Stocks and Shares ISA and a SIPP (Self-Invested Personal Pension). But, to open a stocks and shares ISA or SIPP you need to sign up for a premium plan. Pros

Cons

Overall4.1 |

Methodology: Our experts have tested and ranked the UK’s best investment apps – all regulated by the FCA for your peace of mind.

We chose the best UK investing apps based on:

- Real customer feedback. We analysed over 30,000 votes and reviews in the prestigious Good Money Guide annual awards.

- Unbiased, real-world testing. Our team tests each investing app with real money to ensure you have a seamless experience.

- In-depth feature comparison. We do a thorough comparison of features, highlighting those that make each app stand out from the competition.

- Exclusive insights from the top. Our exclusive interviews with investing platform CEOs give you insider perspectives and valuable information to help you make informed decisions.

⚠️ The Importance of FCA Regulation

All investing apps that operate in the UK must be regulated by the Financial Conduct Authority (FCA), which is responsible for ensuring that UK investment apps are properly capitalised, treat customers fairly and have sufficient compliance systems. We only review investing apps that are regulated by the FCA because this means that your funds are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

What is the best investment app for beginners in the UK?

In our 2025 Awards, Freetrade won “best investing app” and is a great way to start investing with very few costs. With Freetrade you can open an account and start investing with zero fees.

Freetrade is really simple to use, and the more your investments grow, the more the app has to offer with it’s advanced account subscriptions. Plus, Freetrade is now owned by IG, one of the largest brokers in the UK.

What is the best investing app for simple share trading?

Lightyear is a great investing app for simple for share trading as it is very easy to use. Lightyear was set up by some of the founding team from Wise, so user experience has been paramount in it’s development.

You can trade shares in the US outside normal market hours, so you can buy shares in companies like Tesla in the morning, as well as listen to earnings calls directly on the app to stay up to date with the latest company results.

Which investing apps have the lowest fees?

Overall, we rate Lightyear as the investment app with the lowest fees. There is no account charge, share dealing costs £1, and FX costs are only 0.35%. But for individual costs, we’ve highlihgted which apps are cheapest for investing below:

- eToro – zero commission on UK & US shares

- Freetrade – lowest dealing commission

- Interactive Brokers – lowest FX fees

- InvestEngine – lowest pension fees

However, if you want a service investing app with research, access to the most markets, funds and great customer service AJ Bell is the cheapest investing app in our analysis, with account fees starting from 0.25%. interactive investor is the cheapest full-service app for GIA, pensions and ISAs as it has a fixed fees for large investment accounts.

What ISA app is good for first time investors?

For first time investors we rate InvestEngine as the best ISA app. InvestEngine lets you buy ETFs with no commission and no ISA account charge.

The InvestEngine app is really simple to use and for first-time investors, just having access to ETFs (exchange-traded-funds) means that you can quickly build a diverse portfolio with recurring investments into sectors like Artificial Intelligence and the S&P 500 without having to worry about risking your money on individual shares.

Which Investing App Gives You The Most Market Access?

Hargreaves Lansdown offers access to the most funds, UK and international shares, bonds and ETFs.

You can see here how many investments different UK investment apps offer.

| Platform | DIY or Managed | UK Shares | Funds | ETFs | Bonds | US Shares | Derivatives |

|---|---|---|---|---|---|---|---|

| Hargreaves Lansdown | DIY | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| interactive investor | DIY | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Interactive Brokers | DIY | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| AJ Bell | DIY | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Saxo | DIY | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| IG | DIY | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Moneyfarm | Managed | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Wealthify | Managed | ❌ | ✔️ | ❌ | ❌ | ❌ | ❌ |

| InvestEngine | Both | ❌ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

Which Investment App Has The Most Account Types?

Based on our expert comparison of investing apps in the UK, both Hargreaves Lansdown and AJ Bell offer access to the full suite of account types, including a GIA, SIPP, ISA, junior ISA, junior SIPP and lifetime ISA. Both also offer access to cash savings through a “marketplace” of other providers.

| Account Types | GIA | ISA | SIPP | Pension | Junior ISA | Junior SIPP | Lifetime ISA |

|---|---|---|---|---|---|---|---|

| Hargreaves Lansdown | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| AJ Bell | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| interactive investor | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Interactive Brokers | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| IG | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Saxo | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Wealthify | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| InvestEngine | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Moneyfarm | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

Are Investment Apps Safe?

Yes, investing apps that are regulated by the FCA are safe. Legitimate investing apps in the UK are required to be regulated by the Financial Conduct Authority (FCA). If the investing app you’re considering is regulated by the FCA, you can be confident that it’s safe to use.

How to check an investing app is safe

The easiest way to tell if an investment app is FCA-regulated is to go to their website and scroll down to the very bottom of the homepage. There you’ll find a statement about their regulation, including their registration number if you want to look up the details yourself.

For example, on Hargreaves Lansdown, It will look something like this:

- Related Guide: Best Investment Apps Compared & Reviewed

Are all investing apps regulated by the FCA?

Practically every mainstream investment app you have heard of is likely to be regulated by the FCA. Companies such as AJ Bell, Interactive Investor, InvestEngine, IG and Hargreaves Lansdown are some examples.

But not all asset classes come under FCA regulation, however, the most mainstream investments such as stocks do.

Here are some common asset types that are FCA-regulated:

- Stocks and shares

- Bonds and fixed-income securities

- Funds and ETFs

- Contracts for difference (CFDs)

- Derivatives like futures and options

More importantly, there are some asset classes that are not regulated by the FCA, which means they may be less safe for investors as there is little or no government oversight and consumer protection. Some of these include:

- Cryptocurrency

- Real Estate

- Art and antiques

- Wine and whiskey

- Physical commodities like gold and silver

Keep in mind that these assets can be regulated if they are packaged into a financial product, for example purchasing physical commercial real estate (e.g. a retail space or warehouse) is not regulated by the FCA, but purchasing an ETF which invests in commercial real estate will be regulated by the FCA.

How does the Financial Services Compensation Scheme (FSCS) work?

The FSCS provides a backstop insurance policy for consumers if the company they hold money with goes bankrupt. This is limited to £85,000 per person, per banking group. For example, Halifax is owned by Bank of Scotland, meaning that accounts with either bank will both count towards the same £85,000 limit.

It’s important to note that this doesn’t apply to investment performance. If you lose money because your investments have underperformed, you’re not able to claim this back through the FSCS.

What are the dangers of using investment apps?

If you’re using investment apps which are regulated by the FCA, the dangers are really just limited to the performance of the investments you select. Any form of investment comes with some element of risk, such as investing into the stock market.

While it’s possible to achieve returns above inflation over the long term with the right investment selection, it’s also possible to lose money, either temporarily or permanently.

How to protect yourself when using an investment app

If you follow this set of simple steps, you can protect yourself when using any investment app:

- Check the investment app is FCA-regulated – Find the app’s FCA number on their website, and search the FCA register here under ‘Firms’ to confirm that the details match.

- When transferring funds, make sure the bank details are correct – Scammers can pose as legitimate companies to trick investors into handing over cash. Always conduct transactions securely on the app itself if possible. If you need to do a bank transfer, make sure you verify the bank details with the investment app so you know it’s going to the right place.

- Choose your investments wisely – Even if the investment app you’re using is safe, it’s still possible to invest in highly risky investments if you’re not careful. Make sure you research before making any investment decisions, and remember that diversification is the best way to reduce your risk.

Are investing apps worth it?

Yes, investing apps are an essential tool for making and maintaining a successful portfolio. Everyone should download an investing app as soon as possible. Investing apps provide a low cost – even free – way to start investing. By starting small and early you can use compounding returns to maximise your investments for later on in life.

Investing apps are particularly worth it if you have a small starting balance, a time frame of at least five years and are prepared to take some risk to get better returns than you’d get in savings accounts.

Even if you’re a large investor using your broker’s main platform, investing apps provide an excellent way to remain connected to the markets and check on performance wherever you are.

However, there is a downside to investment apps. Because you have constant access to your long-term investments, you may be tempted to buy and sell on a more regular basis. That’s more of a trading strategy, rather than investing.

Investing App Quick Questions:

How do investing apps make money?

Investing apps make money through commissions when customers buy and sell investments, as well as through account charges. You can see a comparison of account charges and commissions in our investment account comparison table.

What’s the difference between a trading app and an investing app?

Investing apps are for long-term capital growth and they provide normal investing accounts, stocks and shares ISAs and SIPPs, whereas trading apps are more for short-term speculation like financial spread betting and contracts for difference (CFDs).

Are investing apps free to download?

Yes, generally, investing apps are free to download from the relevant app stores. The providers of the investment apps will charge for the services available through the app. This charge is usually deducted from your investment account, rather than charged through an app store.

If an investing app is trying to charge you to download it then beware – it may be a scam.

Can you make money with an investing app?

Yes, you can make money with an investing app. However, when investing you only make money if you choose good investments. The value of any investment can go up as well as down.

How do investing apps work?

Investing apps connect to investment platforms and allow you to monitor your portfolio and make trades on the go via your smartphone or tablet. All you need is your device and an internet connection. The key advantage of apps is the convenience they provide – you can invest wherever you are and react quickly to opportunities if you need to.